So there’s a quiet SaaS leader you probably haven’t heard of in the financial reporting space that’s doing just fine today. They manage financial reporting, audit, risk and more. Many of you will end up using it as you scale to later stages. That’s Workiva.

They’ve crossed $600,000,000 in ARR, growing a steady 19%, and are worth a cool $5.5 Billion in today’s world. That’s a pretty good multiple, so they’re doing something Wall Street likes. Let’s dig in and learn just what.

5 Interesting Learnings:

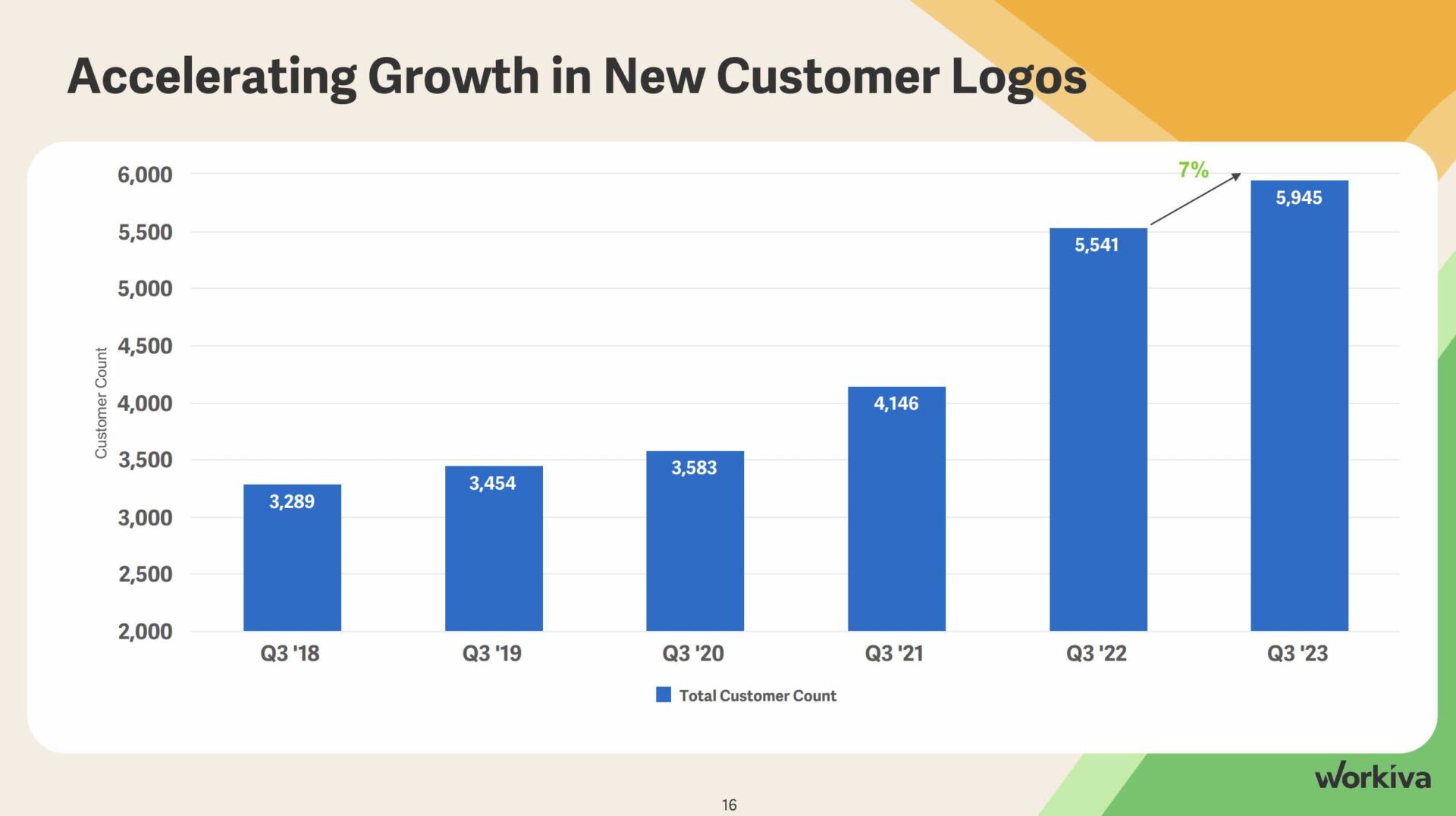

#1. 5,945 customers, up 7% From 12 Months Ago.

