So is it possible to be too efficient in SaaS and Cloud?

Maybe. And if so, maybe that’s Digital Ocean. If you haven’t heard of Digital Ocean, ask your developer. Many have used Digital Ocean at the cheaper, simpler version of AWS-Azure-etc. to get going fast and quickly.

Growth has slowed the past year, but profitability? It’s gotten crazy good. Or at least. operating margins and free cash flow are.

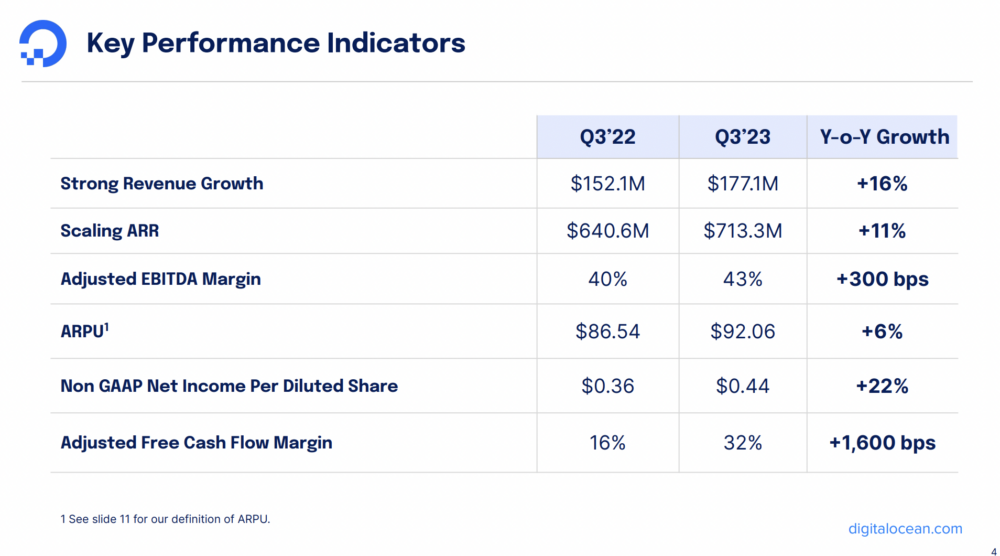

Digital Ocean is growing 16% now at $700m ARR, a mature rate of growth but one now below the Titans of Cloud infrastructure (AWS, Google Cloud, Azure). And in tougher times, churn is up and NRR down. But — it’s raining cash, and earnings per share is growing 22% — faster than revenue.

5 Interesting Learnings:

#1. Super, Duper Efficient Now — 42%+ Operating Margins

Digital Ocean was pretty darn efficient last year, with 40% EBITDA Margins and 16% free cash flow. But like almost everyone, it got even more efficient the past 12 months. Now they’re at 43% EBITDA and a stunning 32% free cash flow. That’s about as free cash flow-y as it gets.

But was growth sacrificed? Maybe. Or at least, maybe like many, tougher times meant holding the line on costs and people, leading to even more efficiency. For now.

#2. Still Pushing ARPU Up, Churn Stable — But NRR Way Down This Year

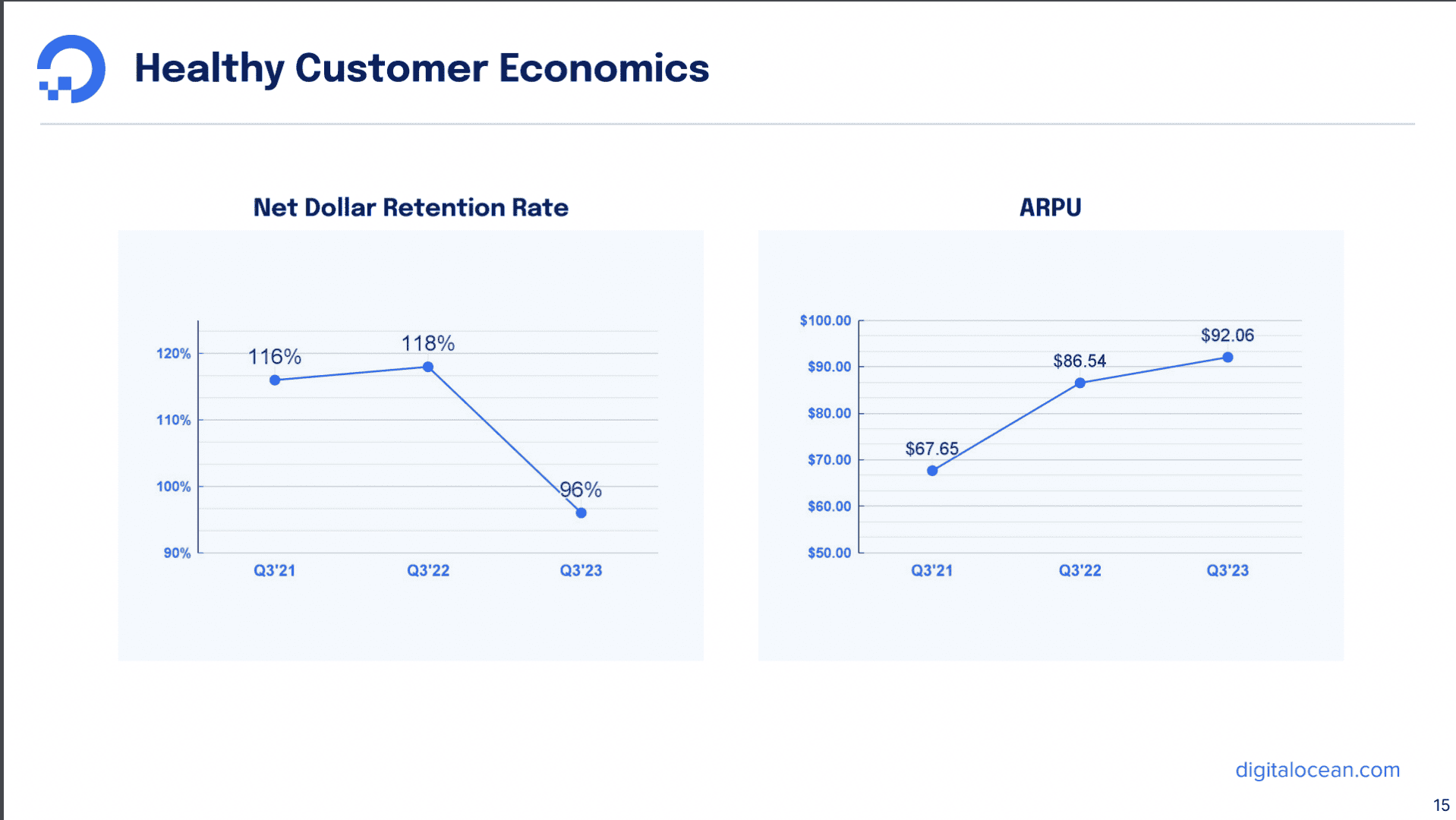

Digital Ocean has small customers and tiny ARPUs, but pushing the ARPU up a bit has a huge impact on a percentage basis. ARPU was up +28% from 2022 over 2021, and another 6% the past 12 months on top of that. That’s fueled a lot of growth. But NRR was hit hard this year as so many optimized their budget, and NRR crashed from 118% to 96%. That’s a big hit in a much tougher year for Digital Ocean. SMBs can be more fickle than enterprises. Zoom and ZoomInfo among others have seen similar challenges in NRR declines in their smaller customers over the past 18+ months.

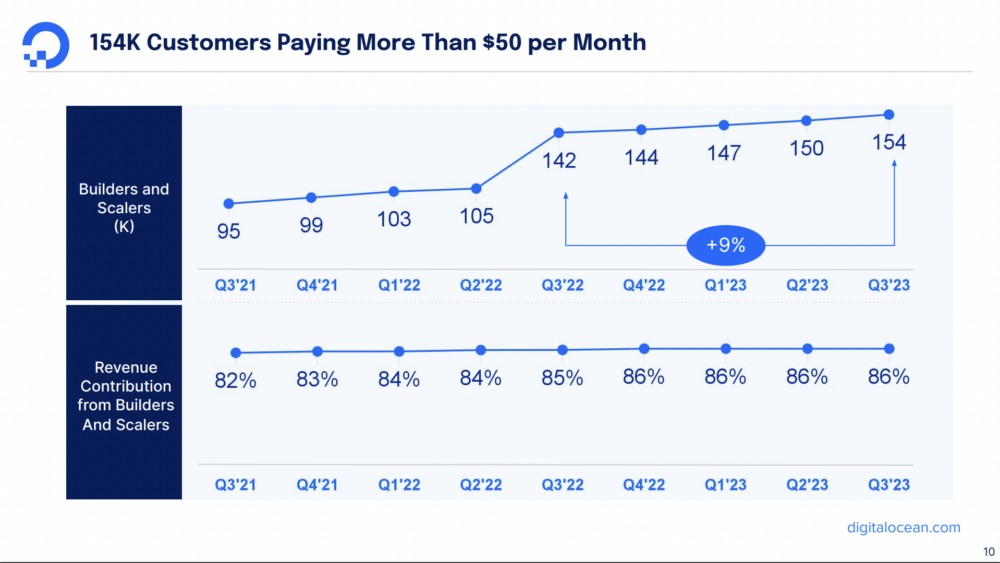

#3. Big Push To Get Customers That Will Pay At Least $50/Month

Ok that’s not a huge number but Digital Ocean really attracts the long tail. But at scale, even the slightly less long version of the tail is where the money is. The focus now is at $50+ a month customers. A reminder that even going a smidge upmarket can really help as you scale.

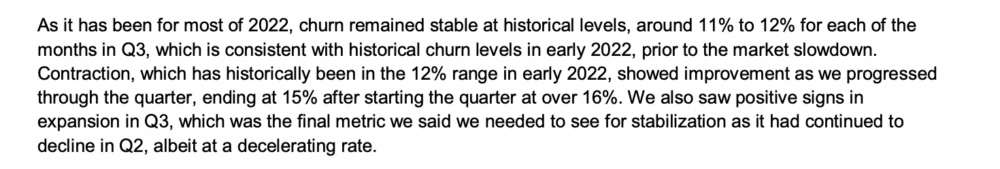

#4. Churn Stable. Customers Just Tried to Optimize Their Spend — Even Tiny Ones

You might think smaller Digital Ocean customers wouldn’t be putting as much energy into optimizing their cloud spend as say a $1m a month AWS customer. But you’d be wrong 🙂 Churn did grow from 12% to 15%, but NRR fell far faster, from 118% to 96% in just one year. Even small cloud customers worked to bring down their spend in 2023. We sometimes forget how cost sensitive folks can be even on small spend — when they are paying out of their own pockets.

#5. Almost All Customers Still Come from Self-Service

This makes sense at these price points. Digital Ocean has added a sales team and now a partner team, but it’s still early for both.

Digital Ocean is the quiet leader for the Long Tail of Cloud infrastructure and platforms. They’ve kept at it, never quit, and even expanded into AI and more.

It‘s a great success story and will be at $1B in ARR before you know it. But with growth slower now than its larger competitors, it’s also a reminder of just how tough it is sometimes at the bottom of the market, and with the very smallest customers.