So the last time we caught up with Palantir, they had just IPO’d and were at $1B ARR. Fast forward to today, and so much has changed. They’ve now cruised to $2B in ARR, but the world for Cloud and SaaS stocks has changed a lot.

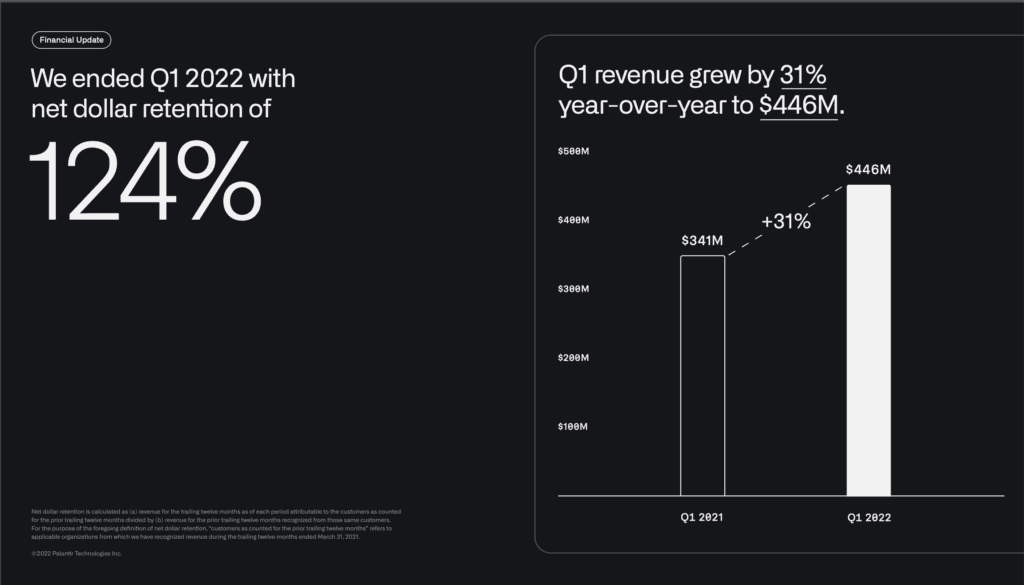

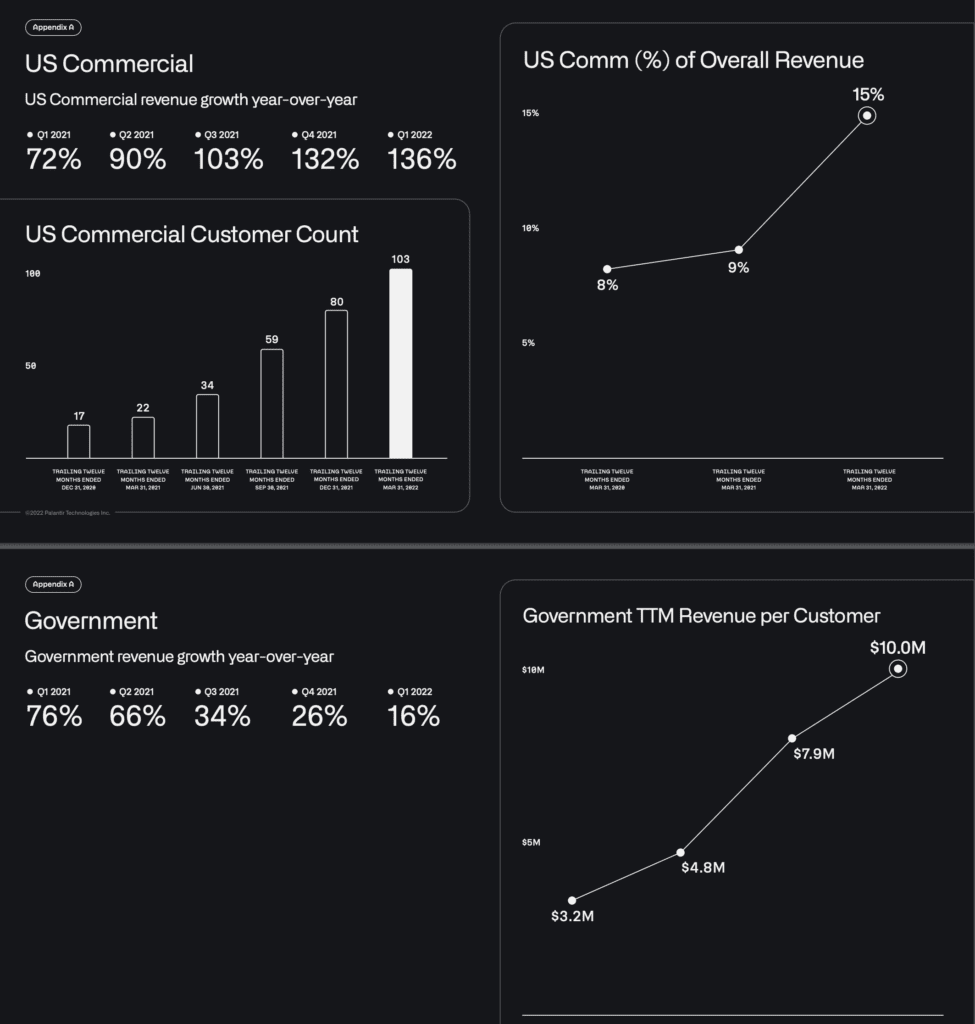

At $2B ARR, Palantir is growing a still impressive 31%. But at $1B ARR it was growing 49%. And while its core Defense Business has slowed down substantially for now, its Commercial Business, while just 15% of revenues today, is accelerating.

5 Interesting Learnings:

#1. 124% NRR fuels growth at scale. This is both the power and the crutch of NRR. It fuels you for years to come, but it’s important not to rely on it for too much of your growth. Or at some point, high growth can’t last.

