Freshworks has IPO’d, one of a next wave of U.S.-Indian SaaS hybrid super success stories. Headquartered in the U.S., but with 3,800 of 4,300 employees in India, and customers spread across the globe — Freshworks is a great example of the future of SaaS.

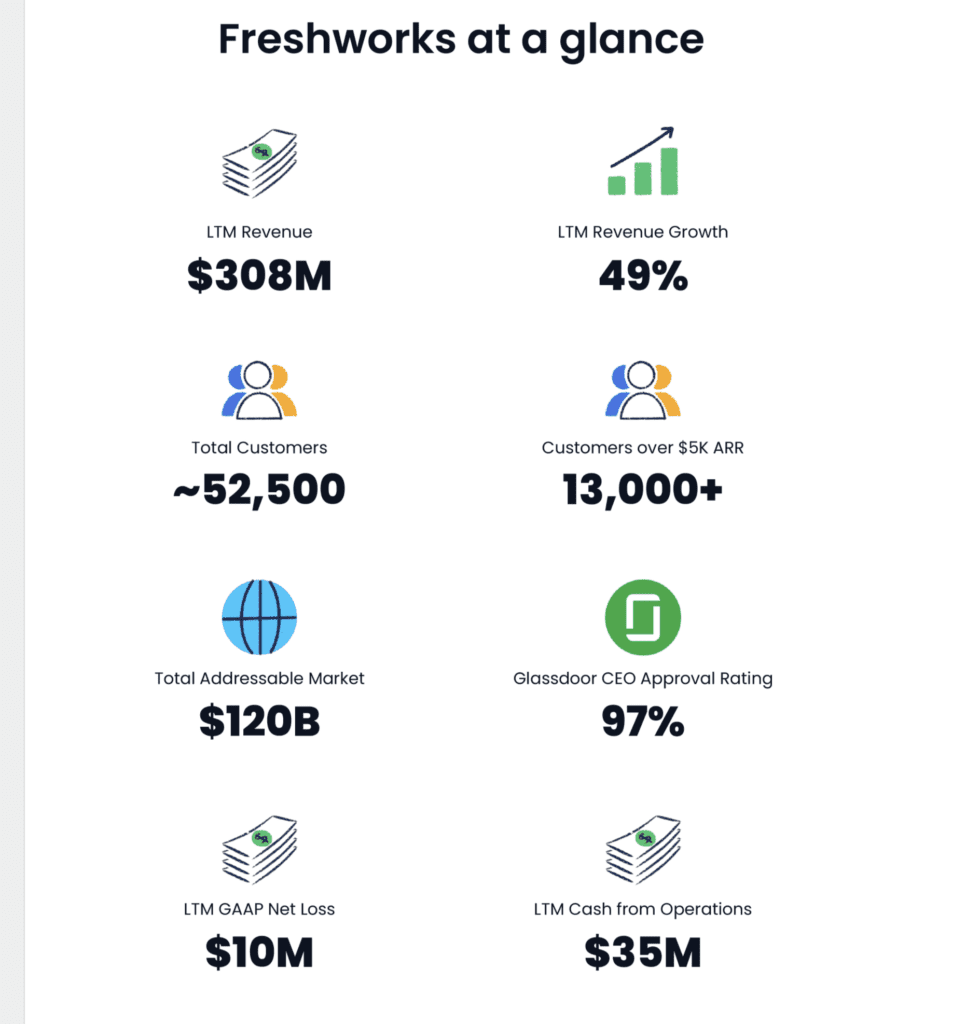

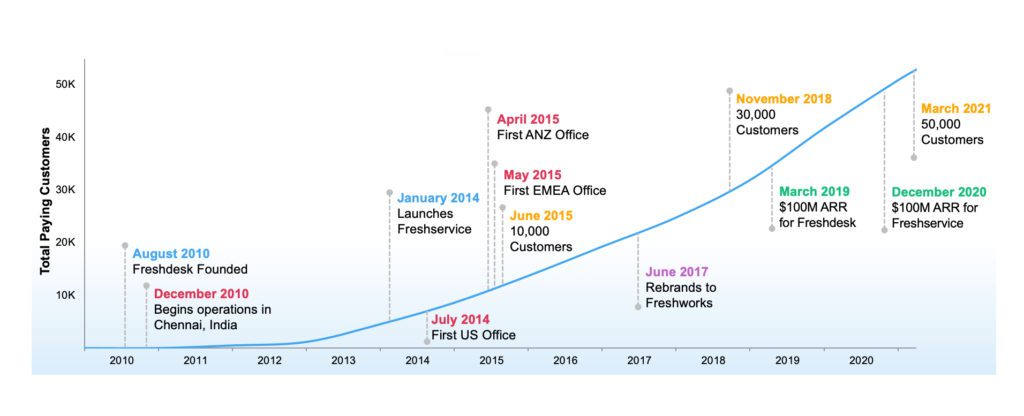

Started 10 years ago as “Freshdesk” and a low-end / SMB helpdesk to rival Zendesk, Freshworks has since expanded its product footprint across IT management (Freshservice) and CRM (Freshsales) to a stunning 49% growth rate at $350m in ARR. Still, and most impressively, primarily from SMBs — although that’s changing.

