Dear SaaStr: When Should You Sell Your Company?

I was with the CEO of a $XB+ SaaS CEO a little while back

He was acquiring a leanly-funded startup. The founder owned so much, he would make more than the CEO.

I asked how that felt.

"That's his journey. We're on a different journey."

— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) April 14, 2022

Money matters. It does. Money is part of why we do this, maybe more in the early days than later. It’s not just about building software and the journey. It’s about turning your shares from $0.00001 into … something.

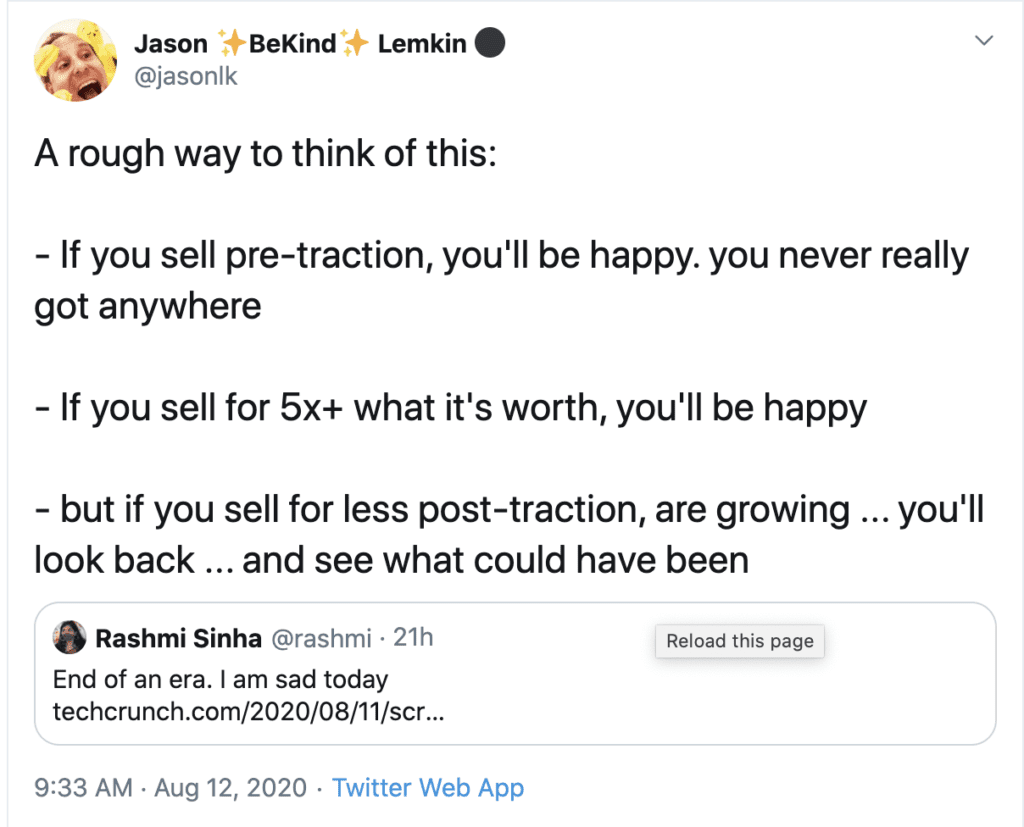

So when should you sell your company — if ever? Especially, if things get a little tougher, selling may seem like a valid option, if you do have options.

You’ll know when the market has passed you by, when you’re no longer competitive, when you just can’t recruit the right team to win anymore.

End of an era. I am sad today https://t.co/oBGDoYcClM

— Rashmi Sinha (@rashmi) August 11, 2020

But … be careful to not let exhaustion and emotion cloud your thoughts here. Especially if you have happy customers and are growing:

- First, and more importantly, bear in mind good acquisition offers are rare. Most start-ups never get a decent one. So the idea you can wake up one day and decide to sell your company is a bit of a delusion. Odds are you will never get a strong offer. Assume that going in and you’ll be happier. A little more on the odds here: Should I Sell for $50m … Or Push On And Try to Build a Unicorn? – SaaStr

- Second, you’ll be in a unique position to understand risk/reward. Your experience, the company’s momentum, and your gut will know better than any outsider.

- Liquidity is rare. But so is lightning-in-a-bottle. If you sell now, that’s probably smart. But what are the odds you can do it again? Maybe lower than you think. Are you OK if the company you started is shut down 2 years after the acquisition? That’s fairly common.

- It’s OK to get a bit behind once in a while, IF your customers are still happy. You can’t go 5 years without innovation. But once you have some scale, if you need a slower quarter, or even a slower year to get your house in order, it may be fine once in a while. If your customers are happy and your net retention is high, they’ll carry you through a patch when you need to reorg things. Don’t let a rough patch make you think you have to sort of throw in the towel. If you can build great software and have happy customers, you can often get back on track quicker than you might think.

- Finally, think about other options if you have something good and are growing and have happy customers. Decent priced acquisition offers tend, by their nature, to come for good start-ups. Especially in SaaS. These days, you can often sell some of your shares in “secondary liquidity” instead. And sometimes, bringing in an outside CEO of your choice can help, too. The need to de-risk our financial lives sometimes pushes us into choices here that are too conservative.

Ask yourself: Would you push on, if you just had a few more nickels in the bank? Then I say, find a way to push on. And see if you can just get those nickels to destress your life and tide you over. Sell 5%–10% of your shares instead, if you can. If that’s enough money (selling 5%-10% of your stake) so that your experience, momentum and gut then say “don’t sell” — then maybe don’t sell.

Have a strong M&A offer? Not sure what to do?

Look at this pic or a similar one

Do you want it? If so, say No

If not? Probably just say Yes pic.twitter.com/K483lKnyzd

— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) April 21, 2021

A discussion on a $1b M&A exit here from SaaStrAnnual.com:

And on maybe bringing in an outside CEO of your choice here:

And on maybe bringing in an outside CEO of your choice here:

(note: an updated SaaStr Classic answer)