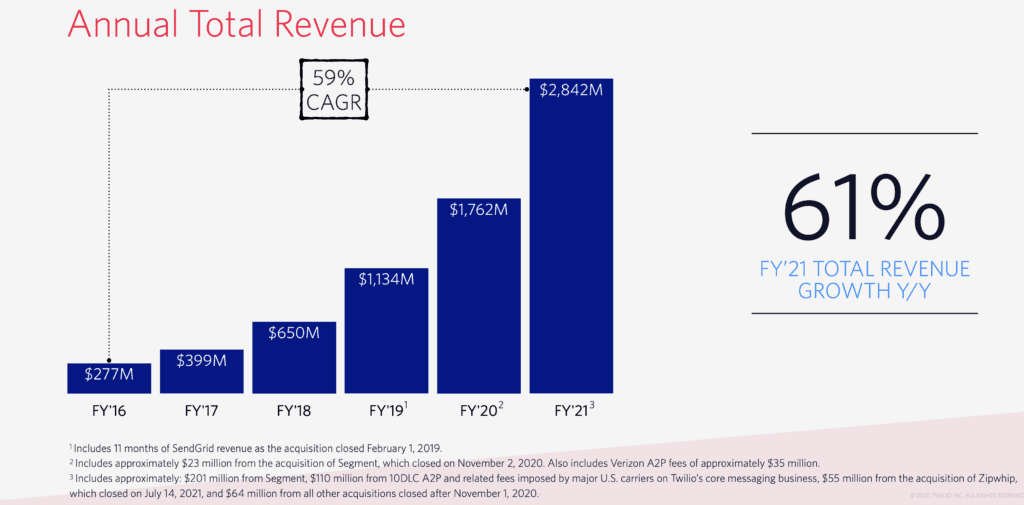

Oh wow, Twilio. We checked in at $1B ARR, and it was an epic company. At $2B, it was even epic-er. And now we’ll check in at $3.4B and just — wow. The best in SaaS and Cloud really do scale just about forever.

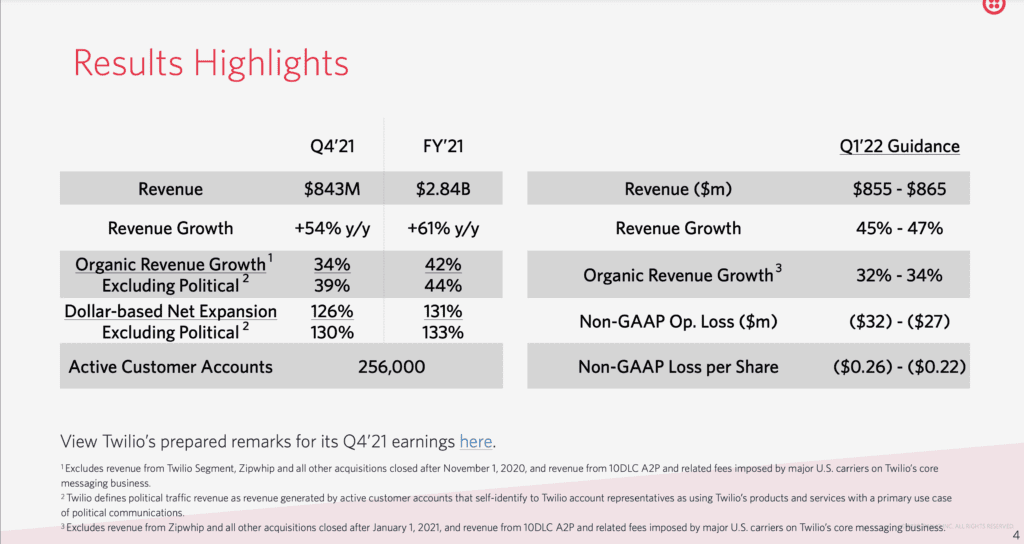

At $3.4B in ARR, Twilio is still growing a stunning 54% year-over-year!

Let’s see how they do it.

