Xero is one of those SaaS companies most of us have heard of and know is a big success and sort of know about, but, not really 😉

What lessons can we learn from this huge Kiwi SMB success, for other founders?

Here are a few:

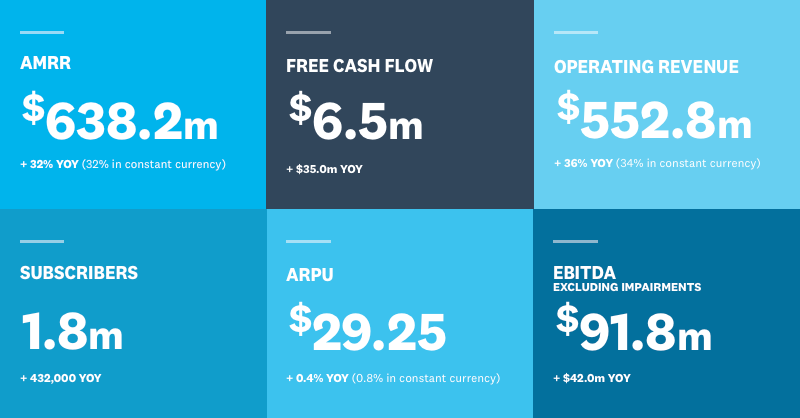

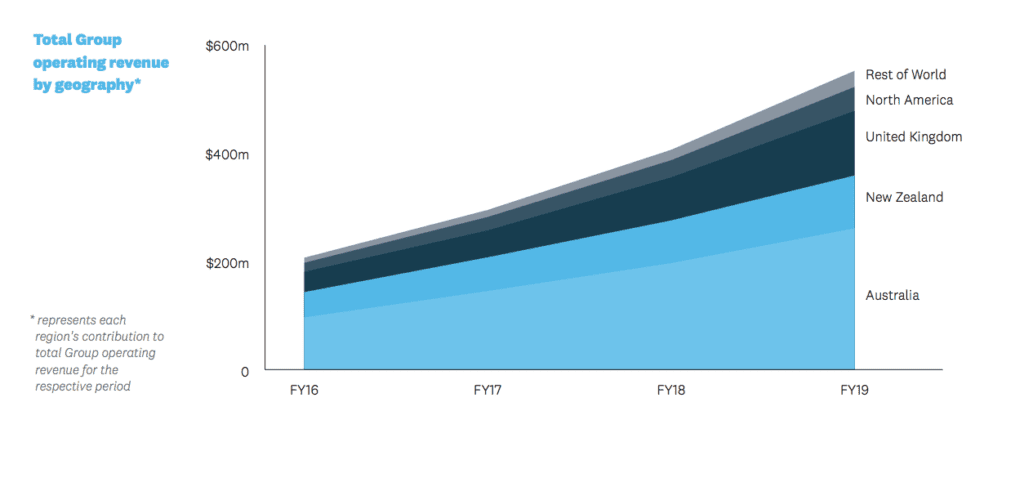

- All the way until $600m+ ARR, the majority of Xero’s new bookings and revenue still came from Australia and New Zealand! Only in this quarter did their “international subscriber additions exceed those from Australia and New Zealand, with particularly strong growth in the U.K.” So even in SMB sales in smaller markets, if you take dominant market share — you can get to $500m+ in ARR!

But yes, the core market is mature — but at $640m+ ARR. New Zealand is growing 18% now, at 351,000 total subscribers. The UK though is growing 46%, at $120m+ ARR.

But yes, the core market is mature — but at $640m+ ARR. New Zealand is growing 18% now, at 351,000 total subscribers. The UK though is growing 46%, at $120m+ ARR. - The U.S. isn’t everything. The U.S. remains an important but smallish market for Xero, at only $44m and 195k of their 1.8m subscribers.

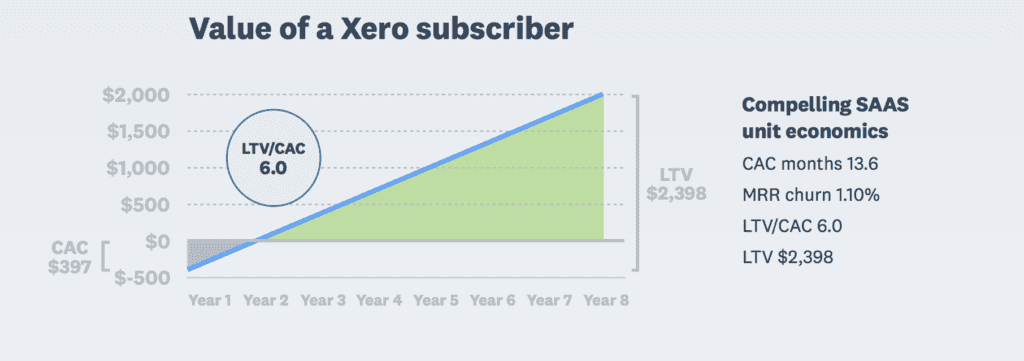

- Churn is 1.1% from SMBs. Most of the companies in this 5 Interesting Things Series have had net negative churn from SMBs (e.g., Zoom, PagerDuty, etc.). Xero’s SMB churn isn’t zero. But it’s low. It’s 1.1%. Aim for that at least in your SMB segment if you can, and if you can provide at least as much value as Xero.

- Customer Lifetime Value is 81 months, from SMB That’s impressive. This is a critical metric. Inclusive of upsells and churn, their ARPU is $29.25 and LTV is $2,398. That means an effective 81 month customer lifetime value from SMBs. Not bad!

- Their CAC isn’t small/short at 13.6 months. It takes them over a year to go profitable on an SMB customer. They have a sales-assisted SMB sales process, which isn’t easy to make efficient. But they’ve done it. A LTV/CAC of 6.0 makes for a very efficient model.

And a few extras:

6. Sales & marketing costs are going up. But, they were also able to raise prices. Expanding into new markets is never cheap, and while Xero is very efficient overall, it’s cost to acquire a customer went up from $376 in 2018 to $397 in 2019. They also raised effective prices, however.

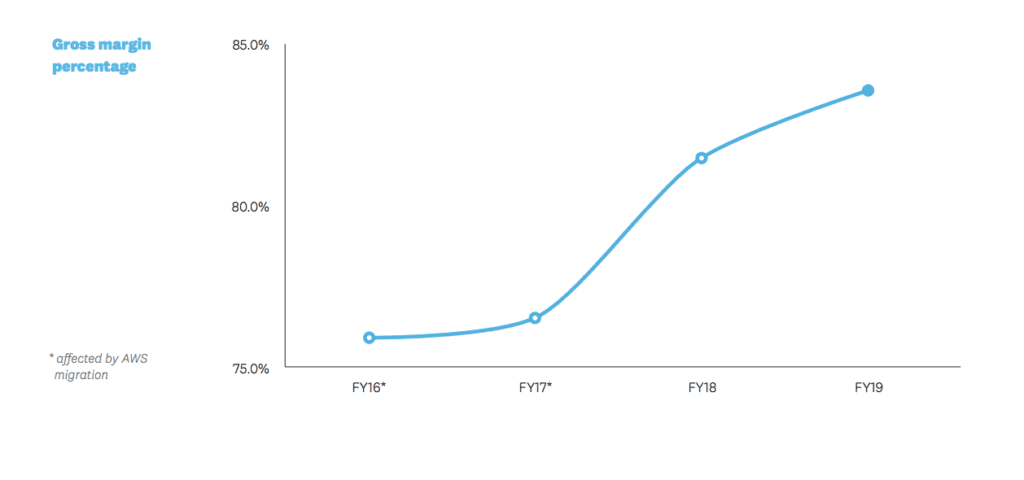

7. Gross Margins have improved substantially. Gross margins have grown to best-of-breed at 83%, after a migration to AWS and more automation in customer support.

8. At 2,500 employees to service their SMBs, Xero has about $240,000 revenue per employee. This is fairly low. So Xero has to be very careful in how much it pays folks. Given that Xero is generating $100m+ in free cash flow, Xero employees are making nothing like SF salaries. Nothing at all. So again yes, you can make good money with a sales-driven low-ish ACV SMB model. But you have to be laser-efficient and focused to do so.