Whatever this downturn looks like, it won’t be the same as ’08-’09. Which was brutal.

But we did learn some things from it that were somewhat counter to our expectations.

What we learned from ’08-’09 in SaaS:

- First, SMB churn went through the roof — as SMBs went under much more quickly and often. As soon as the economy went south, SMBs started to simply go bankrupt and/or shut down. And even before they did, panic set in in businesses with no cash reserves. The first thing SMBs did was look at their credit card payments and cancel everything they could. Almost irrationally. Anyone processing a lot of SMB and credit-card deals saw churn probably double. We did.

- But second, enterprise customers all renewed. Almost all of them. Even in the darkest days of 2019, enterprises still .. functioned. They still needed to process payments, track orders, ship orders, run financials, sign contracts, store data, etc. At EchoSign / Adobe Sign, we really lost almost no enterprise customers at all.

- Upsell slowed way down. But didn’t end entirely. Yes, when hiring stopped, so did the automatic seat upgrades that come with hiring 😉 But silos still expanded a bit, and business process change did not end. So upsell still happened, it just was much lower.

- Some enterprises tried to renegotiate deals, but not that much. Your experience may have been different, but in ours, maybe only 10% of enterprises under stress tried to negotiate contract prices down on renewals. We certainly didn’t raise prices. 😉 But many budgets were simply frozen. A frozen budget isn’t all bad, if you are baked into that budget.

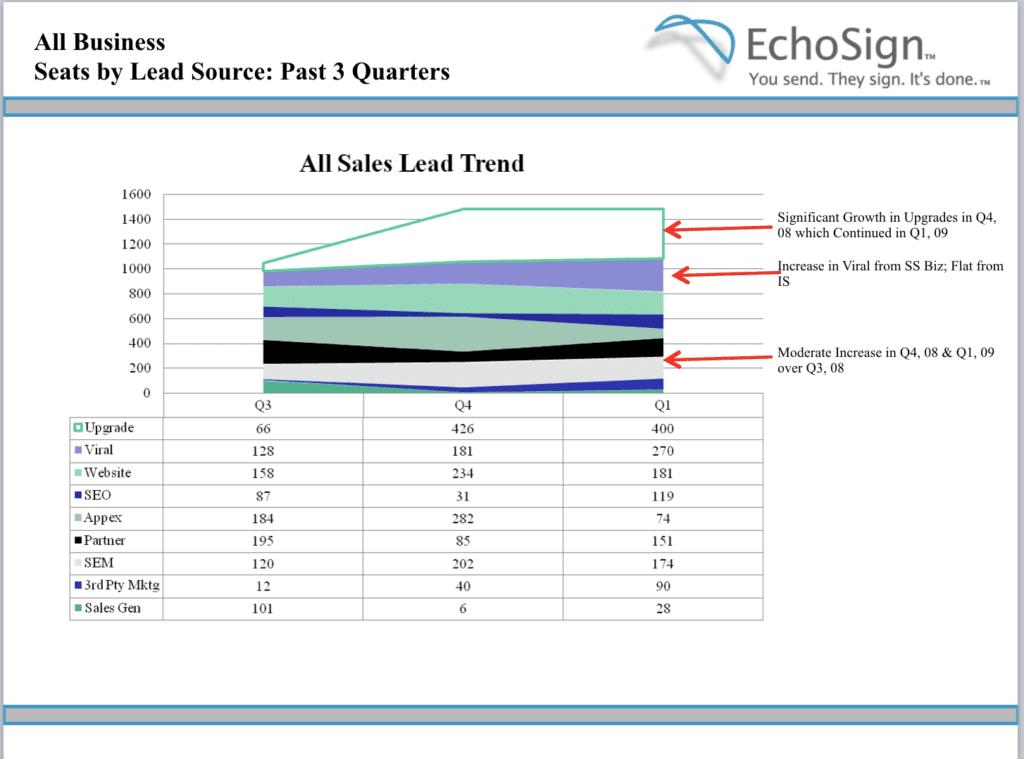

- Leads still came in. Even in the darkest times, buyers were still looking for new vendors. And if they saved money AND met organizational goals? You could still close deals. Yes, we still closed plenty of deals. Not as many. But plenty. Even shrunken budgets still had money to move from old, dated vendors to new solutions that cost the same or less. Here’s what our leads looked like in ’08-’09. A bit flat, but still, more than plenty and not really any decline:

