At the end of the day, all decacorns solve massive problems. They have to. Otherwise, the TAM is too small.

But so many in SaaS start off just solving a tiny piece of that problem.

— Jason ✨BeKind✨ Lemkin 2️⃣0️⃣2️⃣2️⃣ (@jasonlk) January 13, 2022

One of the things that causes a lot of anxiety in SaaS is market size. If you’re creating the latest Pinning app, or social network, the odds are surely against you. But in consumer internet, often you know if you hit it, however low the odds are, at least the market is huge (or at least, the user base is huge).

SaaS is more confusing. Yes, if you are Workday and taking PeopleSoft on back in the day, straight-and-center, you know you’re taking on a $1 billion+ market on Day 1. Zoom knew the market size from WebEx. But for many of us, it’s not at all clear in the early days. Either:

- You’re doing something new-ish, in which case, you really don’t know how large the market will really be. You know the comps and the notional market, but not yet the real market;

or

- You’re attacking a large existing market — but usually only a small piece, a slice, at first. A niche, a segment, and hoping to grow into something larger.

The challenge is that, because SaaS compounds, but starts slow, you’re going to get a lot of confusing data early on. Almost no matter how well you do the first 12-18 months or so — your market may seem small. Kill yourself to get to $2m in ARR, and the going still seems tough? Maybe your market is too small, you think. Happy customers, but just not enough of them? Maybe your market is too small, you think. Or too niche.

The thing is, take a pause. Because actually, you simply don’t know yet.

For a SaaS company at least, I’m going to suggest it’s going to take about 2-3 years minimum to really know the size of your market. That’s been my experience and those of my peers.

Because until you have a fully repeated process, with enough scale to understand how you acquire customers, you can’t really understand how it all works.

You can’t really understand your market size after just a few months. You might think it’s small — but maybe that’s because no one has ever heard of you. You might think it’s small — but maybe it’s really that your product is so feature-poor it’s not touching enough of the potential market. And the market may well grow.

Yes, if you are only selling to brick-makers or to centenarians, then you may know empirically your market is too small. But otherwise, I wouldn’t draw any conclusions so long as you are growing 80-100%+ in ARR, or faster. Because you do have something — and that’s despite the fact no one has ever heard of you. Think about that. That probably means your market is larger than you think. Think about what will happen when people actually have heard of you. When stories of their ROI with your SaaS product spread. When word-of-mouth compounds and kicks in. Really, because of that, because no one has ever really heard of you in the grand scheme of potential customers — I highly doubt at this point you have even tapped 1% of your practical, addressable market.

So wherever you are in the early days, you can at least be 100x larger. And that’s without even expanding your TAM.

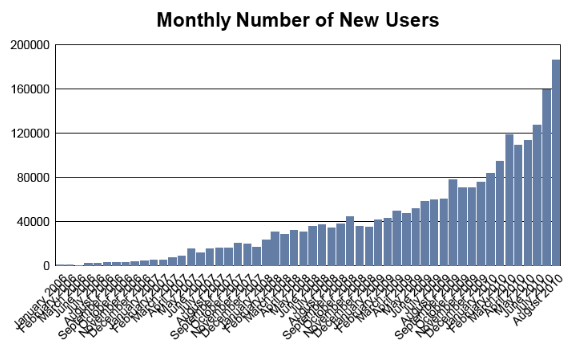

Look at the chart below on our initial new user acquisition rate. You can see, with hindsight, we knew nothing after 12-18 mos. as to true market size and true opportunity scale … let alone after 3-6 mos. from launch:

(note: an updated SaaStr Classic post)