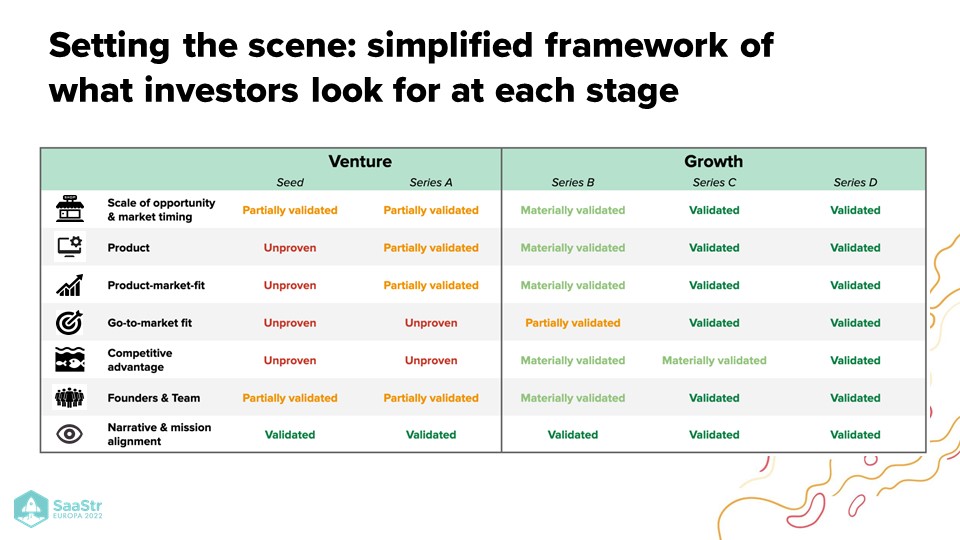

As a founder, there are different ways you can set your start-up apart from other companies at the venture and growth stages. Investors look for specific metrics to see whether you stand out from the crowd, ranging from your market expansion potential to your product vision and product-market fit.

Atomico Partner, Irina Haivas, and Principal, Hillary Ball, explore what investors are looking for from the early stage through growth.

Tapping into your market expansion potential

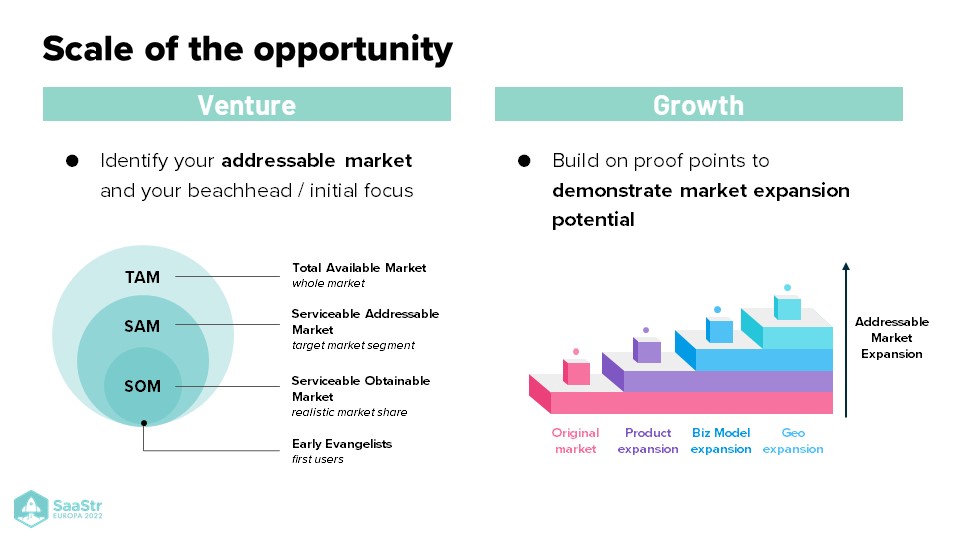

Investors will look at market size as a key proxy for the potential outcome size. You can calculate your market size in different ways:

- Bottom-up: Applying your pricing to a broad set of customers.

- Top-down: Cutting the segment of the market to reflect the realistic customer segments that you’re going to target.

What is essential at the early stage is to have a clear definition of your true market and your realistic share in that market. To figure out your market size, ask yourself how you can get to 100 million ARR. What does that market look like?

Build on proof points at the growth stage to demonstrate your market expansion potential. This can come in a variety of forms:

- Product expansion: Where you might add on new features or product adjacencies.

- Business model expansion: where you might monetize parts of your product that you weren’t previously.

- Geographic expansion: Where your product needs a different formulation or a different go-to-market motion in different geographies.

While it may be tempting to try to capture these market expansion opportunities as soon as you identify them, you should first make sure you nail your core market offering. Otherwise, you may risk wasting unnecessary resources and diluting your focus.

Designing a clear product roadmap

You don’t need to have a fully-fledged product at the early stage, but it is crucial to have a clear product vision and roadmap.

At this point, you should aim to identify the “secret sauce” of your product—the unique insights you have that will differentiate your product that will create engagement and value in the long run as the market grows and becomes more crowded.

The secret sauce could involve insights from your users, your design partners, or even your experience as a founder. Bringing these together is key to developing a clear product vision.

At the growth stage, investors will want to see whether this secret sauce has translated into usage and engagement of your product. This is a way to determine whether the pain point you have identified is real and whether the secret sauce is resonating with the market.

Proving your product-market fit

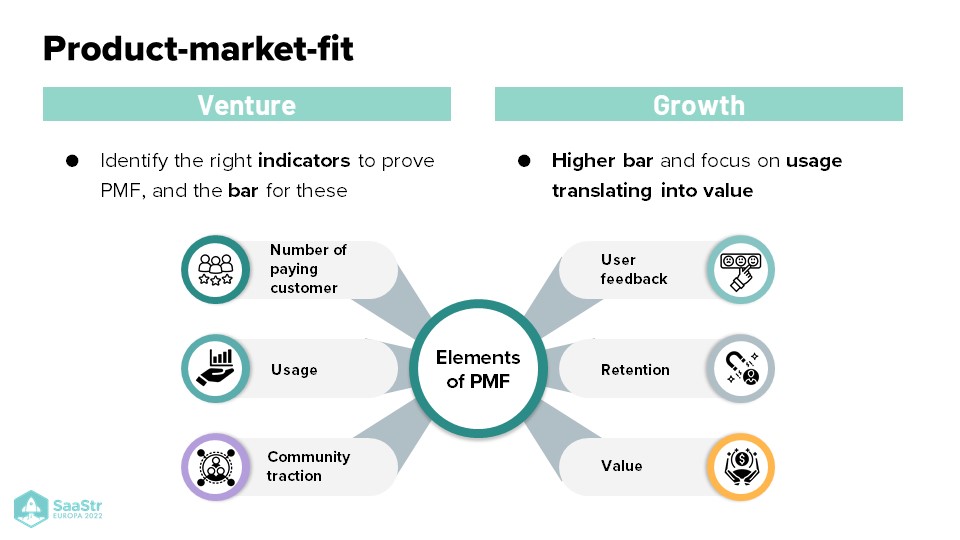

At the early stage venture, start identifying the right indicators that determine your product-market fit (PMF) for your business.

PMF metrics will differ depending on your product type. While, in some cases, the most relevant metrics are customer or revenue based, in other cases, they could be indicators related to users or community-based traction.

“At early stage, investors want to see that you have a set of core KPIs and that you monitor and track them, using them to inform your product.” Irina Haivas

Aim beyond the obvious metrics that investors typically look at. Consider other important indicators to prove your PMF, such as qualitative insights, customer reviews, or retention numbers.

At the growth stage, the bar becomes higher. Investors will look for these indicators to be at a greater scale than they were at the early stage and how they translate into value.

Identifying your go-to-market strategy

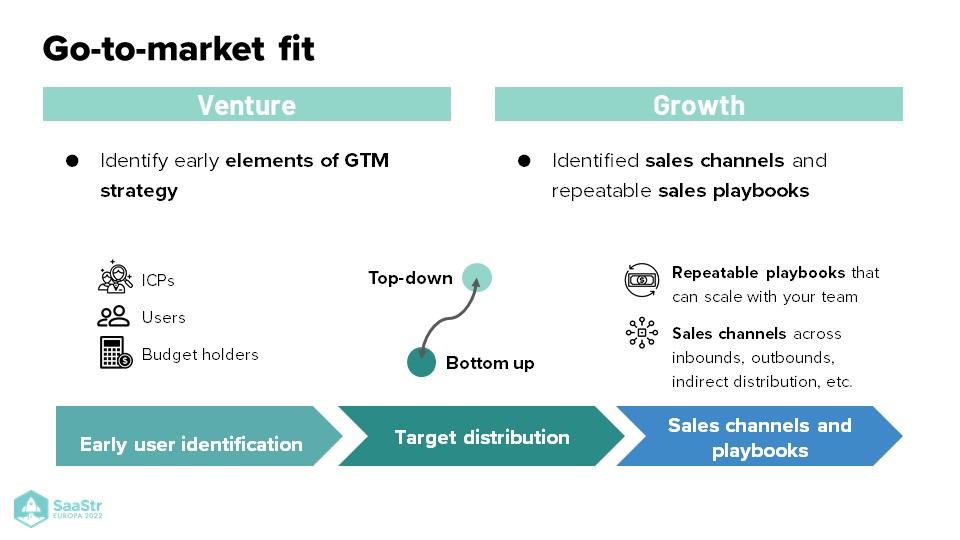

You are not expected to have repeatable sales playbooks at the very early stages. What is critical is that you have an established go-to-market (GTM) strategy and a solid rationale behind it. Investors will look at your choices in deciding who your key customers, segments, and budget holders are and how you derived those conclusions based on the behaviors and incentives of those key stakeholders.

As a founder, you may not have a whole GTM team in place, so at the beginning, you must test the various routes and decide how to sequence them.

From an early growth perspective, investors are keen to see whether these early GTM iterations are starting to crystallize into identified sales channels and repeatable sales playbooks.

At this stage, investors look for increasing efficiency in your GTM, whether the accumulation of insights and data you’ve gathered from these early iterations has enabled you to target your customers more precisely. This should be reflected in your GTM metrics, including your payback periods or your sales cycles becoming more efficient.

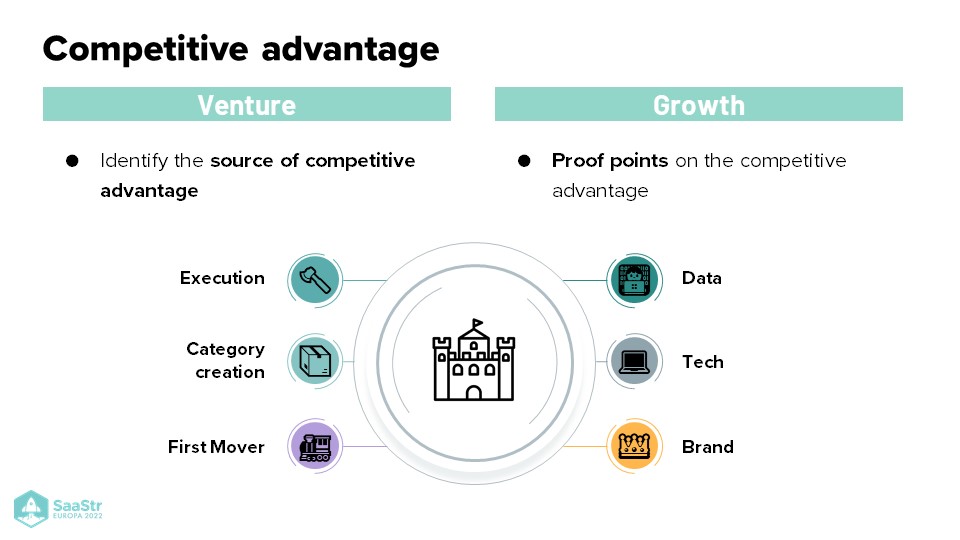

Articulating your competitive advantage

At the venture stage, you should be able to show a good understanding of your company’s competitive advantage—is it IP, category creation, execution, or something else?

The best way to identify this is to zoom out and look at the overall market landscape, not only at the competitive offerings but also at companies in adjacent areas that you could expand into.

At the growth stage, investors want to see that this competitive advantage you articulated at the early stage is now getting validation and resonating in the market.

Often by the growth stage in series B and onwards, your product will be in the hands of your customers. Validating the competitive advantage from the customers’ point of view is essential. Founders will be speaking to your customers to understand how they evaluated your solution against other similar products.

“At the growth stage, it’s essential to get a qualitative and quantitative understanding that your competitive advantage is real and resonating in the market.” Hillary Ball

Many growth investors will employ a quantitative approach to validating your competitive advantage. For instance, they might run market surveys of your customer groups to evaluate how your product ranks relative to your competitors.

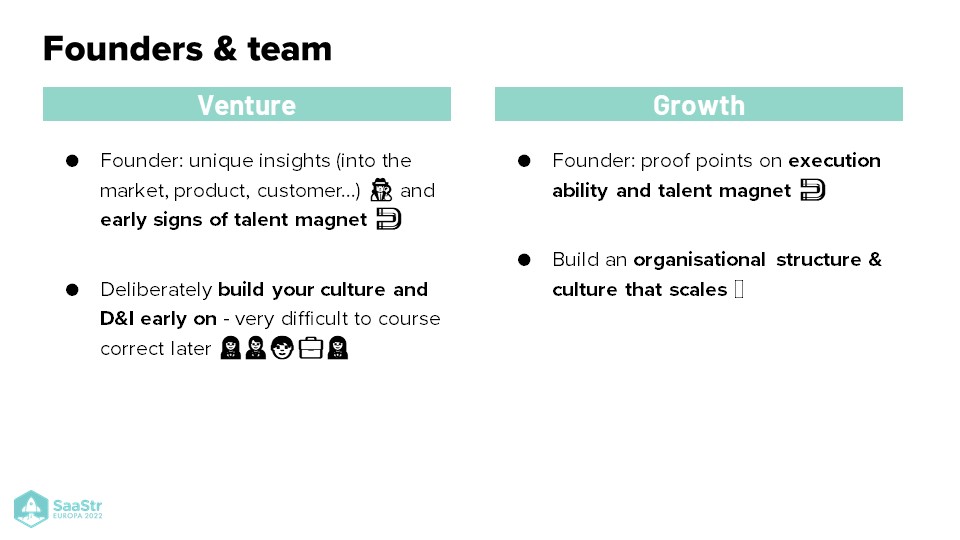

The importance of talent retention and culture

At the venture stage, you should be able to demonstrate early signs of retaining top performers. Investors want to understand whether your best talent will stick around or join another startup.

You should also pay close attention to culture early on. Culture must be a deliberate strategy and consistent effort. Particular elements of culture, such as diversity and inclusion, are very hard to course correct later on.

“Culture is easy to ignore because it may not be the most pressing thing, but they become bottlenecks going forward for talent retention and the team you want to build.” Irina Haivas

At the growth stage, investors will want to verify whether your early top performers are staying on for this next phase of the journey. They will also want to understand your approach to creating an organizational structure that supports your market expansion plan.

In the end, you don’t need to have all these metrics perfectly in place as you go from the early stage through growth. What is really important is that you have a compelling narrative for your business, outlining the gaps and areas to work on and how you plan to tackle them. Investors also want to see that you’ve aligned your mission, culture, and vision across all your stakeholders.