Q: Dear SaaStr: How Do VCs Verify a Startup’s Revenue?

It varies based on the stage:

- Many pre-seed investors sort of take the founders’ word for it that their financials are accurate.

- At SaaStr Fund, we also generally do a bank account cash flow test. We make sure the bank statements tie to the financial statements given to us. If they do, the financials and revenue are likely at least 90% accurate, which is good enough for seed stage.

- The later stage you go, the more diligence that usually is done here. Very late-stage deals often want audited financials as well, and/or at least some third-party certification or review of financials. But not earlier stages.

- And generally Series A on, the VCs and attorneys generally read your top contracts to see that they are “real”. At least, they did outside of the crazy times of late 2020 and 2021.

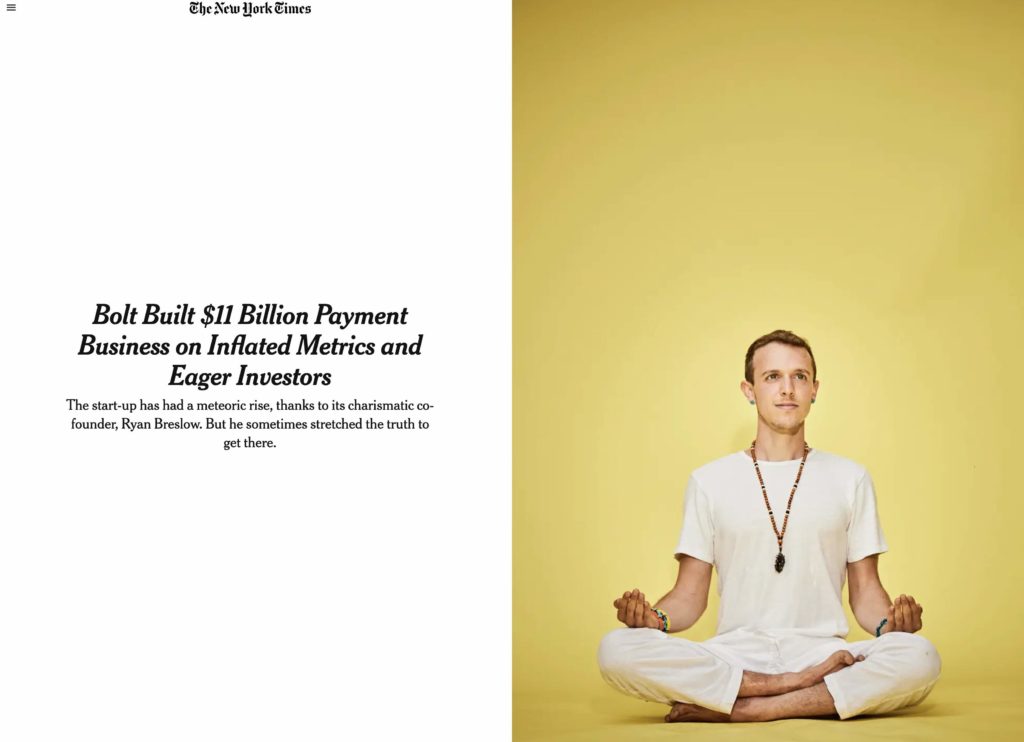

- Fraud is always possible. Even in the earlier stages, founders sometimes claim pilots are real contracts, unsigned deals are signed, etc. They also often recognize revenue too early. In later-stage deals, biggest games, with more risk, is sometimes played. Round trip deals, pseudo-revenue, and more. It can happen.

There definitely is risk here, that what’s presented isn’t quite accurate. In fact, it probably happens far more often than is reported. VCs generally sort of sweep it under the rug if it doesn’t blow up on them publically or otherwise. What can you do, after all?

(Is It Real image from here)

"I mean, dad, no one could find a decent CFO in 2021. No one." pic.twitter.com/XlAOHFHCmS

— Jason ✨Be Kind✨ Lemkin (@jasonlk) December 23, 2022