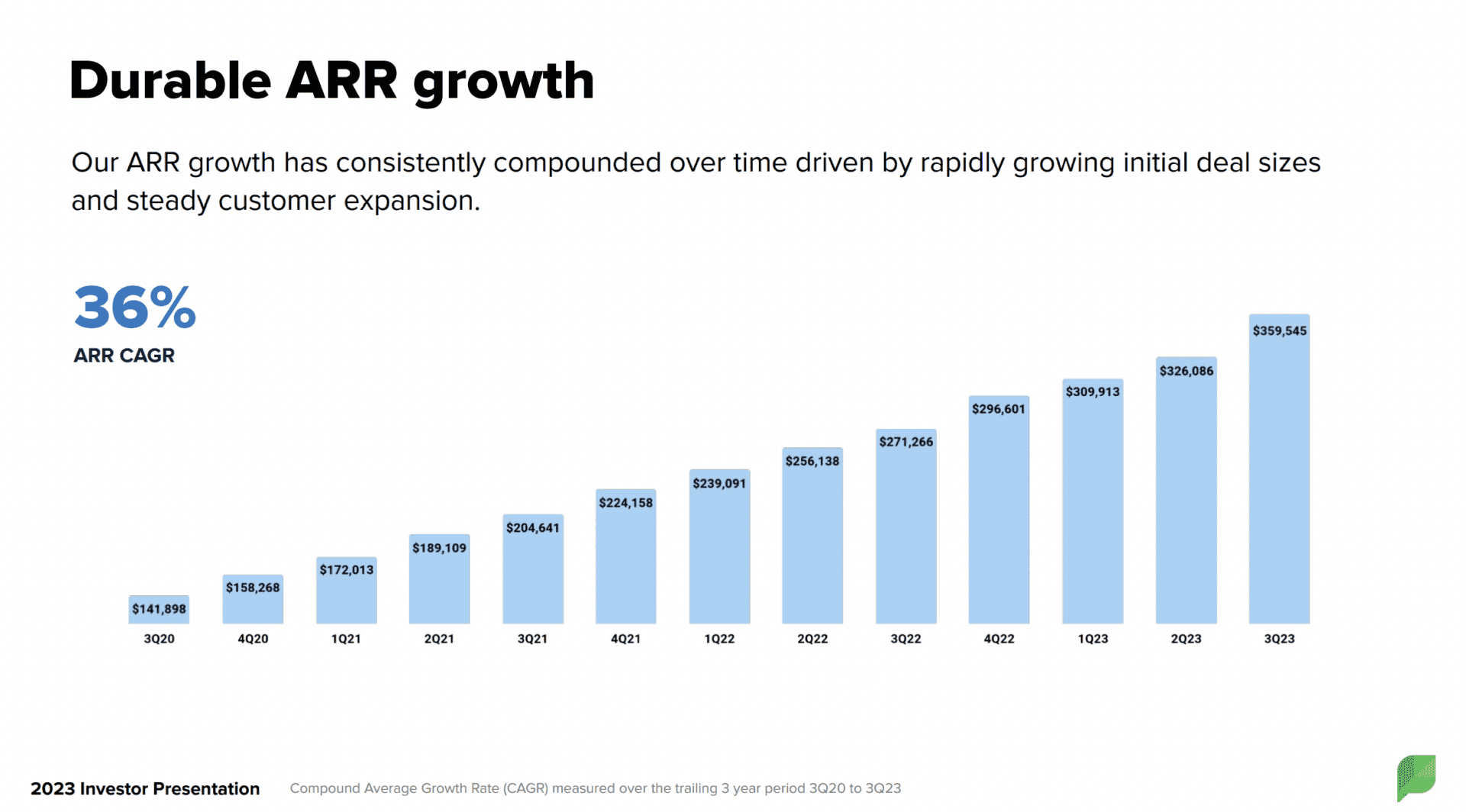

So sometimes steady and even is the right path. SproutSocial is one of those. Founded back in 2010, it had steady growth to $100m ARR, IPO’d quietly in 2019, then has grown 30%+ annually every year since.

That’s compounded to $360m in ARR today, and a market cap of $3.4 Billion, so about 9x ARR. Far better than the average public SaaS company. Sometimes, the committed but measured approach is the best one.

5 Interesting Learnings:

#1. Consistent Growth of 30%+ from $100m to $360m in ARR

Not that many grow as consistently as SproutSocial. Did it have a crazy Covid boost? No. Did it explode on the way to $100m ARR? No. It just grew handily year, over year, over year.

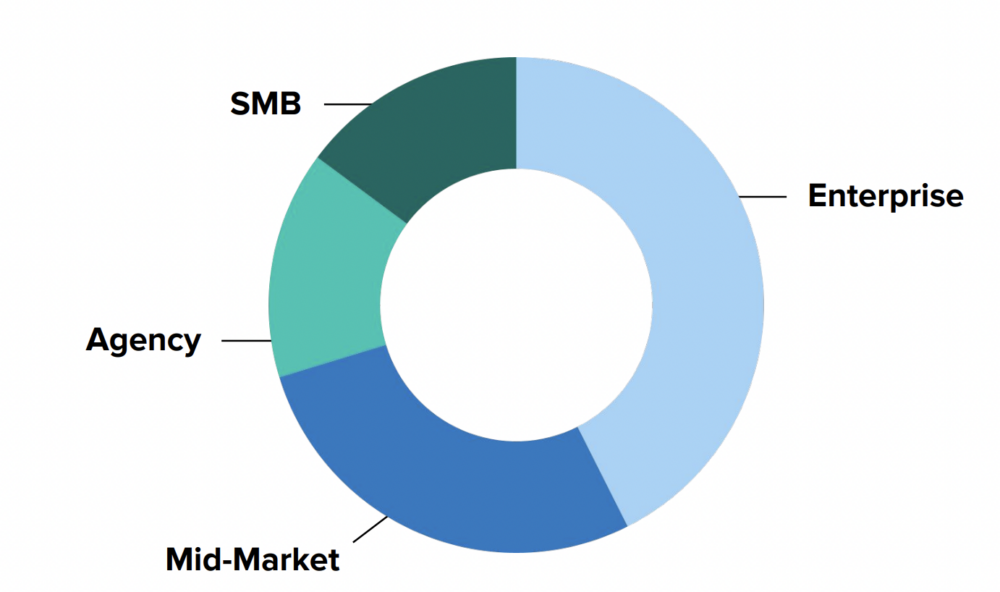

#2. A Healthy Mix of Small, Medium, Enterprise and Channel / Agency Customers

It takes a village in many cases. As we’ll see below, going upmarket and more enterprise has been key to SproutSocial’s growth at scale. But, it hasn’t left behind its SMB and MidMarket roots, which together are still as large a revenue segment as Enterprise. And 20% or so of its revenue importantly comes from agencies, i.e. partners. Not direct. Are you investing enough there?