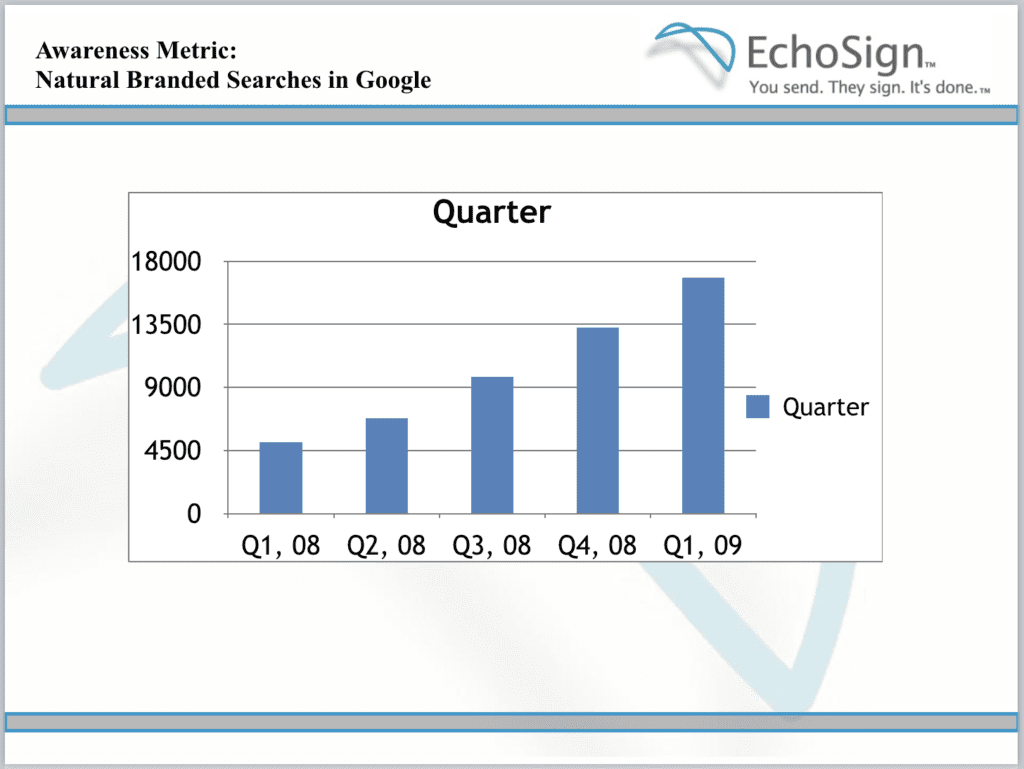

And look at this chart. Folks still continued to search for us in increasing volume, even in the darkest days:

- No one had enough sales reps once the market came back even a little. Since leads still came in, and the internet still grew, and SaaS still had true ROI, everyone was sort of unprepared for when the economy got even a little better in 2011.

- We still doubled sales in 2009. That sort of sums it all up.

But 2020 really is different, no matter where it takes us. In ’08-’09, we had 6+ months to sort of prepare. The change that happened in 2020 — happened in 1 week. So what’s actionable?

- Capital will dry up. Of course it will. These are the best of times. So if your burn rate is scary, bring it down.

- Don’t worry about customer success hires and scaled sales reps. They will still be accretive, even in a downturn. You’ll need them.

- If your net retention is < 100%, you may need to replan. Assume SMB churn doubles — and quickly. Enterprise churn will be less impacted by a downturn than SMB churn. Do a model for your SMBs that assumes churn doubles, and see what that does to cash flow.

- If you have 24+ months of runway, don’t worry too much. Keep calm and carry on. The customers will still buy. Cloud is a tidal wave.

- Cloud momentum is unstoppable. More and more of the $1 trillion spent on IT is still going to continue to move to the Cloud. Almost no matter what.

This downturn won’t be fun. It took 2 years to bounce back, and 4-5 years to fully recover from the last one. This one might be a lot fiercer and shorter (my guess). Or it might not be. The rate of change this time is breathtaking.

But once we did bounce back last time, boy, it all got good.