Even with late stage VC capital much harder to get now, and the IPO markets still frozen, I see many folks on my LinkedIn feed saying Sales and Customer Success are underpaid. And that they, in particular, are underpaid. That they add so much value, they should be paid more.

Never met a sales rep that didn't feel underpaid

It's just the way

— Jason ✨Be Kind✨ Lemkin (@jasonlk) July 19, 2023

That’s fine, and at SaaStr, we’ve been strong proponents of some of this. Of paying your sales team well, of not capping sales commissions, of putting customer success on a variable plan, and of the power of second-order revenue. We and I are still strong proponents of paying your revenue team well. But they do have to deliver. Paying up for performance.

And this is where things got a bit corrupted in late 2020 and 2021. Later-stage venture capital was so free-flowing, that it made sense to invest in sales, customer success (and marketing to some extent) at much higher levels than before.

What do I mean? Well, for most of time, about 10% of the “profit” on a deal has gone to sales, and about 5% of renewals have gone to customer success. There’s a bit of a mix and match here, but let me explain:

- In almost every type of sales, even auto sales, about 10% of the profit usually goes to the sales reps as commission. SaaS basically shortened this to 10% of the whole deal (not just profit), since traditional software margins were 90%+. With about 10% of your quota in base salary, and 10% in bonus, that would yield a 5x ratio of comp:bookings. And really, we pushed this to 4x. So for most of the time in SaaS, you basically had to close $500k to make $100k-$125k OTE, $800k to make $160k-$200k OTE, $1m to make $200k-$250k OTE.

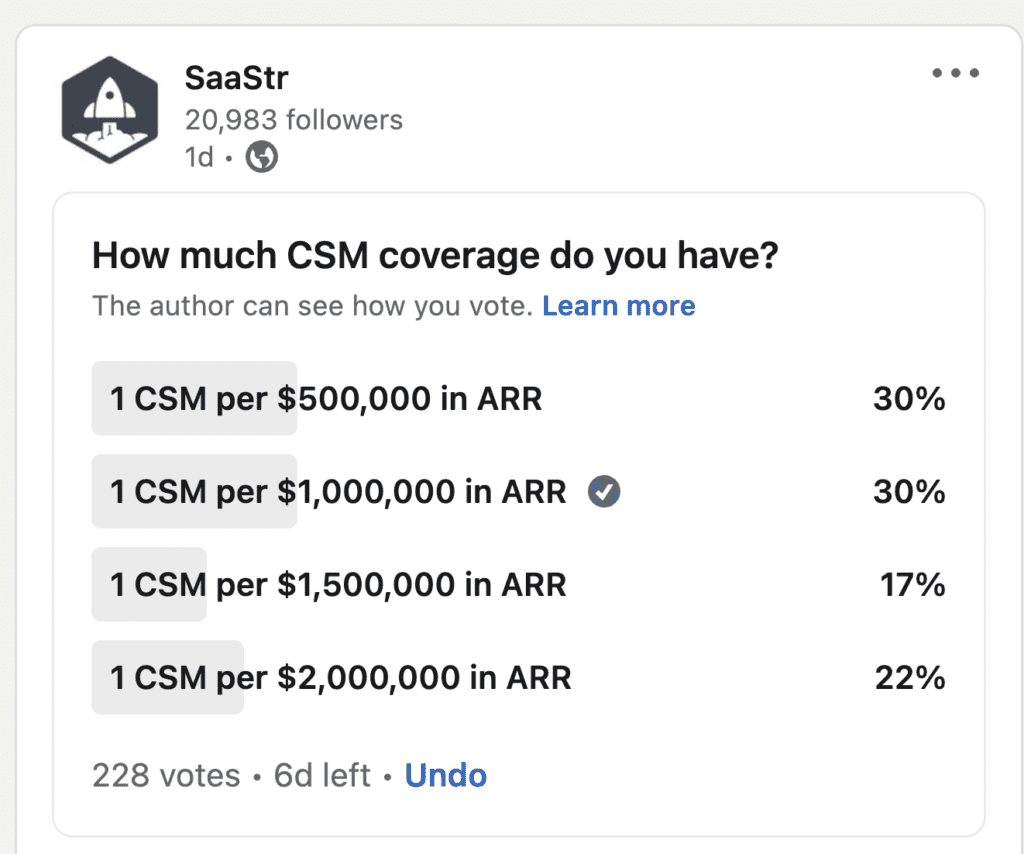

- In SaaS until recently, 5% roughly was set aside for each renewal for customer success. While that may not sound like a lot, it actually is a lot of all your revenue. This led to the classic $2m Man/Woman, where a classic CSM would make $100k or so by handling $2m of renewals.

Now, as SaaS got bigger and we scaled faster, we pushed these metrics up a bit. That’s what venture capital is for, in fact, to some extent. So sales reps started to take home 25% or even 30% of what they closed, and CSMs often covered just $1m-$1.5m of renewals, and made $120k+ or more. That’s much more than 5% — more like 10%.

These investments make sense as you are scaling, sales taking home 25%+ of the deal, and CS being paid out up to 10% of the total renewal. Even if you may not be able to sustain them post-IPO.

But then in 2020 and 2021, things just broke in SaaS comp. The rules sort of went out the window. Inflation set it, competition geared up, and everyone just wanted … more. More money. And importantly … not for more performance. Depending on where you look, comp went up another 20% at SaaS leaders in late 2020 and 2021 — without any increase in quotas, bookings, or coverage.

Now we’re back in more normal times, and it just doesn’t work. You can ask for more money, but at some point, it has to come from somewhere. That $1 of revenue only goes so many places. So we’re seeing it in higher quotas, and lower attainment for sales. And we’re seeing it CSMs, in the end, being asked to cover more to earn more comp.

Massive amounts of later-stage venture capital into SaaS, simply put, led to a large deterioration in sales and success efficiency. Startups that used to burn, say, $200k a month started burning $600k. Those burning $500k a month started burning $1m. And a lot of this went into increased comp, without much higher attainment, for sales and success.

It just can’t last anymore. At least — understand the math. In the end, it’s hard for sales to take home in total comp much more than 20%-25% of what they close. And it’s hard for CS to take home much more than 5%-6% of the revenue they manage. At least at some point, the math has to land here.

A related post here:

xkcd chart from here