5 Interesting Learnings:

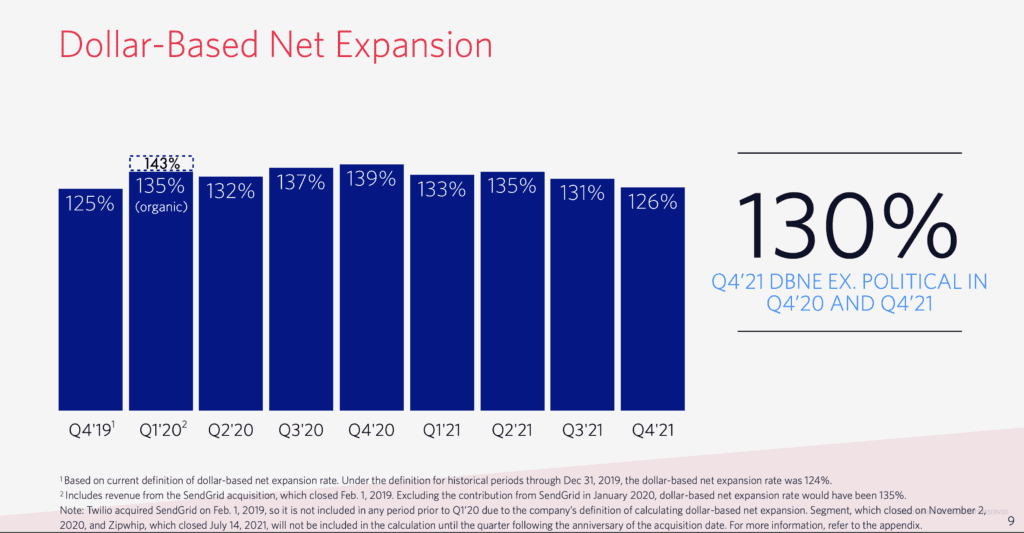

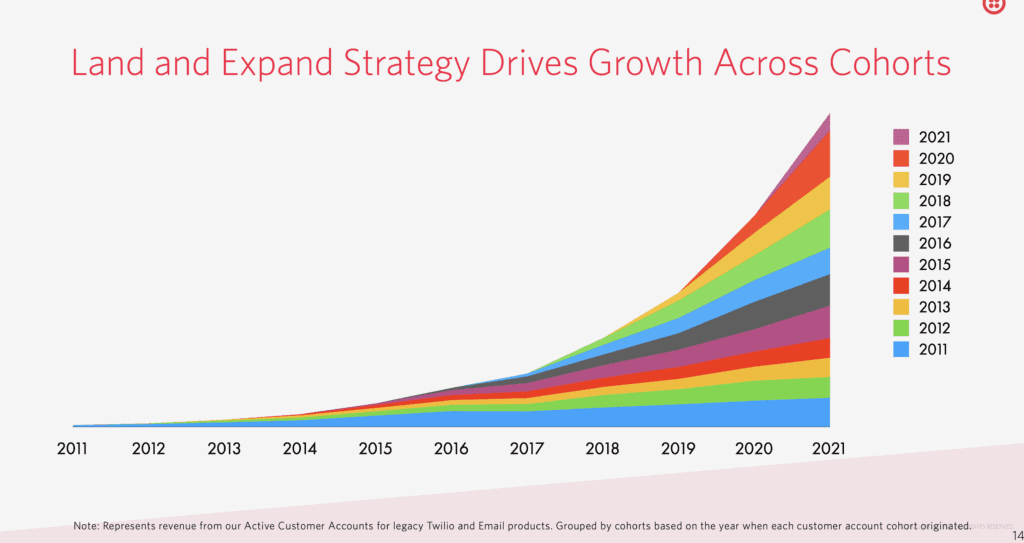

#1. 130% NRR holding up — no decrease even at $3.4B ARR. A reminder high NRR often doesn’t reach a ceiling. It can seemingly scale forever. While 140% at IPO, it’s still top decile today, even adding in the lower NRR from SendGrid.

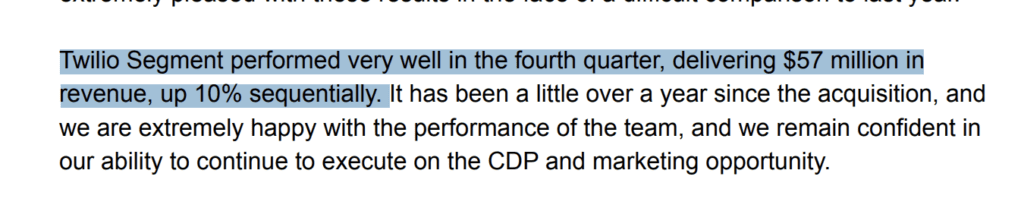

#2. $240m ARR now from Segment. An acquisition well done. Segment appears to be thriving under Twilio.

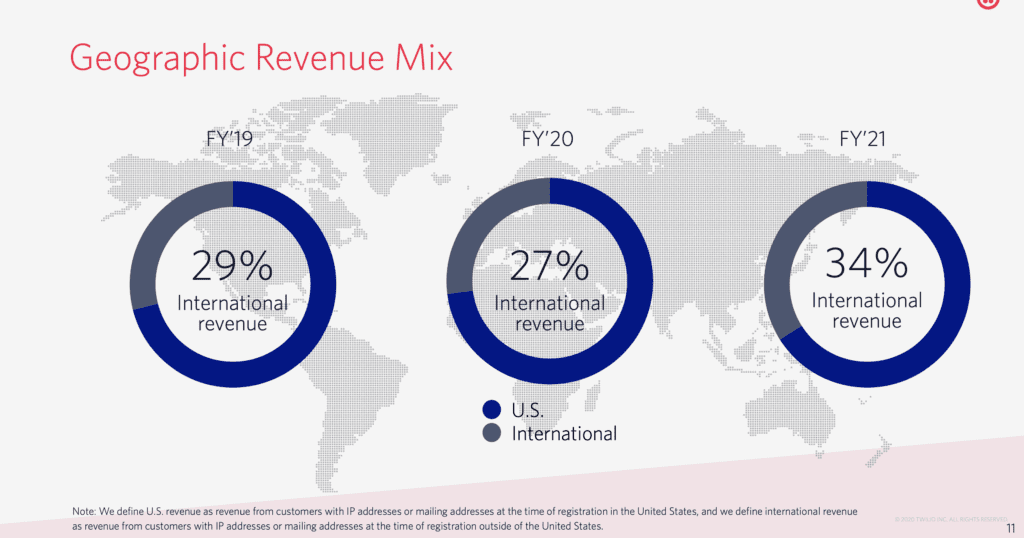

#3. International Revenue up to 34%, from 29% in 2019. Crossing borders with a communications product isn’t hard, but it is harder than a pure B2B product. So it’s helpful to track how Twilio is doing, and they are continuing to go more and more global. A third of their revenue is now outside the U.S.

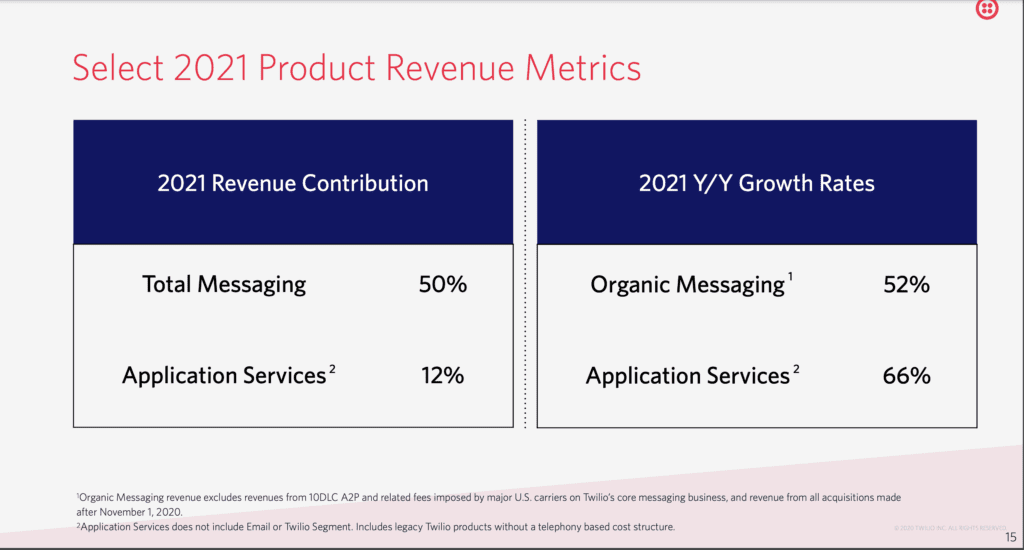

#4. Messaging now just half their revenue. We talked with CEO Jeff Lawson below way back in 2017 about how to go multi-product. Fast forward to today, not only is Twilio multi-product, but its original core of Messaging is now just 50% of their revenue.

#5. ACV continues to go up materially, although not dramatically. With 256,000 customers today, Twilio’s ACV is about $12,000. That’s up from $10,000 at $2B and $7,000 at IPO, so account size growth has been important fuel for Twilio. ACVs are up 70% since IPO. That’s a big contributor to growth overall. But at the same time, Twilio hasn’t gone radically upmarket overall, keeping to a decidedly mid-market ACV, despite 30% of the Global 2000 being customers. It’s just gotten customers to pay more and more over time, somewhat gradually. And it’s paid off.

And a few other notes:

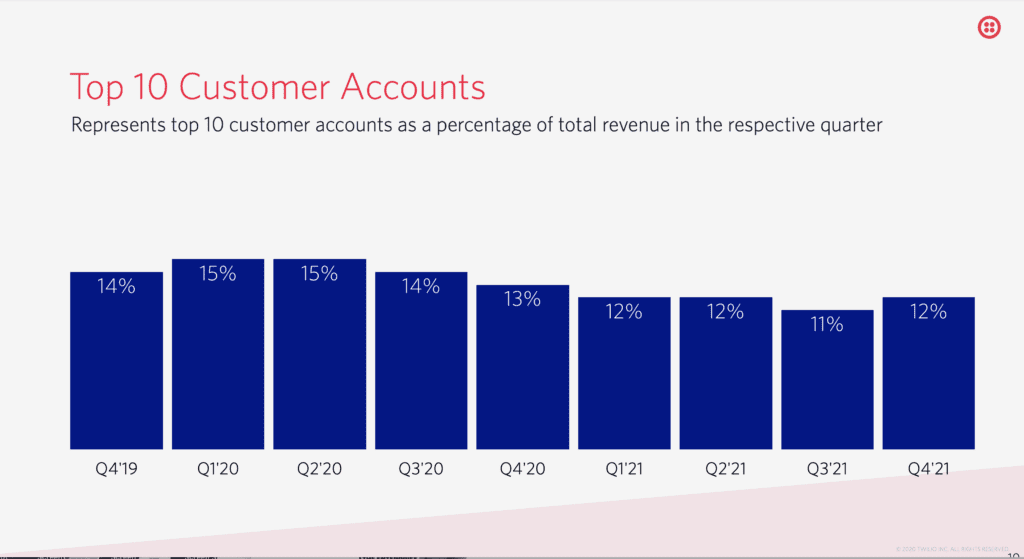

#6. Customer concentration hasn’t gone up since IPO. Twilio has both a broad base of customers (256,000) and a number of whales that really do matter. But the whales aren’t increasing in customer concentration.

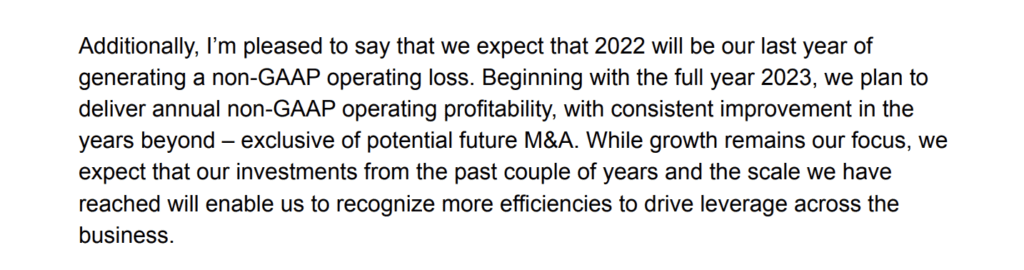

#7. Twilio plans to be profitable next year — at $4B+ in ARR. Say what you will about when SaaS and Cloud companies choose to go profitable, Twilio will be there at $4B in ARR.

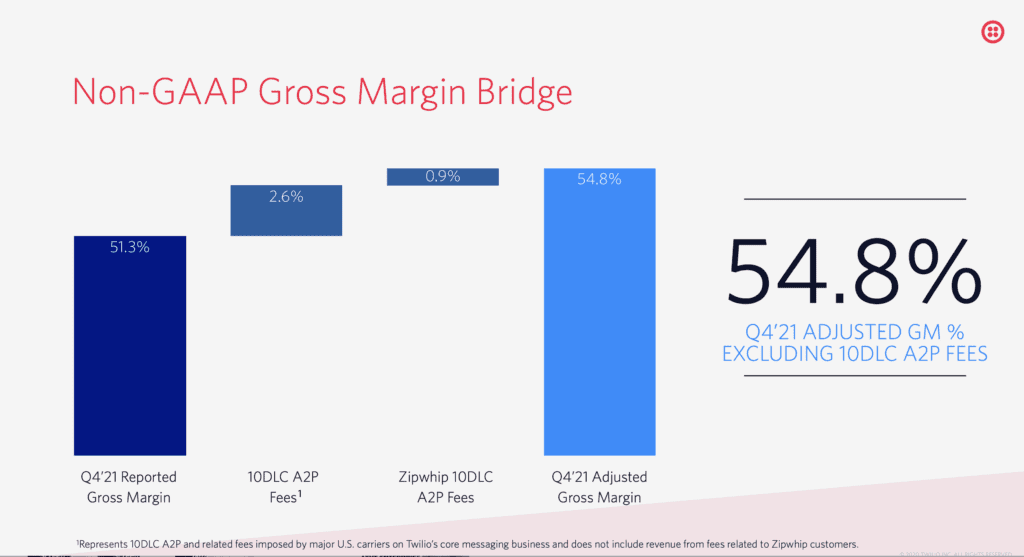

#8. 51% Gross Margins. With significant communication costs, Twilio has to be thoughtful about maintaining gross margins. One recent acquisition (ZipWhip) has brought them down a bit, but gross margins remain above 50%. Still, 60% is the ideal target for being considered a “software” company.

#9. Twilio’s 2011 customers are worth 10x more today a decade later. Probably more. Just a reminder to really, really go long when you have 110%+ NRR:

Just wow, Twilio!! A hero company in Cloud and SaaS for us all to look up!

And take a look back at the early post-IPO days, how Twilio got there, and how they learned to love sales here in this classic SaaStr Annual session with CEO and co-founder Jeff Lawson: