So we’ve covered Klaviyo several times at SaaStr, and we’re super excited CEO Andrew Bialecki is coming to 2024 SaaStr Annual Sep 10-12 in SF Bay to share his learnings!! (We also have a great deep dive we did a little ways back with Andrew below).

Klaviyo is not only a rocketship, but it’s been the only SaaS IPO since Dec 2021. The only one. 1. That’s. One SaaS IPO in 2.25+ years.

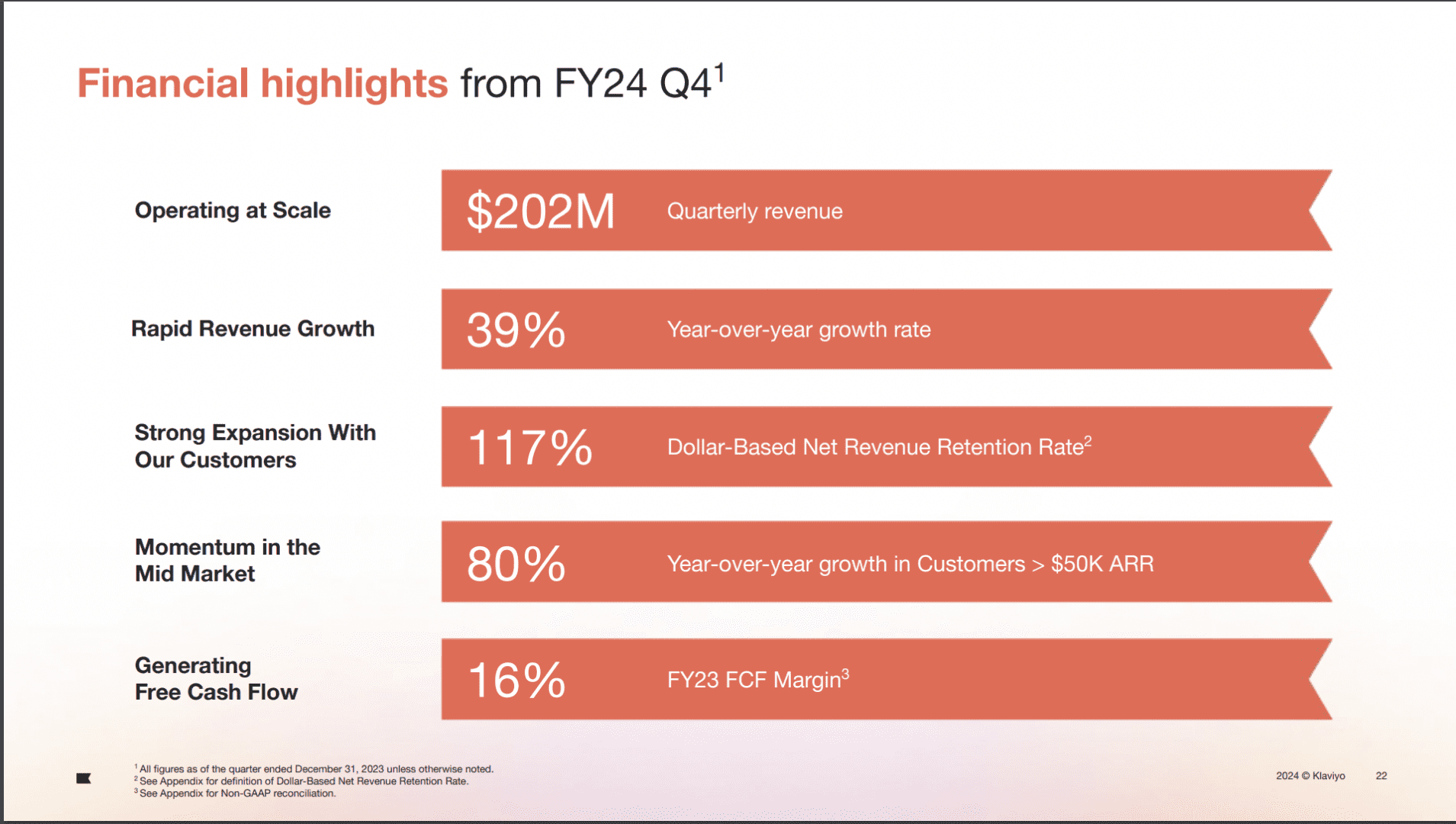

And to IPO in that loooong stretch of … no IPOs … it really had to be a good one. Which Klaviyo is. At $800m it has the full package: 39% (!) annual revenue growth, 16% free cash margins, and 117%. It doesn’t get too much better, folks.

5 Interesting Learnings:

#1. NRR Holding Up at 117%.

