OK Gartner is NOT a SaaS or Cloud company. But — it’s one that is very important to many of us that sell into the enterprise. Its research and reports in enterprise software are critical. And … 92% of its revenue is from subscriptions. So while not SaaS, it is “Research as a Service”. Or something like that.

Given how critical its research is in selling to the enterprise, I wanted to take a look at its business. It’s a lot bigger than I’d realized today.

Today, Gartner has now crossed $6 Billion in revenue, with a stunning $35 Billion market cap. And its very profitable. Not too shabby!

And its stock price is up +35% the last year, and +192% the past 5 years:

5 Interesting Learnings:

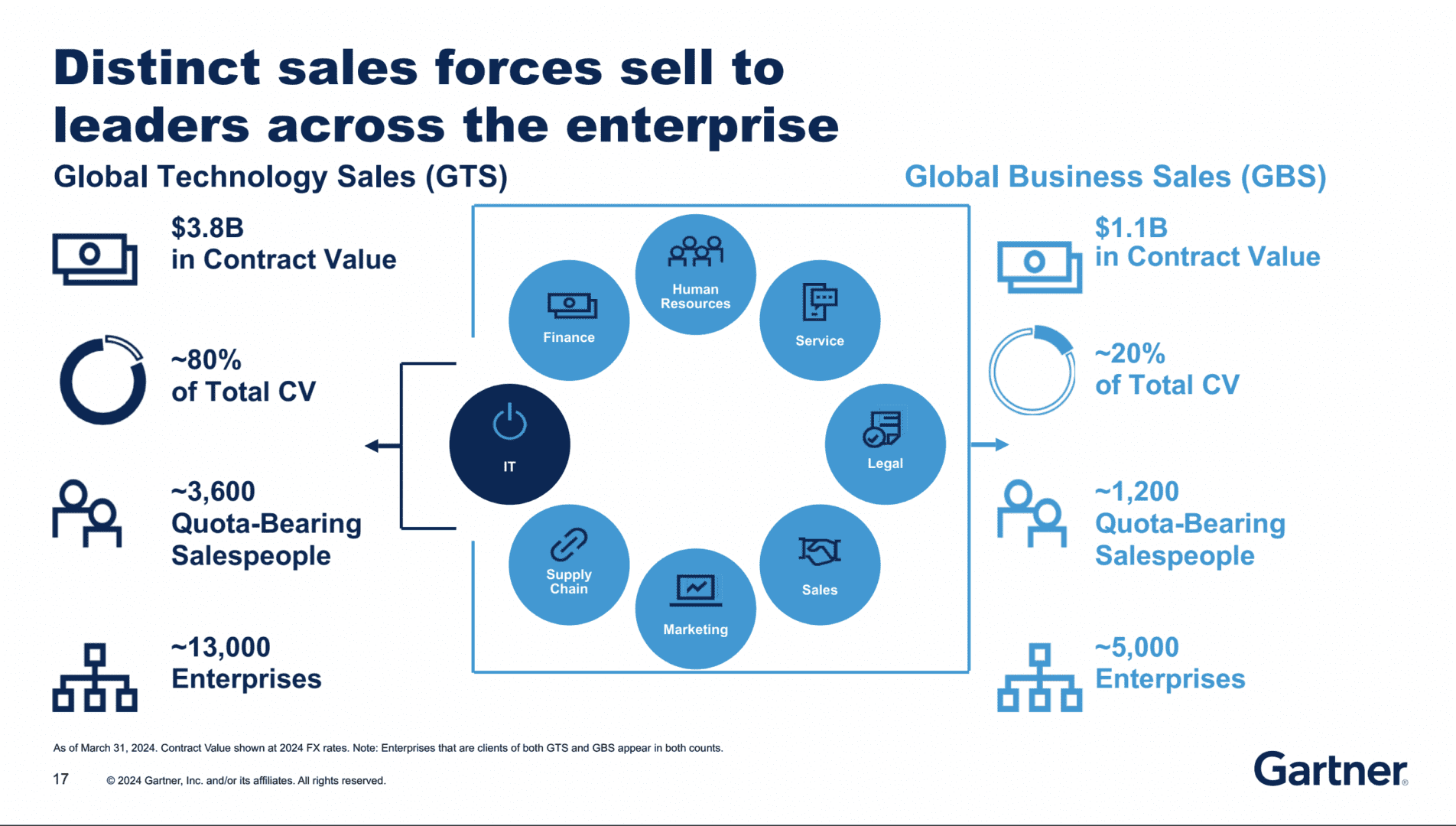

#1. About $1m Quotas for 5,000 Sales Reps

Gartner is split into two divisions, and interestingly, both have quotas of about $1m per rep.

#2. Steady 14% Growth Since 2013 Has Grown Business From $1.3m to 4.9m in Contract Value

The power of steady growth

#3. 92% of Revenue is Recurring

If you’ve bought Gartner research, you know this. Once you’re in, you kinda gotta renew ;). But in any event, it’s interesting how effective this is. A lot of “pseudo SaaS” doesn’t see this type of revenue retention. Gartner’s research does.

#4. About 104% Effective NRR

Gartner sees about -18% gross revenue churn, but price increases add +3% back, and additional research and purchases add +19%. That nets to about 104% “NRR”.

#5. 25% Adjusted EBITA Margins

Gartner doesn’t quite hit the crazy 40% of some of the most efficient in software, but it comes close. It’s very profitable.

And some great Gartner data here: