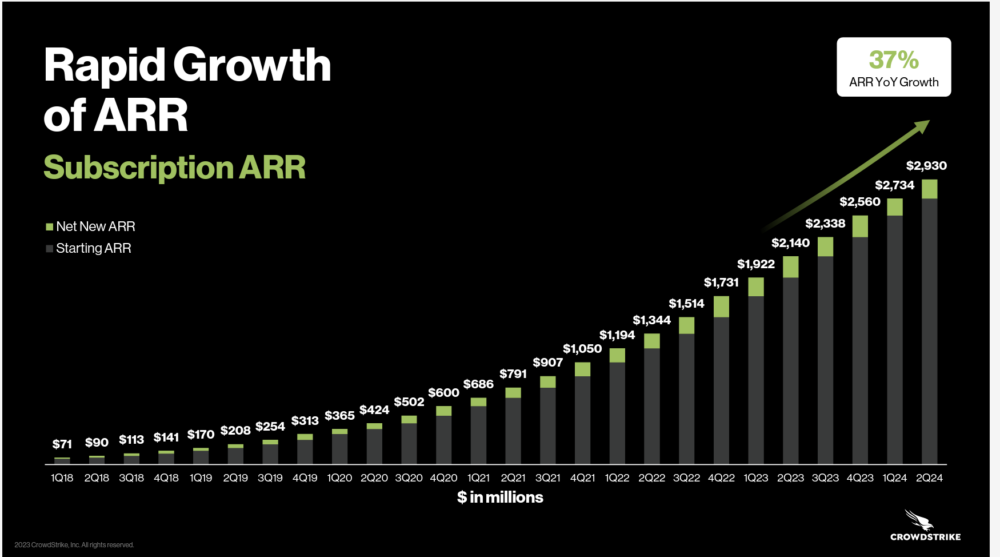

So the last time we checked in on Crowdstrike, they were growing a stunning 65% at $1.7B in ARR. Growth has slowed somewhat as Crowdstrike approached $3 Billion ARR — but only somewhat. The company is still growing a jaw-dropping 37% at almost $3B ARR — and it’s generating incredible free cash flow.

Security remains hot.

And in fact, the stock is up 94.7% this year! It’s market cap is almost $50 Billion. Woah.

Ok times are tough for many out there

But not Crowdstrike:

– Almost $3B in ARR

– Growing 37% (!)

– 26% Free Cash Flow

– 125% NRR

– $48B Market Cap — Up 94.58% this year (!)#nottooshabbby pic.twitter.com/VOlpHaWcVd— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) November 13, 2023

Not every area of SaaS and Cloud is seeing big “macro” impacts.

5 Interesting Learnings:

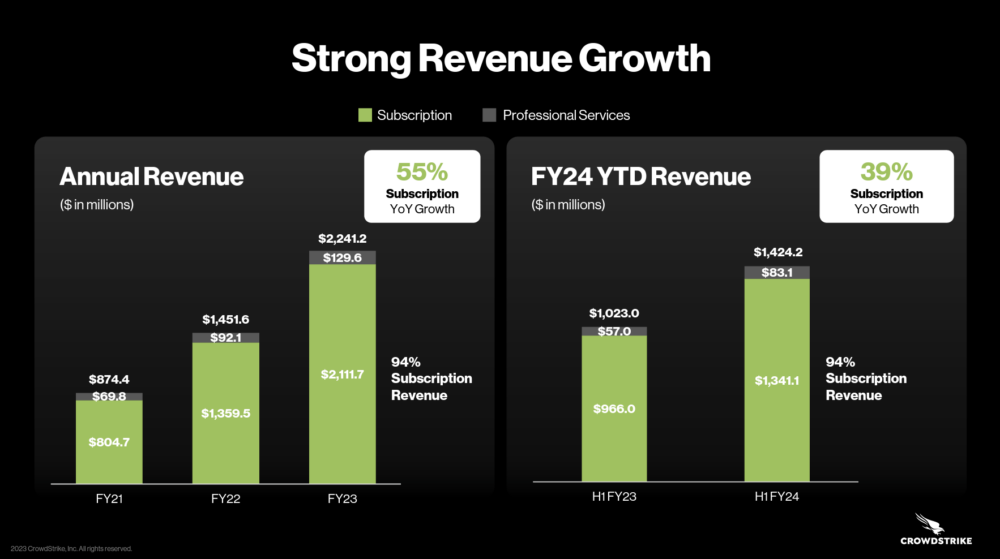

#1. Some Deceleration in Growth — But Still Jaw-Dropping Growth

Crowstrike is seeing growth slow somewhat from 55% to 39% Year-over-Year, but that’s still adding over $1B in net new bookings a year!

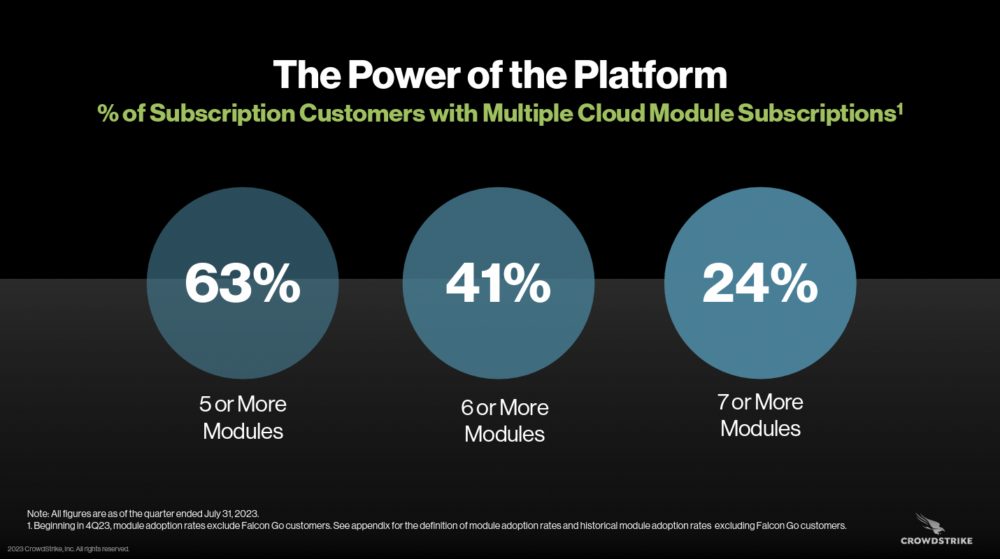

#2. Being Multi-Platform / Multi-Product Key at Scale

A story we’ve seen many times. The majority of their customers use 5 or more modules.

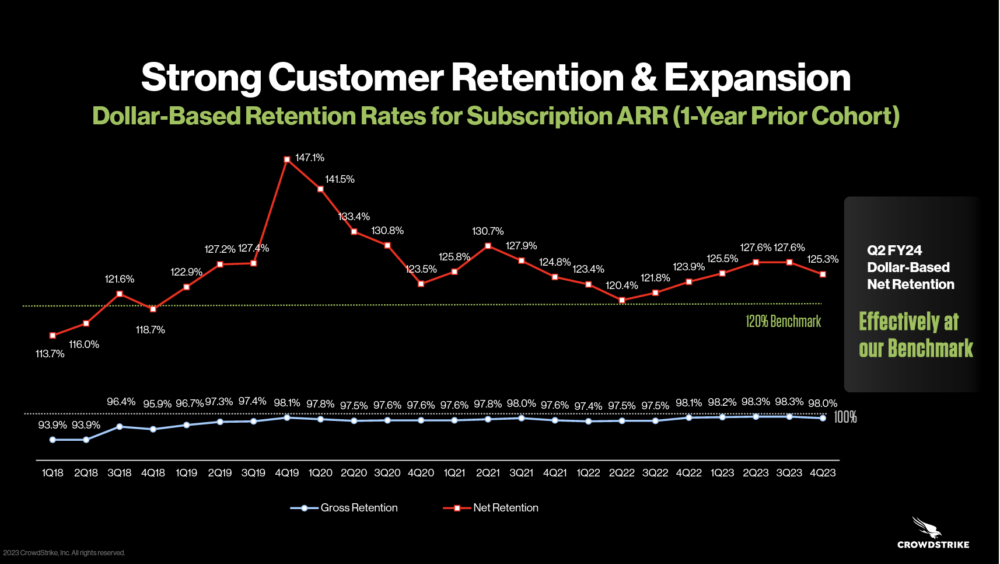

#3. Consistently Strong NRR — And Higher Than 2022

Crowdstrike has targeted a 120% NRR benchmark and it’s interesting to see how it’s fluctuated blow over the past 5+ years. Q2’22 was a low point, but even then, NRR stayed at 120%. Since then, NRR has grown materially.

