So there’s a quiet leader in the work management space that’s quietly … blowing the doors off.

Everyone knows Atlassian, Asana, Notion, probably Monday. But Smartsheet?

You should know them. They’re at $1 Billion in ARR now, growing an impressive 23%. The public markets aren’t completely in love with the space — it trades at an average $6.3 Billion, or just 6.3x ARR. Asana similarly trades at just $4 Billion today on ~$700m in ARR, so about the same.

Today, Smartsheet is proud to commemorate a milestone $1B in annualized recurring revenue. We've grown from a PNW startup to pioneering the enterprise work management by empowering humans to do their most meaningful work. Let’s keep building together: https://t.co/4lhjxTo0eH pic.twitter.com/LK1bFIk4HY

— Smartsheet (@Smartsheet) January 17, 2024

But Smartsheet is a good one. Undervalued? Yeah, maybe so.

5 Interesting Learnings:

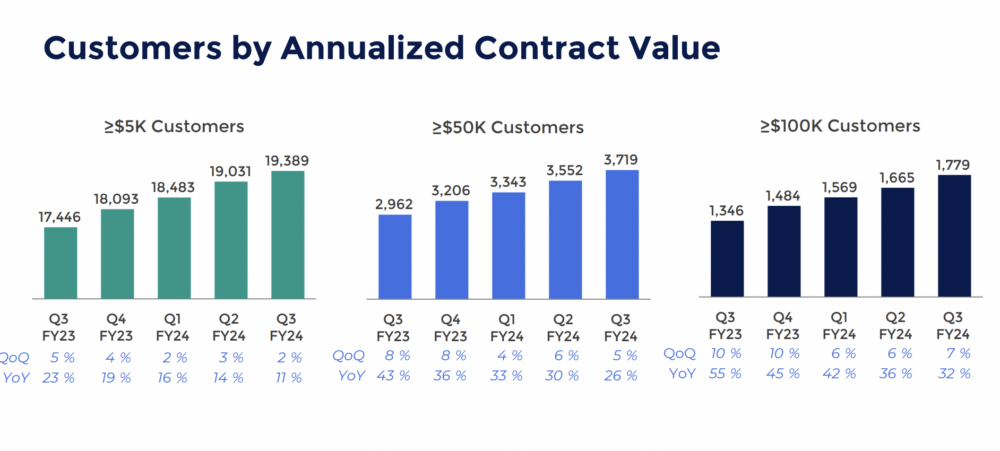

#1. The Biggest Customer Segments Are Growing the Fastest.

Smartsheet has thousands and thousands of small customers, with an ACV of < $5k. But the bigger ones are the ones driving revenue growth at scale. As you can see, $100k+ customers are growing the fastest, followed by $50k, then followed by $5k+ customers. And they now have 59 $1m+ customers, up from 40 a year ago. And 51% of their revenue now comes from $100k+ deals.