Workiva’s average deal size as you can see is about $100k, and their NRR is 112% with ad-ons. 112% + 8% logo growth = 119% total revenue growth. That’s not epic customer growth but it gets harder as you approach $1B in ARR.

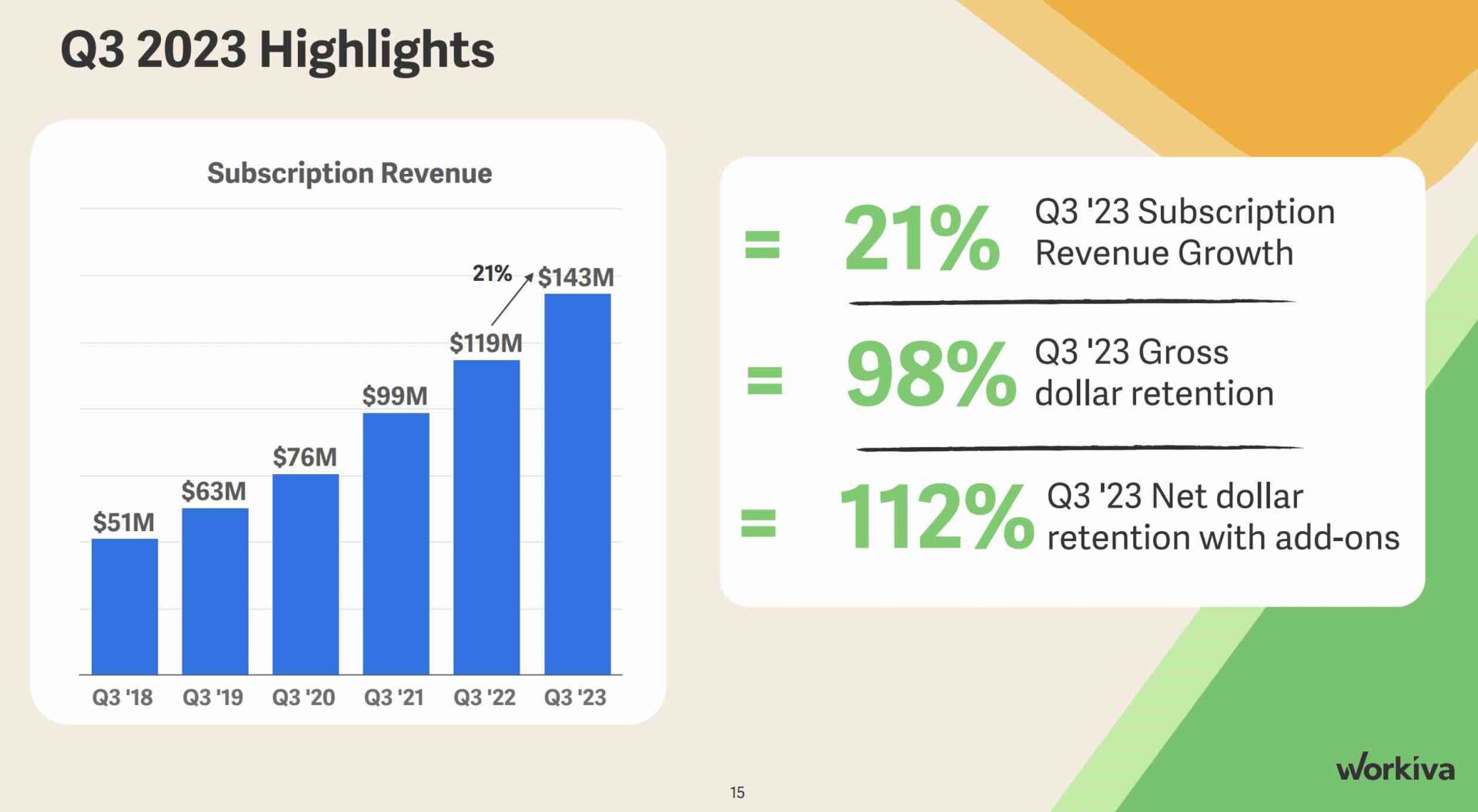

#2. NRR Over 112% — With Add-Ons. 98% With Out

This is a super helpful breakdown. We all now know how important second products can be to driving up NRR. Workiva has nicely broken it out for us. NRR without add-ons is 98%. But with add-ons? 112%

