Expensify:

Founded in 2008 … 13 years ago

A long, tenacious path to $100m ARR, and then … Boom!!

* 60% growth in Year 13 at $140m+ ARR!!

* 119% NRR from SMBs!!

* Super Profitable (35% EBITDA!!)#golong pic.twitter.com/4RJMDVQPMC— Jason ✨BeKind✨ Lemkin ⚫️ (@jasonlk) October 18, 2021

Expensify is one of those incredible companies that maybe was too early to market. What do I mean? It was born in the age of mobile, and from the moment it launched, everyone I knew started to use it to track their own expenses. It was just amazing that when iPhone launched, you could now take a picture of receipts and have them somewhat automatically “expensed”. A jaw-dropping, amazing use of the first generation on mobile apps.

But Expensify, like Bill.com, was also early to the world of the fintech side of expense management. A new generation from Brex to Ramp to Divvy seemed to explode once virtual credit cards could be instantly deployed via API … and that took another decade. But both $25B+ Bill.com and now Expensify became fintechs, adding credit cards and much more. And Bill even acquired Divvy for $2B.

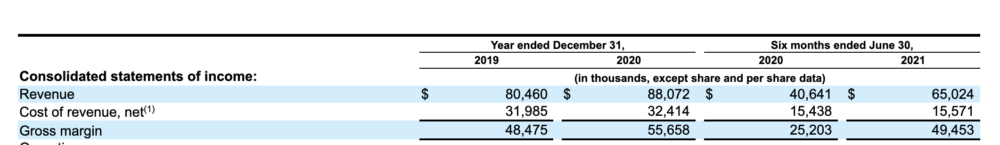

And while it took Expensify 13 years to hit $140m in ARR … now it’s growing like a weed. A stunning 60% year-over-year.

An incredible lesson of being early, being right, and staying the course as the market evolved and changed and got even bigger.

5 Interesting Learnings:

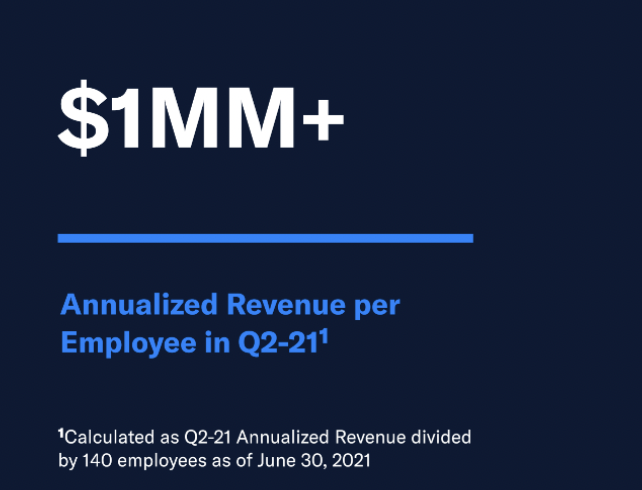

#1. Only 140 employees (!). $1M in ARR per employee could be a new efficiency record at IPO for SaaS. Expensify kept it lean, maybe even almost too lean. They raised little in VC capital and quickly became cash-flow positive. As part of that, they learned to outsource anything they could, and maximize the PLG playbook … leading to a stunning $1m in ARR per employee. We can’t all do this. But it shows it can be done.

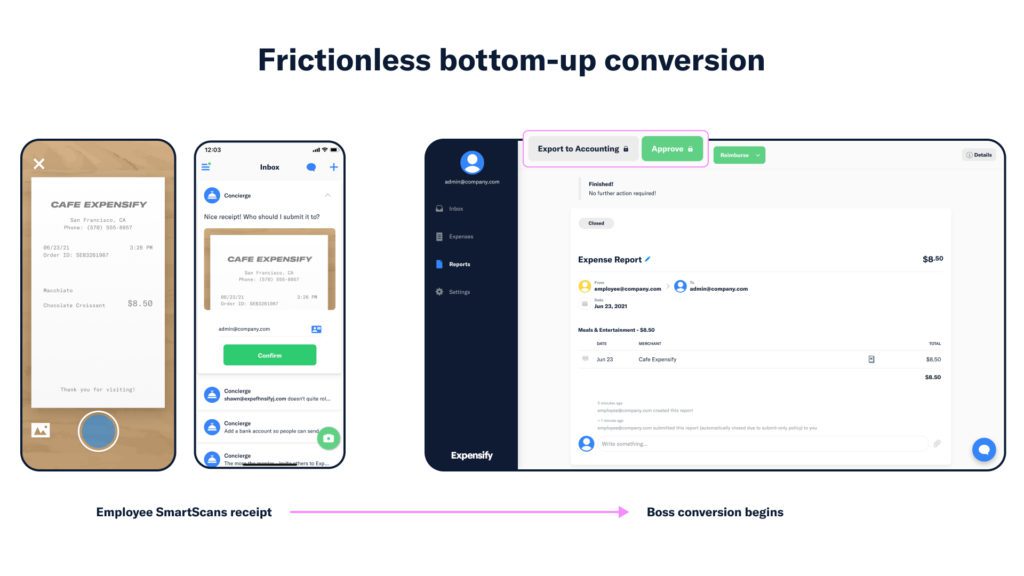

#2. An incredible 60% of their revenue comes from employees using the free version on their own, for their own expenses, and then socializing it to their “boss”. PLG before it was hot:

Expensify, like Bill.com, has stayed the course and remained SMB focused, although both have driven their ACVs up at $100m+ in ARR by adding more value and products, especially payments, credit cards, and more.

Sometimes, the self-serve / PLG engine stalls out at a certain scale. Oftentimes, even. But not yet for Expensify. Not yet at $140m in ARR.

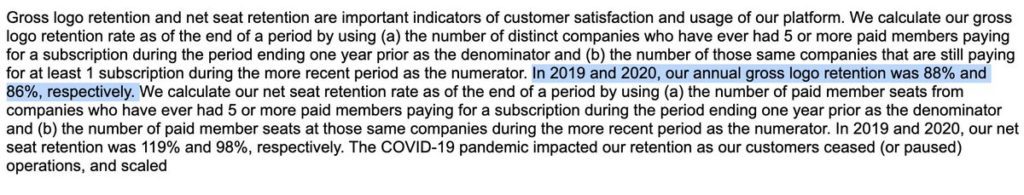

#3. GRR of 86% and NRR of 119% are very impressive for SMBs … although they only count customers with 5+ seats. Their tiniest customers still have higher churn, as with almost every other SaaS company. A reminder to segment churn, and be careful when looking at public company NRR rates. They often exclude the smallest customers, and other segments. Still, 119% NRR from SMB is world-class even for 5+ seats accounts and something to strive for if you have similar-sized customers.

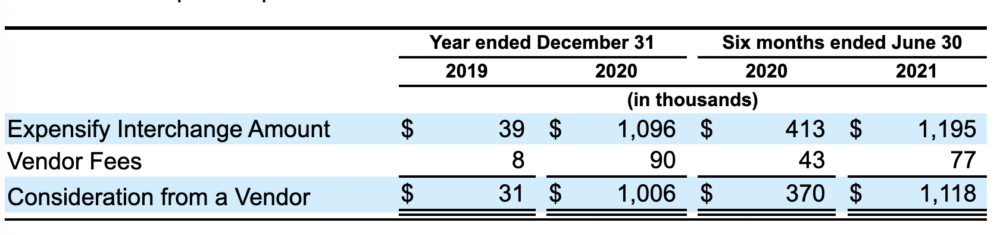

#4. Fintech is the engine of growth at scale. Expense reports are the core product and growth engine, but moving money is the growth vector at scale, (which grew 2.5x year-over-year), just like Shopify, Bill, and more:

Expensify only launched its credit card products just before Covid, but already the contribution is material. Like Bill, it took the process seriously and became a licensed money transmitter itself. Ultimately, this leads to higher margins in payments, but also entails taking on financial risk, fraud risk, and a significant regulatory and legal overhead.

#5. Growth of only 10% in 2019 to 2020 — but then exploded! This is pretty incredible and also close to unprecedented. Covid was a big piece of it. But after adding more credit cards and payments, and coming out of Covid … boom!! From 10% growth to 60%. In one year. Not sure we’ve ever seen that at scale before.

And a few bonus learnings:

#6. 90% U.S.-based revenue. Expense management has many localized components, and Expensify has been relatively slow to expand outside the U.S., but it’s growing from 9% in 2019 to 11% in 2021. Expansion so far is limited to the U.K., Canada, and Australia.

#7. Average of 12 seats per customer. With 639,000 paid members across 53,000 companies, the average customer pays for 12 seats. An SMB sale, but less and less a single-seat sale. 110%+ NRR from SMBs usually requires team-level functionality, and Expensify is a good case study here. 95% pay monthly on credit cards.

#8. Annual contracts used to be cancelable, now aren’t. Interestingly, Expensify allowed customers to cancel annual contracts until May 2020. Most likely a change to get ready to IPO in part, and in part to stabilize things post-Covid. An annual contract that is cancelable can sometimes create many of the economic benefits to the SaaS company of annual deals but remove some of the friction.

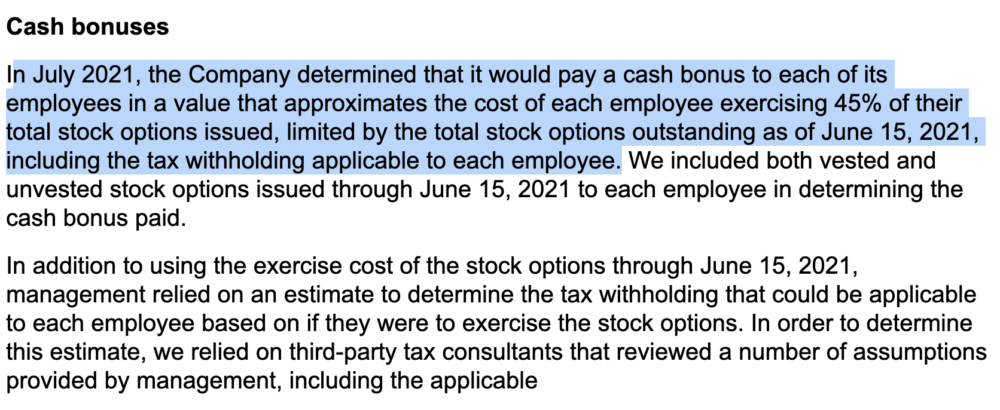

#9. Paid out cash bonuses to help employees buy their options / stock. This is nice to see. The company paid out $9.5m of bonuses to help employees pay the costs to exercise up to 45% of their options. The total amounts under this program are $30m-$36m. It can be tough to come up with the cash to exercise options. Expensify put in place a program to help employees do just that:

#10. Bought out Redpoint (one of their VCs) for $43m. Founder-CEO Dave Barrett is famous for his views on the pros and cons of venture capital (see his talk from 2017 SaaStr Annual below) and he bought out most of Redpoint’s shares for $43m in 2018.