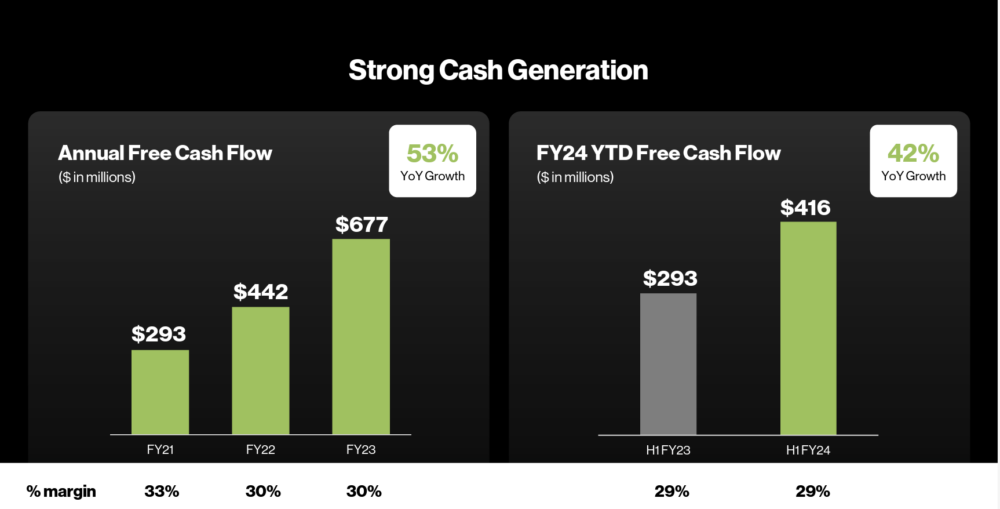

#4. Jaw-Dropping Free Cash Flow and Almost 20% Non-GAAP Operating Margins. Wow.

Crowdstrike is impressively efficient. Crowdstrike is generating an incredible $677m+ of free-cash flow and almost 20% non-GAAP operating margins.

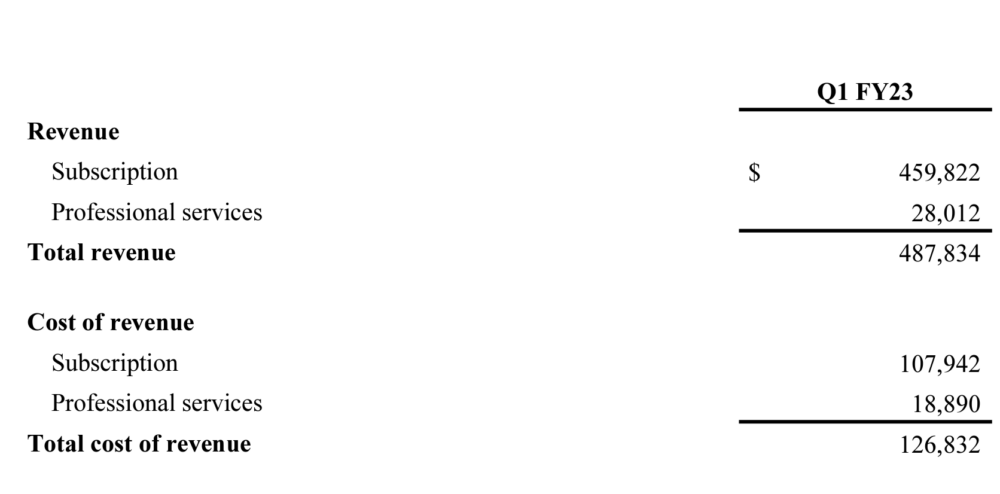

#5. Even Makes Money on Professional Services

Crowdstrike doesn’t do a ton of professional services, but it does some for its biggest customers. But even there, it makes sure it turns a profit. They still make a 38% margin on services. The numbers probably don’t matter much here, but it forces everyone to have the discipline to charge for services that are worth more than they cost. They view professional services primarily as an opportunity to cross-sell more modules.

And a few other interesting learnings:

#6. They Do See Material Seasonality

“Net new ARR generation is typically greater in the second half of the year, particularly in the fourth quarter, as compared to the first half of the year.”

#7. Most Enterprises Buy More Than 60 Endpoint Security Products

So there is room for many winners here.

#8. 64% of Large Customers Sourced From Partners

They are AWS’s largest cybersecurity partner. What’s your channel / partner strategy?

#9. Only Founded in 2011.

This chart of their revenue growth will make your jaw drop:

Not much to not like here. 🙂

Even in a time of odd uncertainty in Cloud and SaaS.