What’s New at Navan: Reinventing a Category with CEO Ariel Cohen

Discover what’s new at Navan: The Most Successful Pre-IPO “True-icorn” Doing Nine Figures with CEO Ariel Cohen and SaaStr CEO Jason Lemkin. Ariel shares what’s new at Navan, a pre-IPO unicorn making nine-figure revenue, and what founders can achieve with the right vision, mission, and team.

What’s New at Greenhouse: $200M ARR, AI in the Real World, Going Big with PE, and More

Discover what’s new at Greenhouse, a $200M ARR recruiting software company. CEO and co-founder Daniel Chait and SaaStr founder and CEO Jason Lemkin discuss AI, trends in the market, getting bought by PE, and much more.

The Chat GPT Growth Story: How AI is Changing the Way We Work with OpenAI’s Head of Sales, Aliisa Rosenthal

Discover how AI is changing how we work and how OpenAI has opened the door for innovation on a rapid scale with OpenAI’s Head of Sales, Aliisa Rosenthal.

The State of Software Buying: From SMB to Enterprise with G2’s CMO

The state of software buying has changed. SaaS spending dipped in the first half of 2020 but has since accelerated and increased as we reach the end of 2021. Amanda Malko, CMO at G2, shares a fascinating look at the data that reveals shifting patterns in the way consumers purchase software.

Power Laws: A Look Back To Where 20 SaaS Break-Out Companies from 2012 Are Today

The second SaaStr post ever, way back in late 2012, was “Everybody Lies: SaaS Revenues in the Inc. 5000”. It was a fun one, analyzing the only public source of data on just how much ARR a lot of SaaS companies had. No one had IPO’d, no one really...

SaaStr Podcast 436: The State of the Cloud 2021 with Bessemer Venture Partners

In today’s SaaStr podcast the team at Bessemer Venture Partners unveils the 2021 state of the cloud. Listen in as Byron Deeter, Elliott Robinson and Mary D’Onofrio share the latest trends and predictions for the cloud marketplace.

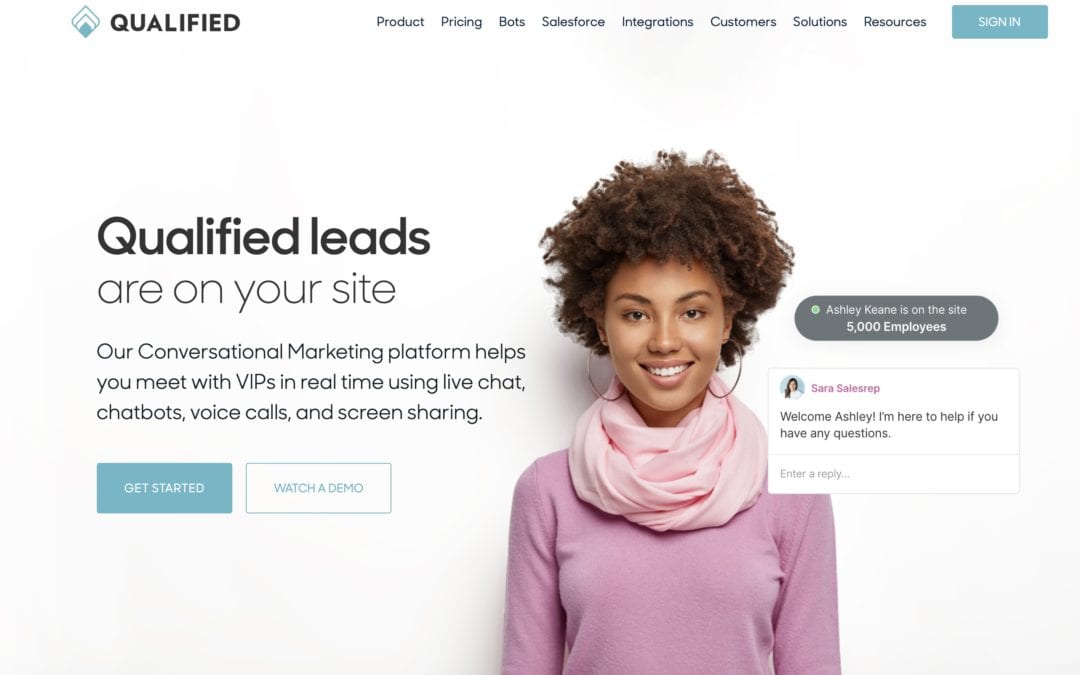

Behind the Round with SaaStr: Qualified.com Raises $12m Series A

Tom Taulli Qualified.com, which operates a conversational marketing platform, has raised a $12 million Series A round (the total funding is $17 million since inception). The lead on the deal is Norwest Venture Partners and the other investors include Salesforce...

The Top Cloud Stories of the Week: Sophos for $3.82 Billion; More Ransomware; Amazon Takes On Coachella; Hitting The ’20 Plan

We now have over 250,000 (!) subscribers to the SaaStr Cloud Daily on Quora, 9,200,000+ views, and are adding thousands of new followers per week. One benefit from Cloud Daily is our community speaks and upvotes their top stories of the week. For this week, here were...

At a $20B valuation, is WeWork overvalued?

Well, goodness since this question was asked WeWork is now worth $20 billion! + WeWork’s $20 Billion Office Party: The Crazy Bet That Could Change How The World Does Business Does this even make sense? WeWork is losing money, its margins are murky and it is...

Is $1.2 billion a fair price for Recruit Holdings to pay for Glassdoor?

It seems like a pretty good deal for Recruit Holdings, and market correct. If Glassdoor was at about ~$100m ARR growing 30% a year (suggested by press, but I have no actual first-hand data), then public market comps suggest the deal sounds “market” at maybe 7x-9x 2019...

What does the future hold for Mulesoft after its acquisition by Salesforce?

So far, Salesforce has a strong record with its larger acquisitions — ExactTarget and Demandware. Their record with mid-sized ones seems more mixed, but that’s what you’d expect. Mid-sized M&A is the toughest category ($200m+ or so) — they have trouble...

What caused Elon Musk to lose his cool on the Tesla earnings call?

I think it showed he’s human. The questions about e.g. gross margin — which you can just read and know and don’t need to ask the CEO about — and others are filler questions. They try your patience. Many really sort of are seemingly “stupid” questions that...

State of the Cloud: 2018 Edition with Bessemer Venture Partners (Video + Transcript)

Having invested in public cloud unicorns such as Shopify, Twilio, SendGrid, and Box (just to name a few), we think it’s safe to say that Bessemer Venture Partners has its finger on the pulse when it comes to predicting the next big thing. What up-and-coming...