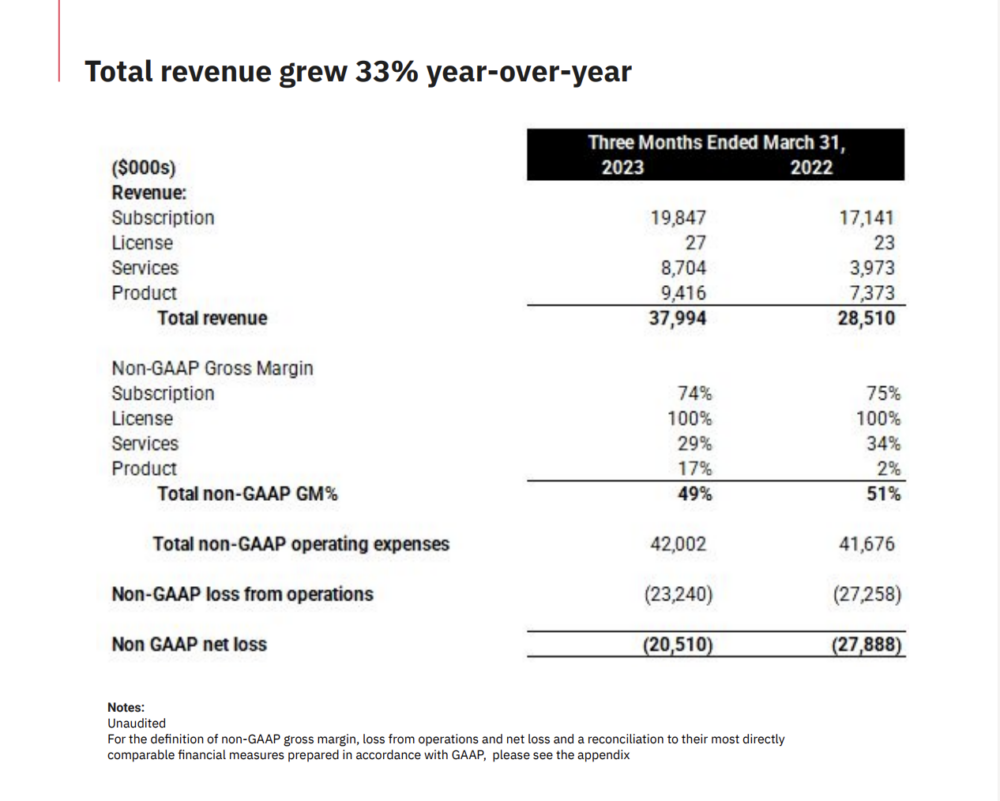

So if you’ve looked for real estate lately, you’ve probably used Matterport software to see those cool 3-D renderings of homes and buildings. The business exploded during lockdown when in-person tours were more difficult, growing 100% YoY from 2020 to 2021, and the business continues to grow today. It’s now at $160,000,000 in “ARR” growing a healthy 33% year-over-year. Its market cap is $945m, but that’s including $450m in cash, so the net enterprise value is closer to $500m, or a bit less than 4x revenues.

One reason to do a deep dive on Matterport is as a case study for the pro and cons of “SaaS + Services” models. These hybrid models have exploded over the past few years. The pro is they let you do a lot more than you can do just in software. E.g., 25% of Matterport’s revenues come from sales of its Pro2 Camera (“Product” revenue), and another large chunk from scanning their properties (“Services” revenue). The cons include lower gross margins, as we’ll see below.

#1. 49% Gross Margins, and Going Down. Services and “Product” revenues (revenues for doing the scans and buying the cameras, respectively) have much lower margins than software — 29% and 17%. That drags down overall Gross Margins to 49%, at the edge of what we’d consider a software company. 60% is the traditional cut-off.

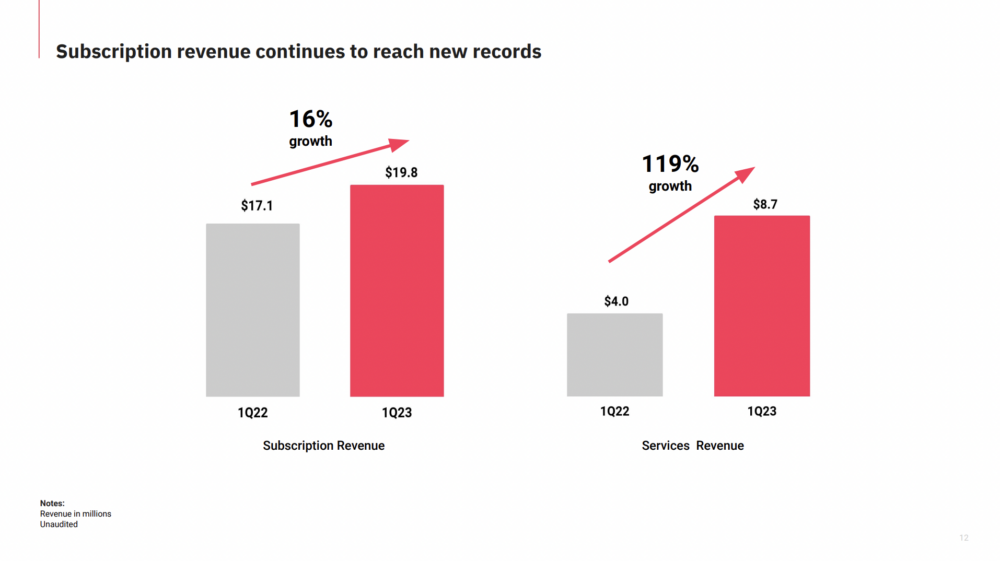

#2. Services Revenues Growing Faster than Software Revenue. Overall revenue growth is solid, but Matterport in a sense is becoming less of a software company, as services revenues grow faster. Subscription revenue is up just 16%, while services revenues are up 119%. Subscriptions are now down to 52% of revenue, from 60% a year ago.

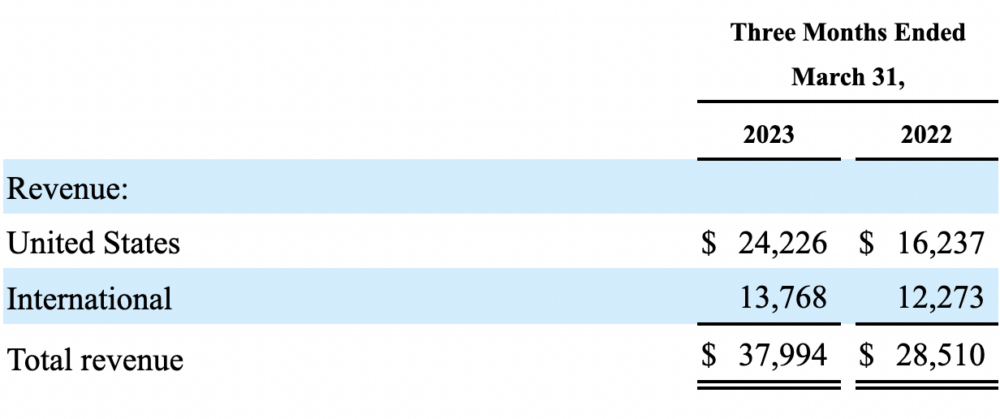

#3. 36% of Revenue From Outside the U.S. Go Global, folks!

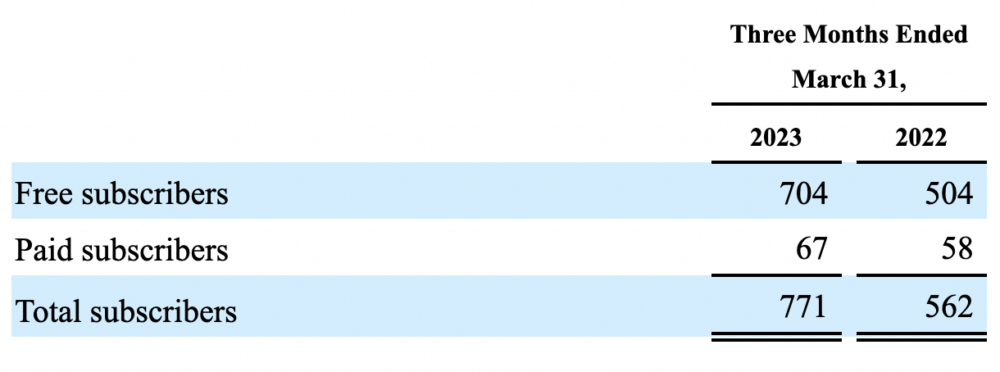

#4. Free and PLG remain a big part of the playbook. 90% of Matteport’s subscribers are Free. One property can be hosted for free, after that, you gotta pay:

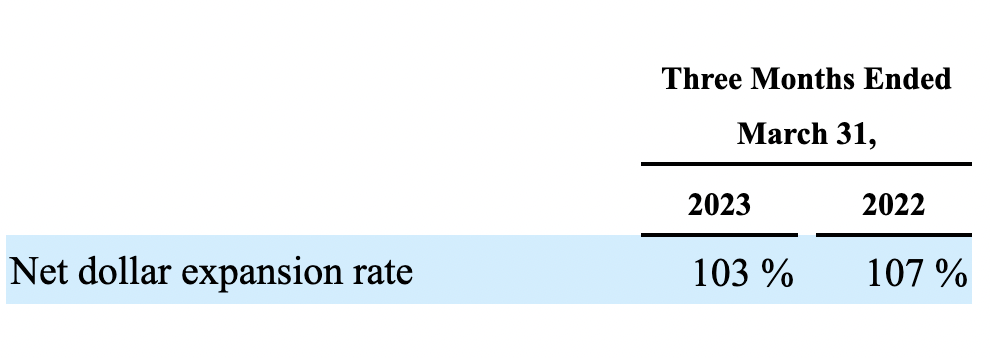

#5. NRR of 103%, down a bit from 107%. While not truly top-tier, it’s still impressive Matterport retains NRR of > 100% when some uses are almost transactional.

Matterport has its challenges, and a tough multiple. But the product itself is beloved with strong market share and plenty of TAM to grow into. Will it ultimately though become a lowish margin hardware + services company, as those revenues eclipse the SaaS revenues? We’ll see.