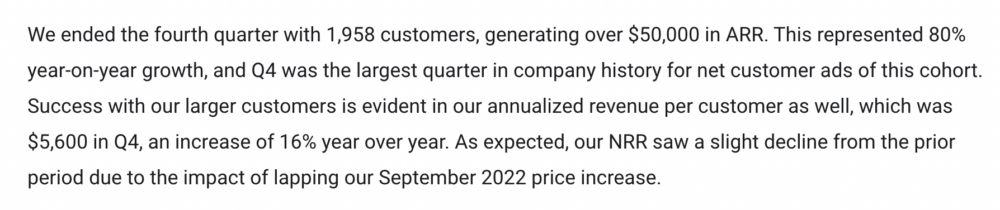

At IPO, NRR was 119%. Today, it’s still 117%, even as other marketing leaders like HubSpot have seen big drops in NRR in today’s macro environment. This is pretty impressive, especially with many smaller customers. A big part of that is likely that e-commerce growth overall remains strong. The small NRR drop Klaviyo attributed to lapping a price increase, not macro impacts. HubSpot by contrast has seen NRR fall from 110% to 100% today.

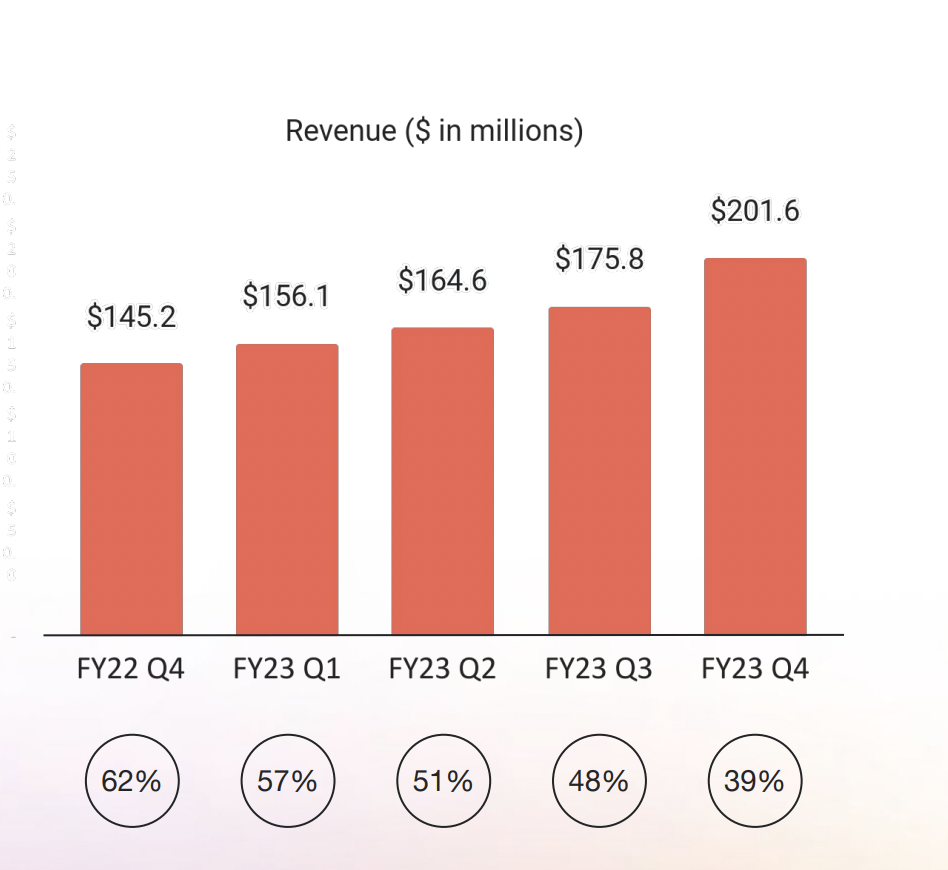

#2. Revenue Growth Remains Top, Top Tier at 39% on Way to $1B ARR. But Down a Bit From Crazy Growth Pre-IPO.

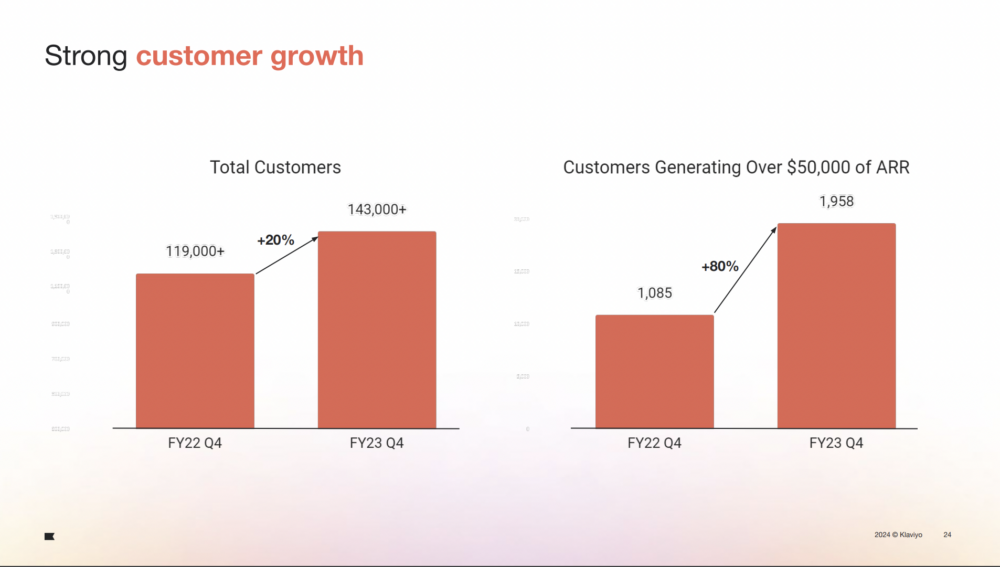

Few at Klaviyo’s scale have its revenue growth of 39% approaching $1B in ARR, especially these days when the average annual growth for public SaaS companies is barely 20%. It’s incredible. Now combine new customer growth of +20% (see below) and 117% NRR, that just about adds up to total growth of 39%. But growth has come down a bit from insane to merely incredible levels.

#3. New Customer Count Up +20%, $50k+ Customers Up 80%

I’ve come to believe that this is the single most important metric in SaaS — your net new customer growth. If net new customer growth is strong, you can fix anything else. And Klaviyo’s is super impressive. Even as it comes up on $1B in ARR, it’s growing new customers overall +20%, and its bigger customers +80%. HubSpot is doing the same at $3B in ARR. It’s super impressive.

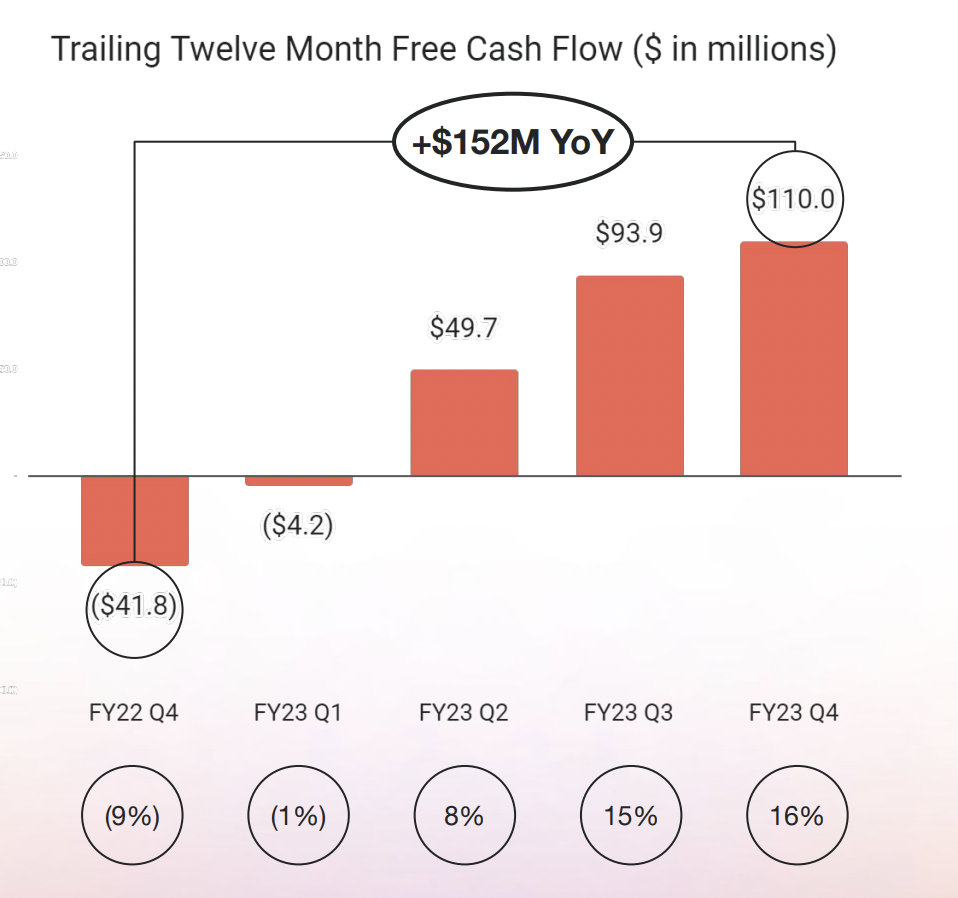

#4. Very Efficient. with 16% Free Cash Flow Margins

Klaviyo was very efficient most of its history, outside of an investment period pre-IPO when it increased the burn, so this is less of a cultural change than it is for other public SaaS companies. But it’s still very helpful to see it this way. Klaviyo is an efficient cash engine.

#5. ACV Up 16% to $5,600

Klaviyo’s roots are SMB but as you can see above, its $50k+ mid-market customers are its fastest growing segment. As part of that drive upmarket, the blended ACV has gone up materially, +16% to $5,600.

And another interesting learning:

#6. 95% of Revenue Still in eCommerce

Klaviyo is slowly expanding from its eCommerce base, but its dominant position in ecommerce and in the Shopify ecosystem remains its core. It’s very early to Klaviyo diversifying off eCommerce, even at $800m+ ARR.

Wow. It just doesn’t get much better than Klaviyo. And honestly, in some ways, it’s a bit initimidating. It shows just how high the bar it is to a strong SaaS IPO is right now.

And a great deep dive with Founder CEO Andrew Bialecki here: