So we looked at Atlassian on the 5 Interesting Learning series pretty recently, but given all the tumult in the markets, we thought it was a great one to take a look at again as it’s now crossed $3 Billion in ARR.

Because despite the naysayers, the doom-and-gloomers, and more … many of the best in SaaS are growing as faster or faster than ever.

Atlassian is one of them. It’s now growing 36% at $3 Billion in ARR, just about the same as the past few quarters. And importantly — Atlassian sees and is currently forecasting no slowdown.

5 Interesting Learnings

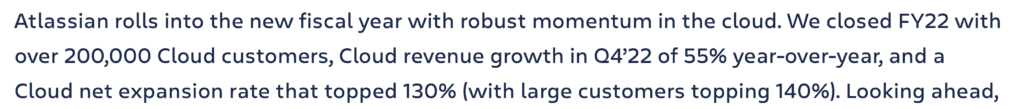

#1. Cloud revenue growing 55% — and Atlassian reaffirms 50% Cloud growth for 2023 and 2024 also! No slow down from Atlassian.

#2. 200,000 Cloud Customers with an NRR of 130%, and 140% from “Large” Customers. This is what we’d expect, and it’s good to see. It fuels Atlassian’s confidence in predicting a strong 2023 and 2024 as well.

#3. 8,800 employees, so an impressive ~$350,000 in revenue per employee. And half of Atlassian’s employees now live 2 or more hours from the office. This is the secret sauce to Atlassian’s business model. Atlassian plans to double its headcount over the coming few years. And it’s doubling down on being hybrid and distributed.

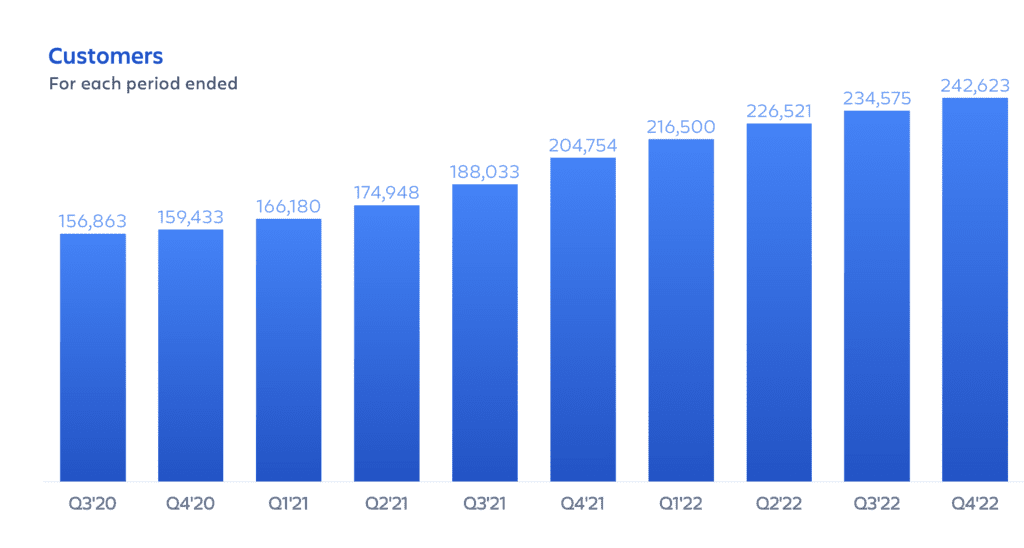

#4. 20% growth in customer accounts leads to 36% revenue growth. The power of high NRR is demonstrated here. Atlassian has healthy customer growth at $3B+ ARR. Anything over 20% is quite healthy. Combine that with 130%+ NRR … and you get epic growth of 36% at $3B in ARR.

Atlassian's customer count is still growing an impressive 20% as year even at $3B in ARR

But it gets more impressive when you combine it with their > 130% NRR

That leads to 36% revenue growth at $3B in ARR

The Power of High NRR

It turns very good growth into epic growth pic.twitter.com/tQ3CQWkVVK

— Jason ✨2022 SaaStr Annual Sep 13-15 ✨ Lemkin (@jasonlk) August 9, 2022

#5. No customer is > 1% of revenue. So while Atlassian has plenty of enterprise customers, it hasn’t gone that enterprise. I might have expected more $1m+ customers, but Atlassian is sticking to its PLG motion that has been wildly successful for decades.

And a few more:

#6. $800m run-rate for free cash flow. This is epic. Atlassian doesn’t return quite as much cash as say, Zoom, but it’s still crazy. It returns 26% in free cash flow. The end state goal for software is 20%+.

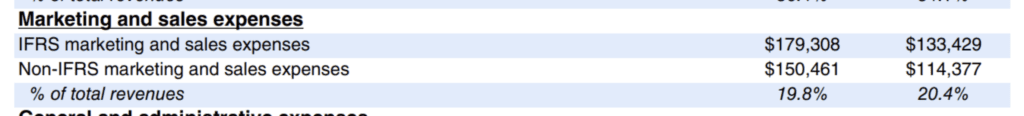

#7. Spends less than 20% of its revenues on sales and marketing. This is about as low as it gets in SaaS. Atlassian turns around and invests some of that savings in engineering and product. But still, spending half of what most of its peers do on sales & marketing is the secret to Atlassian being so profitable.

Wow! Another blow-out quarter for Atlassian, and really a blow-out year for this Cloud and SaaS leader. That should inspire all of us.

And it’s not just Atlassian. ZoomInfo, Confluent, Datadog, Monday, Alteryx, and more also had blowout quarters.

Call it a lot of things. Just don’t call it a downturn.

___________