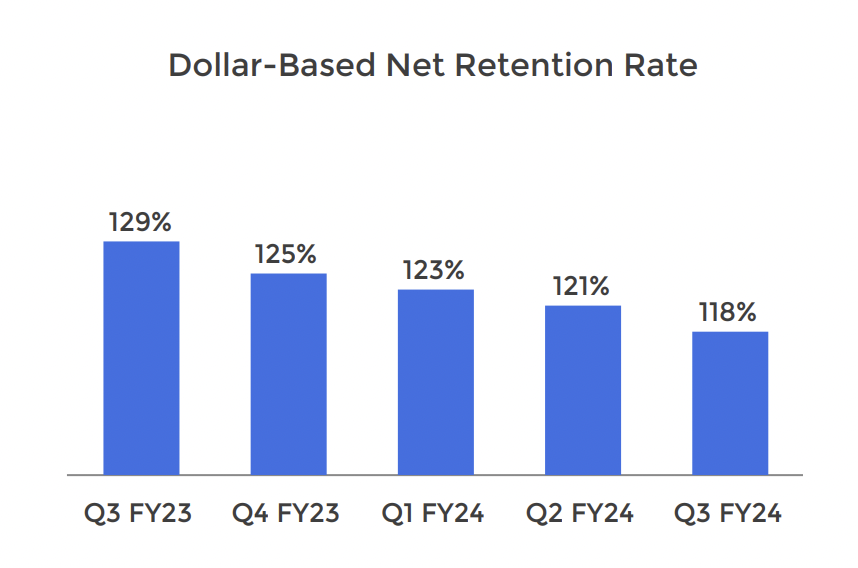

#2. NRR Has Fallen to 118%, But Still Relatively Strong

Smartsheet isn’t immune from downgrade pressures these days. In fact, NRR has fallen over 10% — from 129% to 118%. But it’s still relatively strong. They see it hitting 116% in the coming quarters.

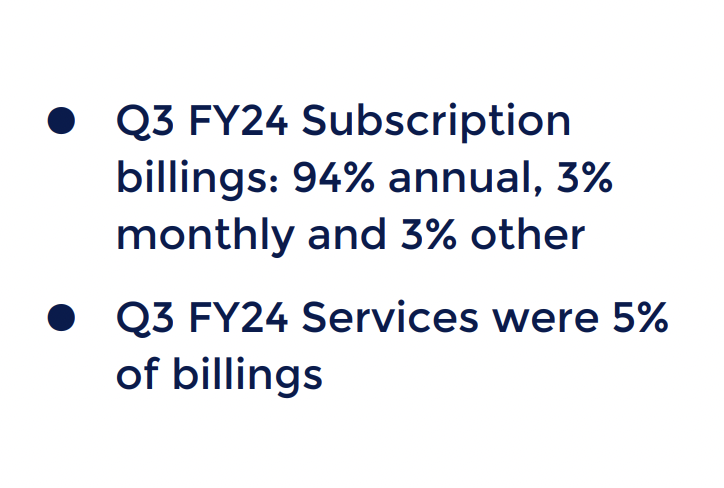

#3. 94% of Customers Pay Annually, Including SMBs

Smartsheet has plenty of smaller customers, and that’s its roots. But it knows onboarding requires business process change, so for the most part, it requires annual contacts, and has for years.

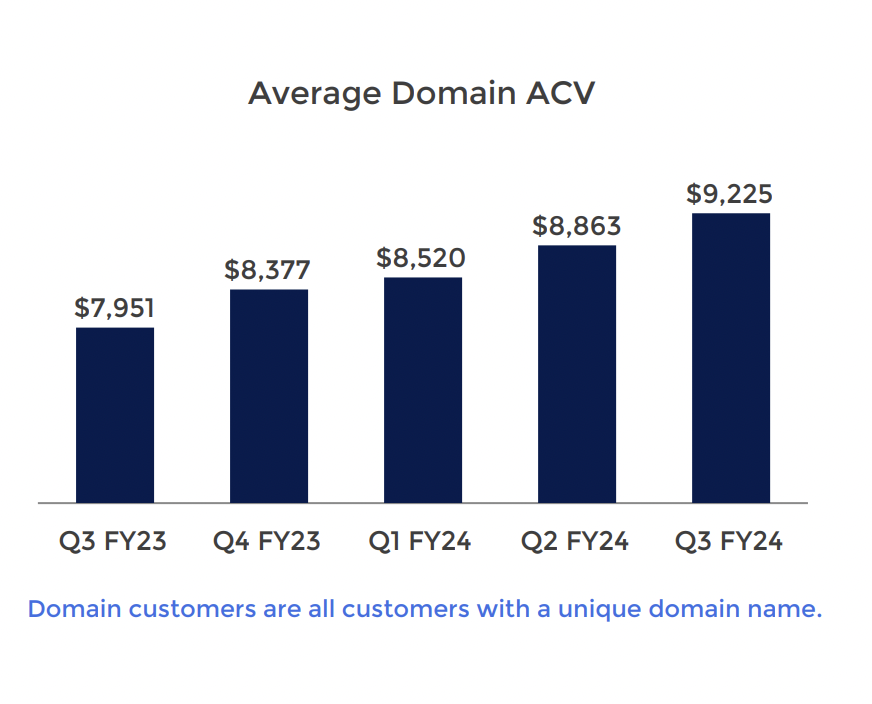

#4. Driving ACV Up 16% Key To Growth

Smartsheet has driven its core customer ACV up from $7,951 in 2023 to $9,225 — that’s +16% in a little more than a year. That’s been critical to them maintaining revenue growth.

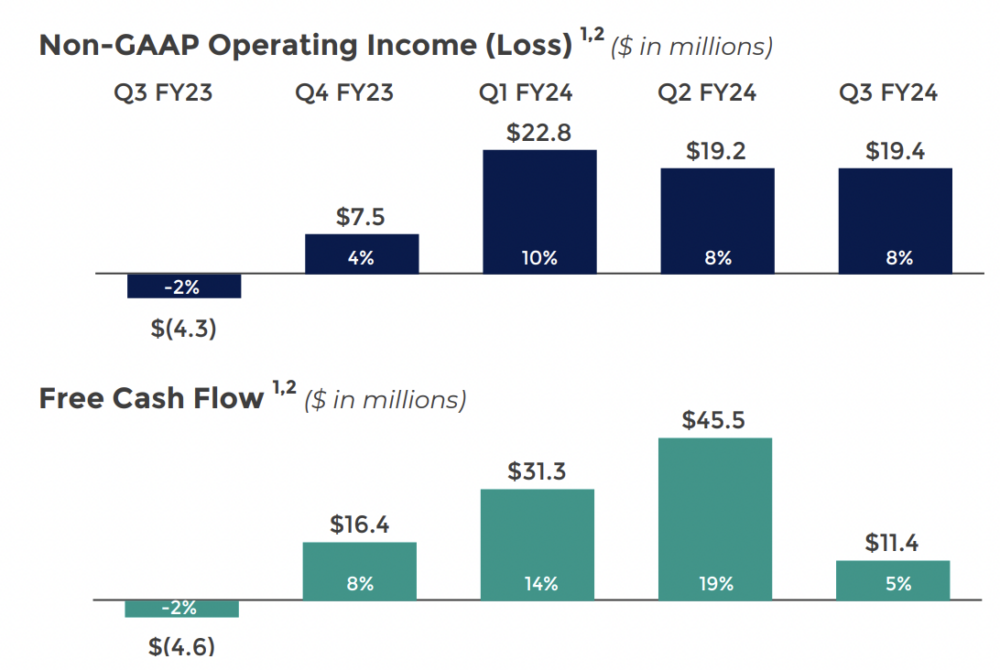

#5. Like Almost Every Other SaaS Leader, They’ve Gotten Radically More Efficient The Past 12-18 Months

A year and a half ago, Smartsheet wasn’t cash flow positive, and it had negative non-GAAP operating income. 12-15 months later, it’s a whole new world. Smartsheet like most other SaaS and Cloud leaders held the line on costs and expenses, but still grew revenue. The result? A much, much more efficient company in 2024.

And a few other interesting learnings:

#6. Growing Faster Than Others Due to “Non-Tech Customers”

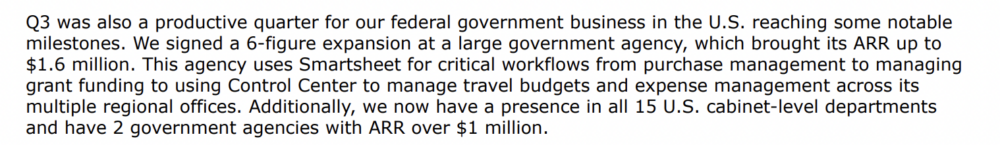

Smartsheet added a $850,000 restaurant customer deal, another big one at a top airline, and a third at a media and entertainment leader. And they grew a government contract to $1.6 million in ARR. Non-tech customers just haven’t been as impacted by the “downturn” in spend as core tech customers.

#7. Only 9% of Revenue From Customers Under $5k ACV

While small customers are Smartsheet’s roots, it’s hard to get to $1B in ARR with $2k customers. Today, only 9% of their revenue is from customers under $5k ACV.

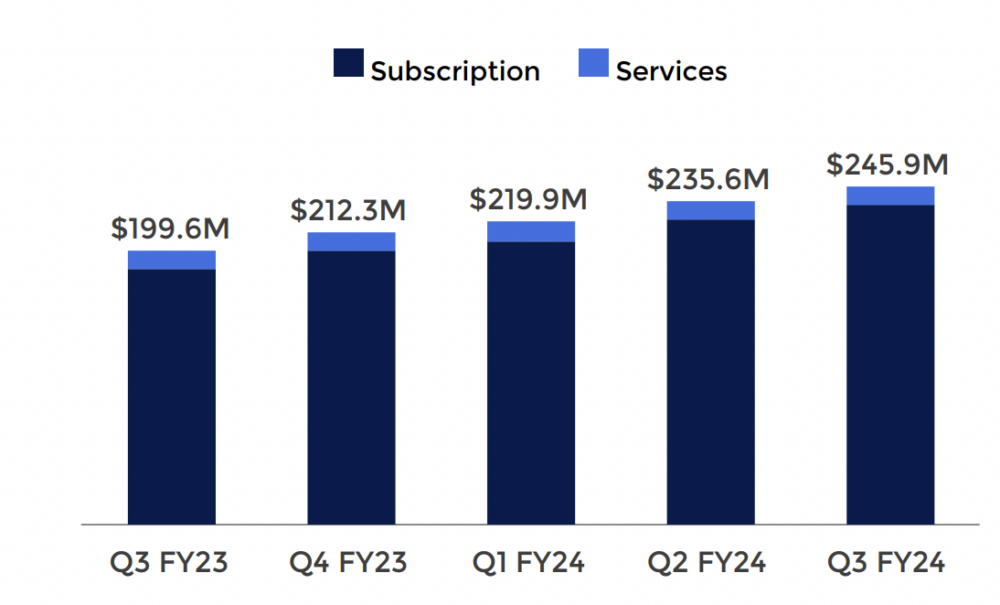

#8. Q4’FY23 Was The Toughest Quarter. Growth Up Since Then

You can see below that Q4’FY’23 was their toughest quarter, and Smartsheet only added $2.9m in net new ARR that quarter. The next quarter was a smidge better, and so on. So many saw their lowest quarter sometime in early 2023 and are at least through the lowest point of growth.

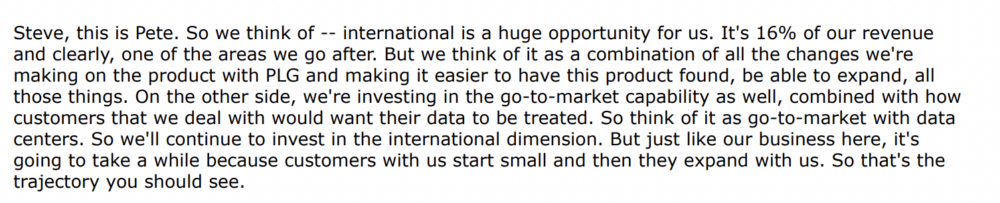

#9. International Only 16% of Revenue

I would have expected more, but in any event, a key growth vector for them going forward.

Boom! Quite a run to $1,000,000,000 in ARR, Smartsheet! We’ll check back it at $2B in ARR, if not before 😉