The world of corporate VC has changed.

It used to be that corporate VCs had lots of strings attached when they invested. Rights, options, business limitation clauses. That was a big downside. Rarely worth it.

Now, strings from corporate VC are pretty rare. If corporate VCs ask for any strings, it’s usually just notice before you are acquired. Not an option, just notice. While suboptimal, this really often isn’t that big of a deal.

The real downside is that corporate VCs rarely write another check, and especially, rarely write another check if you are struggling. So they are “one and done” investors, for the most part. Traditional VCs usually budget another $2 for further funding for every $1 they initially invest, by contrast. This is a big difference.

So all things being equal, having investors that can write checks in the future is a better thing than “one and done” investors.

However, even that can be mitigated by not selling them too much of the company. Having Salesforce or Amazon invest 5 or 10% of a round isn’t going to change things much. It won’t impact the cumulative ability of your syndicate to further fund you if their ownership stake isn’t too material. And you’ll get the benefit of their halo.

So the downsides are a lot fewer than they used to be.

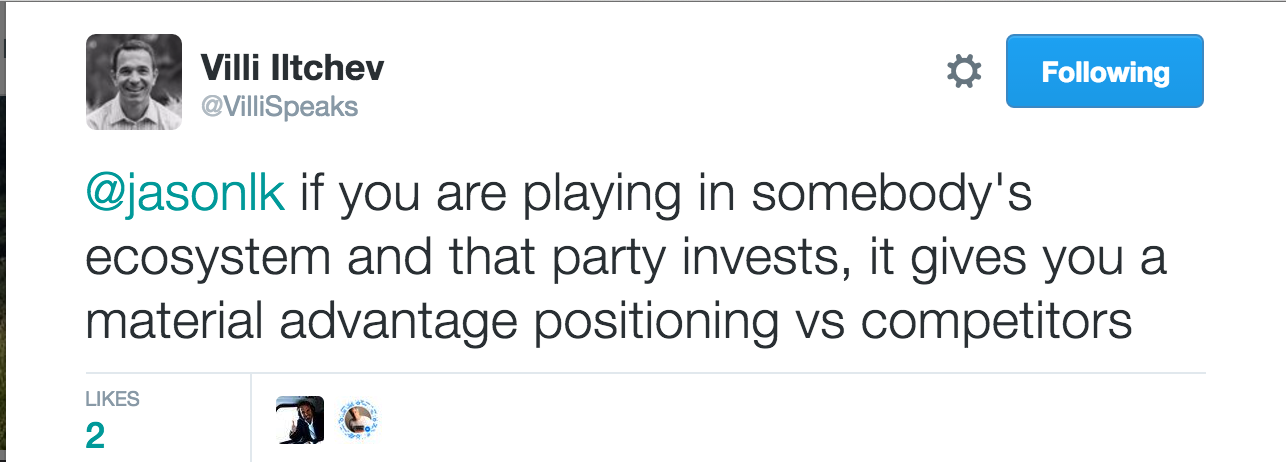

Having said that, the benefits are often more limited than you think.

Corporations with active VC programs invest in a lot of startups, and really don’t have that much time to give them. Even if the investors do have time for you, getting a $500k investment from a $50b company doesn’t guarantee you any face time with the business line VPs you really want to work with, let alone the CEO.

But it does help. You get to attend their insider events. It helps with access, at least at the margin. It helps with partnering, at least on the margin. It helps with visibility.

So if a great corporate VC wants to do 1–9.9% of a round, I say go for it. 10% or more of a round? Then take a pause. Make sure a “one and done” investor is worth it. It still may be.

…

Listen to our podcast with John Somorjai of Salesforce Ventures here to learn more: SaaStr Podcast #020: John Somorjai, Exec VP Corp. Development & Salesforce Ventures @ Salesforce