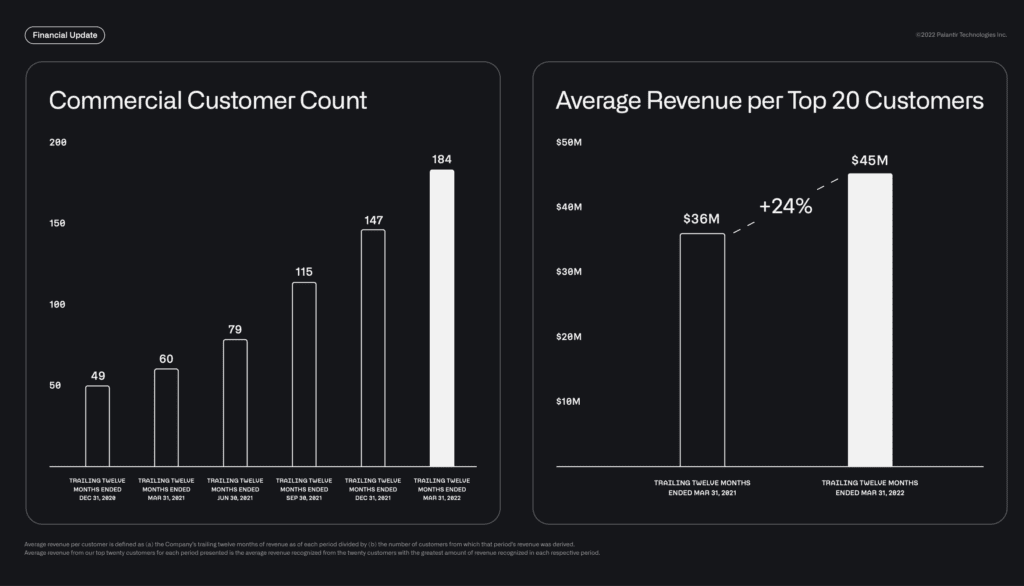

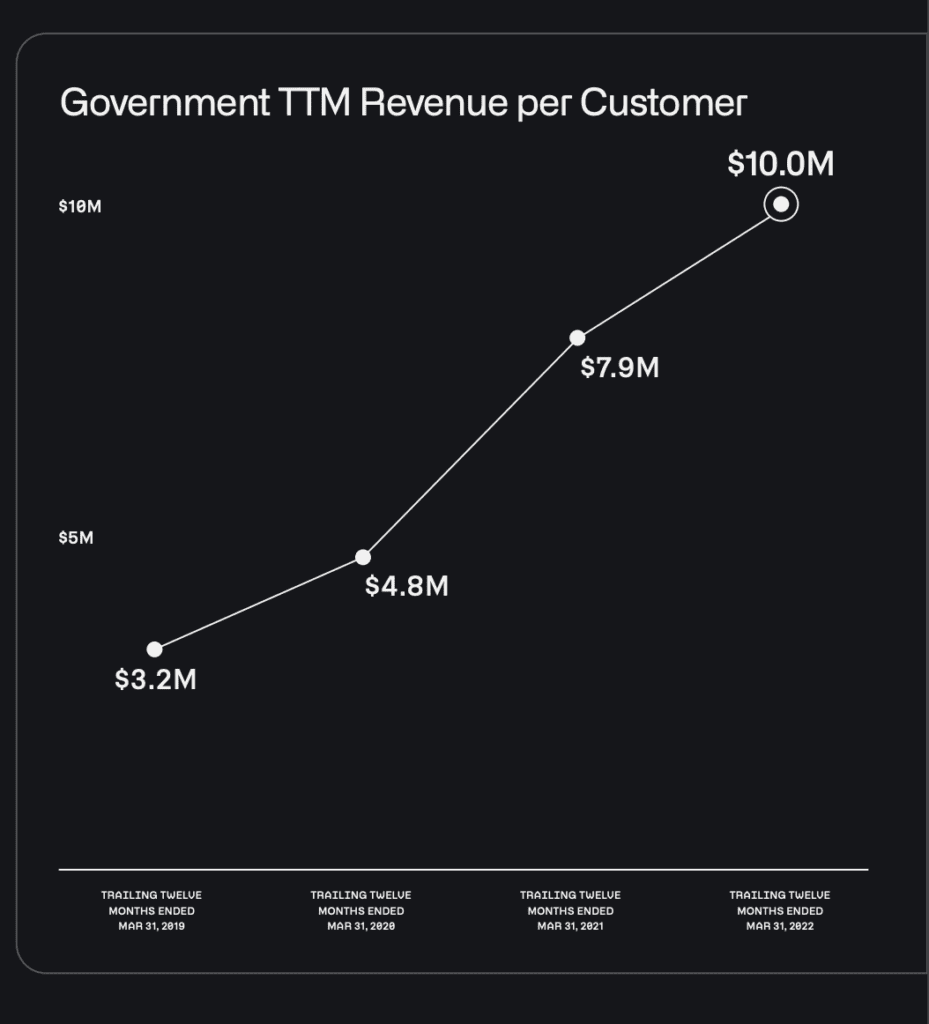

#2. Its Top 20 Customers pay an average a stunning $45m a year (!). And that’s 24% higher than a year ago! Big, big deals. And the average Government customer pays $10m a year (more below).

