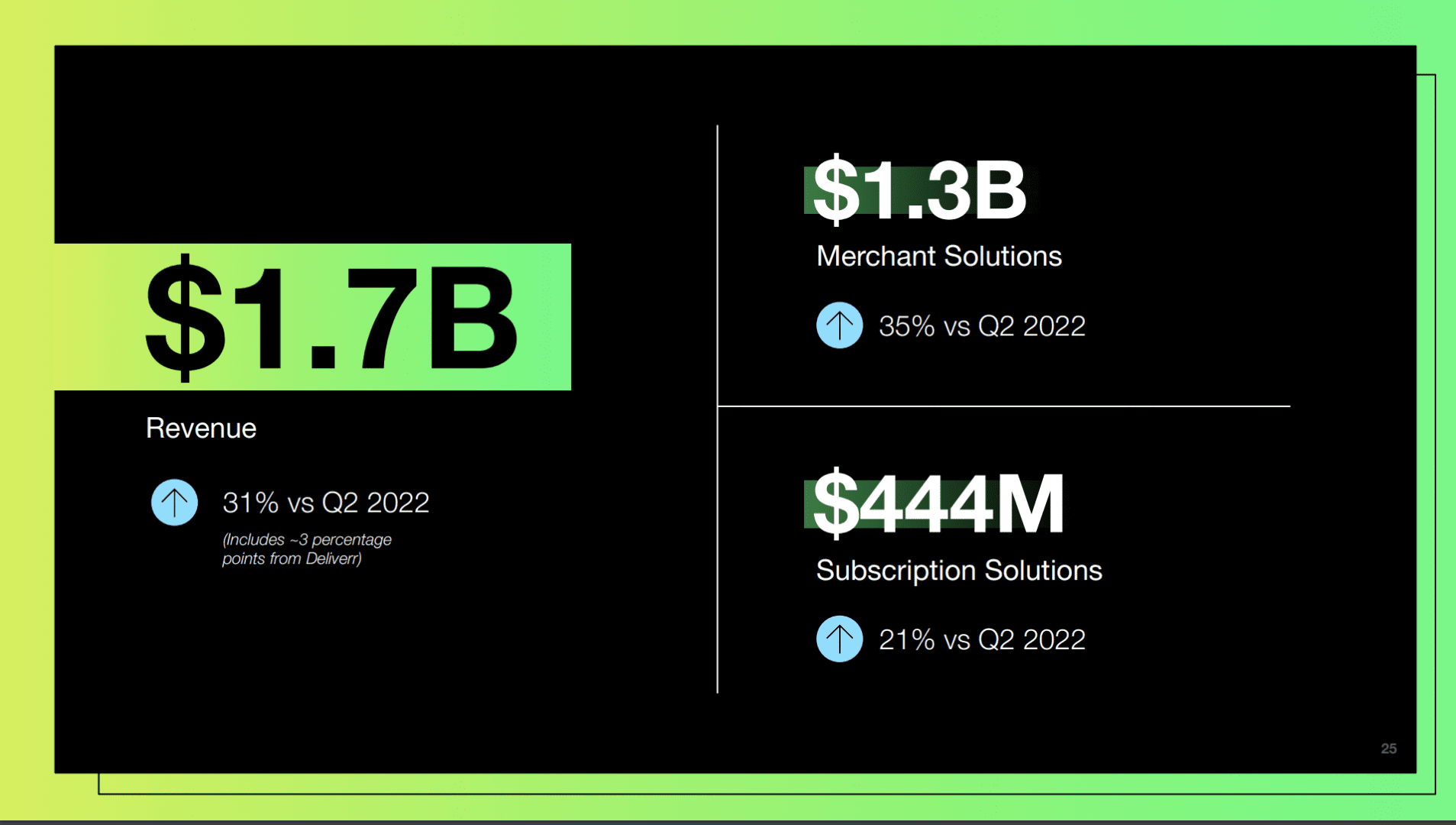

So times are still challenging for some, but the effects aren’t even. One SaaS leader that’s accelerating again is Shopify. At an almost $7 Billion run-rate — they’re still growing a stunning 31% on a constant-currency basis.

And that’s huge acceleration from the post-Covid slowdown, when Shopify went from a crazy Covid-boosted 100% growth, to a low-teens growth rate as it crossed $5 Billion run rate.

That’s not just pretty epic growth at almost $7 Billion in revenue, it’s one heck of a comeback.

Shopify growth slowed dramatically post-Covid as the world reopened. A tough transition.

But it roared back

Today:

▶️ Almost $7B run-rate

▶️ Growing a stunning 31% (!!)

▶️ Radically more efficient, $600m+ adj operating income run-rate

▶️ 29% of biz from enterprise (Plus)— Jason ✨Be Kind✨ Lemkin (@jasonlk) October 10, 2023

5 Interesting Learnings:

#1. Software Important. But a Smaller and Smaller Percentage of Revenue.

From a business model perspective, Shopify has in essence been a fintech and merchant product first and a SaaS product second for quite some time. Overall subscription solutions revenue is up just 21%, while payments and merchant solutions are up 35% — from a much, much larger base.

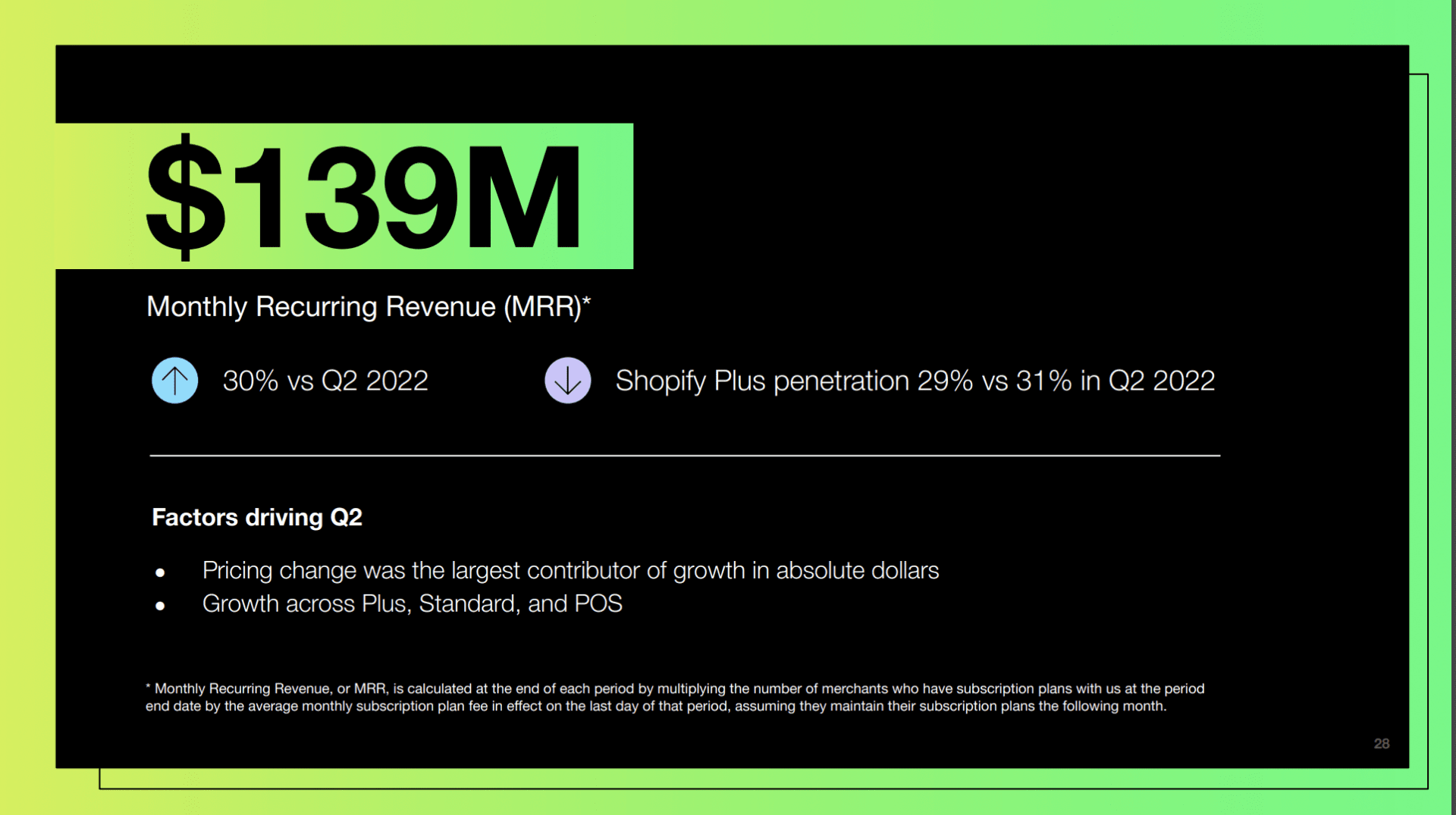

#2. Pricing Increases Really Boosted MRR.

MRR is up to $139M, so ARR is up to $1.7B of Shopify’s total $6.8B in ARR. Shopify’s price increase was the biggest driver here, and that should show up in a good next twelve months of revenue growth.

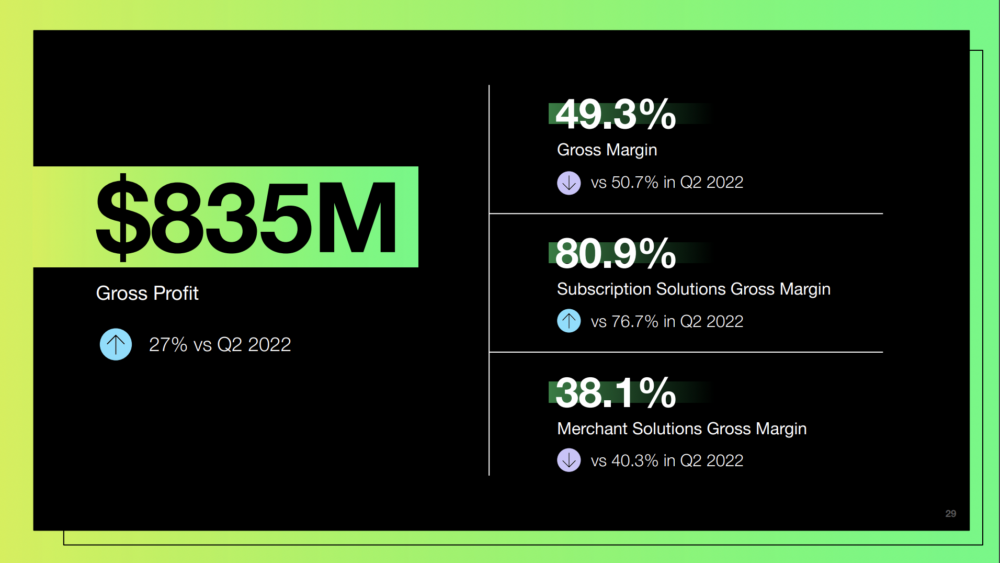

#3. 80% Margins on Software, But Just 38% on Payments and Merchant Solutions = 49.3% Gross Margins Overall

This is the challenge from anyone that adds payments and fintech to SaaS. The top line numbers can be big, but the margins are generally much lower. At 49.3% gross margins, Shopify isn’t really a software company anymore, actually. It’s a hybrid payments-software play.

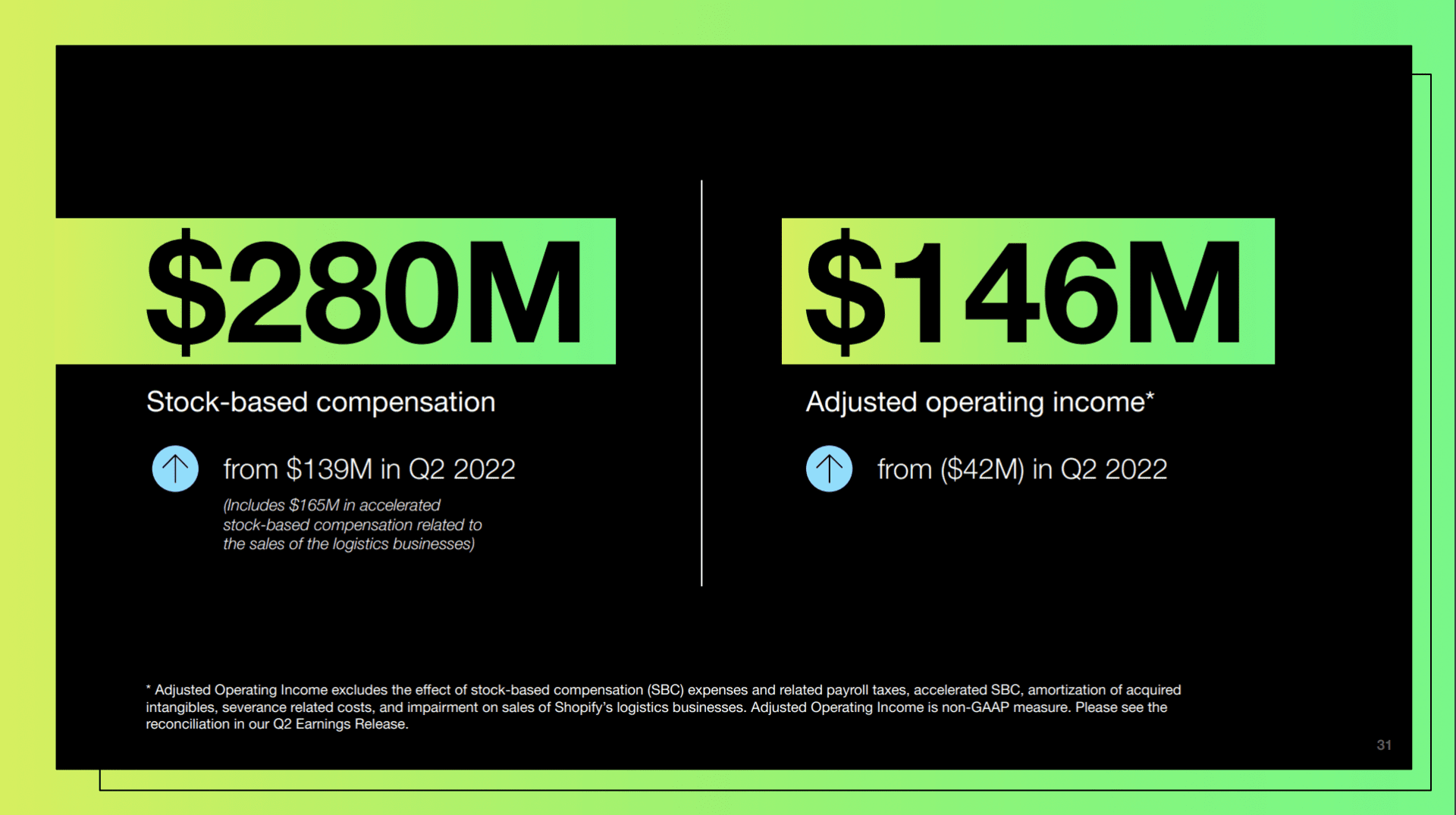

#4. Like Most Other SaaS Leaders, Shopify Has Gotten a Lot More Efficient.

In just one year, its quarterly operating income has swung from a relatively modest but real loss of -$42m, to +$156m in operating income. Wow. Night and day. Quarterly free cash flow also went from -$87m to +97m in just 12 months. A bit more on how everyone from Monday to HubSpot to MongoDB have done it here. Key for Shopify is like Monday and others they’ve stated their committed to growing operating expenses “significantly slower” than revenue going forward. I.e., they’re gonna stay this efficient.

#5. “Shopify Plus”, Shopify’s More Enterprise Offering, Remains at about 29%-31% of Revenue.

Plus has taken off, but interestingly, SMBs have scaled just as quickly, meaning its percent of Shopify’s overall revenue hasn’t really budged. Shopify would be much smaller if it hadn’t gone upmarket and pushed Plus more and more. But the explosion of SMB commerce and the price increase to the SMB Shopify plans has meant Plus revenue growth hasn’t outpaced the overall growth of the company’s SMB base. Sometimes this stuff is a bit noninuitive.

And a bonus interesting learning:

#6. 70% of Shopify Purchases are on Mobile.

We all sort of knew this, mostly, but 70% is a pretty high number!