So I’ve been doing SaaS long enough to remember when Dropbox was a super hot SaaS startup. Fast forward to today, it’s settled into a very mature leader, with slow growth but impressive efficiency … at a stunning $2.4 Billion in ARR.

Operating Margins are a wildly impressive 33%, but revenue growth has slowed to a very mature 6%, and paid customer count actually dropped last quarter. Added together, it does equal “The Rule of 40”. But Wall Street doesn’t just want profitability. It wants efficient growth. And as a result, DropBox’s market cap is $7.8 Billion today.

It trades at just 3x ARR. And that includes $1.4B in cash. Net of cash, it trades at just over 2x ARR.

Profitability matters, but it isn’t everything.

5 Interesting Learnings:

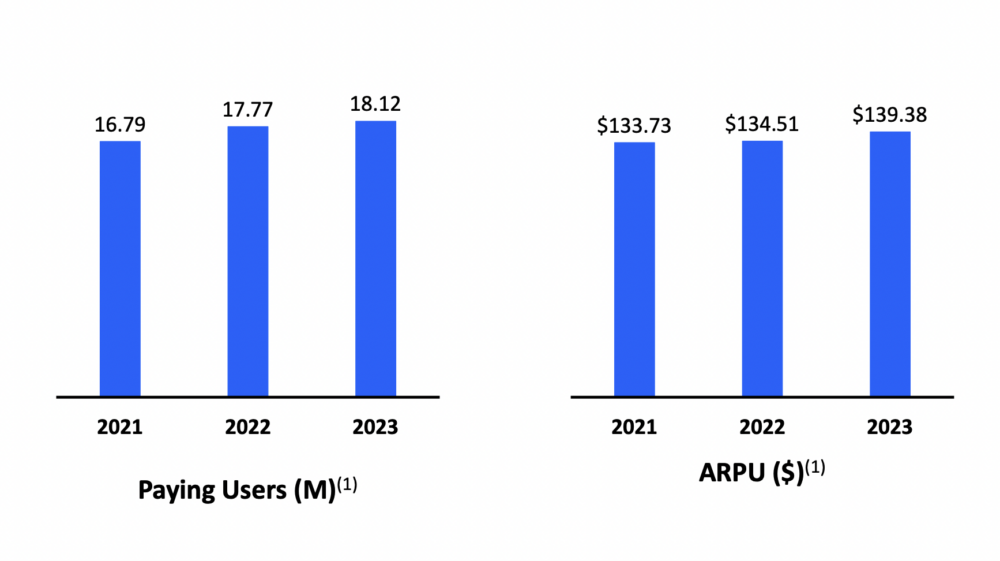

#1. 18,000,000 Paying Customers (!), Up 2% Year over Year — But Paying Customers Shrank This Quarter

DropBox has a big business push, but in many ways at this scale, it’s as much a consumer company as a business software company. HubSpot has 200,000 paying customers. DropBox has almost 100x as many — albeit they pay 1/100th as much at just $139.38 a year. But it’s just about saturated the market. New customers did grow 2% year over year, but actually decreased last quarter for the first time.

#2. ARPU Up 4% at $139.38

Many in SaaS have found a way to drive their ACV and ARPU up over the past 18-24 months with price increases, more products, and more. But DropBox’s ARPU has stayed relatively flat the past few years. Still, at this maturity, even a modest increasing in ARPU makes a difference, and pricing is up 4%. Combine that with only 2% annual customer growth, and overall revenue growth is (just) 6%

#3. Seat Contraction and Churn Remains Elevated

DropBox is still seeing elevated levels of customers reducing seat count and elevated churn.

#4. Ending Unlimited Storage

This seems to be a theme with many mature SaaS leaders, as they meter what they used to allow unlimited use of. While DropBox cites abuse as a core reason, financial engineering appears to be the core driver given how high DropBox’s gross margins are. These high-usage, low ARPU customers do appear to be churning based on cutting back on unlimited storage, leading to the decrease customer count above, for now.

#5. MultiProduct Bundles Didn’t Incent Customers to Pay More

A big theme for the leaders in SaaS the past few years has been going multi-product to continue to fuel growth at scale. So far, it’s only been a partial success for DropBox, which in many ways is still a one core product plus extension company vs. true multi-product. They attempt to drive up pricing and ARPU by bundling multiple product, but customers weren’t willing to pay a higher effective price. At least not yet.

And a few other interesting learnings:

#6. Paying $79 million to get out of their SF lease, but expecting to save $220m over the full term.

We’re all still figuring out the distributed and hybrid world!

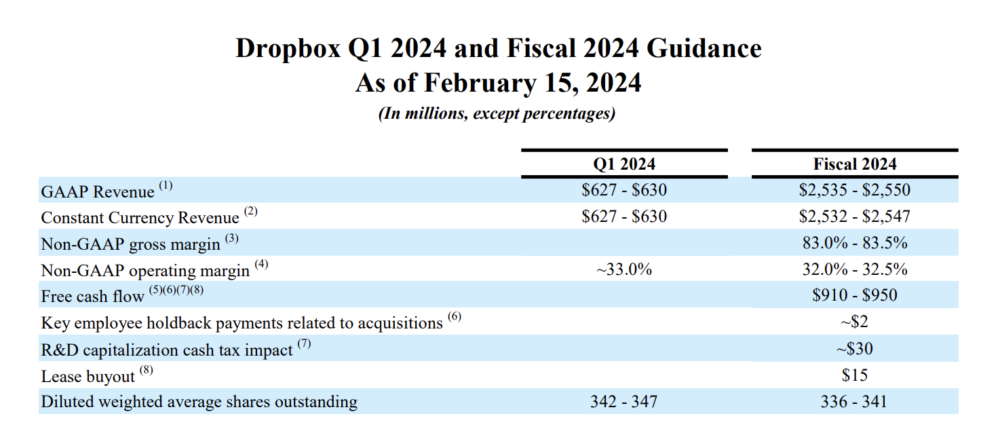

#7. On Track for Almost $1 Billion in Free Cash Flow in Fiscal 2024

Yes, SaaS models can. be highly profitable at scale. They should be.

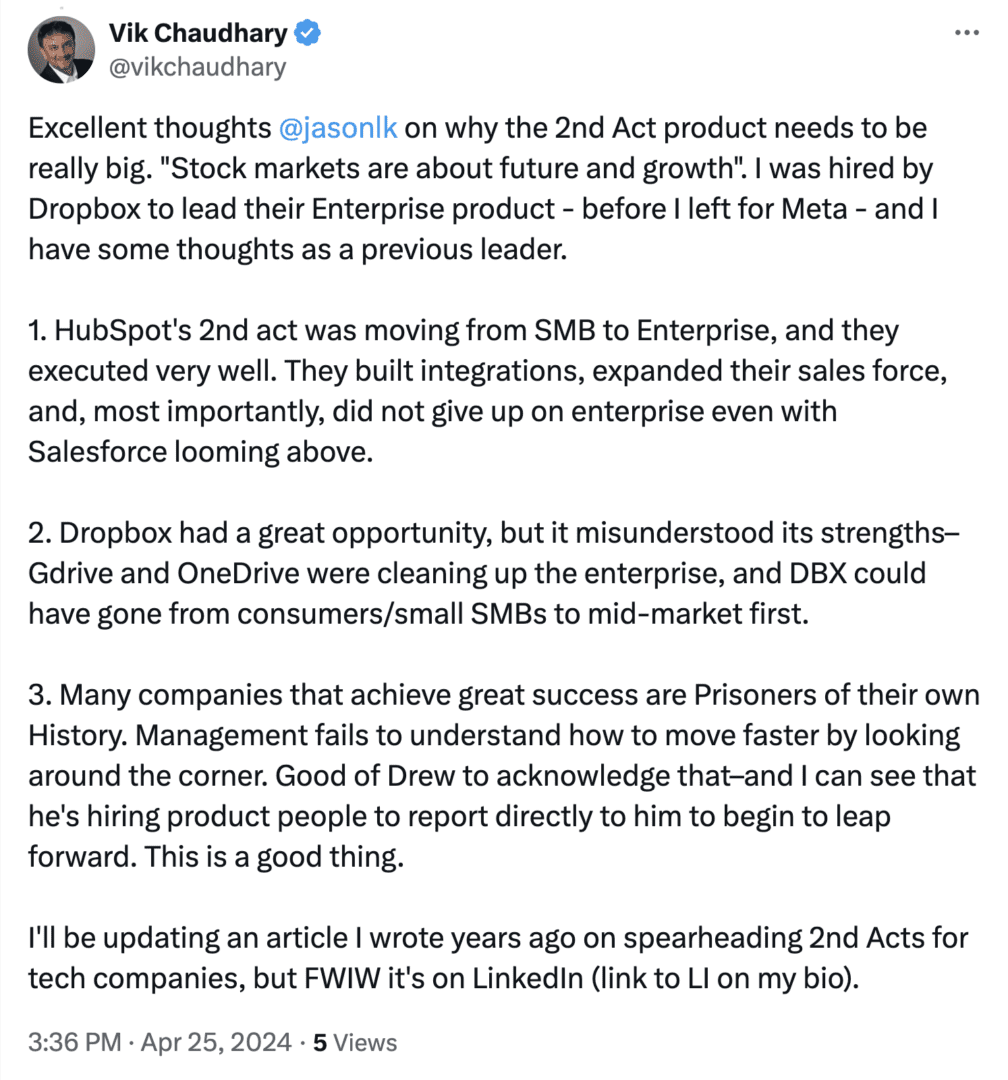

DropBox is a fascinating case study of incredible, viral product-market fit that fueled a rocketship engine to the first $1B in ARR. But then growth slowed as it became, in many ways, just a single-product company. As they acknowledge below, they are still early into their second act. Getting this timing and shift right is tough, but critical, as you cross 10%+ market share in your first core product and market.

And a great insider view on The Second Act here: