Dear SaaStr: Is 5 Co-founders Too Many When Raising Venture Capital?

Yes, it can work. My first venture investment was Pipedrive, it had 5 co-founders and sold for $1.5 Billion.

10 Years of Investing pic.twitter.com/zsSupe0CRP

— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) September 13, 2023

But — it will be a flag.

My recommendation: maybe have 2, or 3 max, of the founders be the “C-level founders” going forward. For fundraising, and probably, for real too.

Clean up your org chart so only 2 are C-level executives. The others can have their equity, etc. and the title of “co-founder” but ‘demote’ them from the C-level. 2 founders running the company is great. 5 scares most investors off.

This may create some tough conversations. But it will also clean-up the company for most VC firms to invest. Venture capital is a business of outliers, but it also involved a lot of pattern-matching, for better or worse. 2 co-founders is the most common pattern.

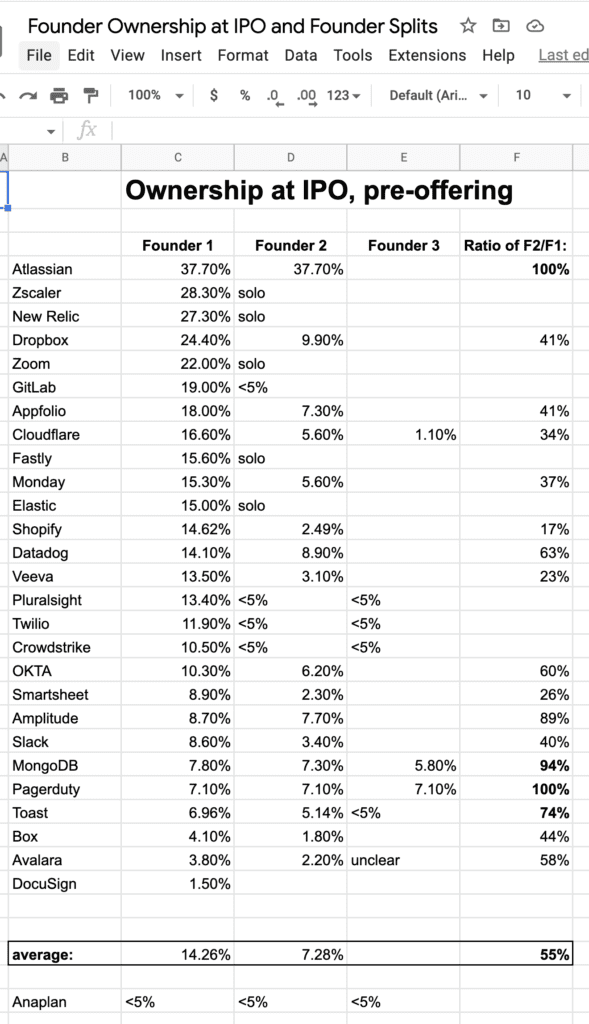

You can see in the chart below, most SaaS leaders at IPO have 2 core co-founders. Some have just 1, a few have 3 or more. But most have 2:

If you have 4-5+, maybe just quietly demote them. Just a little bit. It just makes sense.

(me+him image from here)