So Okta is one of our favorite SaaS and Cloud leaders.

The story is super inspiring. Founder CEO Todd McKinnon was VP of Engineering at Salesforce and left to start Okta in the depths of the last downturn. Salesforce and Marc Benioff at first said the core market, secure identity, was too small of a market. Then, they brought out a competing product :). That mostly failed.

Today, Okta is at ~$2,500,000,000 in ARR! More on that story here:

Okta is also interesting today, in today’s world. because it straddles two segments. On the one hand, it’s a leader in security — a hot space that is still growing like a weed. Cloudflare, Zscaler, Wiz, and so many more are on fire today. But it’s also tied to B2B seat models and tech. So as tech companies tighter their belts, and decrease seats, the same headwinds that have impacted ZoomInfo, Zoom, and many B2B leaders from Outreach to Gong and more also impact Okta.

Net net? It’s growing 19% a year at $2.5 Billion, ARR, so at the edge of still being in growth mode. But that’s way down from 37% at just $2 Billion in ARR.

5 Interesting Learnings:

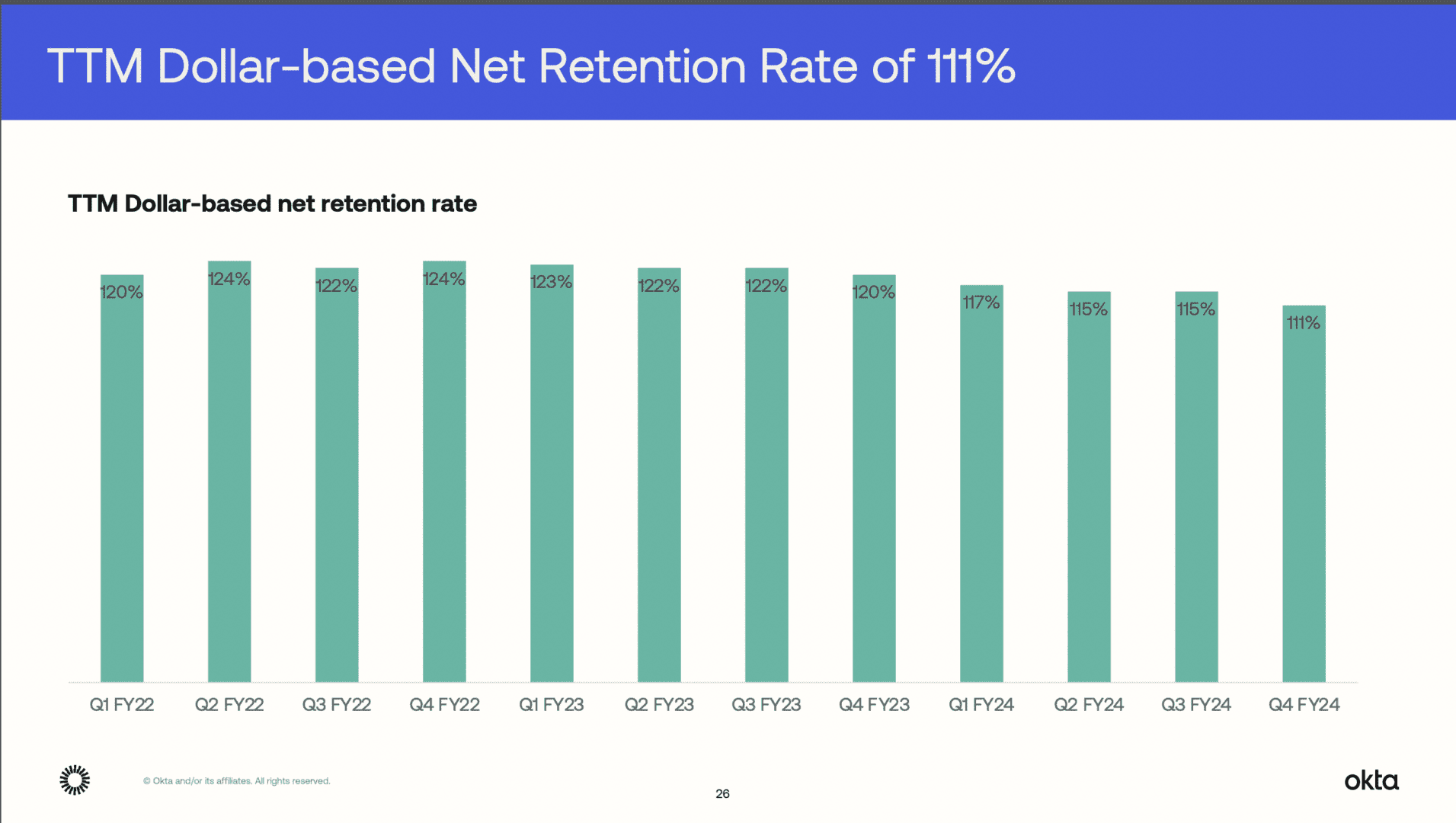

#1. Seat Contractions Have Brought NRR Down From 120% to 111%

While 111% NRR is still quite an engine at this scale, the drop in NRR from seat contractions explains a good chunk of the headwinds Okta has seen.

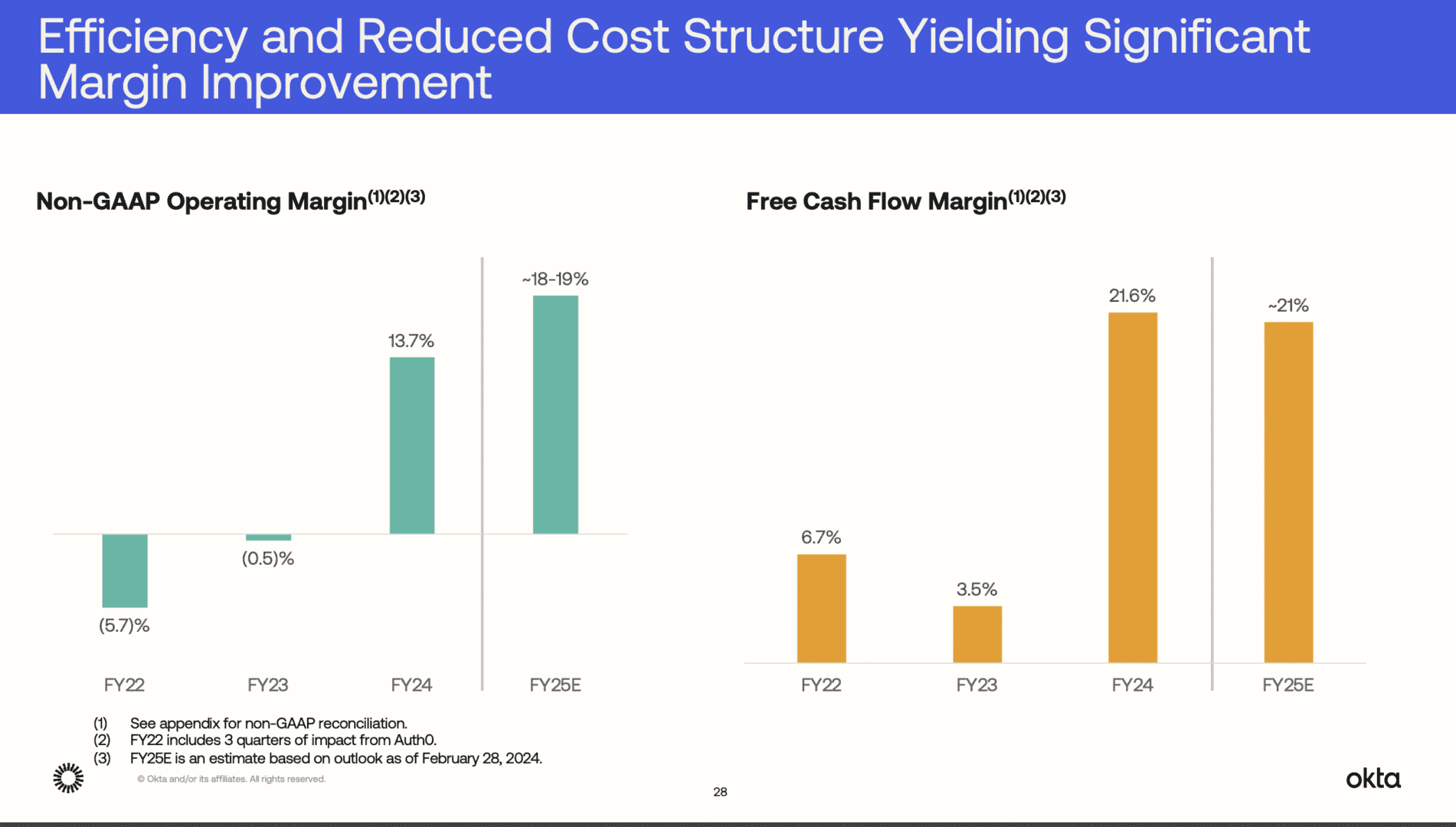

#2. Much, Much, Much More Efficient Than 12-24 Months Ago

The story of almost every Cloud leader. In just 12 months, Okta has gone from -1% non-GAAP operating margins to +13.7%. Free cash flow is even more impressive. It’s rocketed to +21.6%. That’s radically more efficient. That’s 2024.

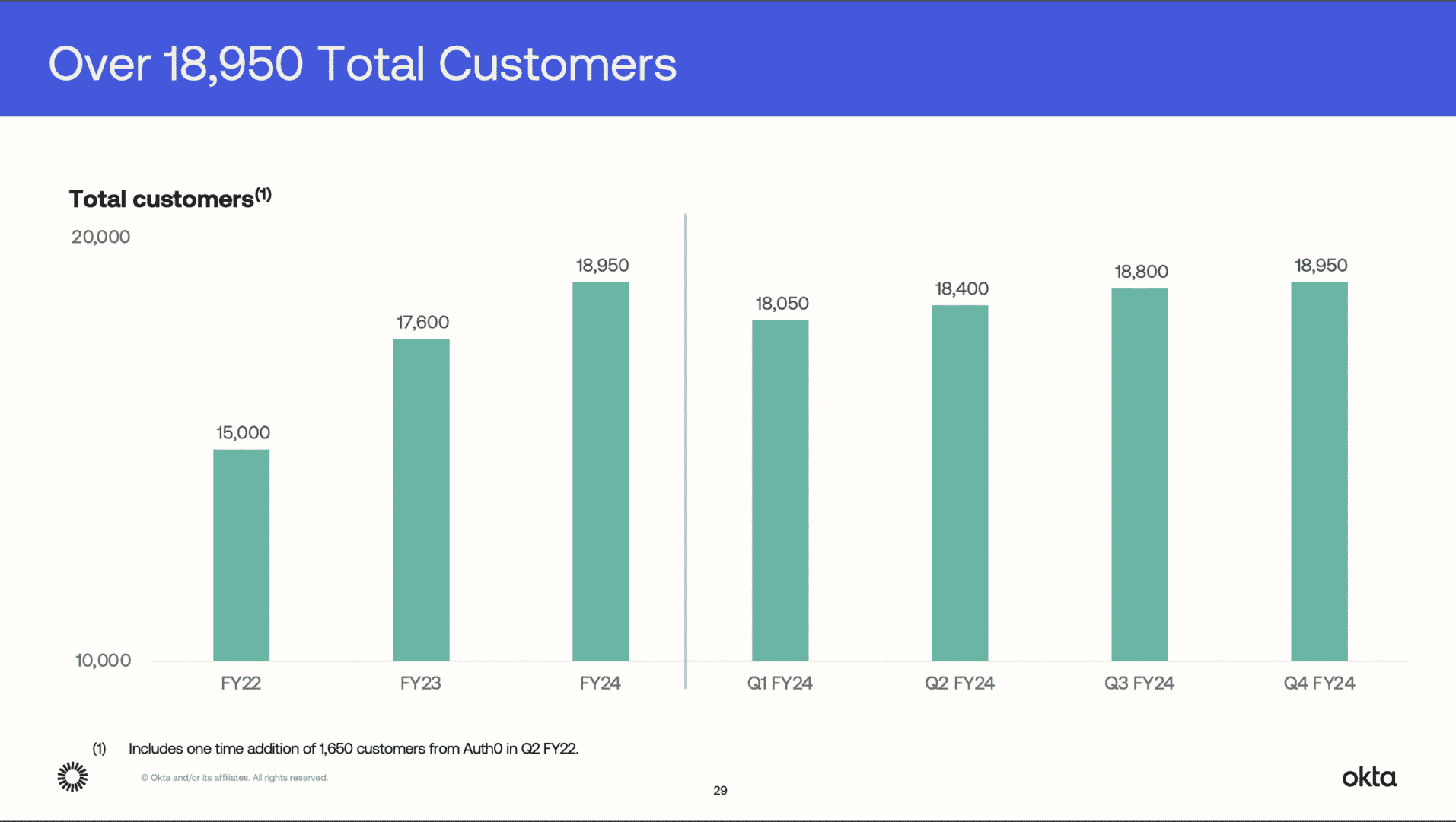

#3. Customer Count Up 8% Year-over-Year to 18,950

It’s hard to find net new customers after $1B ARR. At some point, it can feel like everyone already is a customer. But Okta keeps going there even after $2.5B ARR. 8% new customers + 111% NRR = their +19% yearly growth now.

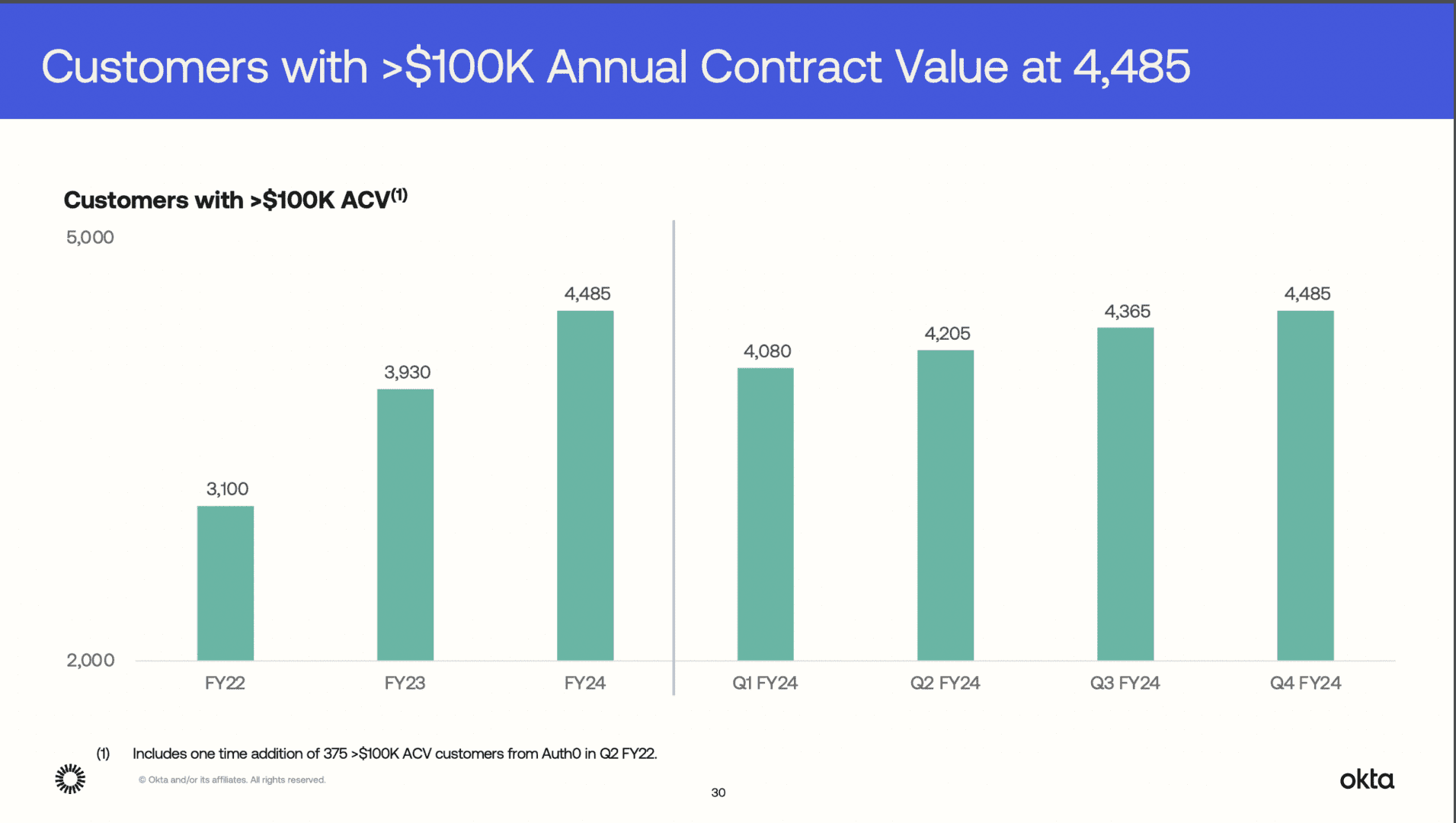

#4. $100k Customers Growing Faster, at +12% a Year, and $1m+ Customers Up 30%

Okta’s bigger customers, at $100k+, aren’t growing radically faster than the rest. But like many SaaS and Cloud leaders today, the bigger ones are still growing faster. They are overall benefitting here from the growth in Cloud and security budgets, even if smaller companies and startups and scaleups are struggling more. Their multi-million dollar contracts are 30%.

#5. Split Sales Team Managing SMB Accounts Into 2 Teams, One on New Business and One on Upsell

It’s interesting to see Okta do this a bit later in life than some, but it makes a ton of sense given the current macro environment. While many tech SMBs are struggling, finding the gems in the SMB base that can grow into large accounts is still critical. So it makes sense, where practical, to split the teams here.

And a few other interesting learnings:

#6. 8 Out of 10 of Top Deals Were Sourced or Influenced by Partners

And more than 40% of their total business is invoiced via channel partners. AWS alone generated $175m of contract value for Okta, growing 130%. Way, way too many startups focus 100% on direct sales. You usually have to start here, but as time goes on, you need to bring in partners in most cases.

#7. GRR / Logo Retention in Mid 90% Range.

Strong, and what we’d expect.

Wow, what an engine at $2.5 Billion in ARR! Go Okta!

And another great SaaStr Okta session here, this one with co-founder and COO Frederic Kerrest: