So we’ve covered hero company Atlassian many times on this series. First, it’s an epic bootstrapping success story. Second, it showed early you can build a SaaS and enterprise leader from anywhere. And third, it’s a SaaS and Cloud leader we all have opinions on. We have a sense of.

And Atlassian has been saying something for quite a while — that while things have gotten harder the past 18 months or so, buyers are still buying. Atlassian has seen some modest macro impacts, but they’ve just kept selling. Through PLG motions, through partner-led motions, and through a modest sales team as well.

5 Interesting Learnings:

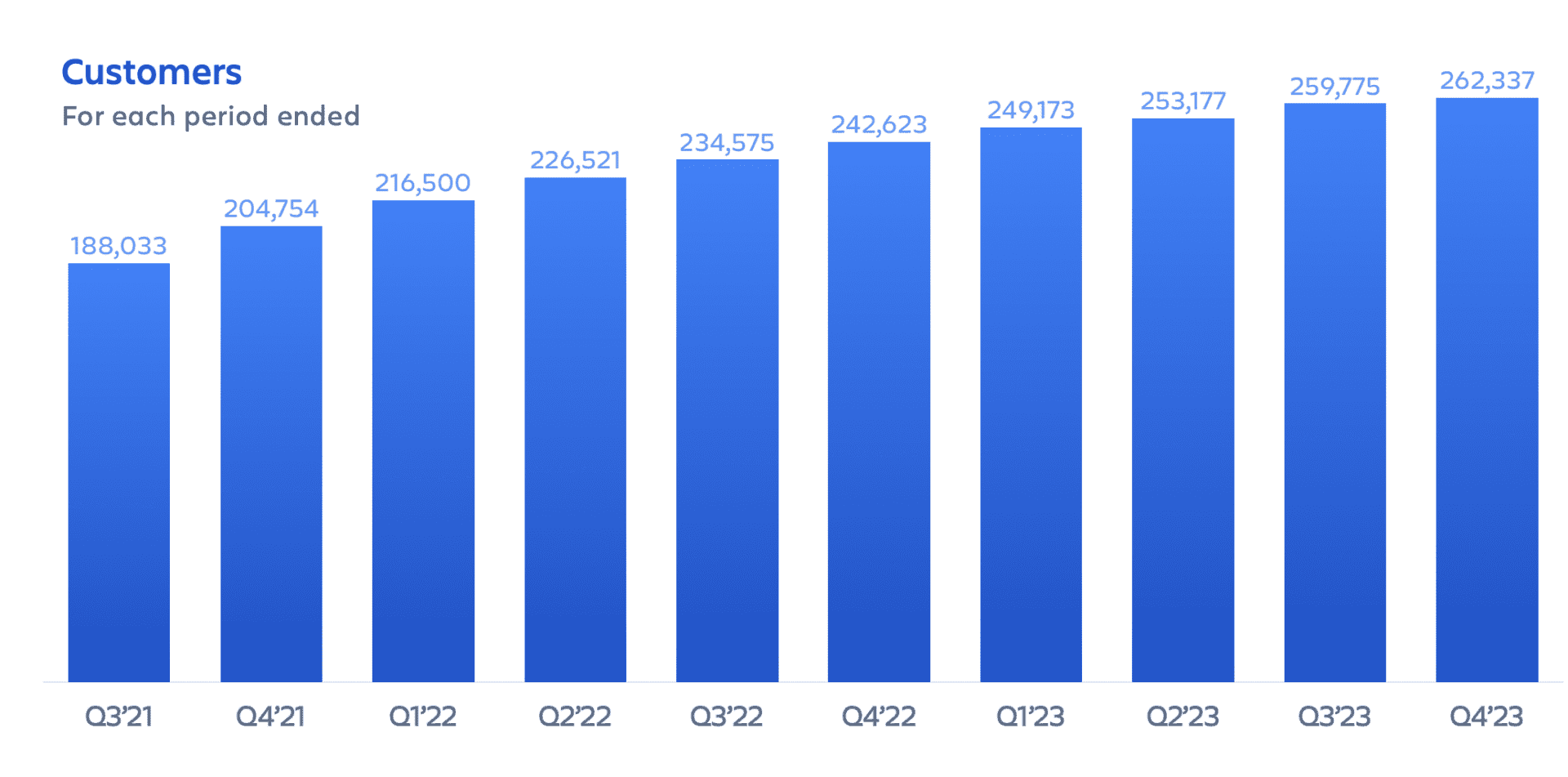

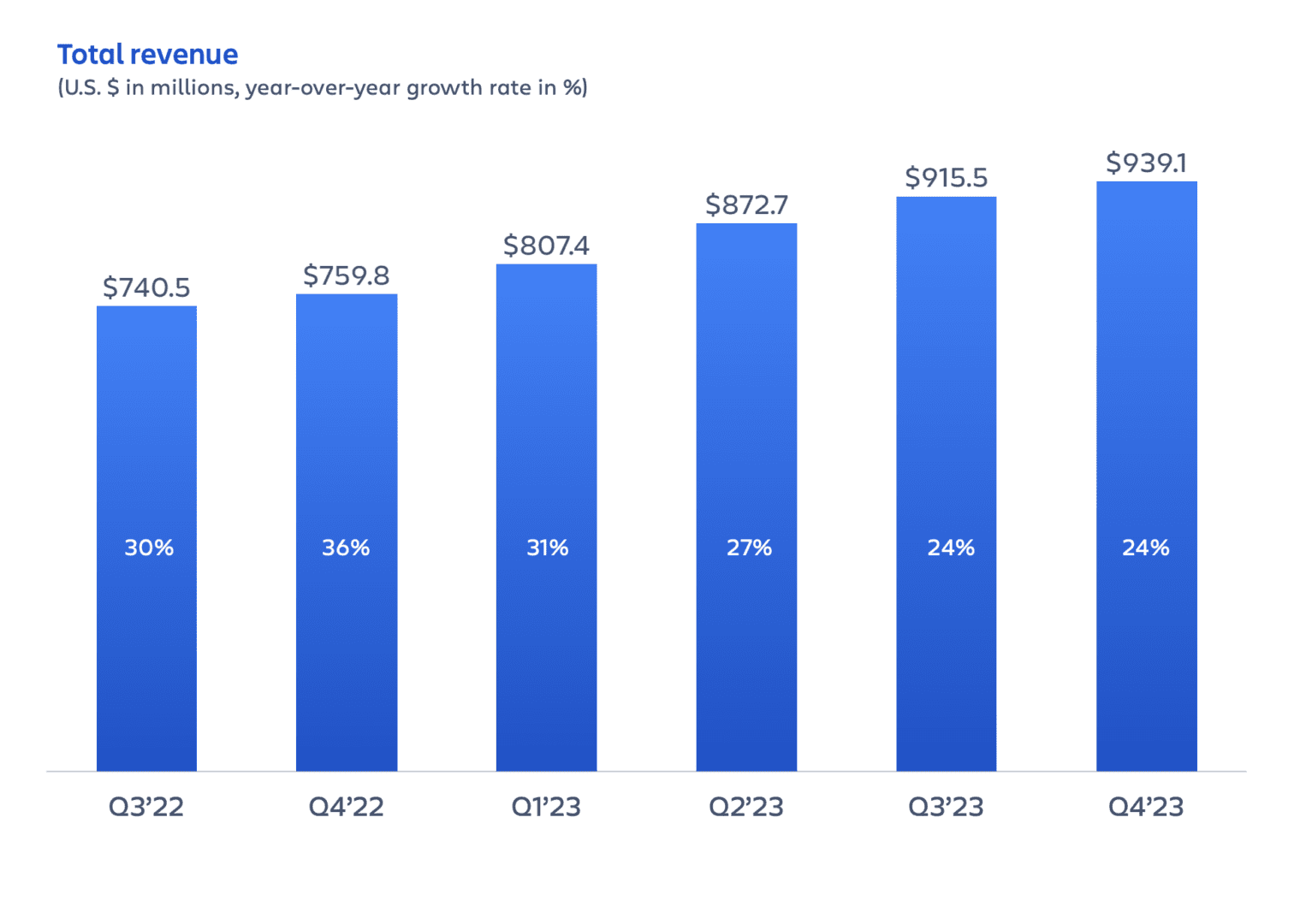

#1. Revenue Up 31%, But New Customer Count Up Just 8%

This is perhaps where you can see the challenges of scale and macro impacts hitting Atlassian a bit. Yes, 31% growth at $3.2 Billion in ARR is epic. Epic. But they had to monetize the base a fair amount to get there. New customers grew significantly, but more modestly at +8%.

