So almost every Cloud infrastructure leader has done pretty well at least during these “macro impacted” times. They’ve seen some impacts, but not as many as others in many cases. Everyone has spent the past year managing their budgets more carefully, but the awesome force of simply running more workflows in the Cloud has still pulled growth forward.

HashiCorp is one example to look at. They’ve had some macro headwinds no doubt. But, growth it still 26% at almost $600,000,000 in ARR. Strong, although down significantly from 51% growth at $400m in ARR.

Also, importantly, for them Q1’23 seemed to be their low point of macro impacts. We’ve seen this also with MongoDB, ZoomInfo, Zoom, and many — though not all — Cloud and SaaS leaders. Things may not be easy going forward. But we do seem to be past the lows.

Quarterly net new ARR trends. As a reminder, I calculate ARR as quarterly subscription rev x 4. It's the best "swag" for public companies when ARR isn't disclosed. pic.twitter.com/6H4Knebr0A

— Jamin Ball (@jaminball) August 31, 2023

5 Interesting Learnings:

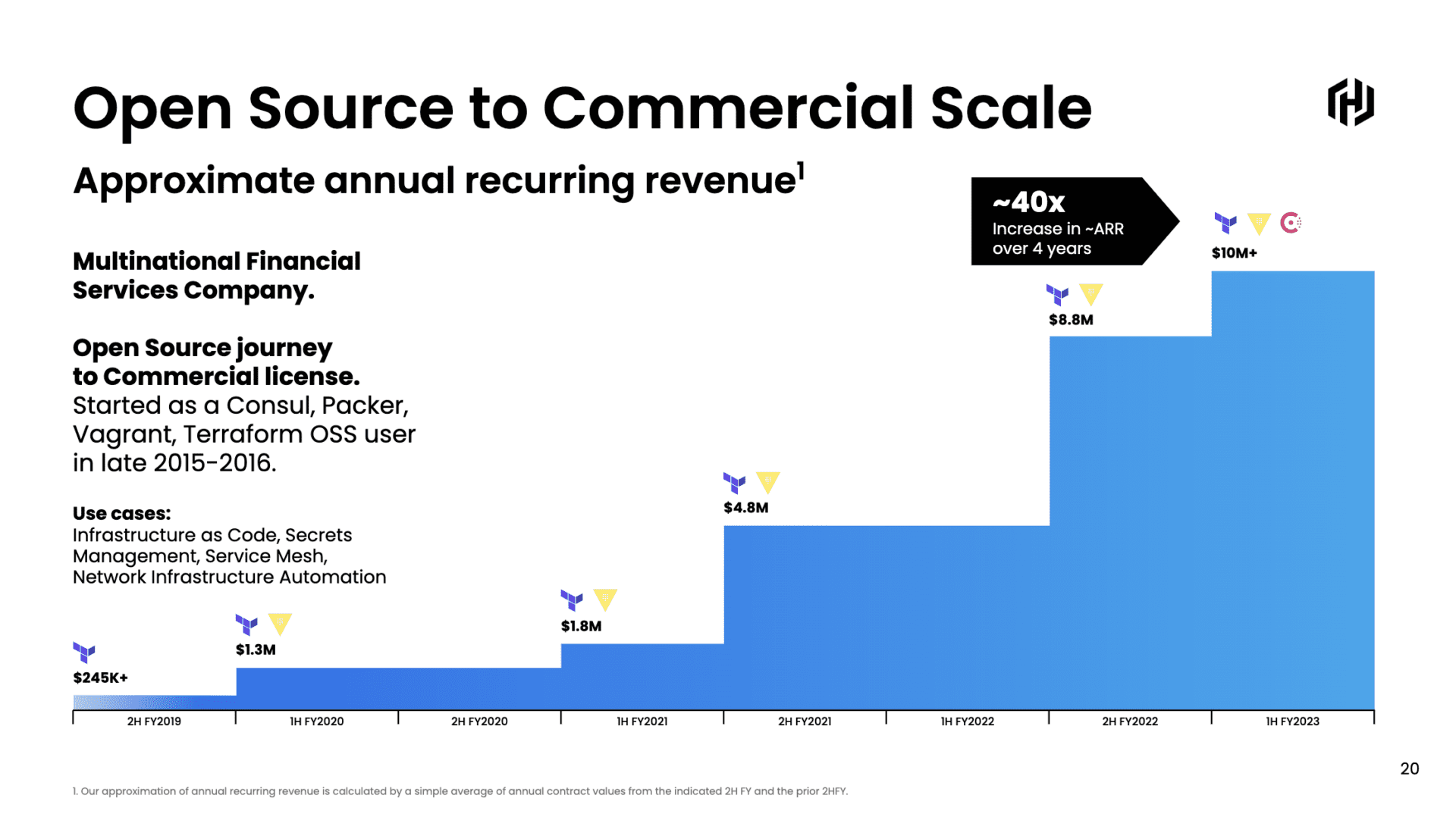

#1. Big Customers Take Years to Get Huge. And That’s OK.

We’ve seen a similar pattern with MongoDB. HashiCorp’s mega-customers don’t always start that way. But that’s OK. It leads to just an awesome force of nature years down the road.

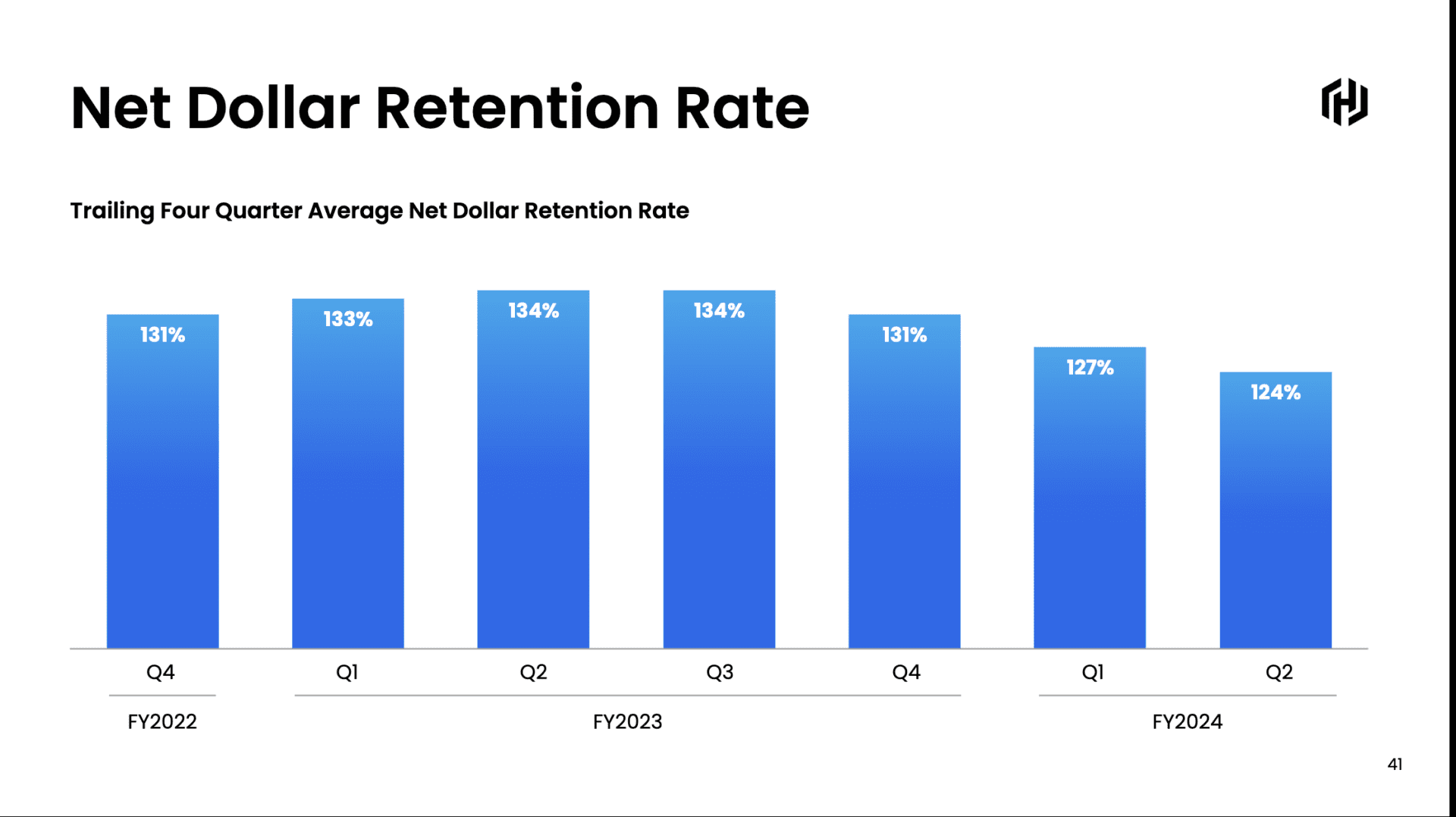

#2. NRR Down a Bit, Yes, But Still Impressive At 124%.

Here’s where we can see some macro impacts, but not enough to stop the train. Still, the drop the past quarters has dented growth, even if it hasn’t stopped it.

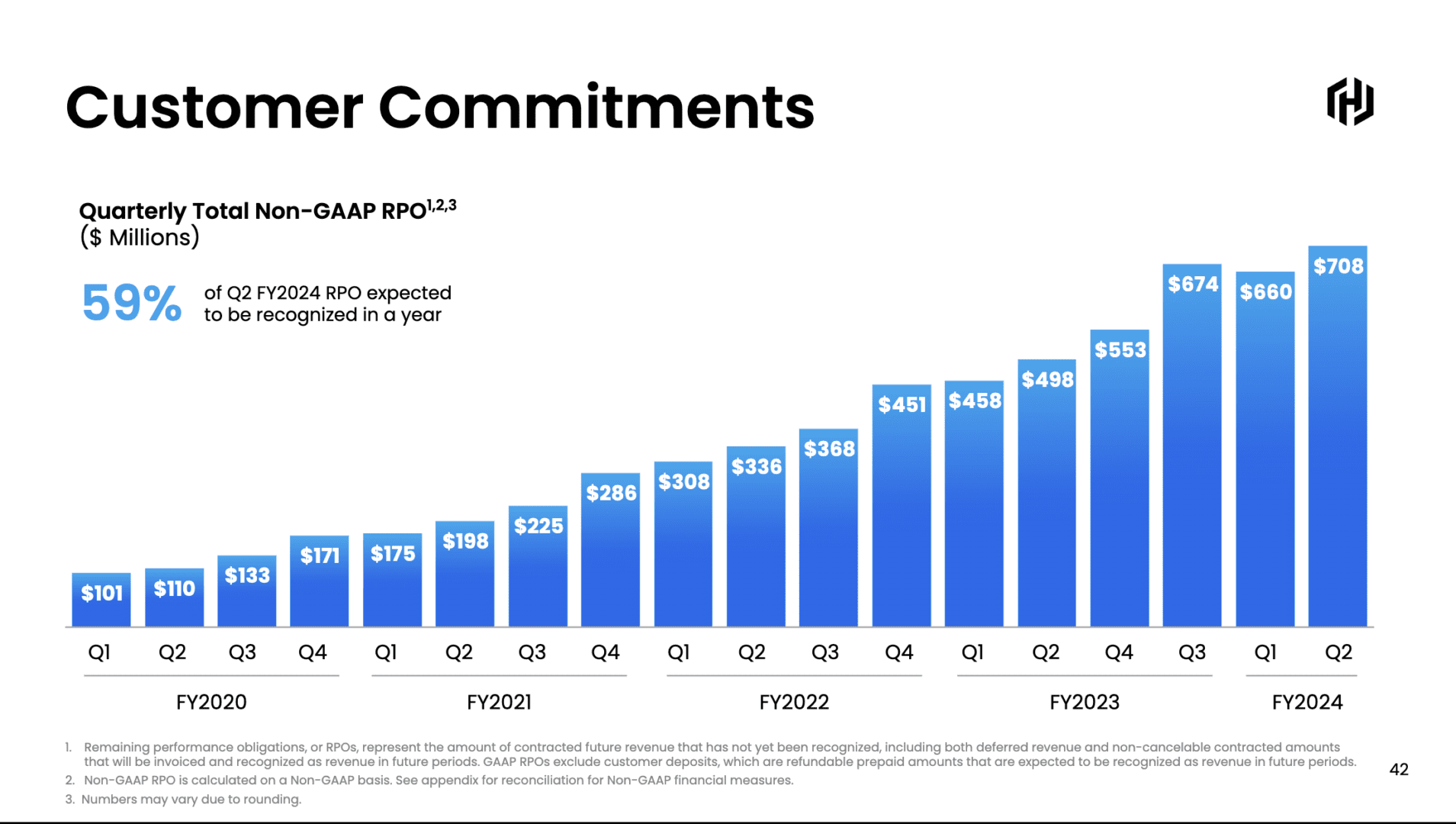

#3. RPO Back To An All-Time High.

This is the most encouraging “tea leaf reading” sign. RPO is a measure of revenue under contract that hasn’t been delivered yet. And after a dip at the start of the year — a dip almost everyone else saw — HashiCorp has come back with its higher RPO ever.

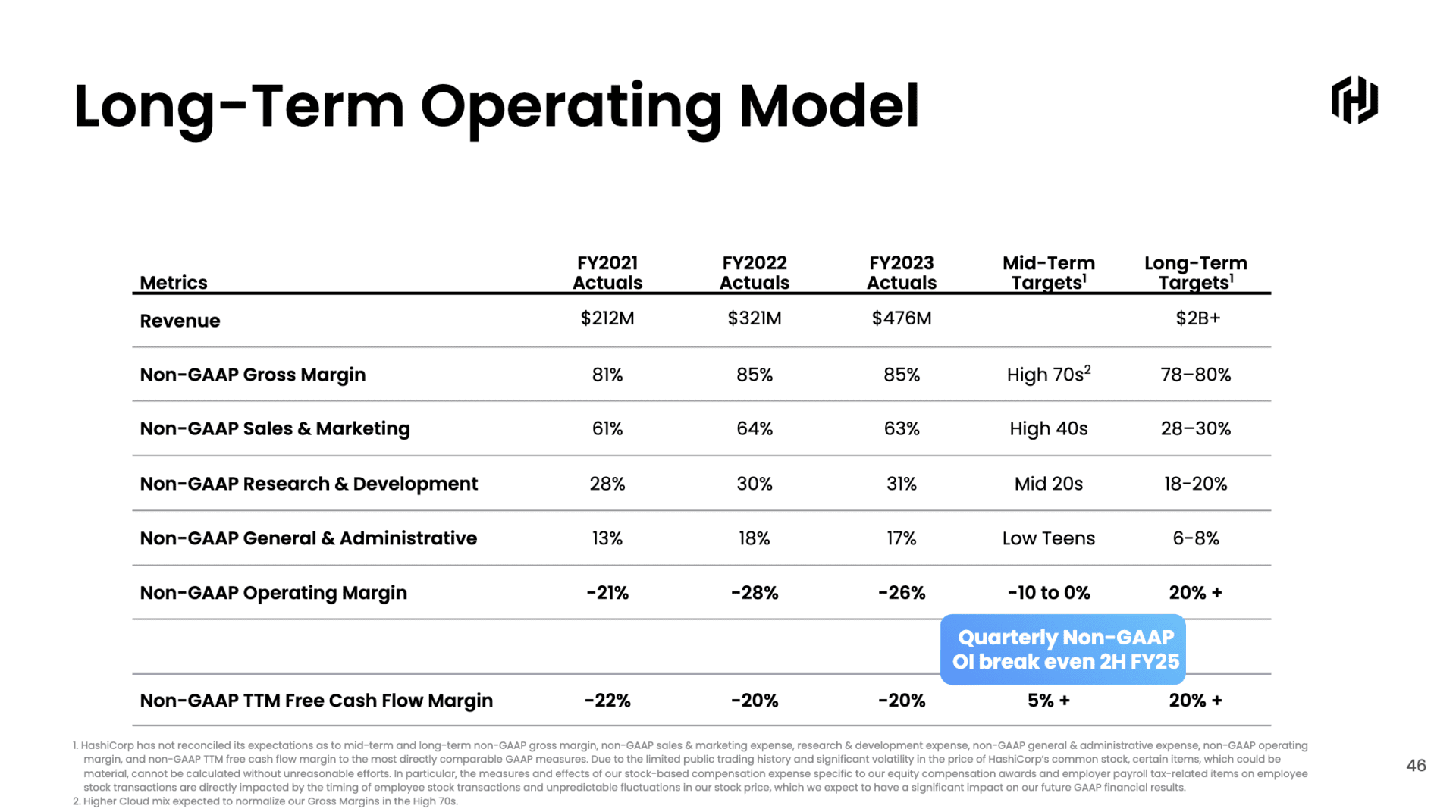

#4. Not Much More Efficient — Yet

Unlike most other Cloud and SaaS leaders, HashiCorp didn’t get radically more efficient the past 12-15 months. They’re still trading at $5.3 Billion in ARR, so at 10x ARR, strong, so perhaps delaying getting more profitable is fine for them. Still, they’ve traded up on 6% this year, when other efficient leaders have traded up far more. So likely Wall Street is partially punishing them for continuing to invest heavily in growth. While CAC I find hard to accurately calculate from public numbers, you can see Jamin Ball is estimating a 60+ month CAC. That can make it harder to magically get more efficient overnight.

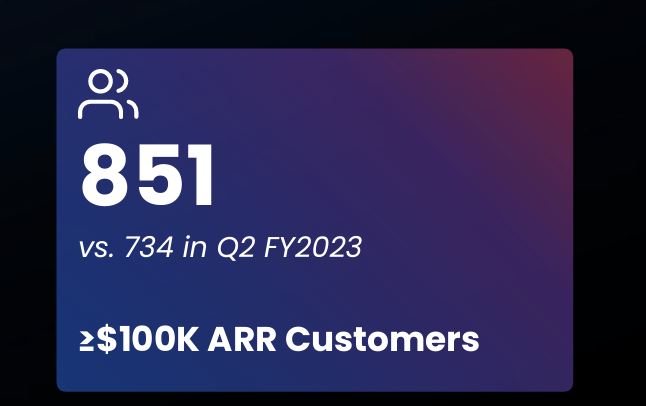

#5. 20% of Customers Pay $100,000 a Year or More.

We’ve seen a similar pattern with MongoDB and other open source adjacent and open source and COSS leaders. The smallest customers they don’t really try to monetize, so the ACV ends up being relatively high. They have 4,217 total customers, of which 851 pay $100k or more.