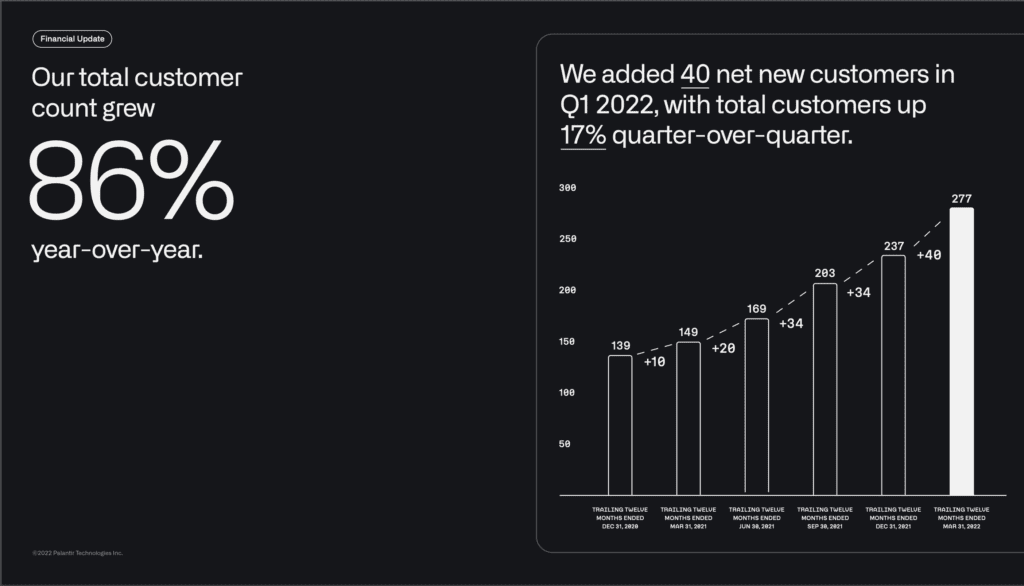

#3. Net customer adds grew 86% year over year. If they equal size of existing customers over time, that’s fuel for years of growth. But I would have expected revenue to grow even more, when combined with 124% NRR.

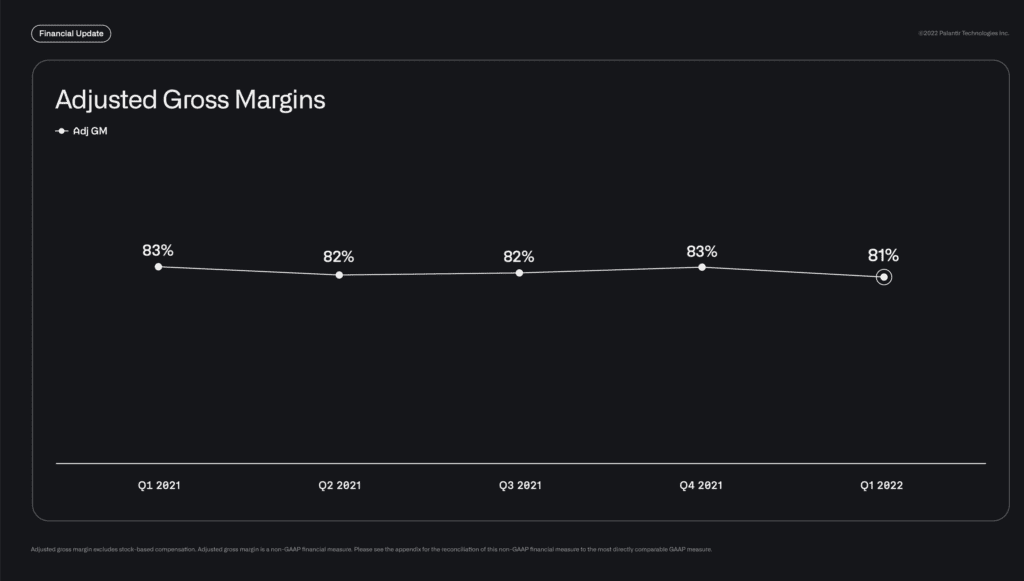

#4. Yes, Palantir is Solidly a Software Company. Gross Margins remain well above 80%. It was perhaps fair to criticize Palantir as a services business in large part in the run up to the IPO — but no longer. With many quarters of 80%+ gross margins, that’s software.

#5. Government Revenues Plummeted, While Commercial Kicked Into High Gear. A reminder of the importance of being multi-product and multi revenue stream. Government Revenues plummeted from 76% growth in Q1’21 to 16% in Q1’22 (ouch), but Commercial Customers accelerated from 72% in Q1’21 to 136% in Q1’22. Palantir needs both revenue streams to consistently scale. Commercial customers are still only 15% of the total however, and weren’t to fully offset the drop in government deals.

#6. The average Government Customer now pays $10m a year — that’s up from $3.2m in 2018. A vivid example of the power of combining 120%+ NRR and driving up deal sizes.

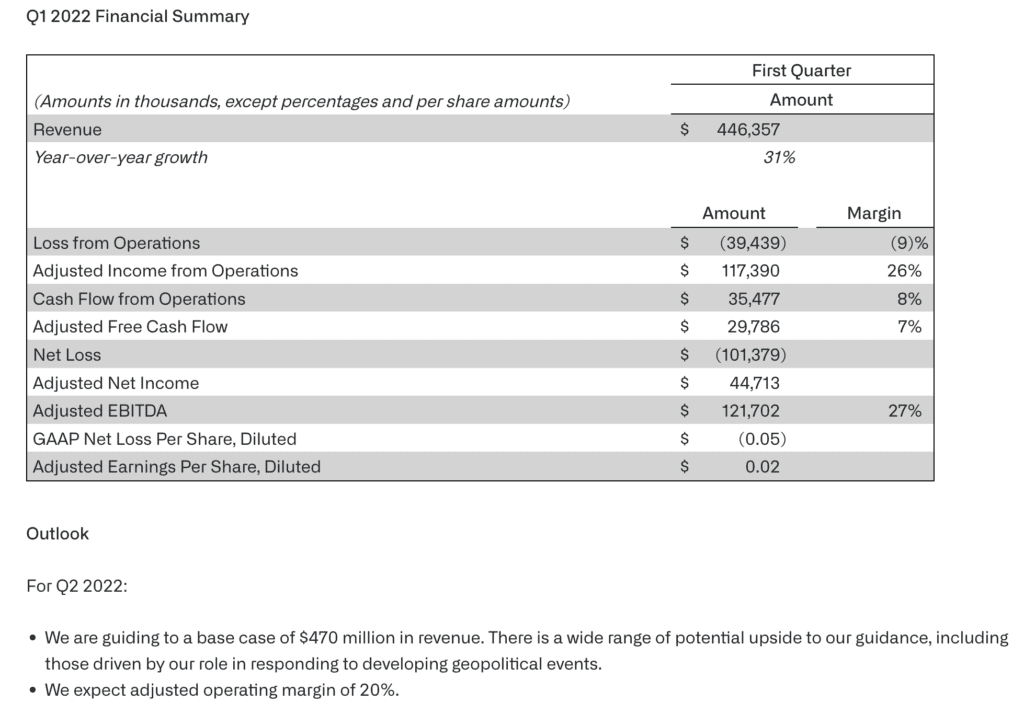

#7. Generating real, but not huge, free cash flow at $2B ARR. Palantir isn’t particularly profitable yet. Actually, it’s not profitable yet at all, but it is generating $30m of “adjusted” free cash flow per quarter, for 7% operating margins. Their longer-term goal is 20%, the place all SaaS companies have to skate to at scale.

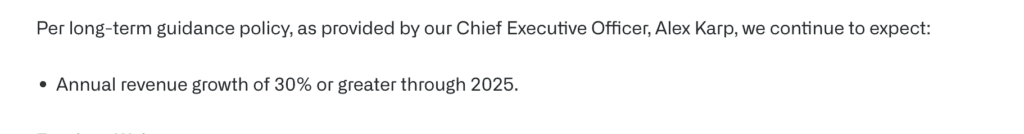

#8. Predicting consistent 30% growth through 2025. While off the torrid IPO pace, this would get Palantir well past $5B in ARR. Big numbers really compound into something amazing,

#9. Still a highly concentrated customer base. Palantir had a highly concentrated customer base at IPO, and it still does. It’s impressive its Top 20 customers each pay $45m on average per year. But that also means 45% of its revenue comes from just its Top 20 customers. It comes with the territory to some extent at these deal sizes. You optimize around them. But it also means even missing or just pushing a deal or two can be really tough on the company. Even at $2B ARR.

What a run so far, Palantir! We’ll check in again well before $5B in ARR!