In many segments, competition-to-the-almost-death seems the norm in SaaS. Just look at Larry Ellison or Marc Benioff. While both seemed to have mellowed a bit recently, you can still see it in their eyes, their press releases, their ads in the Wall Street Journal. Ellison and Benioff clearly want to kill their competitors. And each other. Every day.

Why is this? I’ll admit at first I struggled to make sense of it, but once I came to Adobe and learned that the Omniture guys were just as competitive as Ellison, even with Josh James long gone, I realized it was The Way of the SaaS Universe in many categories. But why?

I think it has to do with a combination of two basic factors: Oligopolies in SaaS and the effectiveness of Dominant Strategy in SaaS.

First, why are many SaaS categories “Oligopical”? In other words, why are there generally just a few leaders that own almost all market share, with perhaps a few scrappy guys behind them? I think we all know why SaaS is rarely truly monopolistic — there generally aren’t true market and network effects. Just because I use Salesforce, you can still use HubSpot or Pipedrive or maybe NetSuite or Oracle. I use Slack, you use Teams, or whatever. There isn’t much data exchange.

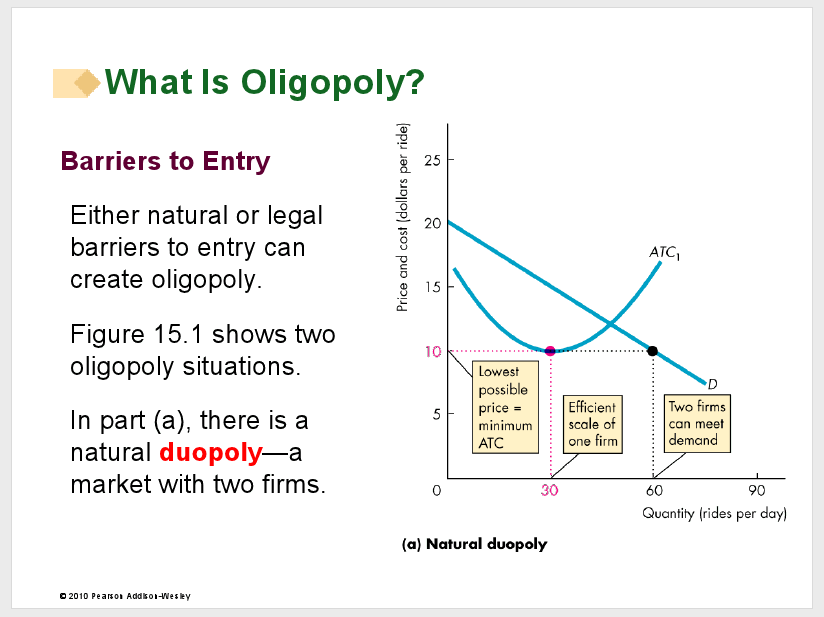

But the cost to develop these apps becomes high, and it becomes higher as the markets emerge and in the beginning, often still remain small. High costs + small market in beginning. VC capital can distort this somewhat, by creating ‘room’ for an extra competitor or so — but that’s about it. So you end up with room for only a couple of viable competitors, and some very small ones trying for scraps:

Chart from this PPT.

Second, the players generally are in no way interdependent – so pure dominant strategy becomes the norm. As ugly as Apple-Samsung/Google-style conflicts are, the extremeness is unusual, because Samsung is also Apple’s largest vendor. Most of the time on the hardware side, even when folks sue each other, it’s slightly gentler than it otherwise would be, because they’re often also each other’s customers. Game theory says here, where there’s some level of interdependence, there’s generally an Invisible Hand that guides the competitors to an outcome that maximizes the greater good, or at least that involves a constant game of ‘chicken’, waiting to see what the other guy does first before expending effort.

With SaaS, there’s no greater good and no interdependence among competitors. Instead, pure dominance strategy works once the top competitors have efficient scale. Dominance strategy states that your best strategy is irrespective of anything your opponent does. So as long as there is capital to fuel it, SaaS competitors will try to enter every possible market niche, compete in every area possible of their market and for every single customer, spread as much FUD as they can, try to steal your customers even if the ROI is close to zero. It doesn’t matter, because there’s no downside if the capital is there. There’s no game of chicken, of wait and see. Because there’s no ecosystem and no interdependence.

And importantly, in enterprise SaaS, with bigger customers — there often are not that many economies of scale on the sales-marketing-success side. It just keeps getting more and more expensive to acquire, service, and manage those customers. And to build all those niche features that in the beginning you don’t need or don’t even have time to say Yes to, but later become critical to closing that extra big customer. It can be hard for a smaller team to keep up on the human capital side, in a way with a simpler B2C or SMB-focused app, maybe they could. If you think you could rebuild all of Salesforce’s rich CRM functionality in even 5 years, you are dreamin’.

OK, great, so what’s to do here? I think the learnings perhaps are as follows, beyond the obvious of build the #1 best company you can (which needs no advice or discussion):

- Most importantly — understand if you are in an oligopical market. If so, understand you probably cannot kill the #1 or #2 player once they have achieved efficient scale. So try to kill them sub-scale if you can. But after that, recognize you cannot kill them. You may think you are “winning” every deal your $100m+ ARR competitor is also in, but really all that means is you aren’t in a ton of deals they are in.

- If your competition has efficient scale and you don’t – run even faster. Otherwise, they’ll be able to do everything and you’ll get cornered.

- More money doesn’t always win. But it really helps in oligopical markets. Atlassian, Mailchimp, Zoom, Zoominfo, Qualtrics, and more didn’t need money to win. But in other categories, the competition is brutal.

- Learn to adopt dominant strategy tactics. Once you’ve achieved efficient scale in your market, you need to be attacking every segment and every area aggressively, because your opponent will as well. There’s no detente in oligopical SaaS.

- Understand it never ends. Because of dominant strategy, hyper-aggressive competition doesn’t mellow over time. It simply increases, as more force and leverage can be applied. If it feels like your competitor(s) are all around you, they’re in every deal now — get used to it. It’s only going to increase as you get more successful.

- Don’t let it get under your skin. FUD, douchey partners, changing alliances, friends-turned-enemies … this stuff can be hard to take if it’s new for you (or even if it’s old hat). Get over it, learn from it — and play a better version of the same game.

- Eventually — things do change. But it can take decades. Understand which trend line you are riding. And maybe switch to one that is more in transition.

- Redefine the market. Maybe you need to do something different. Maybe the world doesn’t need another Salesforce, another Slack, another Zendesk. But maybe it needs Slack-for-eCommerce. Or Salesforce-for-Construction. I’m not sure. But what is a niche today, can be something huge tomorrow. But what is already big and established today almost certainly will be very similar over the next few years at least.

[Note: an updated SaaStr Classic post]