So we’ve been fans of Bill.com for many years at SaaStr, and covered them from the very early days, as a niche product most hadn’t heard of.

Well, fast forward to today and it’s truly an SMB powerhouse.

At $1.2 Billion in ARR, it’s still growing 48% year-over-year. Yes, 48% at $1.2 Billion in ARR.

How is SMB SaaS doing today?

Take a look at Bill:

– $1.2 Billion ARR, growing a stunning 48% (!)

– 111% NRR, although down from 131% in 2021

– 15 Month CAC

– Gotten very efficient, +$194m net profit

– Transactions growing faster than software, like Shopify

– From $120m ARR in… pic.twitter.com/hYImIBKyNQ— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) October 26, 2023

Pick your jaw off the floor while we dive in with 5+ Interesting Learnings:

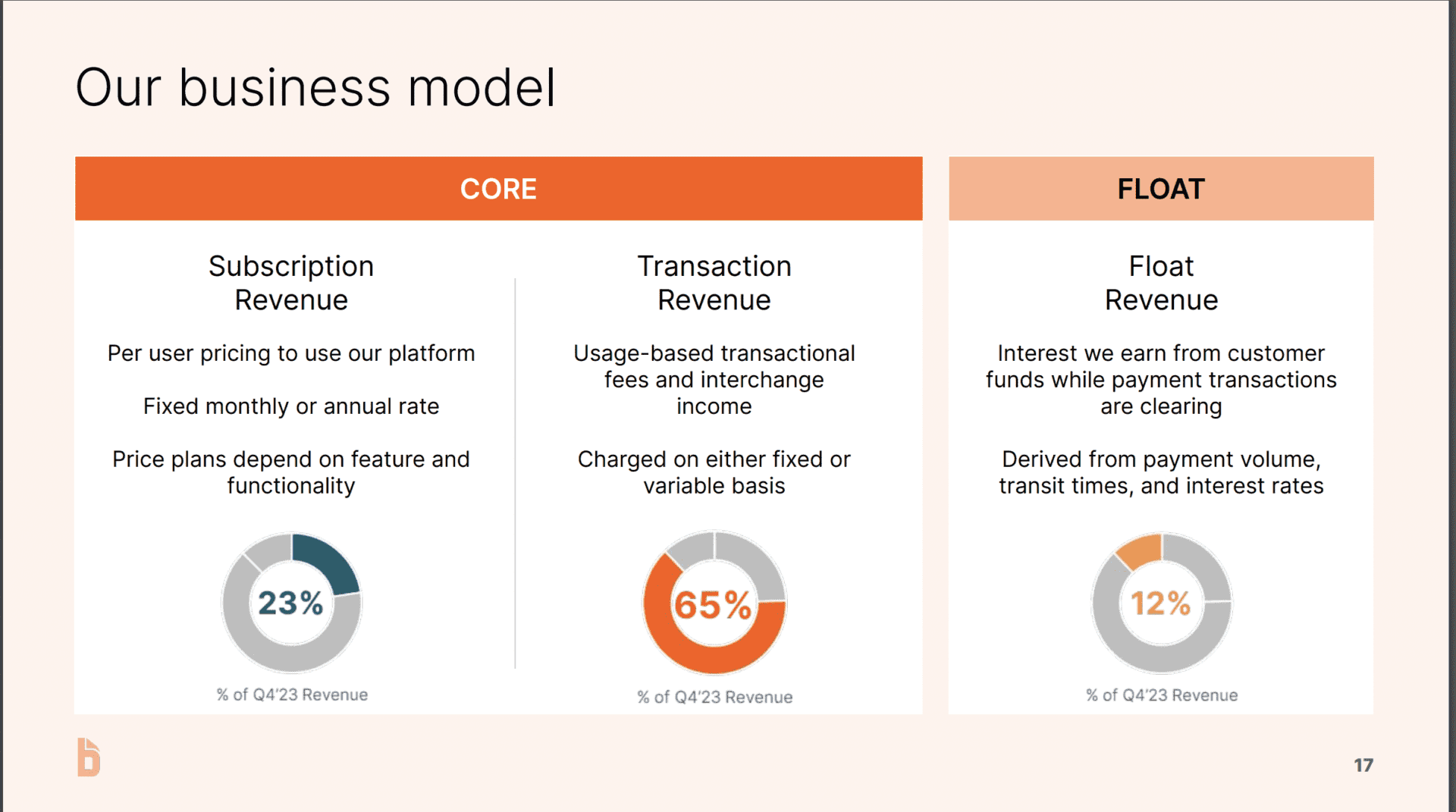

#1. Transaction Fees Growing Far Faster (38%) Than Software / SaaS License (21%). And Far Bigger.