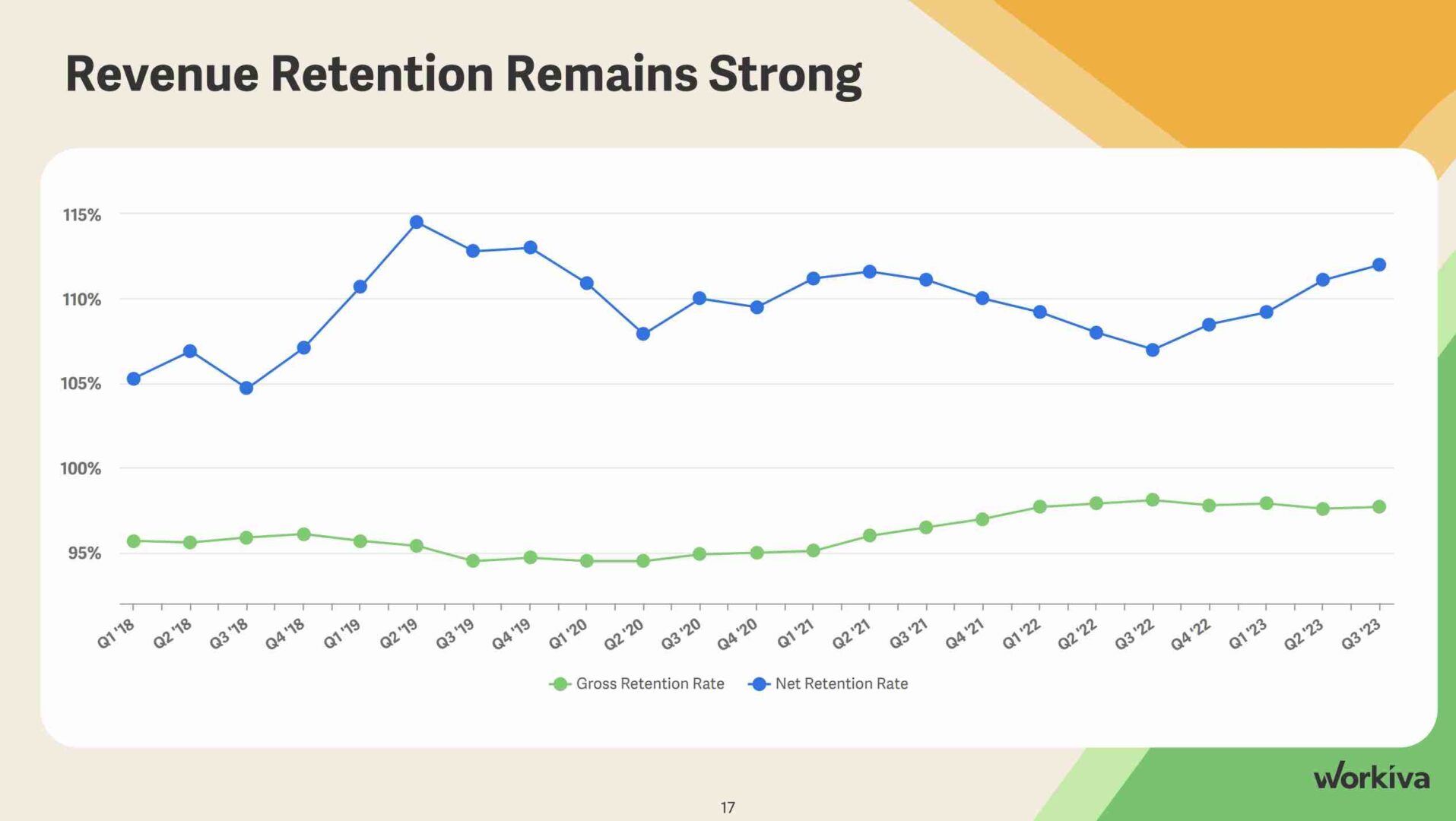

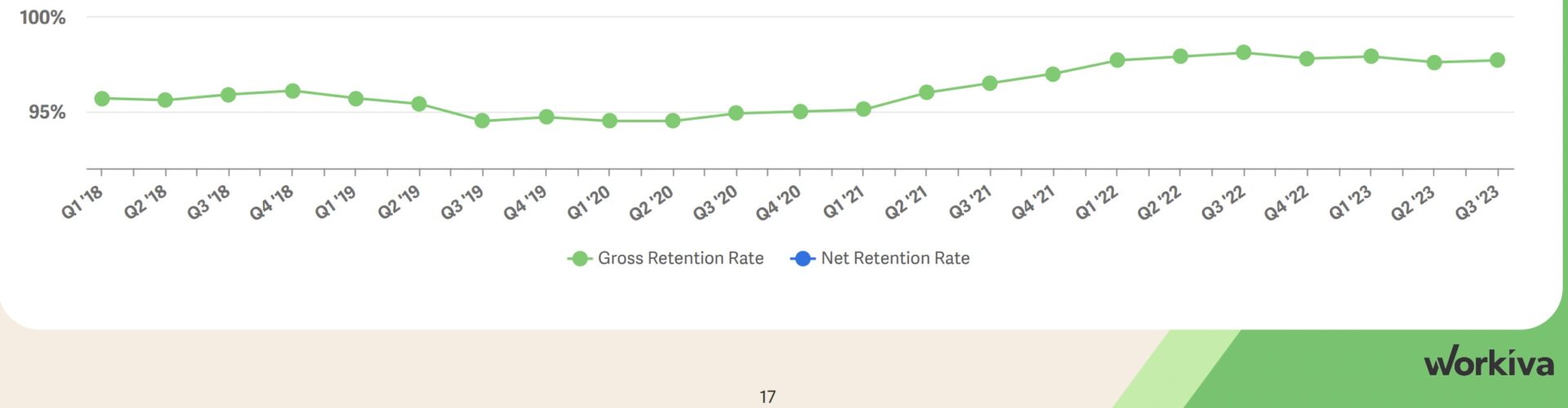

#3. A Slight Dip in NRR in 2022, But They’ve Fully Bounced Back

Workiva saw some NRR dip in 2022, but they’ve bounced back in 2023. And its GRR is higher than ever, at an impressive 97%+. They don’t go.

#4. High GRR “Balances Out” Good-But-Not-Top Tier NRR

The math here is interesting, as you can see in the chart in Slide 3. NRR is good but not top-tier for an enterprise solution, at 112%. But what is very enterprise and top-tier is their customer retention, at 97% GRR.

Once folks put in a financial reporting system, they don’t tend to rip it out. Workiva is still on the journey of going multi-product and driving NRR up, as we’ll see in the next point, and there probably is even more to gain here.

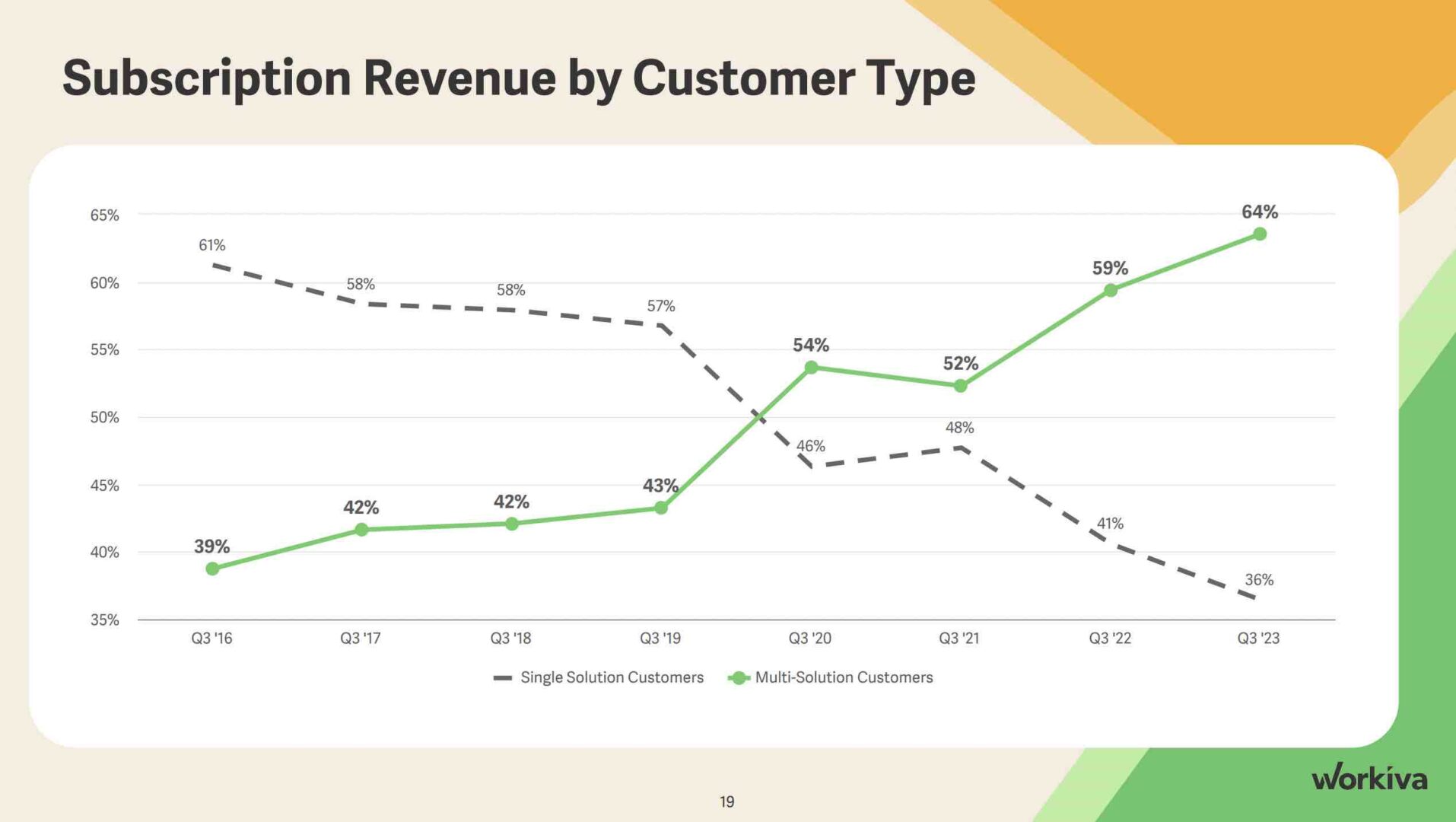

#5. Majority of Customers Now Multi-Solution / Multi-Product.

This is the theme of so many leaders in SaaS as they cross $100-$200m ARR. You just have to have a multi-product engine in most cases to keep growing. Workiva has leaned in here and since 2020, most of their customers are now multi-solution.

And a few bonus learnings:

