The Cloud is expanding and moving forward at a phenomenal rate, so we invited the team at Bessemer Venture Partners back to SaaStr to unveil their latest findings in the 2021 State of the Cloud. Here are the latest trends and predictions from the BVP team of Byron Deeter, Elliott Robinson, and Mary D’Onofrio.

Is Cloud growth sustainable for the long term?

A lot of elements within Cloud have accelerated in a way that will reflect across long-term tech trends. For example, telehealth has skyrocketed at a 300X increase given the cloud and COVID combination. At the same time, the construction industry is another example of this, in some ways, also the ultimate in-person physical industry, and yet these businesses as well are now moving to collaborate virtually on cloud technology stacks and be able to have efficient work product in the field and with global supply chains in this hybrid and heavily online collaborative world.

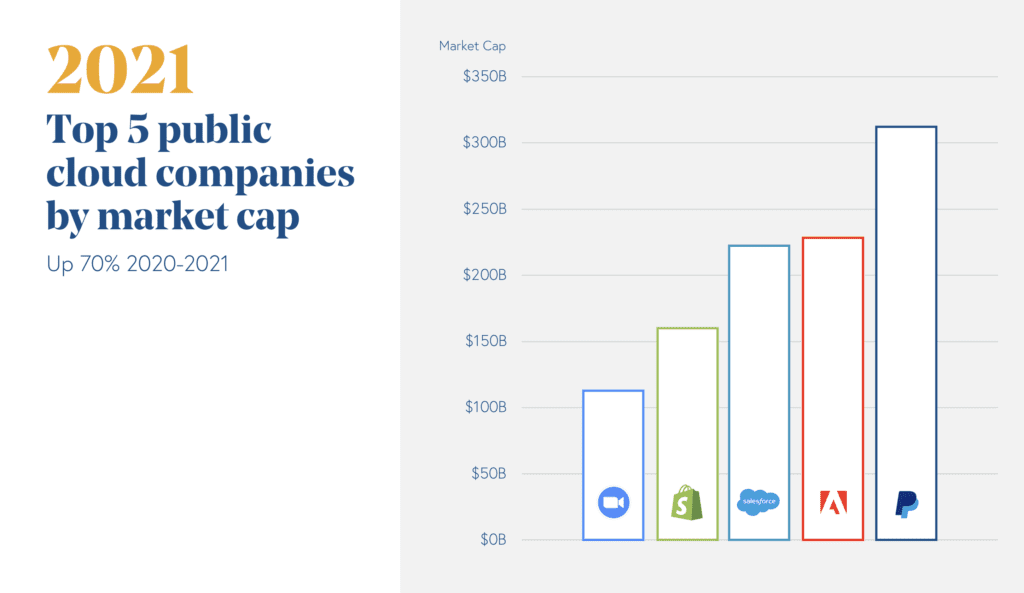

Then if we look at the top five public cloud companies. Shopify, since last year, has nearly tripled in market cap driven by the rise of e-commerce, but also the digital payments and the QR code system they provide for contactless payments. PayPal has continued to skyrocket, and then, of course, Zoom replacing ServiceNow in the top five from 2020, as Zoom meetings, Zoom backgrounds, and for all of us, even a little Zoom fatigue is becoming a necessary and important element of our every day.

Zoom’s market cap grew over 4X to reflect that. In aggregate, what you see now in total is $1 trillion of market cap across these top five companies, and they on average saw a 70% increase in their market cap over the last year since State of the Cloud 2020.

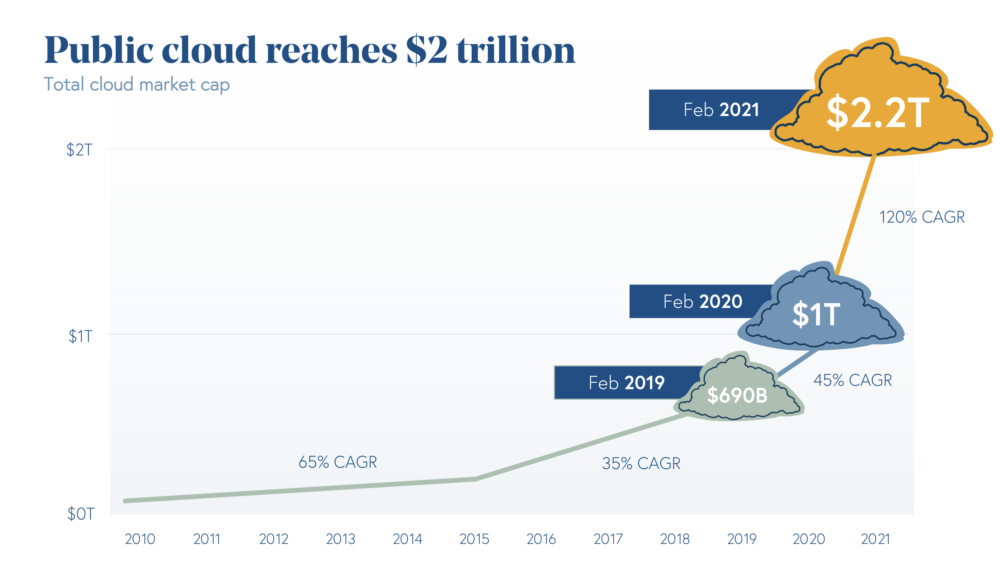

Now, combined with the COVID tailwinds and the ascendancy of the top five, that alone are now at a trillion, and with the addition of the other 56 companies, so 61 in total comprising the cloud index today, you have a shocking $2.2 trillion in market cap for the pure plays (not including proportional shares from the Amazon, Microsoft, and Google, or Alibaba businesses that are their cloud businesses.) Each of those, independently, are massive market cap drivers for their businesses as well. In some cases like Amazon, you can absolutely make the case that the cloud business is driving the majority of their market cap.

Hello Unicorns

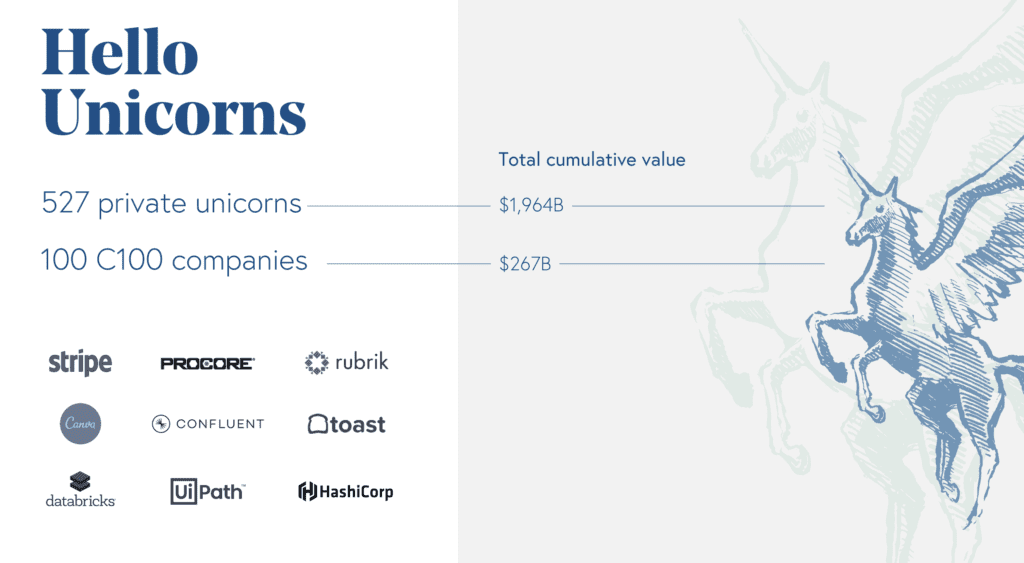

As of January 2021, there were over 527 private unicorns with a total cumulative value of over $1.9 trillion. In drilling down to the cloud companies on that list, we find the majority of them on the Cloud 100: the definitive ranking of the top 100 private cloud companies that Forbes and Bessemer put together every year. These companies are worth an impressive $267 billion, including Procore, Toast, HashiCorp, and Canva. They also address really wide-ranging industries from construction to restaurants, to designed infrastructure.

The number of private unicorns has actually doubled in the past two years. We’re seeing more and more companies, particularly cloud companies with the ability to scale and grow even more rapidly in the new normal. As we go forward, the real question is, what’s driving the growth in these unicorns?

- Cloud multiples are going up

- Cloud companies are growing faster than ever

- There is more demand than supply for Cloud assets

First up is the incredible growth in cloud multiples. Interestingly, in 2020, the top Cloud companies broke away from the path to trade for 30X, as a step function change in how the public cloud markets are valuing the strongest cloud companies, including Zoom, Twilio, and Shopify. In addition, with historic Cloud IPOs in 2020 and M&A success that cloud companies have had as of late, that has also accounted for much of why investors are willing to pay more than twice what they did five years ago for private cloud companies.