We’ve seen the same story at Shopify. Both Bill and Shopifty have morphed over the years from almost pure SaaS companies to payments platforms built on top of a SaaS core. The rest of the growth is from its Divvy platform, which is bought in 2021 for $2.5 Billion.

Today, software is “just” at a $270m ARR run rate, and just growing 21%. But payments and transaction are far bigger at $800m run rate — and growing faster at 38%.

#2. By Building Its Own Payments and Financial Network, the Gross Margins Have Stayed Very High — At 87% (!)

This is one huge difference. Shopify’s blended margins, Toast’s blended margins, etc. are realtively low, as a huge amount of their payments revenue goes out to the payment processors. But Bill did it the hard way, and built the payment platforms itself. It took years. But as a result, they have stunning gross margins of 87%.

#3. 111% NRR from SMBs. Down A Bit, But Still Very Impressive for SMBs.

NRR was 131% at $800m in ARR, so Bill has seen some material decline here. But still — 111% from SMBs is very impressive. And from small SMBs. Very small ones.

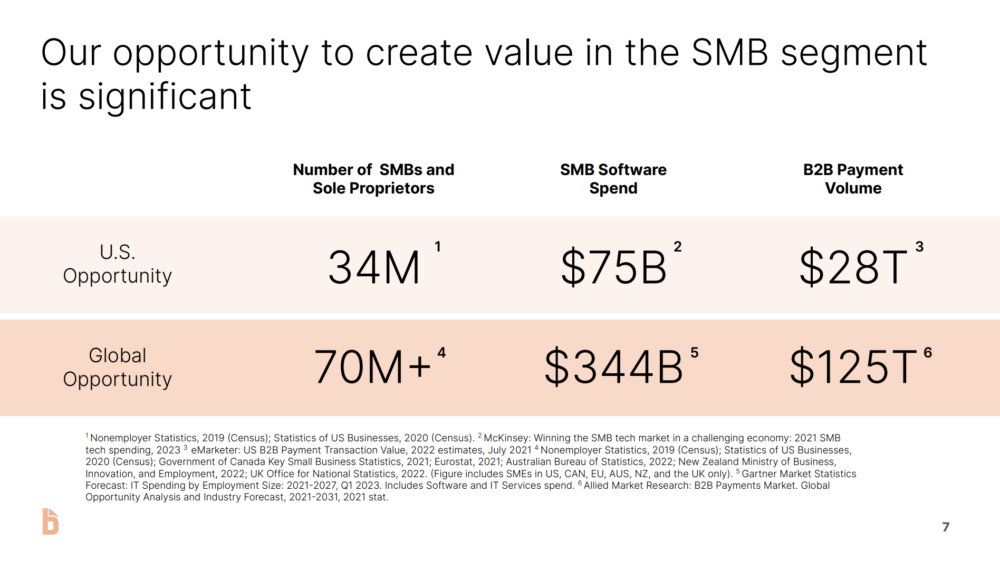

#4. Relatively Late to Go Global, But A Big Focus for Growth

Fintechs and the like often are late to go global, due to global regulations, etc. Bill is one. But now it’s a big focus to double their TAM.

#5. 15 Month CAC

Helpful to see Bill break this out. Most SMB-focused businesses need shorter CACs to make the model wok, but with 111% NRR, Bill can invest at > 12 months here.

And a few other interesting notes:

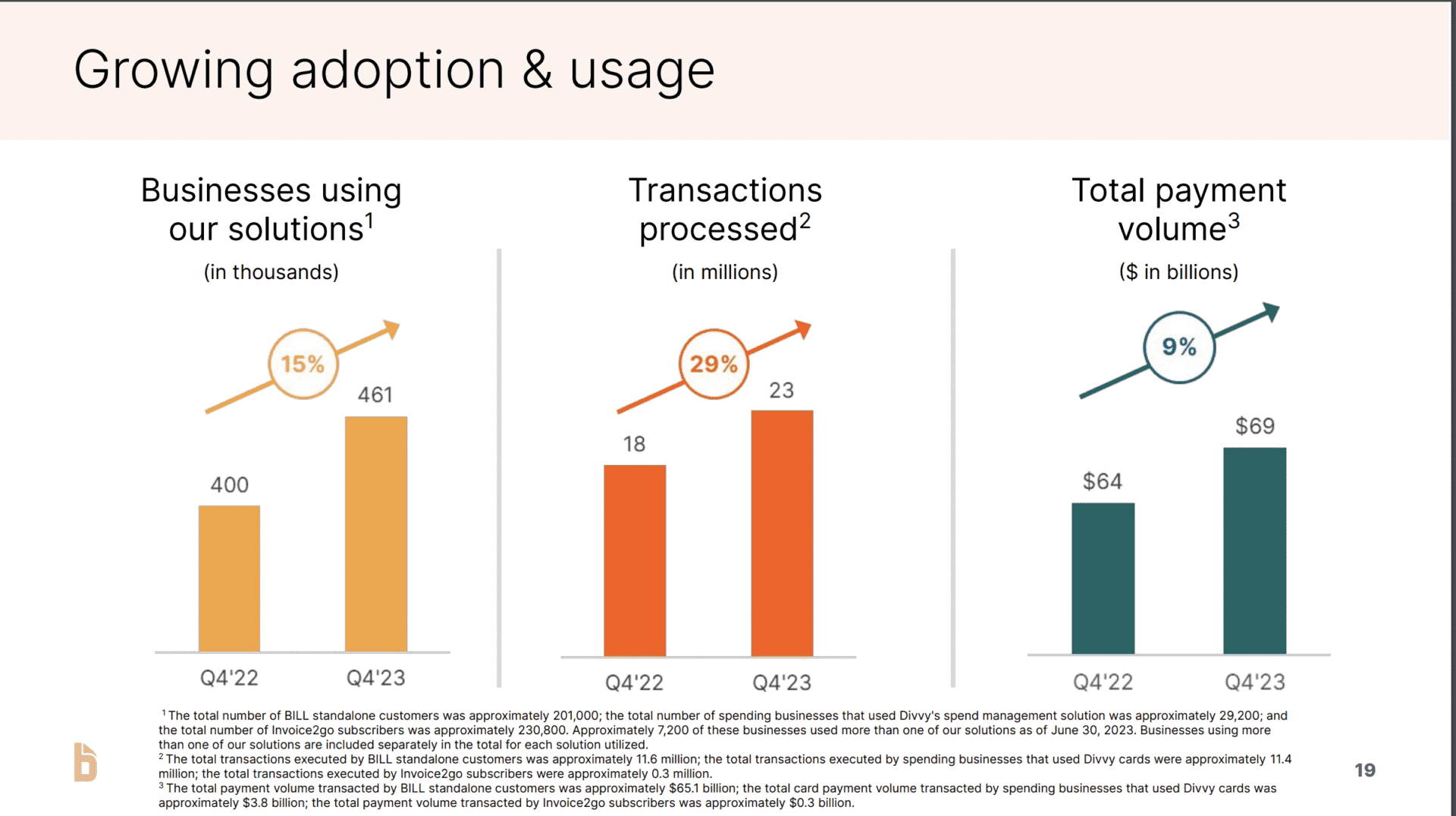

#6. 15% Customer Growth Leads to 48% Revenue Growth

Always helpful to me to see this math broken out. Having 110%+ NRR means your revenue will grow significantly faster than your new logo count.

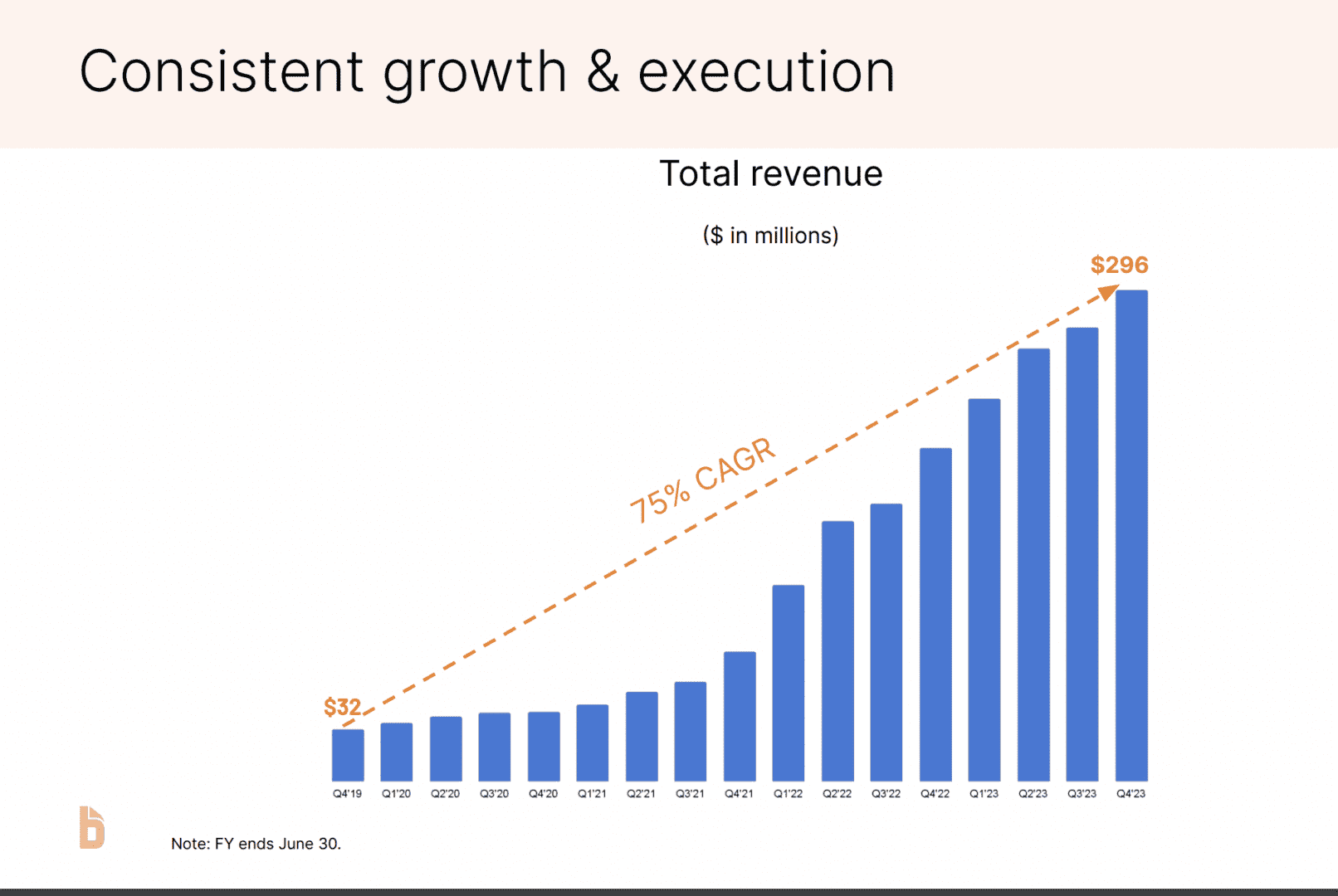

#7. From $120m ARR in 2019 to $1.2 Billion ARR in 2023. 10x in 4 Years.

We often underestimated the sheer, raw power of recurring revenue in SaaS. Things can seem slow. But over years, 100%+ NRR becomes a force of nature.

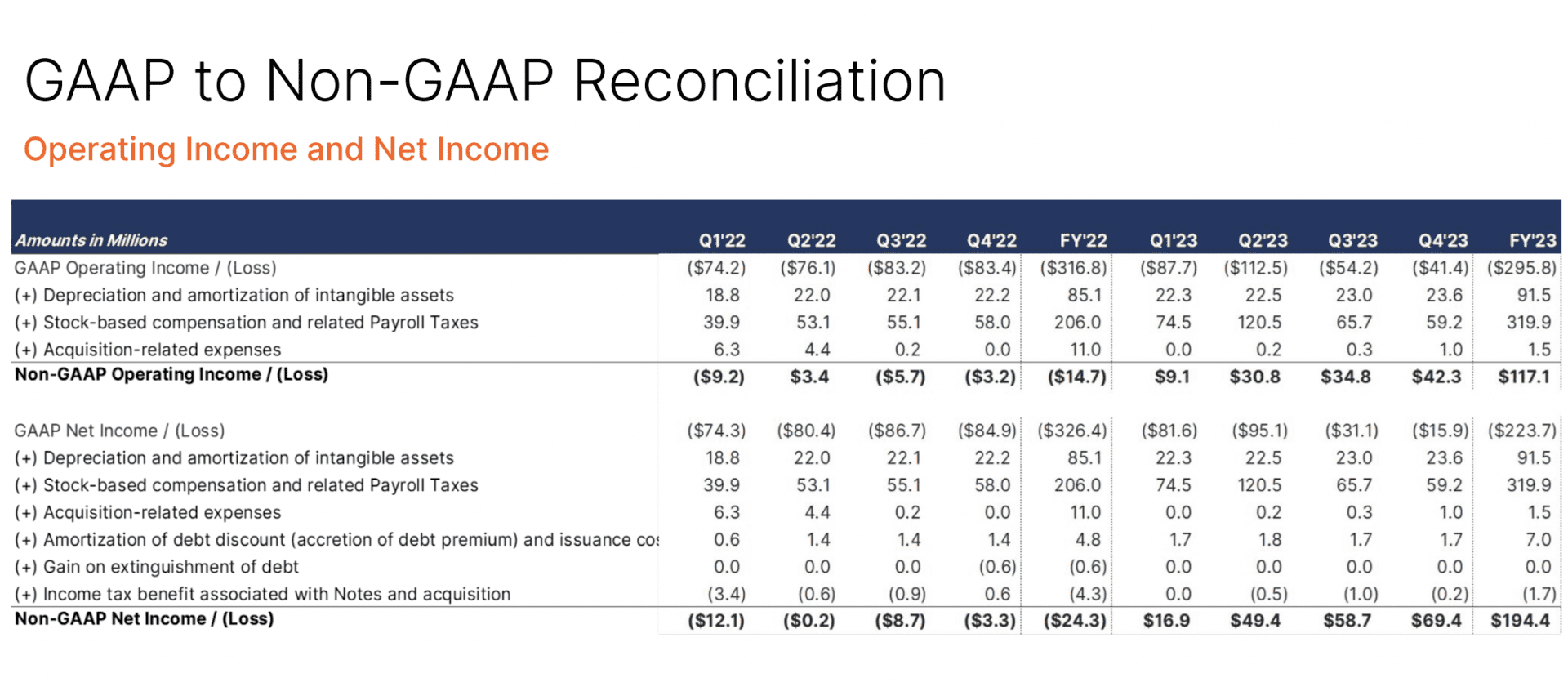

#8. Like Most Others, Radically More Efficient in 2023 Than 2022. Radically.

Bill’s non-GAAP net income was a relative slight loss at -$24 in 2022. Then they got radically more efficient — like most of us — and swing to a +194m net profit in 2023! Wow. That’s a lot more efficient.

How did they do it? By just growing expenses a smidge. Sales & Marketing, Engineering (R&D), and G&A expenses actually all went up in 2023. Just not that much. Much less than revenue grew.

That’s the theme for many today. Spend is back, but many leaders are trying to contain spend growth to less than revenue growth. Do that, and you get pretty efficient, fairly quickly.

Wow what a story and what an engine. A great deep dive with founder CEO Rene Lacerte here from a while back, including on why they built their own payments and transaction processing network here: