So Zoominfo is one of our favorite SaaS / Cloud leaders at SaaStr. Why? Basically bootstrapped. Incredibly profitably — amazingly so. Great founder-CEO. Won big in a category that’s complicated (data). And also, because it’s one of the Cloud leaders at scale ($1B+ ARR) that’s sort of canary in the coalmine. They sell sales & marketing tools. So do many of you. When they are doing well, we’re all probably doing well. And when Zoominfo has harder times, many in sales & marketing likely are, too.

And ZoomInfo’s seen big headwinds the past 9-12 months. It’s gotten a lot, lot harder for them. So it’s not just you.

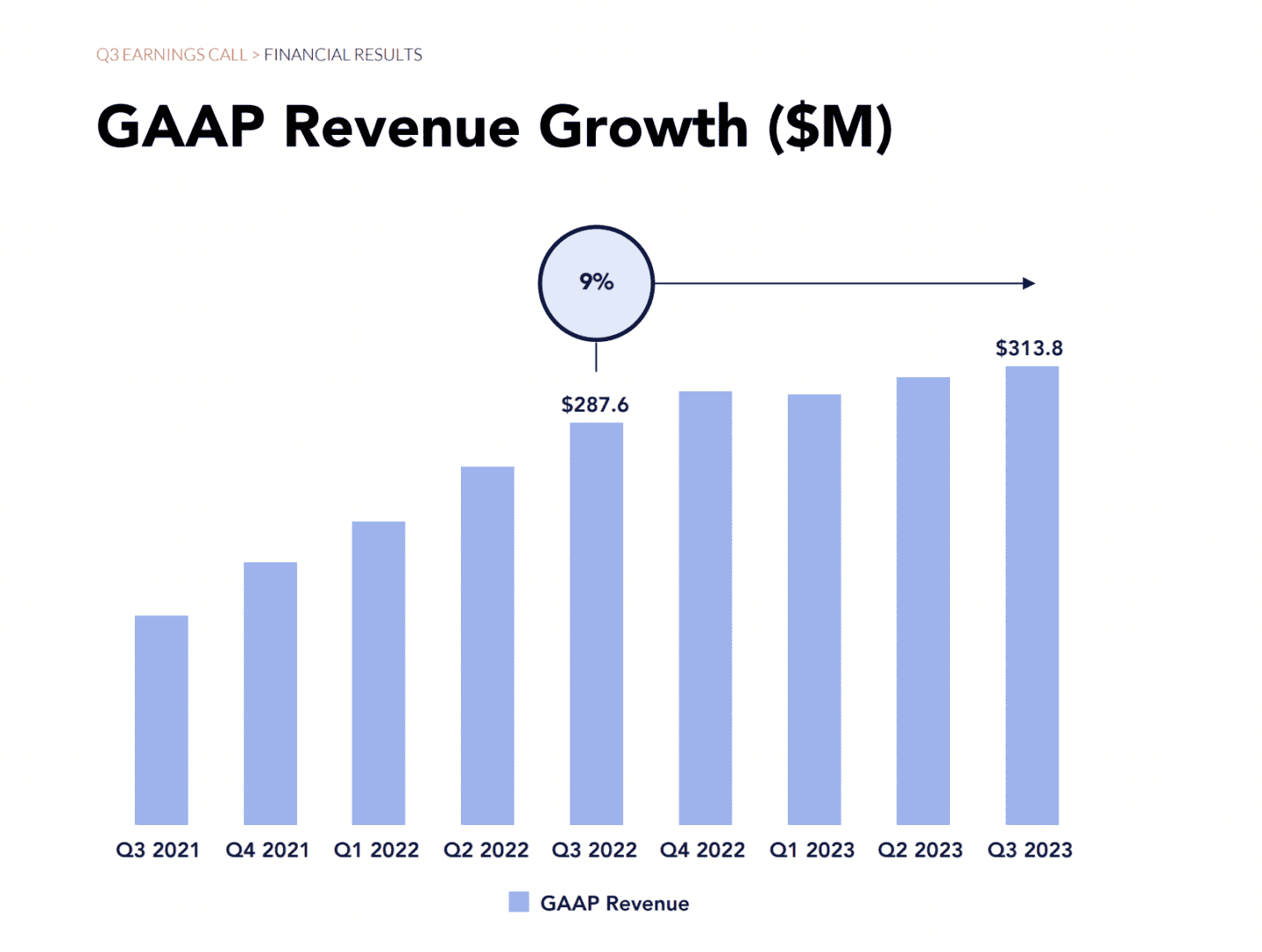

