Alex Kayyal and Julie Kainz, Partners at Lightspeed, shared at SaaStr Annual a framework they developed around how to think about this new era of Artificial Intelligence in SaaS, what opportunities are out there for startups, and how to think about incumbents. Together with Abhay Parasnis, founder and CEO of Typeface, they chat about what it looks like to be a builder at the forefront of Generative AI.

Lightspeed has invested in companies for about 20 years, with roots in early-stage Enterprise investing. Enterprise technology spend has remained resilient, with Cloud spend tripling over the last year. The real shift they’re noticing is with GenAI and the impact of that shift on the SaaS community.

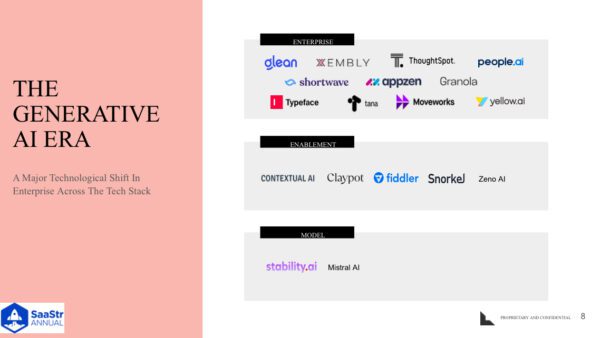

In our Gen AI Era ✨

Lightspeed breaks down this major technological shift in the Enterprise into three buckets:

- Foundation Model

- Enablement

- Application

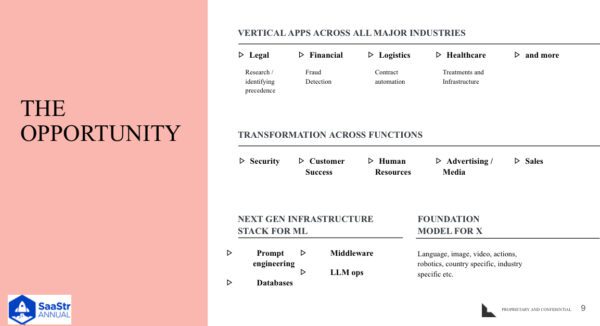

Vertical SaaS will be a big part of it. The real opportunity of GenAI is enabling industries that have been slow to adopt software — services like legal, accounting, and healthcare.

There’s an incredible amount of opportunity and so much of what history books will say about this era is happening right now.

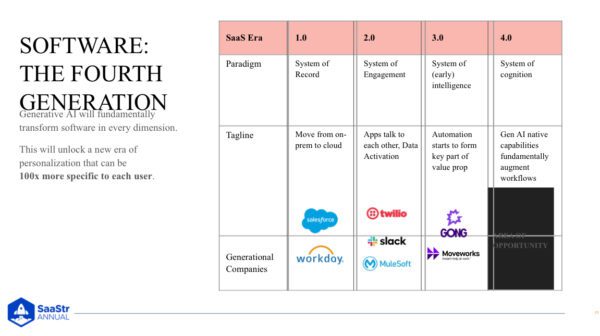

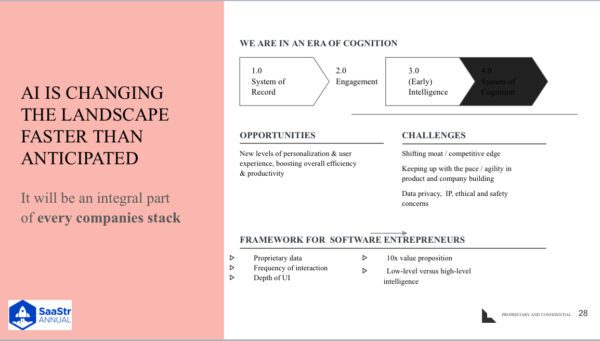

The first era of Cloud was around ‘99 when Salesforce pioneered the shift. CRM wasn’t a new category, but they were done on-premise. This is what Lightspeed calls the 1.0 era, where SaaS was really about the system of record. You move one over to 2.0, the system of engagement, and all of a sudden, it wasn’t just recording and storing data. It was about activating and connecting systems and apps to it. Then, 7-8 years ago, we had the early innings of AI — The first automation of how to drive more intelligence. This was a precursor to the GenAI movement. Now, finally, we’re in the 4th era. Lightspeed calls it the Era of Cognition. It’s not only about automating a small part of a task but creating a new workflow where work gets done. We still don’t know where the category winners will be.

SaaS 4.0 Implications for Software Companies

There are a few implications for software companies as we shift into this 4th generation.

- Creativity is being completely democratized.

- There’s an evolution from being data-driven to a more sensing approach. Instead of suggesting the next best video based on preferences, we create a video that matches your preferences from scratch.

- We’ve entered into a new era of personalization, with massive opportunities in content, education, and healthcare.

- Privacy, intellectual property, ethics, and safety implications are emerging.

With all of this opportunity comes huge responsibility. With an ecosystem that’s moving incredibly fast and lacks ownership to some extent, there’s an unknown for many folks of what’s happening under the hood. We must ask ourselves the implications of such personal data being used and shared with employees, organizations, customers, and users.

Incumbents vs. Startups

How have the dynamics shifted between incumbents and startups because of GenAI? Today, the ability to access large amounts of proprietary data is more important than solely being agile and fast-moving. This changes the playing arena for startups.

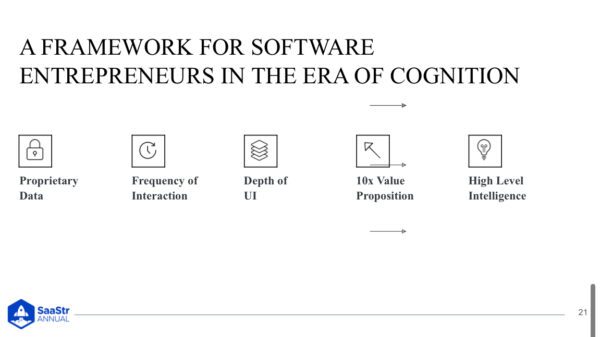

A Framework for Software Entrepreneurs

As venture investors at Lightspeed, they get to meet a lot of companies. Some big dimensions that get Alex and Julie most excited land within five areas.

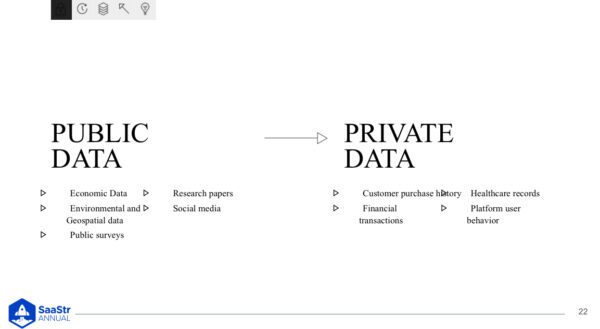

1. Data

Is it proprietary or publicly available? Data is a lot more valuable if you can take advantage of proprietary, private data. For example, if you’re building an inventory optimization company, what will be more relevant: weather patterns of buying ski gear or integrating into the transaction history of the merchant and driving insight that way? If you have access to data in a public domain, large incumbents do, too. Look for unique data sets you can develop in your customers to drive insight and automation.

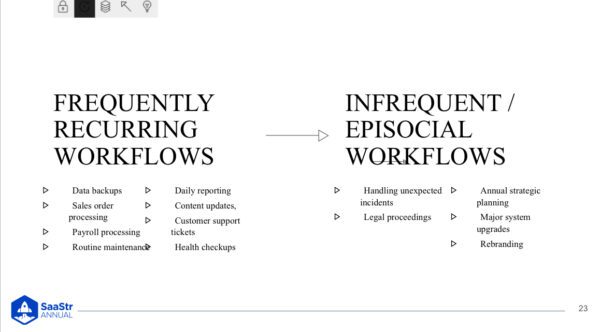

2. Frequency of Interaction

The beauty of software is it powers workflows. However, not all workflows are created the same. Some tasks happen once a month or quarter or even per year. Others happen daily or weekly, and Lightspeed’s excitement regarding the next generation of software is focused on the frequency of interaction because it drives a lot more engagement and value with customers.

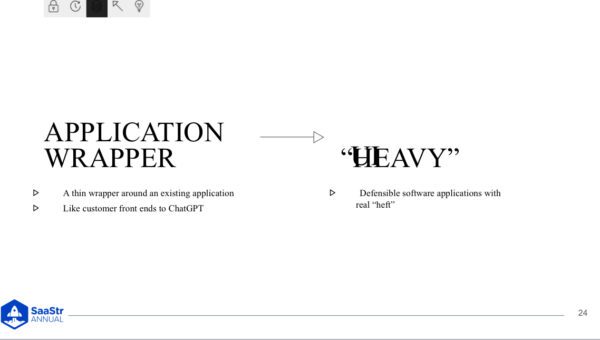

3. Depth of U/I

What product are you actually building? When comparing building a product today vs. 20 years ago, 20 years ago, it took $20M just to get an email server up and running. It’s incredible how much amazing tech is at our fingertips today, so product gravity matters a lot. Just having a thin wrapper around an existing workflow won’t drive a sustainable advantage. It’s more about how many workflows you can drive, the community you can build around the product, and moving beyond initial use cases.

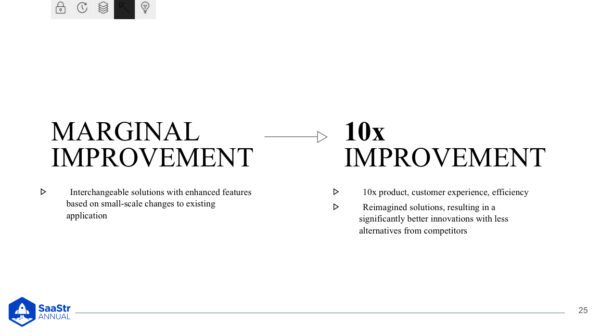

4. 10x Value Proposition

There’s an amazing opportunity to drive 10x improvements from a use case product collaboration perspective. Decision makers in software are inundated with tools or companies. So, ask yourself how to drive a 10x improvement, whether through the product, experience, business model, etc. This will be a tidal shift in terms of what can be built, and the companies that drive significant improvements will be the winners.

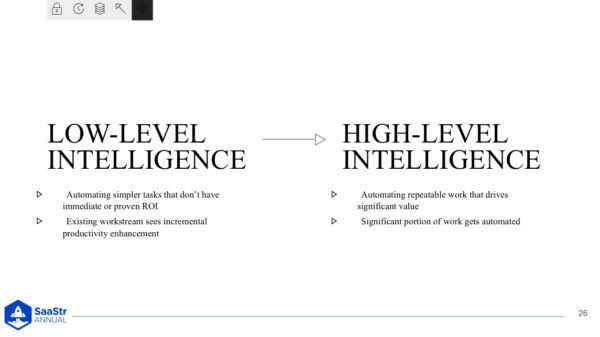

5. High-Level Intelligence

What are you automating? Is it a nice-to-have, low-level intelligence that could help a business but not move the needle forward? That will be a very different outcome for a company than automating a more high-level automation that drives meaningful ROI. Go back to the customers and figure out what’s in it for them.

These five areas are Lightspeed’s framework for building software.

A Look Inside Typeface

When having these discussions about GenAI and fast-growing companies within the space, people often expect there to be a well-laid plan. The reality is there were a lot of coincidental moves. Abhay Parasnis, the CEO and founder of Typeface, has always loved software and programming. His first project was working on Java. In November of 2021, Abhay was the CTO at Adobe, and they were investing a lot in AI, but not GenAI. Early models weren’t quite there, but you could see how software would fundamentally change.

Adobe sat at the intersection of creativity and science, and the world of content in Enterprise has been stuck in the dark ages because there wasn’t a 10x benefit yet. GPT even in early form showed it was clear we’d get to a place where the entire world’s content architecture for companies would go through a massive inflection point. It’s the same as when the original printing press happened. It was only one form until typefaces were invented. You couldn’t personalize your story. Typeface’s thesis is that if the underlying GP models are the equivalent of an AI printing press, you need personalization for every story and brand. So, they went and built that software.

When Typeface began 15 months ago, it was before ChatGPT was released. One question early investors often asked was what the platform would be because none existed. Investors saw the arc of where it could land, and there was a conviction around it, but they thought it would take another 3-5 years. But here they are within a year, and everything has changed. Whenever there’s a disruptive shift, you have to start with a deep product thesis, a heavy app layer. This is required whether you’re a startup or an incumbent.

Companies like Adobe or Microsoft have products that are still considered a gold standard 30-40 years later, which is rare. It’s because they have a deep tech moat and an exceptional product user experience. When you’re a big company, your ability to disrupt your own business takes a significant amount of commitment and discipline and an ability to move and adapt to a fast-moving market. The incumbent will likely never commit because their economic incentives are misaligned.

Accessing Proprietary Data as a Startup

Typeface is going through this journey now with data uniqueness. For the first time, software isn’t just about codifying your intellectual property through a bunch of automation and algorithms. It’s about extracting unique patterns through data sets and verticalizations. The hardest thing for incumbents is having a gold mine of data and assets, but they didn’t build their businesses with those architectural patterns, so they can’t extract insights. But, if you’re a startup, you don’t have access to that data gold mine.

The best strategy is to partner with these incumbents who don’t have ways of extracting that value. Many incumbents don’t know how to connect tremendous data to GenAI and are nervous about handing over that data to OpenAI, Microsoft, or Google because they’re worried about their proprietary data landing in the hands of incumbents. So, many companies with gold mines of data are extremely excited about working with startups. With Enterprise, you have to set yourself up to access data from a security perspective. As exciting as GenAI is, Abhay thinks it will take a long time to make this shift.

Partnerships Between Startups and Incumbents

In the GenAI space, incumbents won’t stand still, but there won’t be one winner-take-all. Every big player will own their share of the prize in the coming decade. As a startup, can you ignore the investments of Salesforce, Google, or Microsoft? Or can you capitalize on their interests in the space?

Typeface struck deep partnerships with Microsoft, Google, and Salesforce because distribution is the new product mode in GenAI. You can’t just build the product. You need distribution advantages like proprietary data. The biggest misconception is that startups think large corporations want to destroy startups. Of course, there’s competition, but many of these incumbents are looking for partners to accelerate their success.

A rising tide lifts all boats. The size of distribution power and even brand association helps lift you up from being a person in the room that no one’s heard of to having an aura around you. For Typeface, having that association is incredibly valuable and has given them access to Enterprise customers. You have to live with that contradiction of exploiting their brand but being mindful that they have their own self-interest.

Can you find those areas in an incumbent’s ecosystem where they won’t have the incentive to go? We’re at a moment in time where there’s urgency. Startups can capitalize on that and hitch the wagon to the bigger boat and take that tailspeed as far as it can go.