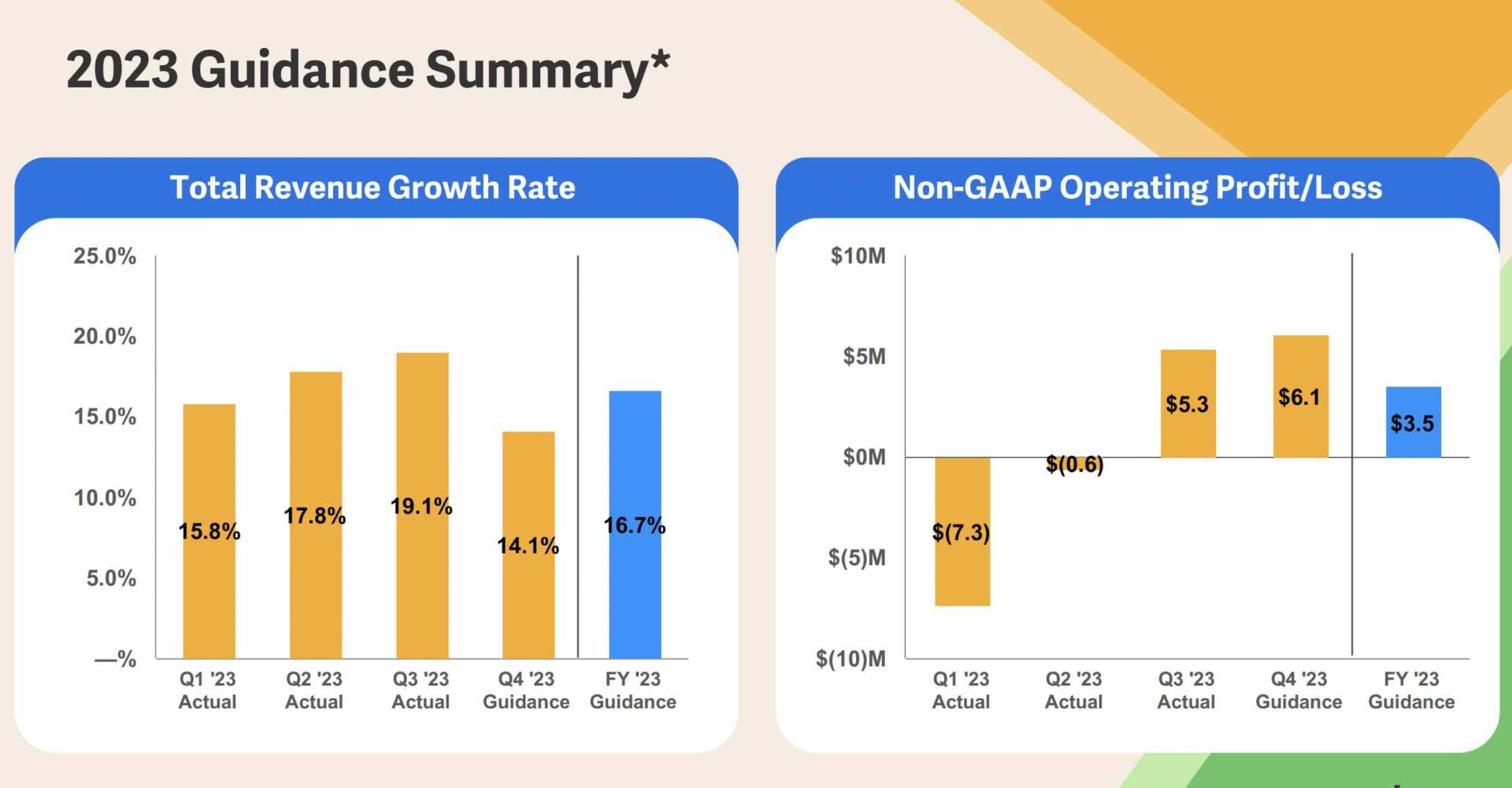

#6. Like Almost Everyone Else, They’ve Gotten A Lot More Efficient. And Now Have An Operating Profit.

Workiva has held the line on costs and hiring, and as a result, growth has stayed pretty consistent but the company has flipped and become operating margin positive this year.

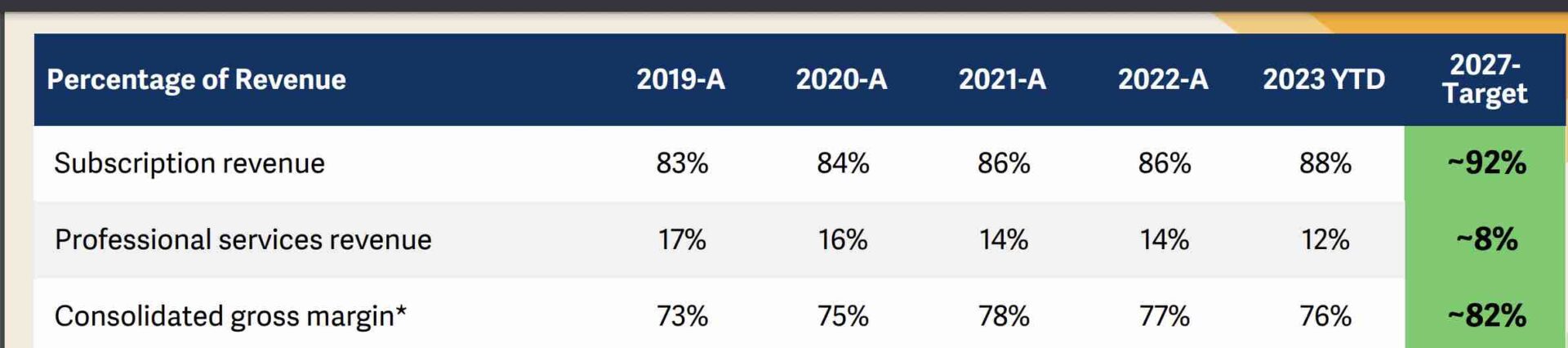

#7. Professional Services is 12% of Revenue, Down from 17% a Few Years Ago

Products like Workiva that entail a significant amount of business process change almost always require professional services. That’s not a bad thing, but the margins are lower and the distraction can be high. So the question tends to be who does them — the vendor themselves, or an agency or partner?