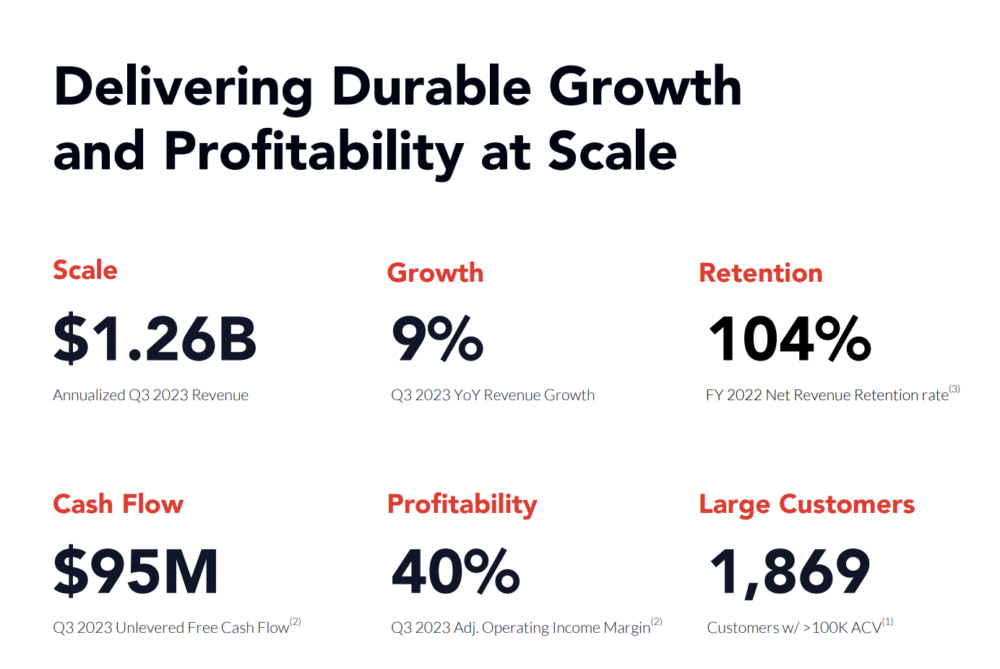

As it came up on $1B ARR, Zoominfo was growing a stunning 59%. And then the headwinds of the past 12+ months hit. And Zoominfo radically decelerated to 9% growth at $1.3 Billion.

5 Interesting Learnings:

#1. From 59% growth to 9% in just 18 months. That’s a lot of macro headwinds.

Zoominfo has been hit hard by customers cutting back on marketing and sales spend. New sales have gotten harder, and NRR is down as existing customers stay, but have worked hard to spend less. As we’ll see below, folks aren’t canceling their subscriptions so much as trying just to downgrade and buy less.