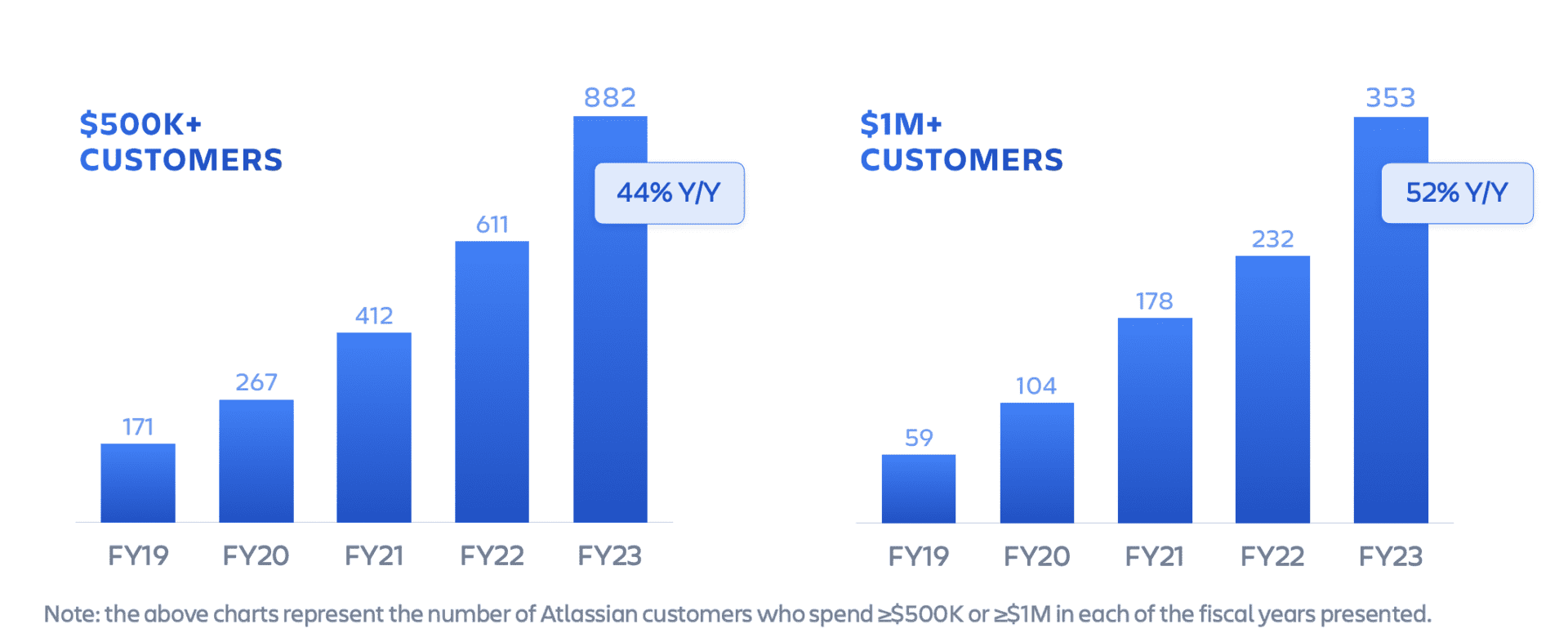

#2. Big Customers Have Helped Fuel the Impressive Growth

The new logo count has been modest, but $500k+ and $1m+ customers are outpacing the rest, growing 44%-52%.

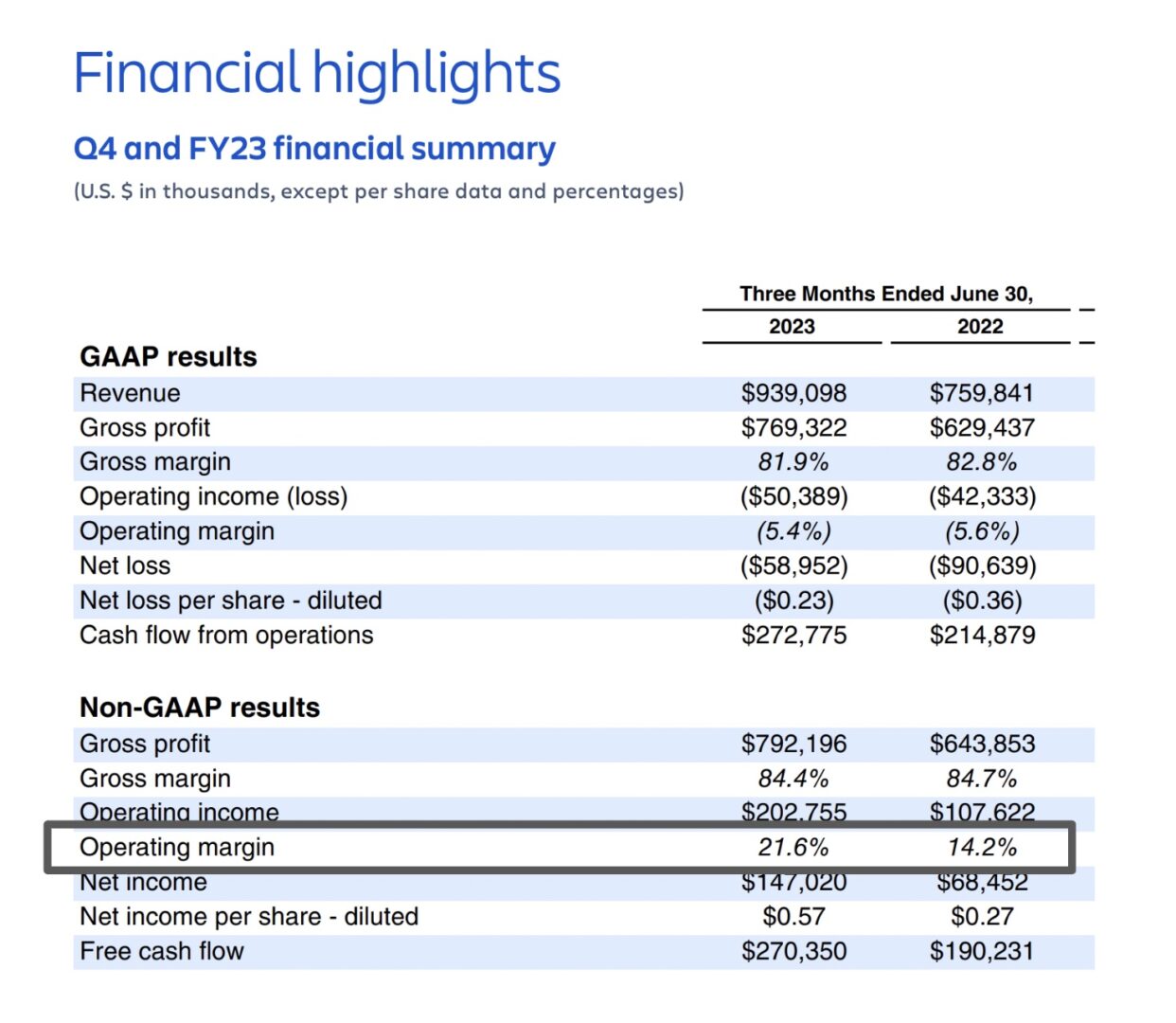

#3. Atlassian’s Model Was Already Pretty Efficient. But It Got Even More Efficient The Last 12 Months, Like Almost Everyone Else.

Atlassian already spent less on sales and marketing than virtually ever other public SaaS company. But that doesn’t mean it couldn’t get even more efficient — and it did. It held heacount mostly flat like many other Cloud leaders and saw Operating Margins expan from 14% to a healthy 22%.

#4. Free-to-Paid Conversions Down / Tough in Current Macro, But NRR and Usage Stable

Atlassian’s biggest macro impact is that the low-end, Free users, aren’t converting at the same rate to Paid as they did in the go-go Days of 2021. But upsells, NRR, and growth into $1m+ accounts remains strong.

#5. Still Hiring and Hiring Faster Than Prior Quarters — But Still Fairly Slowly.

Atlassian is still hiring and a bit more than the last few quarters, but it’s going to continue to maintain a careful pace here. This is the story with most public SaaS leaders, and most of how they’ve gotten more efficient over the past 12-18 months. And despite impressive growth, Atlassian is still cutting non-discretionary spending themselves.

And our great recent CRO Confidential with Atlassian CRO Cameron Deatsch and Founders Fund Sam Blond here: