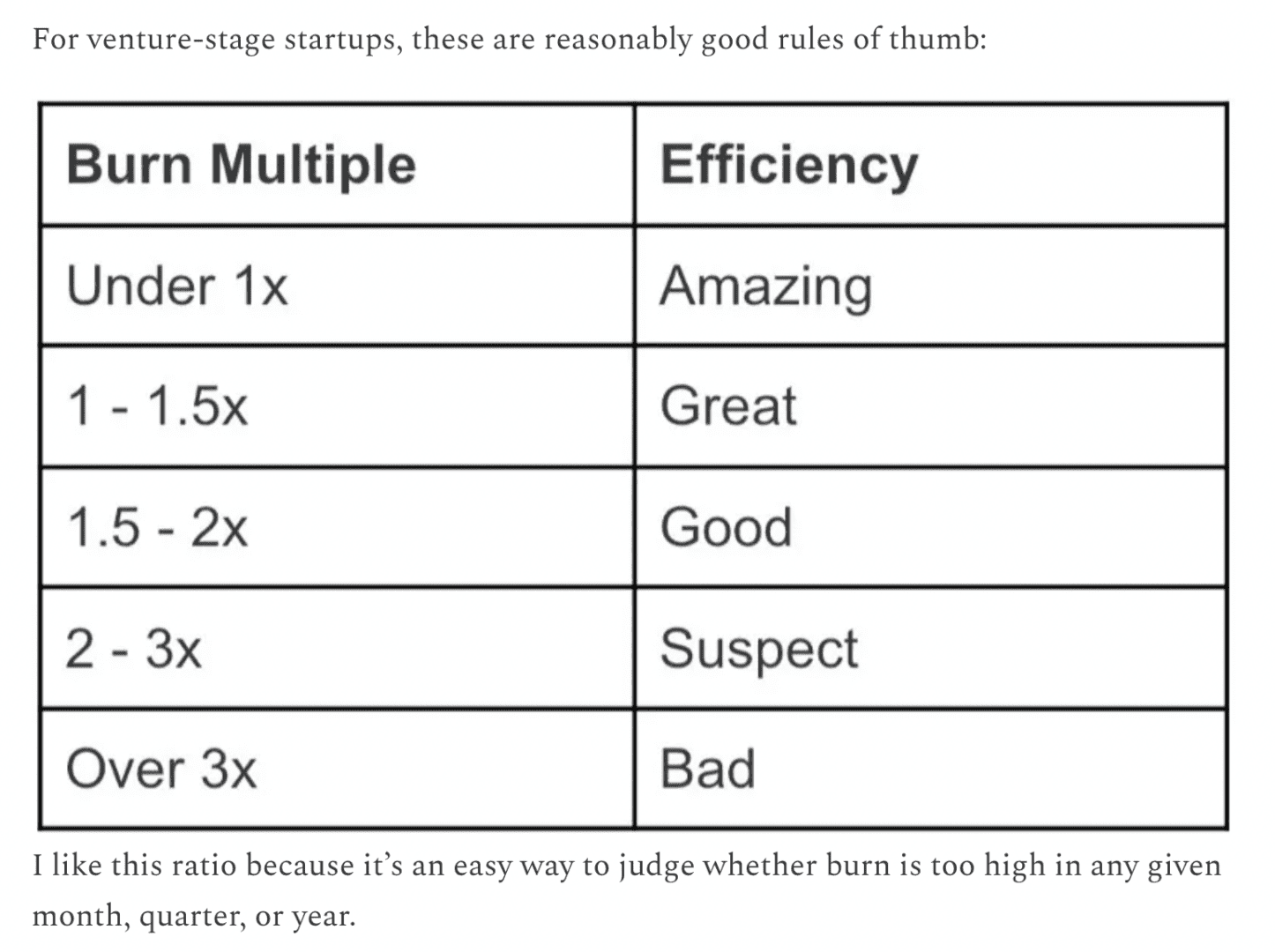

David Sacks’ classic post on Burn Rate Multiple is A+ and a key metric for every venture-backed startup. It simplifies a lot of complexity into one metric.

That if you’re venture-backed, then yes you do have money to spend (and burn) — up to a point. But the best startups burn less each month than they bring in from new bookings and revenue (a Burn Multiple of 1x or less).

And especially these days, having a Burn Multiple of 1x or less will certainly make you more attractive to VCs — if the growth is also there. If.

However, I’ve seen this metric now misused by many venture-backed startups as a magical health meter for a “good enough” burn rate. Why? Well, at a practical level, it assumes the next round is coming.

Many VC-backed founders miss a simple, basic point:

- You can still run out of money even at 1x

- You can still run out of money with a “good” Burn Multiple

- The math on Burn Multiples sort of assumes you have 75%-80% gross margins (see my convo with David Sacks on this below). Much below that, and your Burn Multiple needs to be lower

- The math on Burn Multiples sort of assumes you have 100%+ NRR. Much below that, and your Burn Multiple needs to be lower.

- The Burn Multiple math, most importantly, still assumes you can raise another round

A Burn Multiple of 1x or less is relatively efficient, but it’s still a burn.

If you aren’t 95%+ sure you can raise another round, Zero Cash Date is even more important.

More on Zero Cash Date here: