So Toast is the latest SaaS leader to get much more efficient in the past 12-18 months. Monday, HubSpot, Mongo and more all did the same.

But they’re still cruising — growing a stunning 45% as they blow past $1.1 Billion in ARR! Even with a company that is much more efficient than an IPO. And their stock is up 34% Year-to-Date, and it trades at a health $12.6 Billion — or 12x ARR.

5 Interesting Learnings:

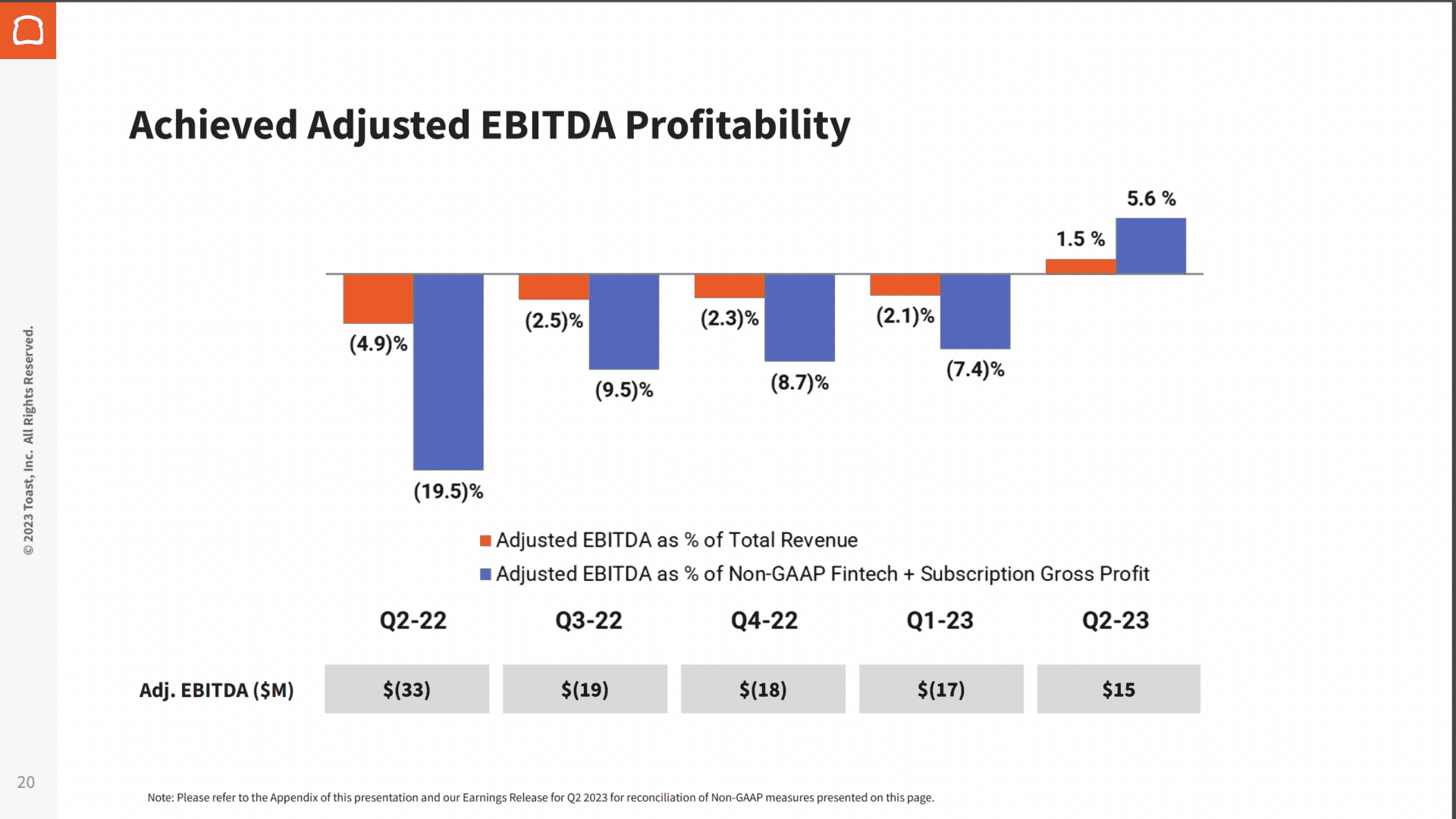

#1. Much More Efficient Business Today.

While I don’t love the different types of “Adjusted EBITA” Toast uses, this chart still demonstrates just how much more efficient the business is than a year ago:

Free cash flow is also up to $39 million last quarter, compared to negative $30 million a year ago. So that’s a lot more efficient, too.

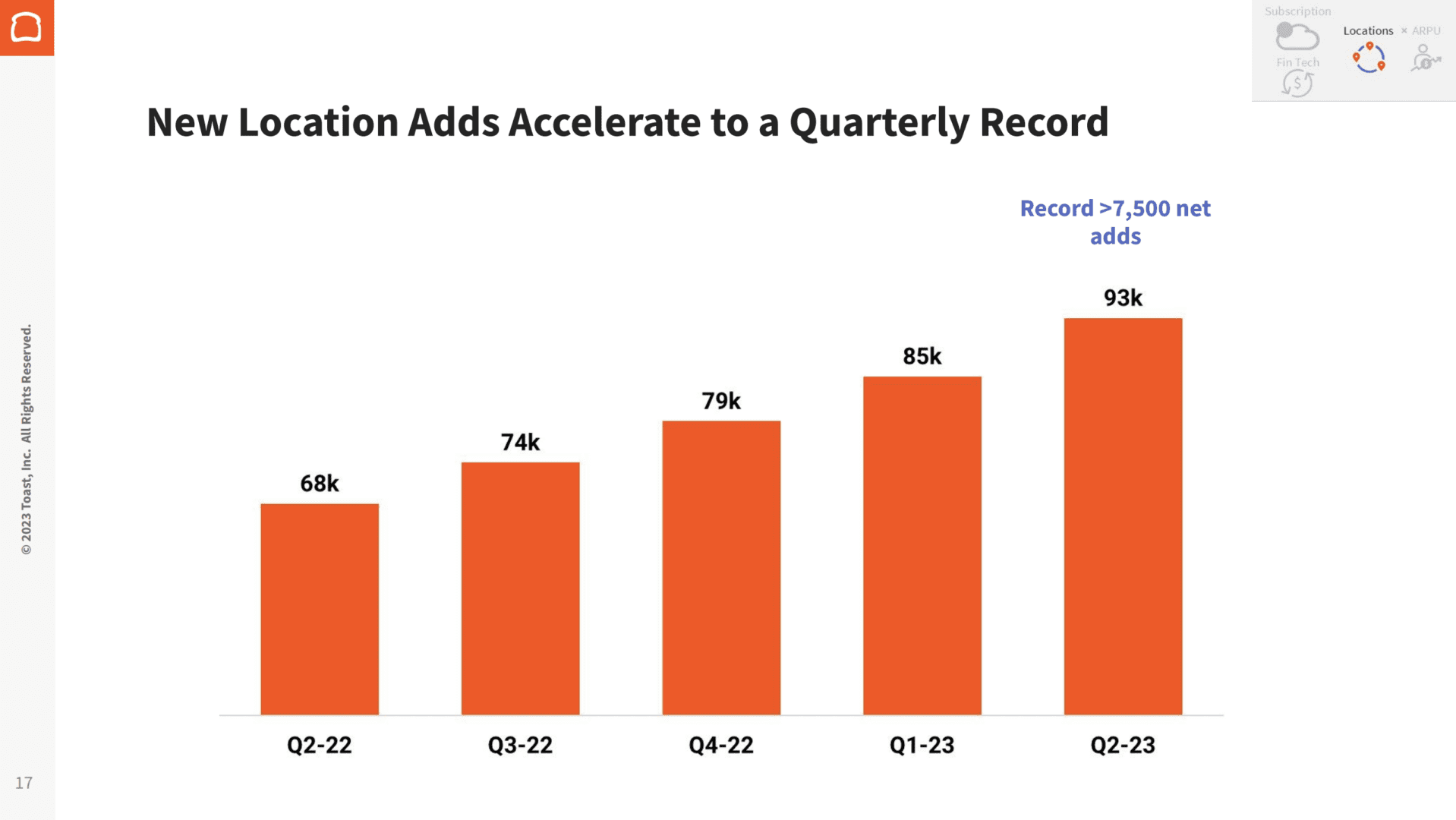

#2. Total Restaurant Locations Still Growing 35% at Year at $1.1 Billion in ARR.

Now we see the power of a truly large TAM. Restaurants are one of the largest segments of our economy, enabling Toast to still grow “logo” count at an impressive rate after $1B in ARR. While numbers vary, the number of restaurant locations in the U.S. is likely around 750,000. So Toast has significant market share, but it hasn’t tapped it out yet at $1.1 Billion in ARR.

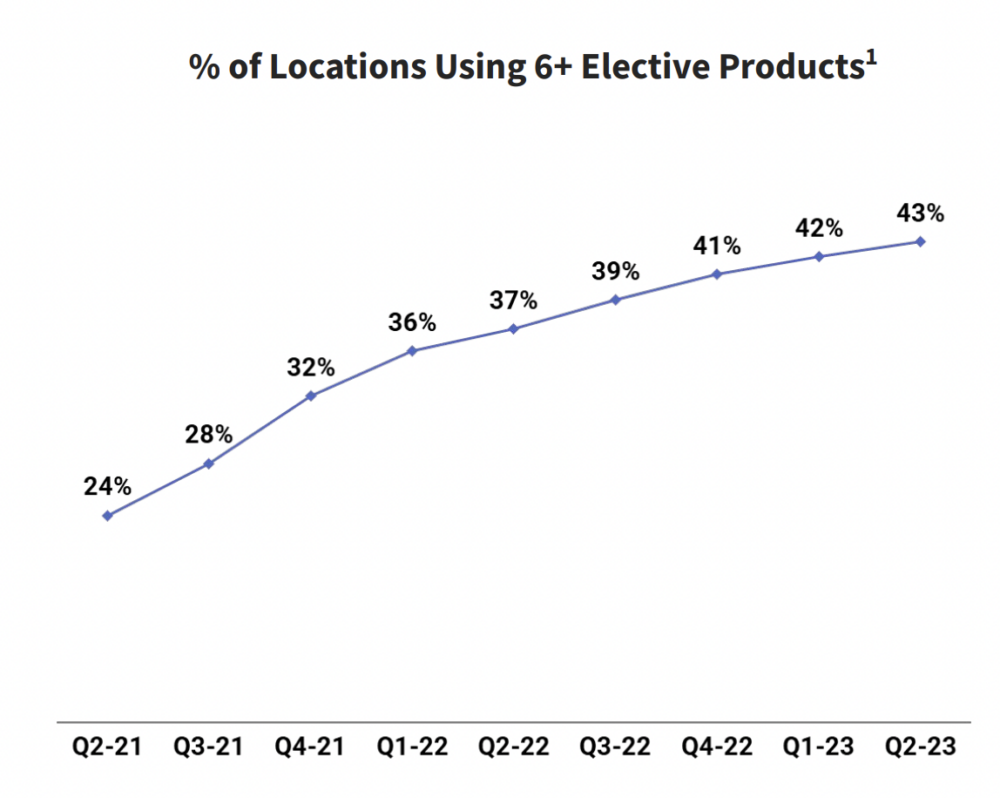

#3. Going Multi-Product is the Key to Growth at Scale.

The story we’ve learned again and again in SaaS, that’s it’s pretty tough to scale past $100m-$200m ARR in most cases being single product. Or in many cases, earlier than that, especially if you sell to SMBs.

