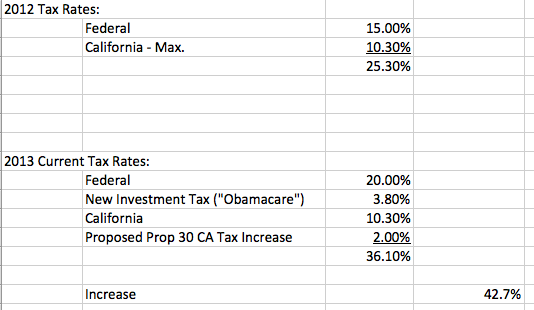

I try to stay out of political discussions. Just noting that many seem unaware of how much taxes are going up for founders and entrepreneurs on January 1, 2013. 42.7%. In California, total taxes will rise from 25.3% to perhaps 36.1% for long-term capital gains:

And many, many folks will pay the new investment tax of 3.8%, which will actually make short-term capital gains, i.e. exercised stock options, taxed at a higher rate than ordinary income.

It’s a lot. And it may even go higher. Will it discourage innovation? Probably not. Long-term capital gains will still be preferenced over ordinary income, and thus ordinary jobs.

But, it is kind of a bummer.

High taxes on stock options are sort of like taxes you have to pay each year on reinvested dividends in a mutual fund you continue to hold. Intellectually you can understand it, but somehow, it just doesn’t feel right.