So a vertical SaaS player many have heard of but rarely talk about as a business is LegalZoom. You’ve seen the commercials for years. LegalZoom was founded way back in 1999. But you probably didn’t know they IPO’d not all that long ago.

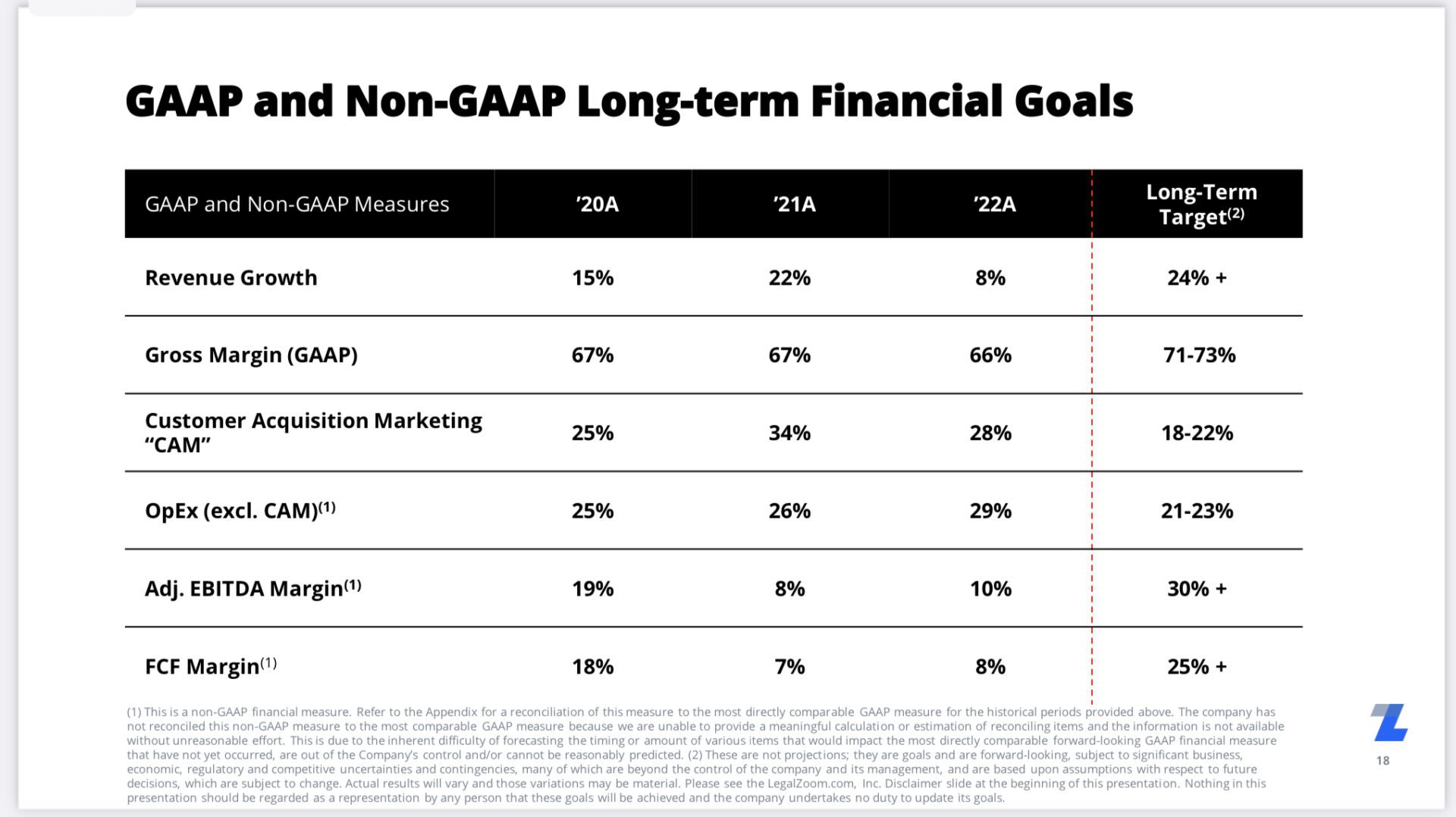

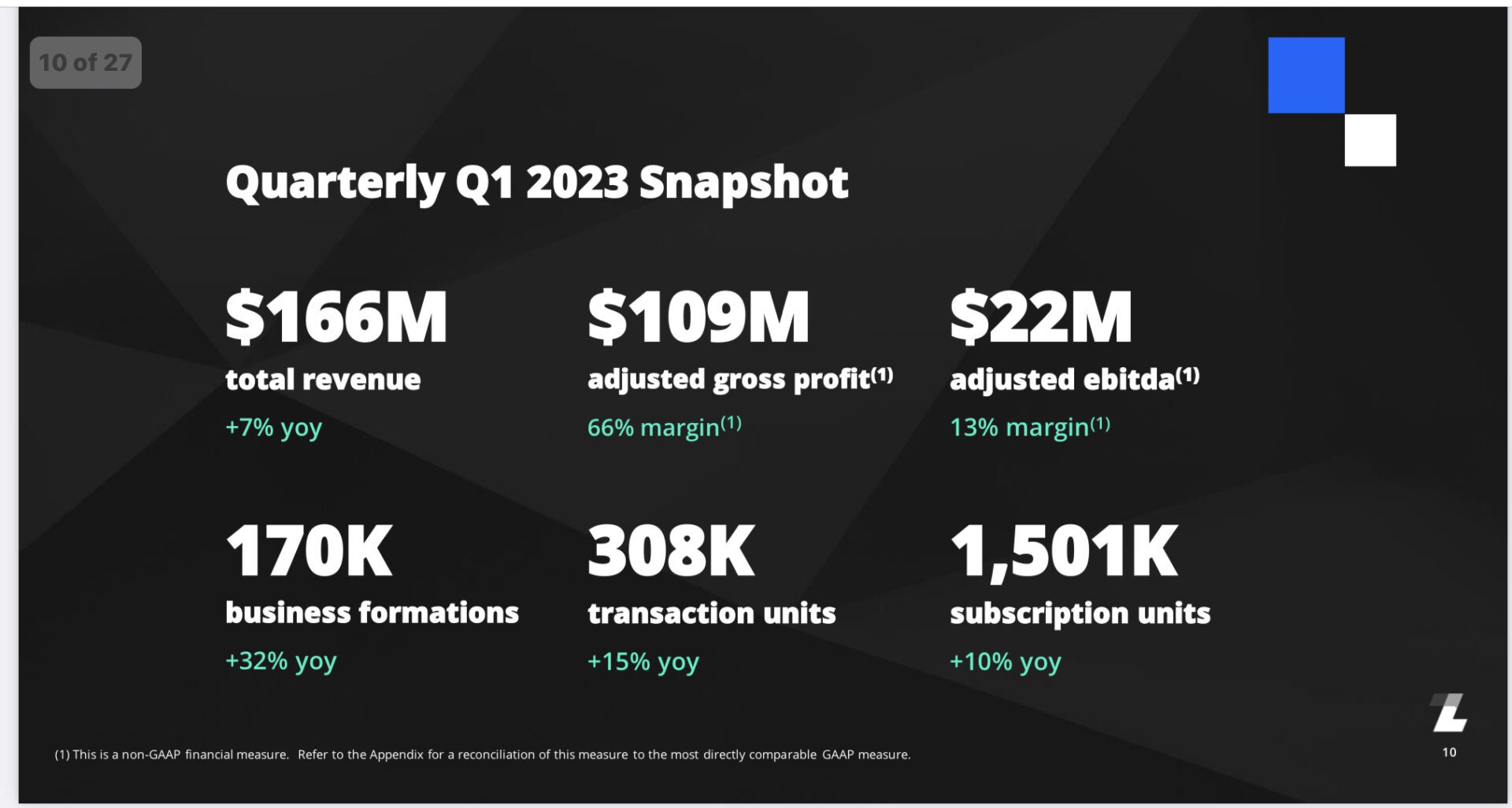

Today, the self-service legal services giant is worth an impressive $3.4 Billion at $660m in ARR and is fairly mature. They’re only growing revenue 7-8%, but they are relatively efficient, with 13% adjusted EBIDTA margins.

So while no longer a rocketship, LegalZoom is still growing and working on becoming even more profitable, guiding to $100m+ in adjusted EBIDTA for this year.

5 Interesting Learnings:

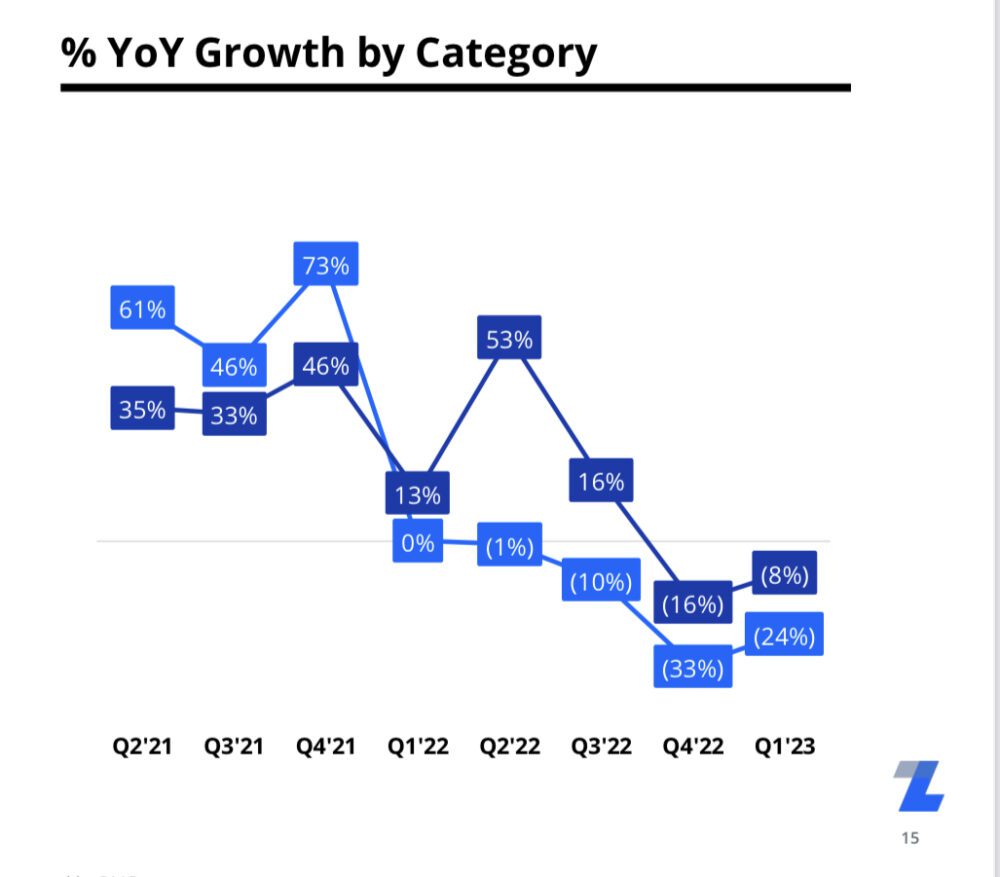

#1. Growth Slowed from 22% in 2021 to 8% Today. LegalZoom has seen significant headwinds, although it’s important to note they may not truly be “macro”. As LegalZoom notes, corporate formations, for example, are up year-over-year.

#2. A Bit of A Rebound From a Q4’22 Low, However. While growth has slowed dramatically at LegalZoom in the past 3 quarters, Q1’23 was up from the prior quarter.

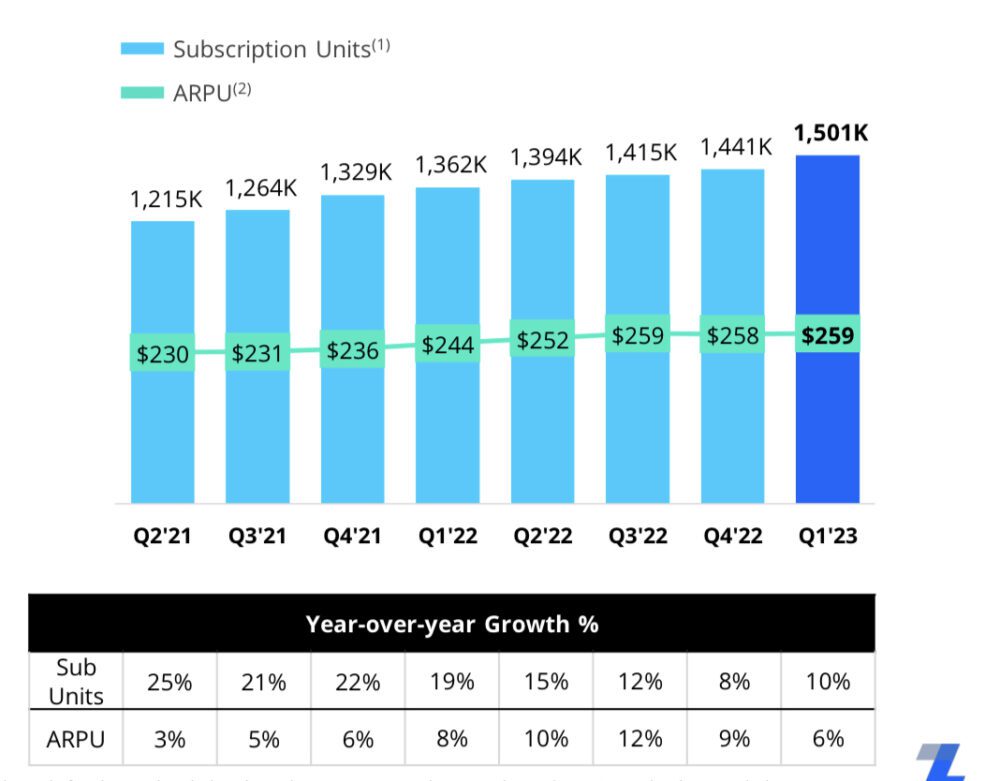

#3. Slowly and steadily moving ARPU up every year. LegalZoom hasn’t had any huge increases in ARPU, but it does drive ARPU up a smidge every year. Over time, that really helps once growth itself has slowed.

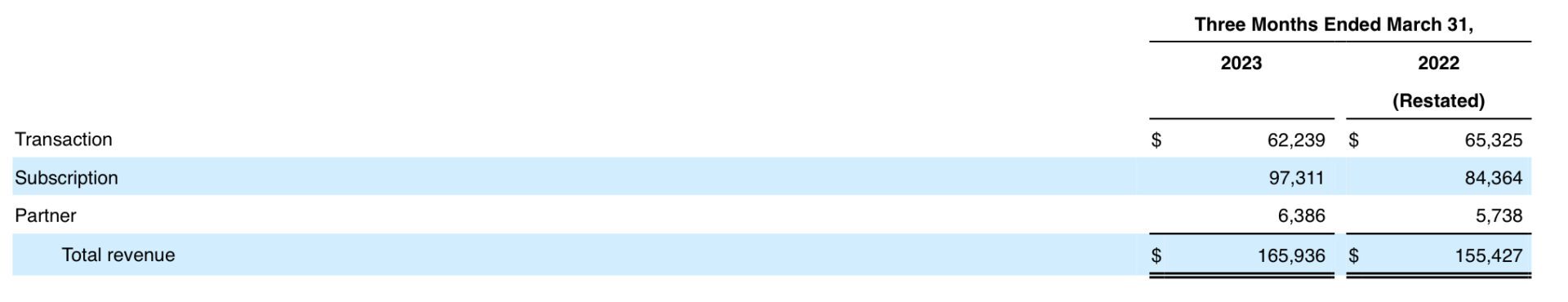

#4. Transaction Revenue Has Slowed, But Subscriptions Are Up. LegalZoom has pushed more and more customers to subscribe to its legal services vs. just purchasing one-off products like incorporation.

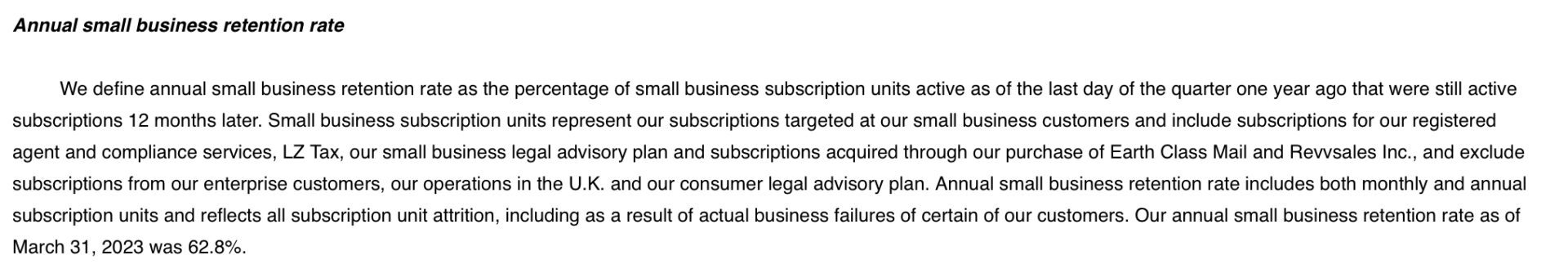

#5. 62% Logo Retention Rate. The ultimate challenge with a lot of low-end self-service businesses is they often see inherent churn of around 3% a month. LegalZoom is one of them, only retaining 62% of its new customers one year later.