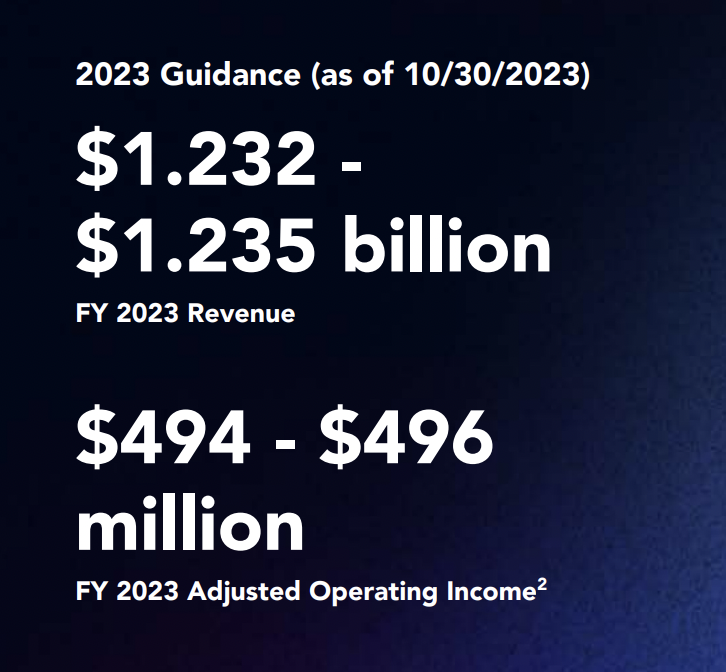

#2. Still Insanely Profitable, With a Stunning Projecting $500m on Net Income on ~$1.3 Billion in ARR.

Done right, even with a sales-led motion, ZoomInfo is simply insanely profitable. Even in tougher times, with 40% adjusted operating margins.

#3. $100k+ and Really $1m+ Customers Are the Big Push. Along with more PLG efficiency on low end.

Zoominfo’s been hit hard by customers looking to spend less for the same data, and its sales team has focused on $100k+ deals to stablize things. They are coming up on 2,000 $100k+ customers. In Q3, they closed 200 $100k+ customers, multiple $1M+ deals, and a $15m TCV deal.

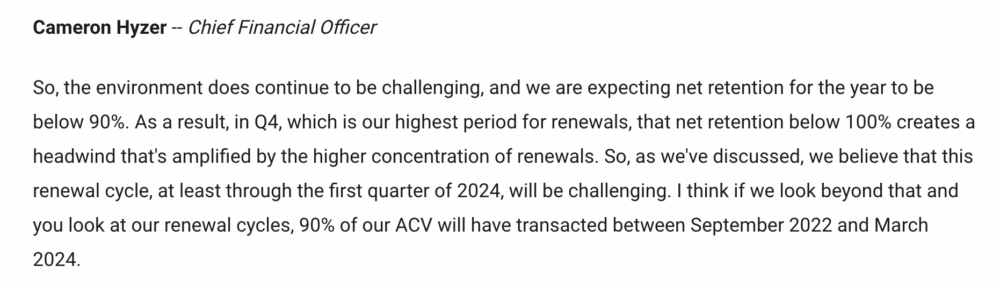

#4. Expecting NRR to Fall Below 90% This Year, From 104% in 2022.

This is the big drag on ZoomInfo. NRR has gone from decent to well below average. Logo retention isn’t down much, it’s just customers are looking to cut, cut, cut back their spend, via fewer seats and less upsell.

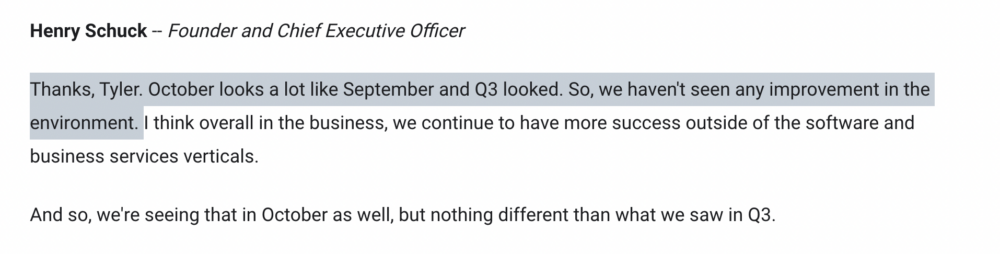

#5. Not Seeing Any Macro Improvement Yet.

Cloud infrastructure has seen some reacceleration, as have leaders like Samsara and MongoDB and others. But not in Zoominfo’s space. They were honest, direct and almost a bit glum that in their space, we haven’t pulled out of a downturn yet — at all.

And an important note:

#6. 20%+ Growth for Non-Tech Customers

ZoomInfo got hit hard due to so many tech companies being customers. That was a gift in the Boom Times of 2021, but that segment shrunk the most in 2023. Their non-tech customers? They grew 20%.

ZoomInfo is a true category leader, and if you’re in their space and struggling and not seeing a turn-around yet … at least know you are in great company.

Growth will reaccelerate at ZoomInfo. It’s a product basically all of use and need. It’s a question of when, not if, faster growth will resume.

But that reacceleration hasn’t kicked in yet.