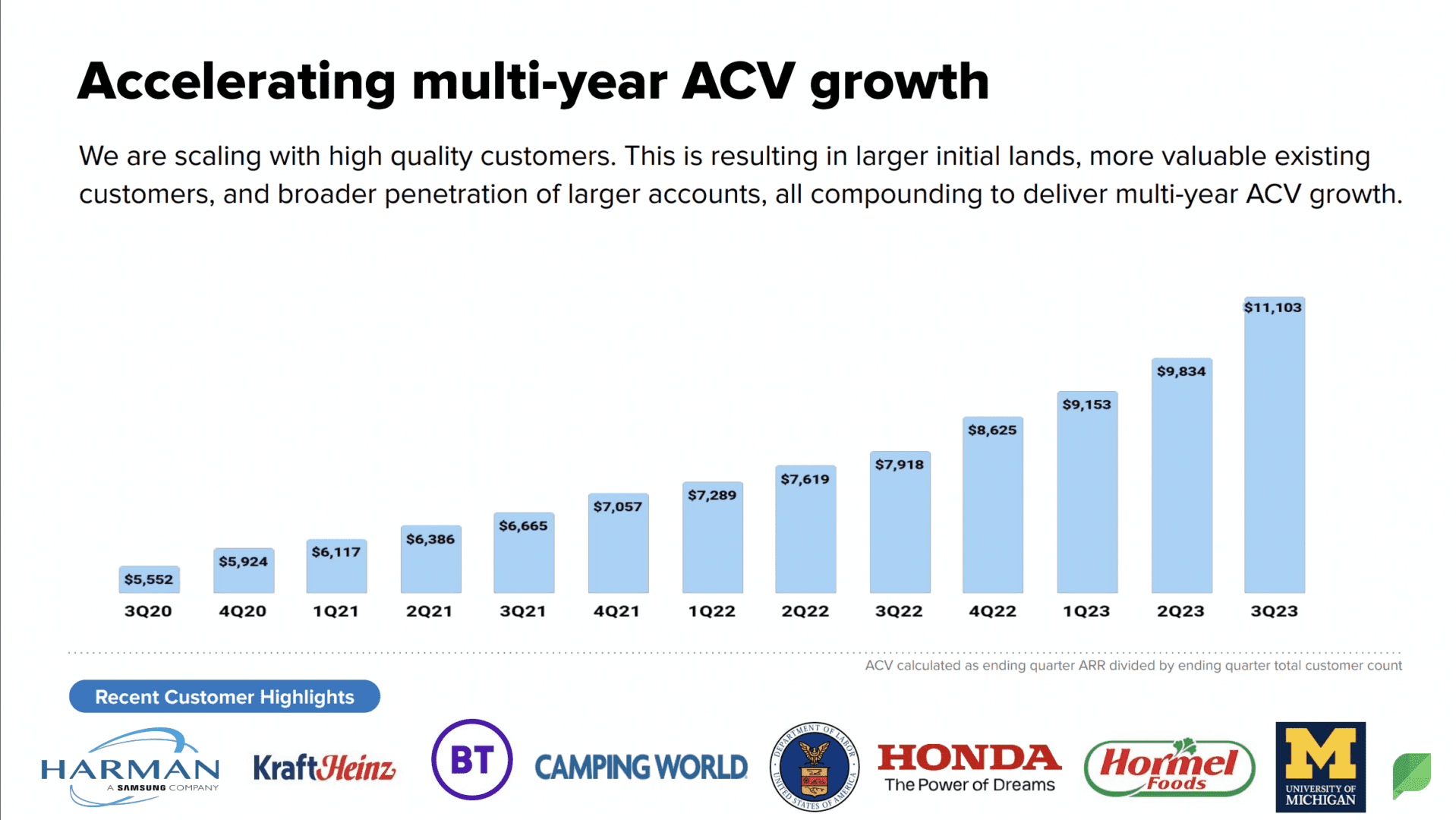

#3. Doubling ACV Over Past 3 Years Key To Sustaining Growth

SproutSocial hasn’t gone radically enterprise, but it’s gone upmarket enough to double its ACV over the past 3 years from $5.5k to $11.1k. Without that, it would not have been able to maintain 30%+ growth every year.

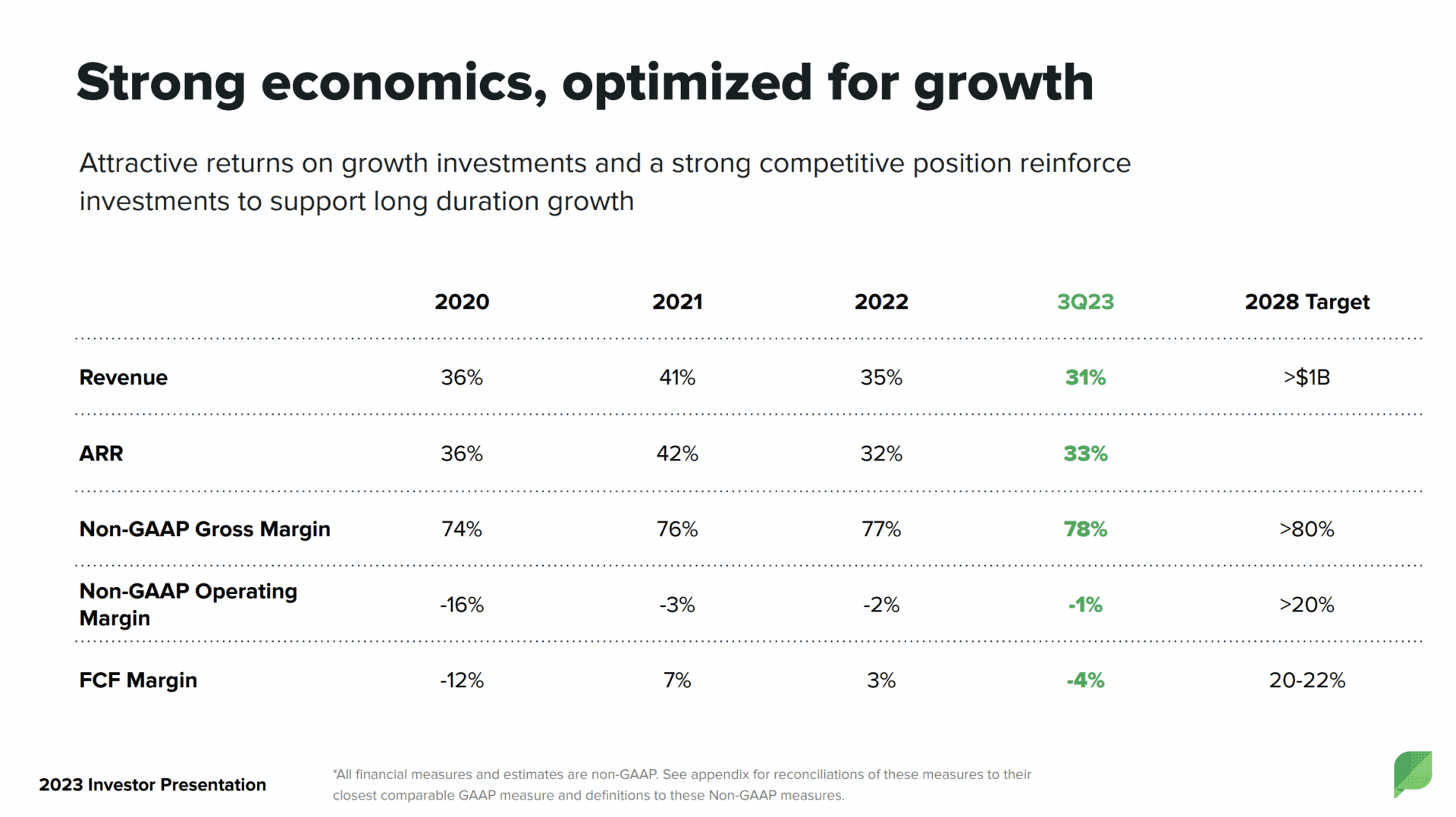

#4. Far More Efficient Than a Few Years Back, But Not as Dramatically So as Some

Yes, SproutSocial has like almost everyone, gotten far, far more efficient. It’s gone from -12% free cash flow margins in 2020 to positive today, and non-GAAP operating margins have gone from -16% to just -1%. So that’s a lot more efficient.

But they haven’t gone so far as to sacrifice growth. They don’t plan to hit 20% non-GAAP margins — the general definition of true “efficiency” — until 2028.

So they have pushed hard here, but not as dramatically as some — and the trade-off of an almost 10x ARR valuation has worked for them. Efficiency plus growth — not just radical efficiency on its own.

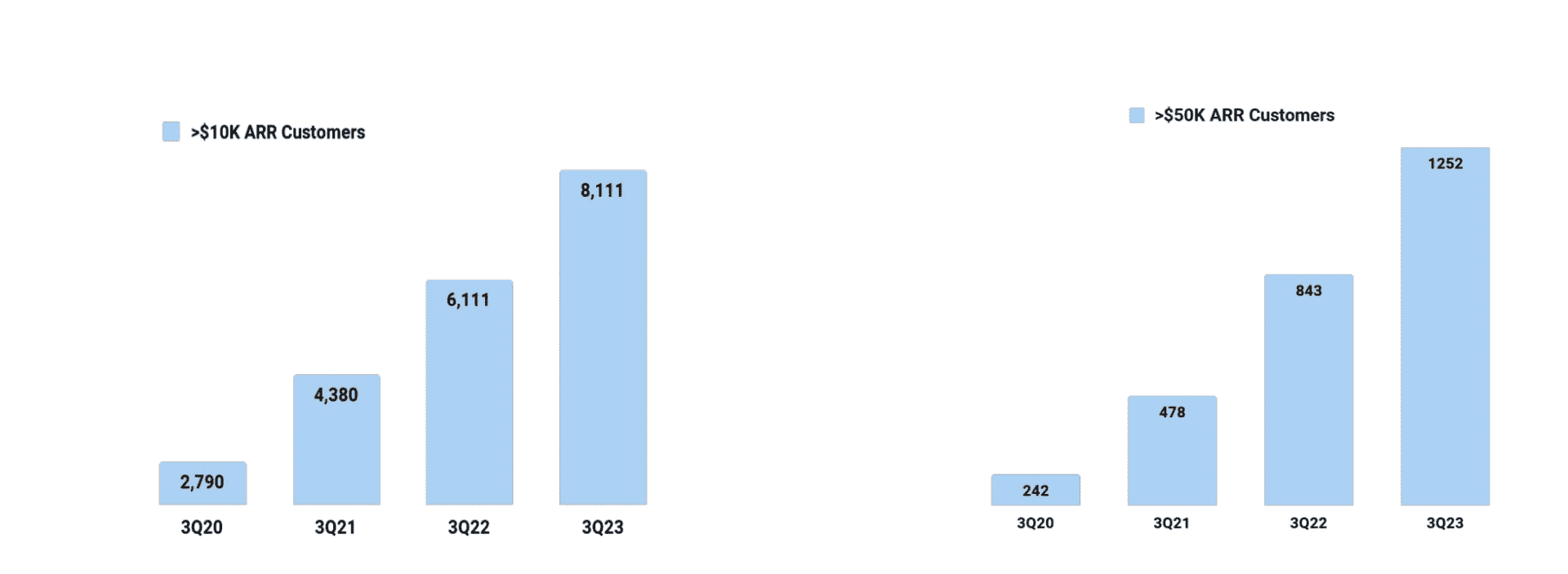

#5. Only 3% of Their Customers Pay $50k or More A Year, But They Constitute 40% of Revenues Now

SproutSocial has 30,000 paying customers, but only 1,250 of them pay $50k or more a year. That’s not super enterprise. But they do move the needle. Those 3% of customers make up about 40% of total revenues today.

Sometimes, a flashy rocketship is what it takes to win.

And in some categories, like social media (ironically?), maybe it makes more sense to keep your head down, deliver great software, and just keep growing at consistent top-quartile rates, year over year.

Like SproutSocial. The quiet $3.4 Billion market cap winner in the space. A story maybe all of us could learn from.