But we aren’t just seeing more unicorns because cloud companies are being given a higher multiple on the same ARR. Growth rates are increasing as well, which is noteworthy. The top quartile companies have increased their growth rates from 65% in 2017 to over 100% in 2019, and we’re able to maintain that growth rate in 2020, despite a lot of the headwinds that COVID presented.

Lastly, is the impact of having more demand than supply for Cloud assets. Over the past decade, there’s been a 10X increase in the number of dollars going into private cloud companies to over 180 billion in 2020, which reflects the growth of the companies, the performance that they’ve had, and the exits they’ve had, but the reality is that the massive influx of capital has driven cloud valuations higher. Demand has very much outpaced supply, making investors more willing to outbid one another to partner with the best-in-class companies.

Want more? Enter your email below for the latest SaaStr updates

Nail it Before You Scale it

If you want to succeed in the Cloud, don’t scale anything until you have measurable proof that it’s working, and follow this mantra: nail it before you scale it.

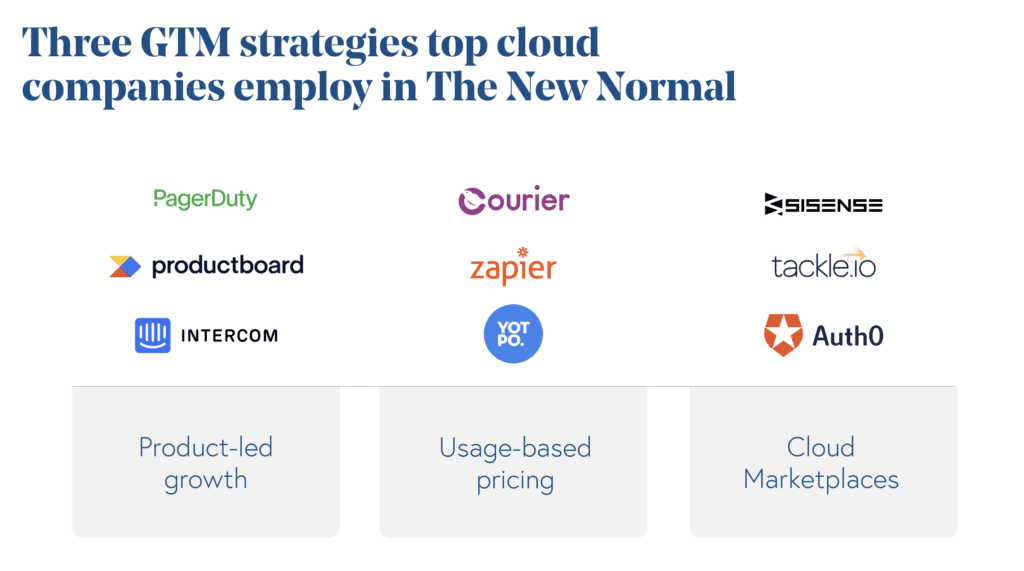

Over the past year, BVP looked at the companies performing extraordinarily well throughout COVID and into the new normal. They identified 3 go-to-market strategies that have really helped propel companies to defy gravity.

- Product-led Growth

- Usage-based pricing

- Cloud Marketplaces

First, on product-led growth strategies: we’ve seen companies like PagerDuty, Productboard, and Intercom do that really well. It’s really this idea of focusing your product right on your customer, getting in their shoes, and thinking about the user as your go-to-market motion. It’s not a new idea, but a renewed strategy in the new normal. Your success is not defined by going from 50 customers to 100— it’s about making sure that your interactions and product are focused on each individual customer to improve their ease of use and long-term retention.

Usage-based pricing models is a trend that we’ve seen more and more, but whereas five years ago, a lot of the traditional go-to-market motion focused on a SaaS license or annual enterprise sale, there’s a lot of new ways that Cloud companies are leveraging usage-based pricing to drive up net-dollar retention and gross retention. Companies that employ a usage-based pricing model have about a 10% higher public market valuation. What BVP also found is that usage-based companies that achieve scale (100M+ ARR) can actually maintain their growth endurance much easier than those that have the traditional model.

Then lastly, something BVP has seen grow rapidly over the last year is the emergence surge and cloud marketplaces, which help B2B businesses find each other and transact in the cloud.

Cloud Predictions for 2022:

- Unbundling of the Office

- We’re bringing S-M-B back with SaaS

- Diversity, equity, and inclusion software taking their rightful place

- Data and machine learning infrastructure accelerates to new heights

- The rise of the “citizen” developer and creator

- Fintech and crypto players are changing financial services forever

- The vertical SaaS wave becomes a tsunami