(Note, as I type this Freshworks is probably at about $380m in ARR. We’ll just round up, as they’ll be at $400m ARR by the time most folks even read this).

5 Interesting Learnings:

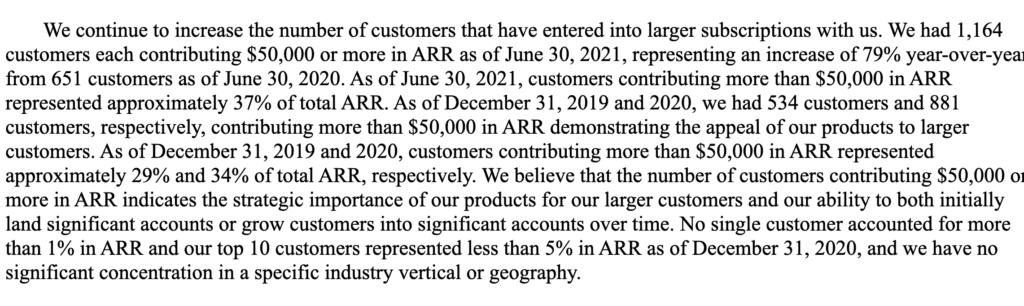

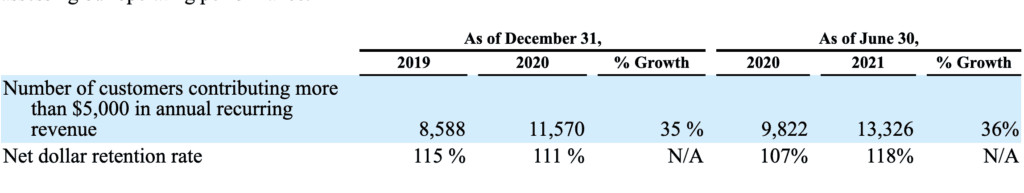

#1. A steady march above $5k in ACV. While only 25% of Freshworks’ customers pay more than $5k a year, they represent 84% of total ARR.

And that number has gone up from 78% in 2019 to 84% today. Freshworks hasn’t gone super-enterprise. But even with SMBs, it’s the bigger ones that are driving growth at scale — 50% of ARR is now from customers with more than 250 employees. And the largest customers now are driving the fastest growth. Just 2% of their customers now pay $50,000 or more in ARR. But those customers paying more than $50k represent 34% of ARR (!), up from 29% just a year ago.

Going a smidge upmarket is key to Freshworks’ putting up the big numbers at scale.

#2. NRR of 118%.

This is pretty impressive for a high ACV SMB sale, although pretty consistent with where Zendesk is today as well at 120%.

#3. 49% revenue growth from 20% customer growth.

This is pretty impressive given how many SMB customers they have (although consistent with 118% NRR). Freshworks had about 44,000 customers on June 31, 2020 and now has 52,500 — 20% growth in customer count in a year. But ARR is growing 49%.

#4. Both the Freshservice and Freshdesk product lines are well in excess of $100m ARR each. A reminder of how key multiple products can be.

Many of us older timers in SaaS will continue to think of Freshworks as mainly Freshdesk, but that’s hardly the case. Freshservice on its own crossed $100m in ARR in December 2020. And Freshsales is the smallest of its big 3 products, but even there, they have 6,500 customers today, vs. 8,900 on Freshservice and 35,800 on Freshdesk.

#5. From 10,000 customers in 2015 to 50,000 in 2021.

Just a visceral reminder of how things compound in SaaS. 10,000 customers is a big milestone, and many SaaS companies with larger ACVs IPO around then. But it’s just the start. Freshworks quintupled its customer base from 2015 to 2021.

And a few bonus learnings:

#6. 62% of revenue from annual subscriptions.

A reminder that, like Zoom, you don’t have to force annual subscriptions. 62% annual is up from 54% in 2019, so a big push there. But still, 38% of Freshworks customers pay monthly.

#7. Only 18% of customers purchase 2 or more products today — but those 18% represent 45% of total ARR.

Another way to see how critical a multi-product strategy often is at scale. Like at Box and other leaders, the bigger customers want and buy multiple products.

#8. Global footprint key to growth.

Freshworks is a global SaaS company, but perhaps reflecting its roots, only 45% of its revenue is in North America. Still its largest market, but 40% is in EMEA and 15% ROW. Truly a global customer footprint.

#9. S/M/L customer count mix: 38,700 SMBs, 8,300 mid-market, 1,300 enterprise.

A lot of apps that customers of every size can use see a roughly similar distribution.

Most of all, Freshworks is a reminder of just how many winners there really can be in SaaS today.

Competing with both Zendesk and Salesforce, as well as HubSpot and more, they are still growing an epic 49% at $400m in ARR.