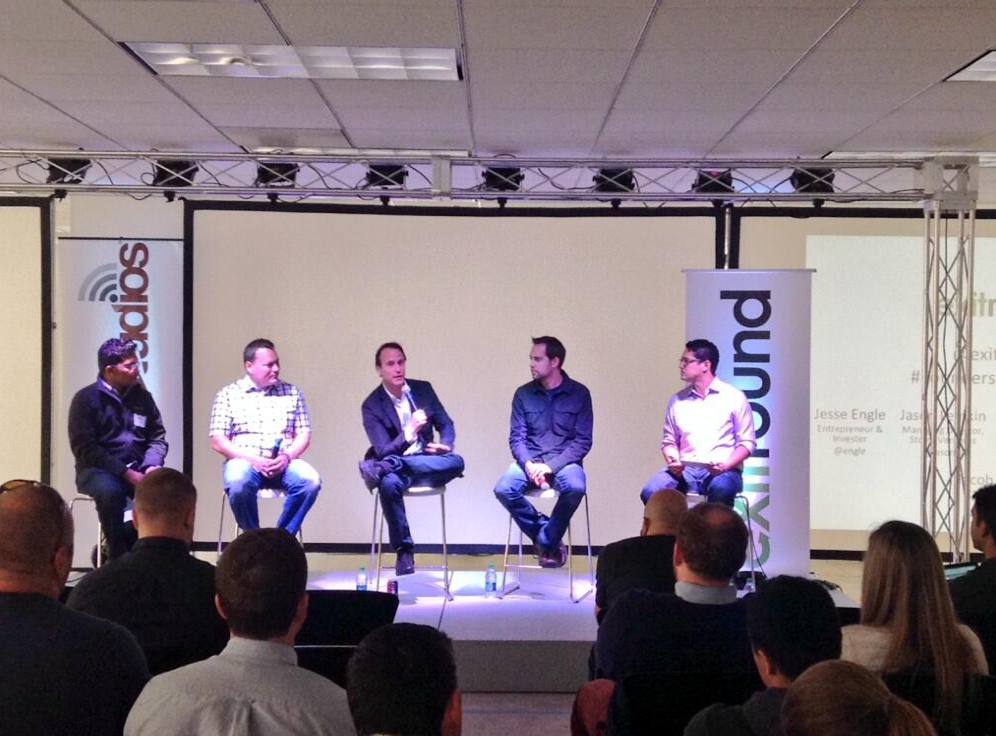

Recently I did a founders-only event sponsored by ExitRound. It was off the record, so I won’t go into anything we spoke about.

Recently I did a founders-only event sponsored by ExitRound. It was off the record, so I won’t go into anything we spoke about.

But there was one theme the audience told me from all 4 speakers. They didn’t know selling was so emotional.

If you haven’t sold a start-up before, you think it’s a combination of a (x) milestone — a success and (y) money, or liquidity. And so it is.

But unless you sell in your first year or so, it’s more. It’s selling a piece of your life. Maybe it’s like you’re a painter, but you only get to paint 2 or 3 or 4 paintings your whole lifetime. It’s more than just a transaction.

TechCrunch recently published a piece I wrote on this exact topic. More below.

The original post (with some edits thereafter) below was published here on TechCrunch:

Right after Adobe acquired EchoSign, I ran into a friend whose company had recently been acquired for several hundred million dollars (wow) after having raised very little capital. It was a great outcome. The acquirer was a public company, but not one you’ve likely heard of. I asked him if he had any regrets, learnings, etc.

“Well, no. It’s a great deal. But it might have been nice if we’d been acquired by Oracle or IBM or more of a brand name.”

Fair enough. If you’re acquired by Waste Management Inc. for $200 million — even with its $20 billion-plus market cap — it really won’t do quite the same thing for your resume as being acquired by Google and being made SVP of World Wide Something. It does sound pretty cool to get acquired for millions of dollars and then run Android, The Marketing Cloud, or Whatever Cool Sounding Job at Brand Name Acquirer. And maybe that will be cool. Clearly, Andy Rubin has had a great run at Google, for example.

The thing is, though, once you sell, It’s Not Yours Anymore.

In a similar vein, not that long ago, I bumped into two more friends, one who had sold to someone Google-esque, another Adobe-esque. Both were coming up on 24 months after their acquisitions, having been given great VP-level jobs at their acquirers. I asked if selling to Those Great Companies really mattered two years on. Did it mean anything to them at an accomplishment level, at a life level, at a journey level?

They said no. It just didn’t matter who they sold to 24 months down the road. They just didn’t care. Not even one bit. Even though both were excited when they signed the deals to sell to a Great Tech Company.

What’s my point?

- When You Sell, Sell For the Most Money. Period. Ignore the Logo. Don’t leave any money on the table to join a Great Company Over a Good Company, or even a Crummy Company. You will care a lot at first. But I don’t think you’ll care 24 months later.

- Don’t Take Your Post-Acquisition Job Too Seriously — If Only Because You’ll Have No Idea What It Will Really Be. It may work out great. But most founders, unless they’ve lived and loved the BigCo life before, aren’t really going to actually enjoy BigCo life. And you may not really have any idea what your job post-acquisition really will end up being.

- You Really Will Have No Idea Why They Bought You. Any BigCo could buy any of 100+ great companies a year. Why did they really buy you? They may not even care about your customers and revenues. Or they may care only about your customers and revenues. It may really be about the future. Or the past. More defensive, or offensive. You’ll really have no idea. And corporate priorities change every year. They’ll definitely change even just the first year after your deal closes. So if you sell, don’t sell for whatever you see happening after Day 1 at the acquirer.

- The World Will Change So Much Over Your 24-36 Month Stay Period. Selling to LinkedIn over Waste Management may sound cool today. And it is. But if you’re asked to stay for 36 months, that’s an eternity in web time. Maybe in 36 months you won’t really care about LinkedIn being cool. Maybe it won’t even be cool anymore.

Having said all that, one key thing to make sure you do get right in any acquisition, because it can be so across the board, is the retention packages. If you do get acquired, the acquirer will put aside some extra consideration in the form of cash, stock, etc. to retain the team.

All things being equal, the great tech leaders (Google, Salesforce, etc.) that do a ton of acquisitions have the best retention packages. Generally, much better than the next tier, because they do a lot of M&A, and they want to make sure it works post-deal. So make sure you understand how the retention packages really work. In that sense, i.e. the sense of money, selling to Google or Salesforce may be a better idea than Yahoo! or Waste Management. Maybe.

I know it can sound very appealing — very desirable — to get acquired by Facebook, by Google, by Salesforce, by LinkedIn. By Any Very Hot Company. But you really think Kevin Systrom is so happy he sold for $1 billion to Facebook, looking at the WhatsApp guys?

The world changes so much, so quickly. And once you sell, it’s not yours anymore.

If you do sell, do it for the money. Not the logo.