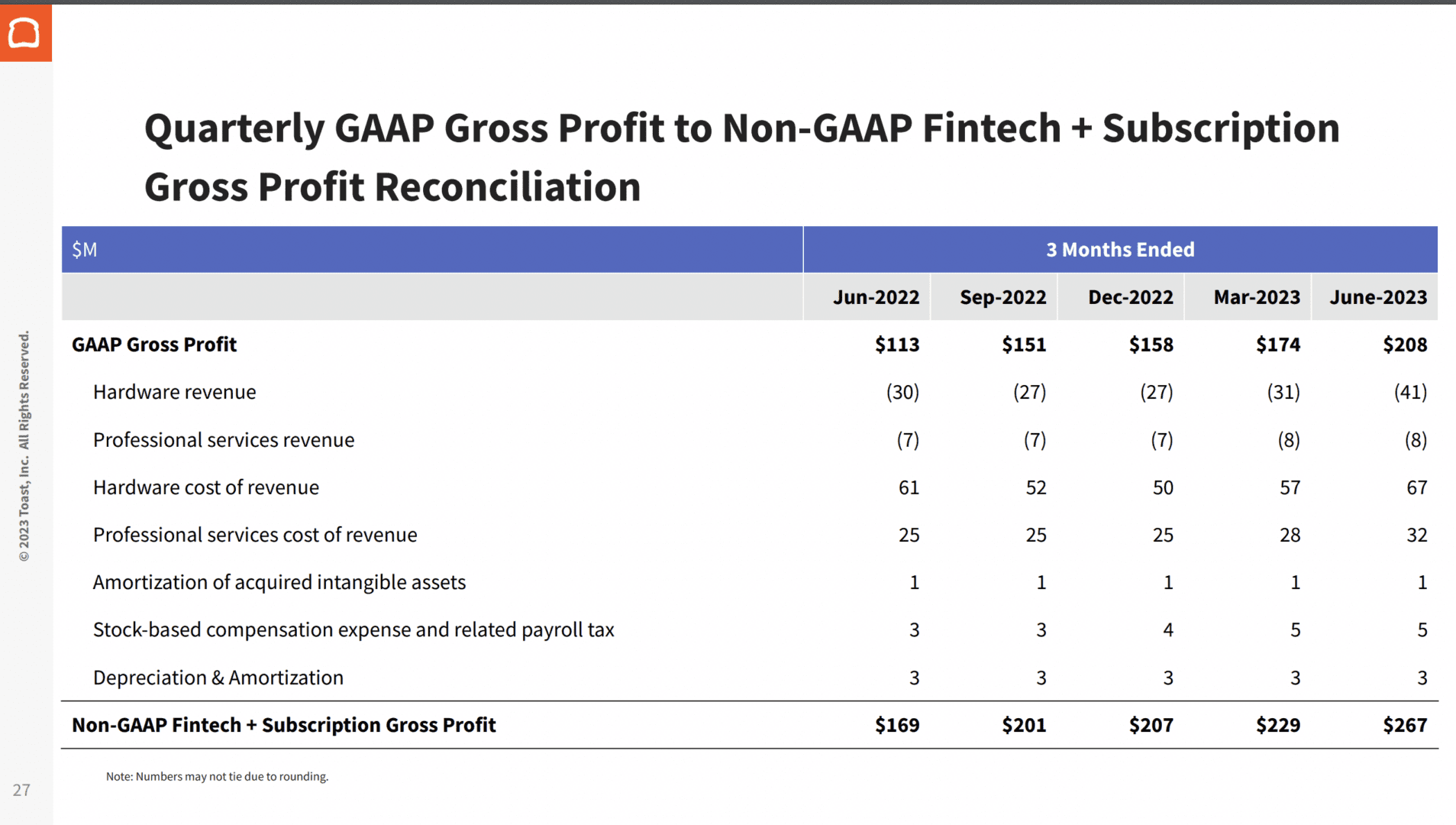

#4. Still Losing Money on Hardware and Services.

This is the challenge in Toast’s model. They’ve made efficiencies across the board, but they still lose money on the Toast restaurant hardware, and on getting new restaurants onboarded. Hardware + Software models are tough. The margins are finally working for Toast at $1B+ in ARR, but before that, it was harder.

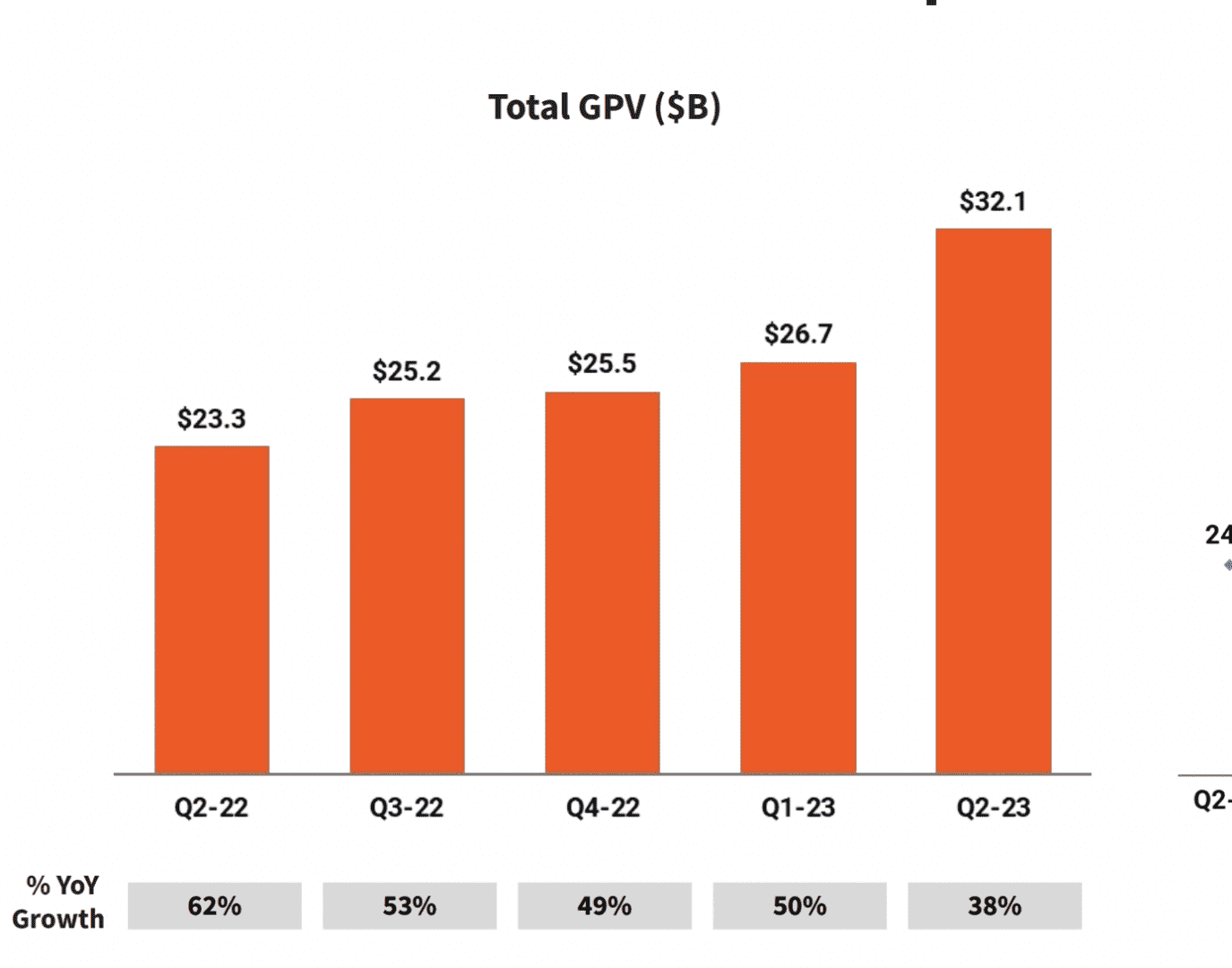

#5. No Slowdown In Transactions — In Fact, Usage is Up.

While some in SaaS are still seeing macro challenges, Toast is seeing a big gain in GMV. It just really varies based on product and industry. Yes, it’s tough times in some places in SaaS. But the U.S. economy remains on a tear overall.

And a few other interesting learnings:

#6. Customers are SMBs But Still Sign 1-3 Year Contracts.

This is fairly common when hardware needs to be subsidized by software revenue, but still always harder to convince SMBs than enterprises.

#7. Only 20% of New Customers Come From Word-of-Mouth

While 20% is still great, materially lowering their CAC, I would have expected even higher, given the strength of the brand. Getting a lot of. your customers from word-of-mouth is traditionally the way to get the tougher unit economics of SMB software to work.

Wow, quite a ride to $1B+ ARR for Toast, and still growing a stunning 45% (!). And quite a turn on efficiency. If Toast can do it, get more efficient — so can you.