When I started off as a SaaS founder, the #1 SaaS company’s market cap was … $2.6 billion. Yup, Salesforce was worth just a bit more than $2 billion. And their largest acquisition to date at the time was (drumroll, please) $15m.

Fast forward to 2019. Twilio has just bought Sendgrid for $3 billion. SAP bought Qualtrics for $8 billion. Microsoft bought GitHub for $7.5b. And Salesforce? It’s now worth $125b and has acquired a string of SaaS leaders for $1b+ (Mulesoft, ExactTarget, Demandforce, etc.). And done pretty well with those bigger acquisitions.

Proud to release @saastr w/ @jeffiel @twilio & @spdholakia @SendGrid discussing why operators must maximise number of "at bats" as possible & why developer first is a maturation in supply chain of software. Thanks to @ryan_mcintyre @ethankurz @bdeeter Qs! https://t.co/iB4tM3i3ao pic.twitter.com/wtd5Yc0ynB

— Harry Stebbings (@HarryStebbings) March 18, 2019

What’s going on? Two things:

First, the old big guys of software are all going through a Cloud Disruption phase. This means Microsoft, Oracle, SAP, Adobe and Google all are ready to pay up — and have. Maybe we can add Salesforce to this mix (it’s 20 years old now, after all) as well as Cisco, which is buying a lot in Cloud and SaaS leaders (Duo Security, AppDynamics, etc). That’s 7 folks at $100b-$900b in market cap that actively want to buy SaaS and Cloud leaders. $1b is only 1%-0.1% of their market caps (valuation).

Second, the explosion of the Cloud is creating a new generation of Decacorns. Fast. Twilio buying Sendgrid is an example of the power of a new Decacorn. Atlassian IPO’d at $4b, and spent 10% of its market cap to buy Trello for $450m. But today Atlassian is now worth $26b! They haven’t done a $1b deal yet, but it would be “cheaper” today to buy a company for $1b-$2b than buying Trello for $450m was at the time.

Generally, speaking you have to be worth $10b+ to buy something for $1b+. And you often have to have been around long enough to either feel some pressure of a phase change in the market, and/or to feel pressure to sustain crazy growth. Twilio aside, most folks take a while to warm up to a $1b+ deal 🙂

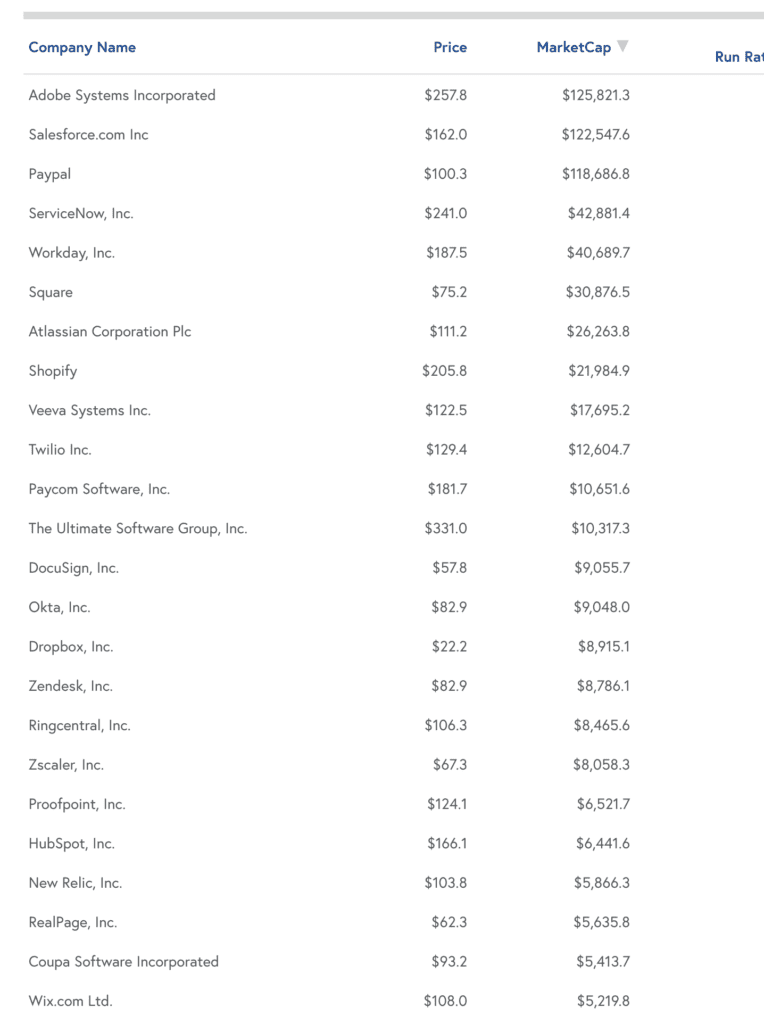

But take a look at the Bessemer Nasdaq chart above. We’ve got another 25 Cloud leaders that are at $10b, or are halfway there and will be there soon.

Each decacorn can afford to pay $1b for a deal that they just have to have. Not every company is acquisitive (see, e.g. Apple, Workday, etc). But most end up doing more and more acquisitions over time.

And each $100b+ market cap leader can do a $1b deal every year without really breaking a sweat.

Probably even two.

It’s not remotely easy. But, what was once impossible (a $1b acquisition) and then rare is now becoming routine.

Good times to be a break-out winner in SaaS.