Workiva has been slowly and steadily driving down the percent of revenue from services, and is working to get into the single digits by 2027.

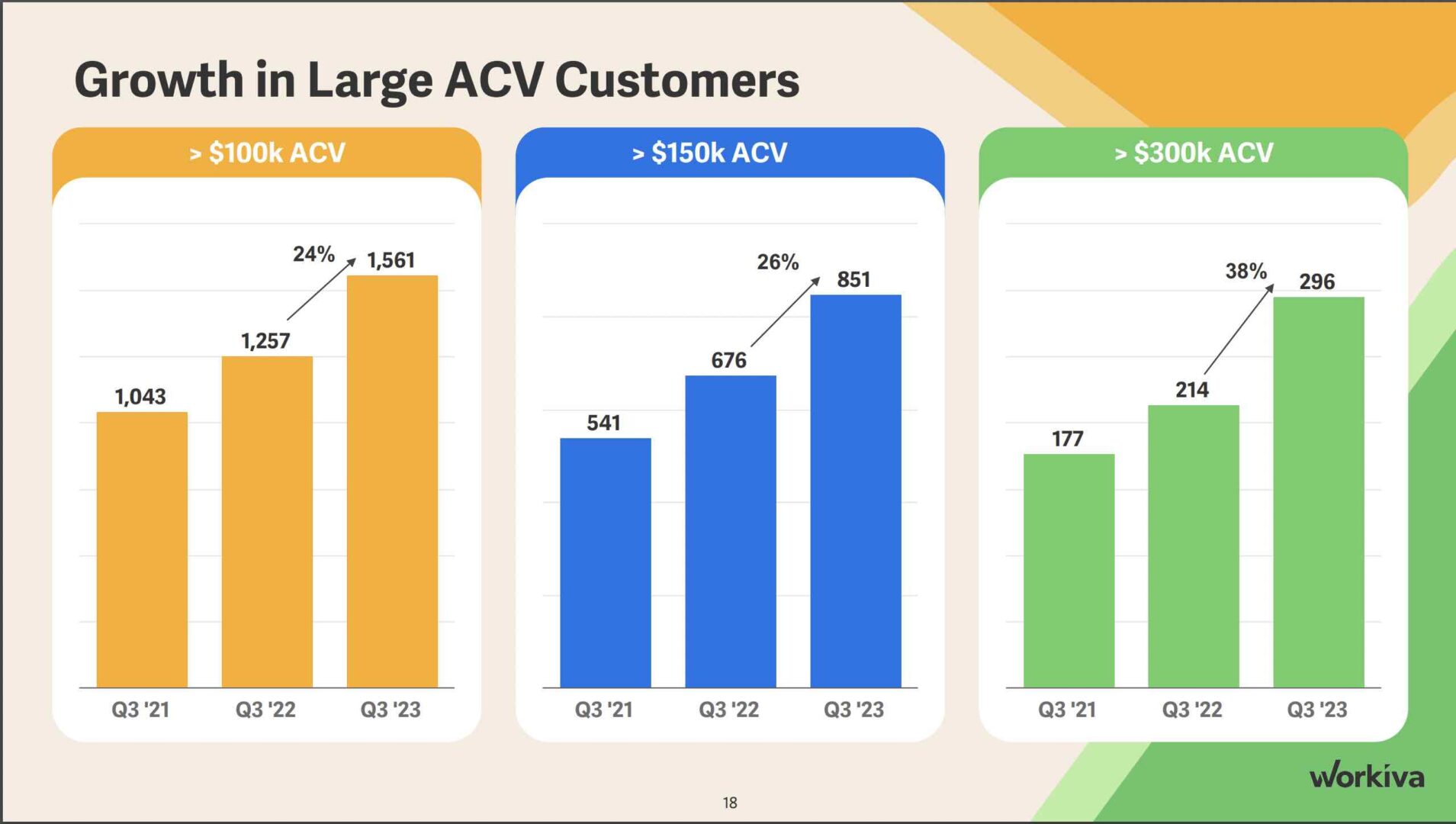

#8. All the Growth Is In $100k+ Accounts Now

While not a surprise, it’s helpful to see this broken out. Sub-$100k deals just don’t move the needle at Workvia anymore.

Workiva! The financial reporting and compliance engine that just keeps scaling!

And watch the A+ SaaStr Annual session with CEO Julie Iskow on just how they’ve gone upmarket here: