So of the beloved leaders in Cloud and SaaS, few have been hit harder than Hashicorp by the “downturn”. At $400m ARR, they were growing 50%. Now at $600m, ARR, growth has radically slowed to 17%.

Some of it may well be some of the challenges in commercializing open source. HashiCorp’s competitors sell a variant of some of its own open source-based products for less. Some of it may be that the move from onprem to Cloud has evolved. But it’s been a lot of change in 18 months, that much is clear.

There’s room for optimism, too. New customer count is up an impressive +19%, and new bookings are up +40%. 2024 might just be a transition year for HashiCorp.

5 Interesting Learnings:

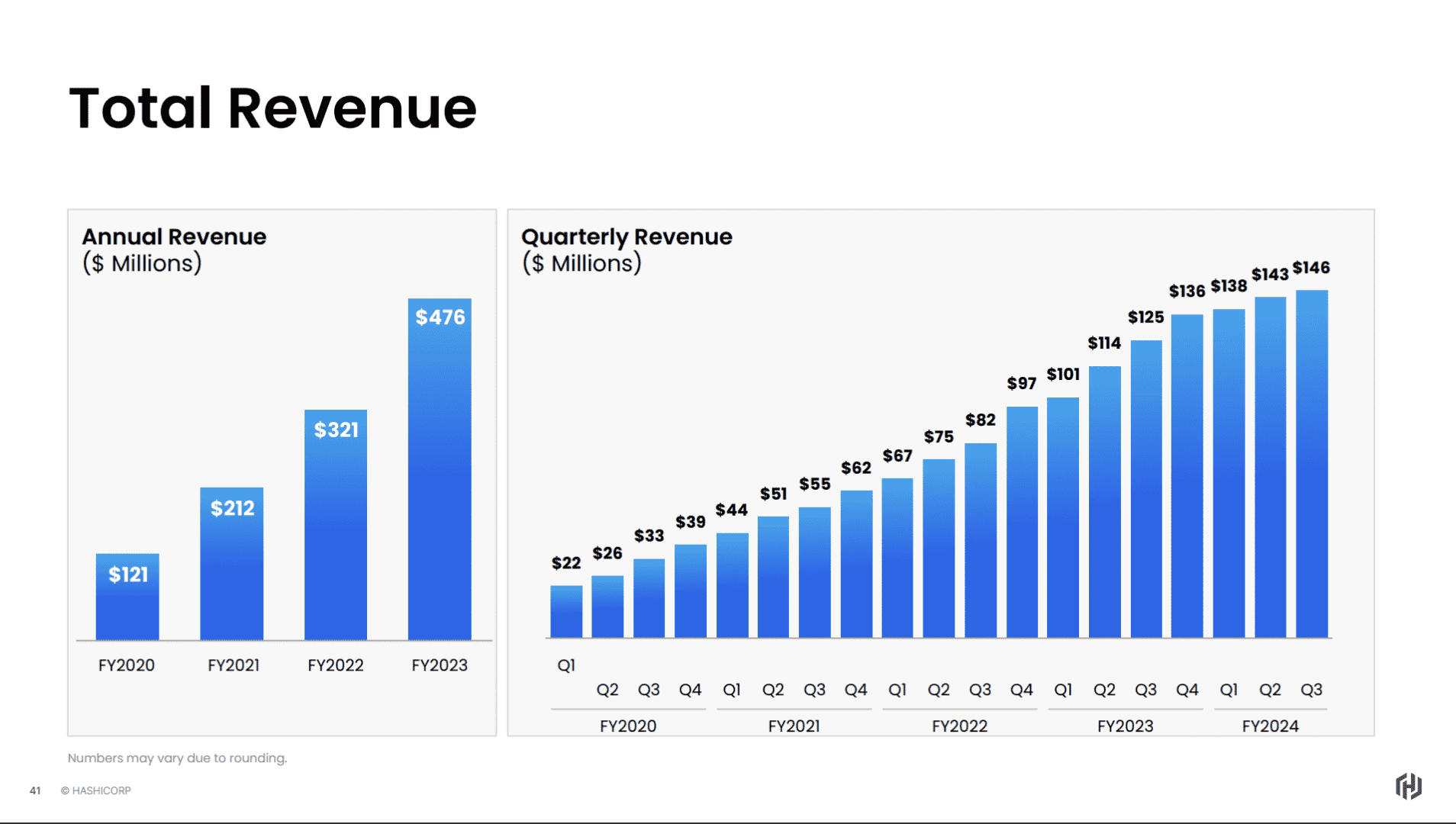

#1. Growth Hit a Wall in 2023

HashiCorp was a rocketship from inception all the way until FY24, or early 2023 in calendar years :). Then, ouch. Q1’24 was essentially flat with Q4’23.

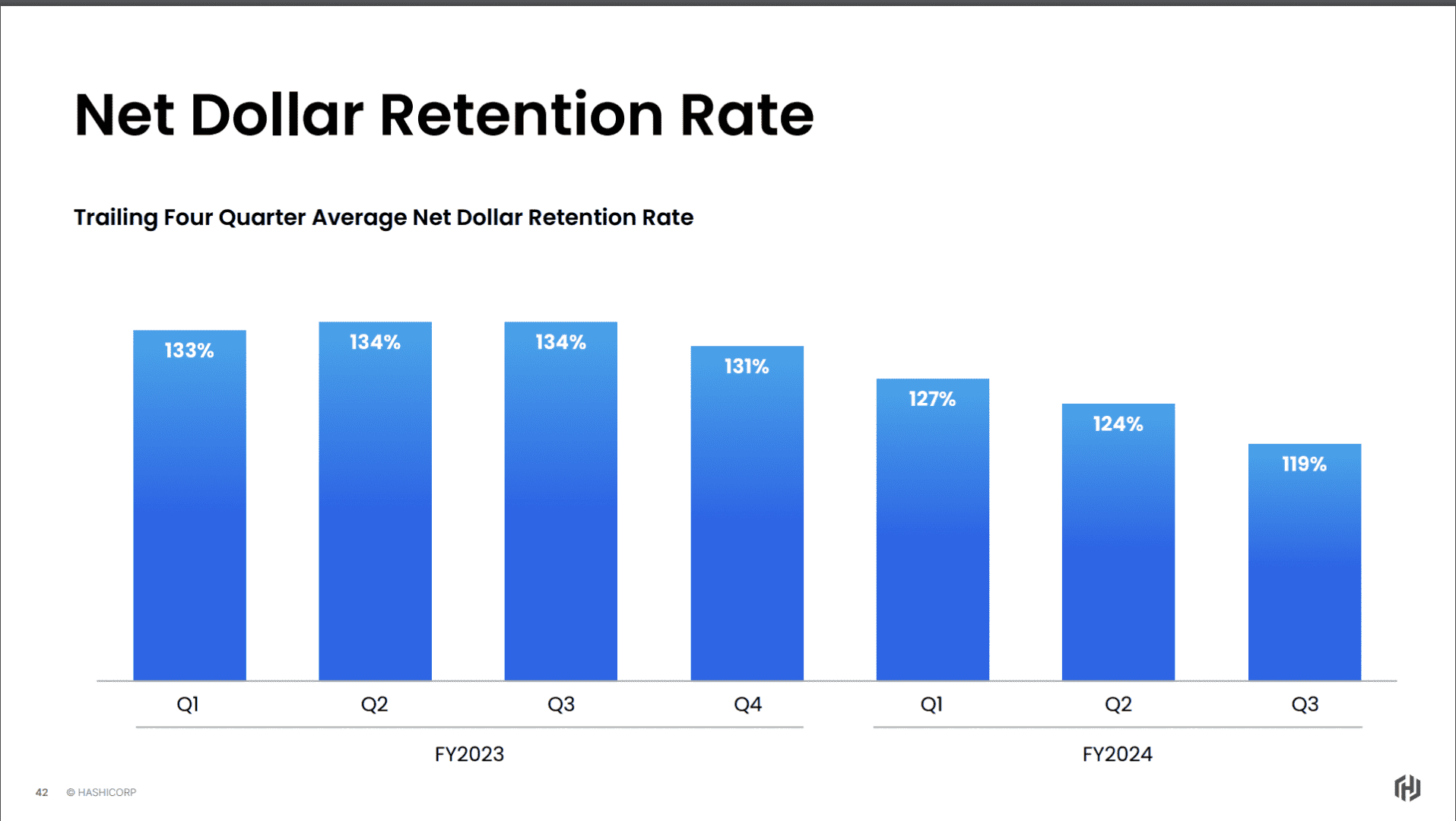

#2. NDR Remains High, But Has Fallen From 133% to 119%

This is pretty consistent with industry averages, and we’ve seen a similar decline at Snowflake and other leaders. Still, it’s a big drag on growth when NRR declines -15%.

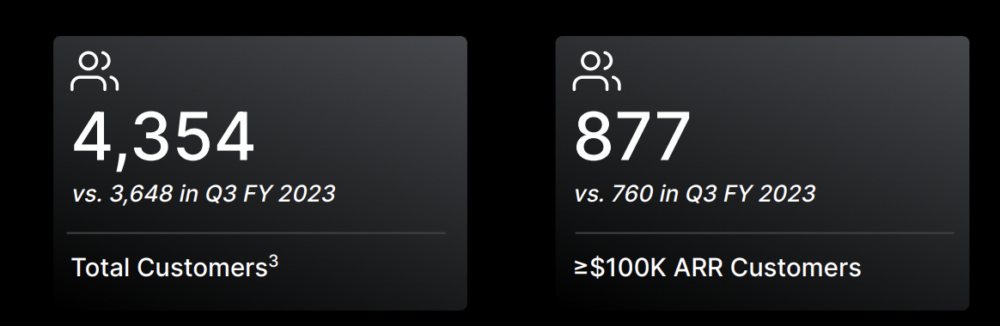

#3. Customer Count Still Growing Impressively, Up +19%

At scale, it can be hard to increase new customer count at ~20%. Overall, that’s a strong sign for a promising future. Even if the present is a bit challenging.

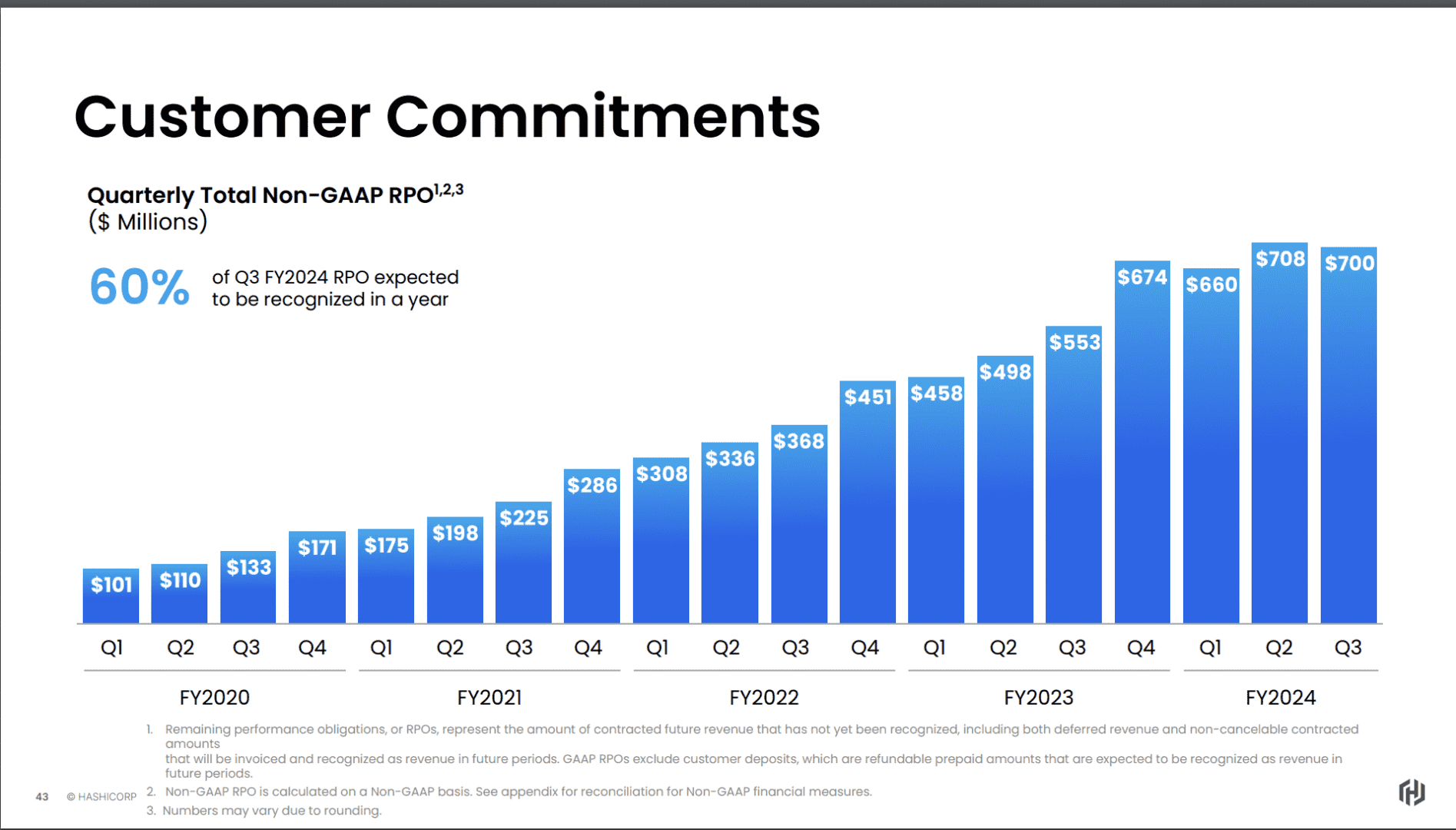

#4. A Strong Year for Customer Commitments

Even though HashiCorp’s revenue growth has radically slowed this year, its customer commitments are way up. Up ~40%+. That should bode well for the coming year, especially with 60% of that expected to be recognized within a year.

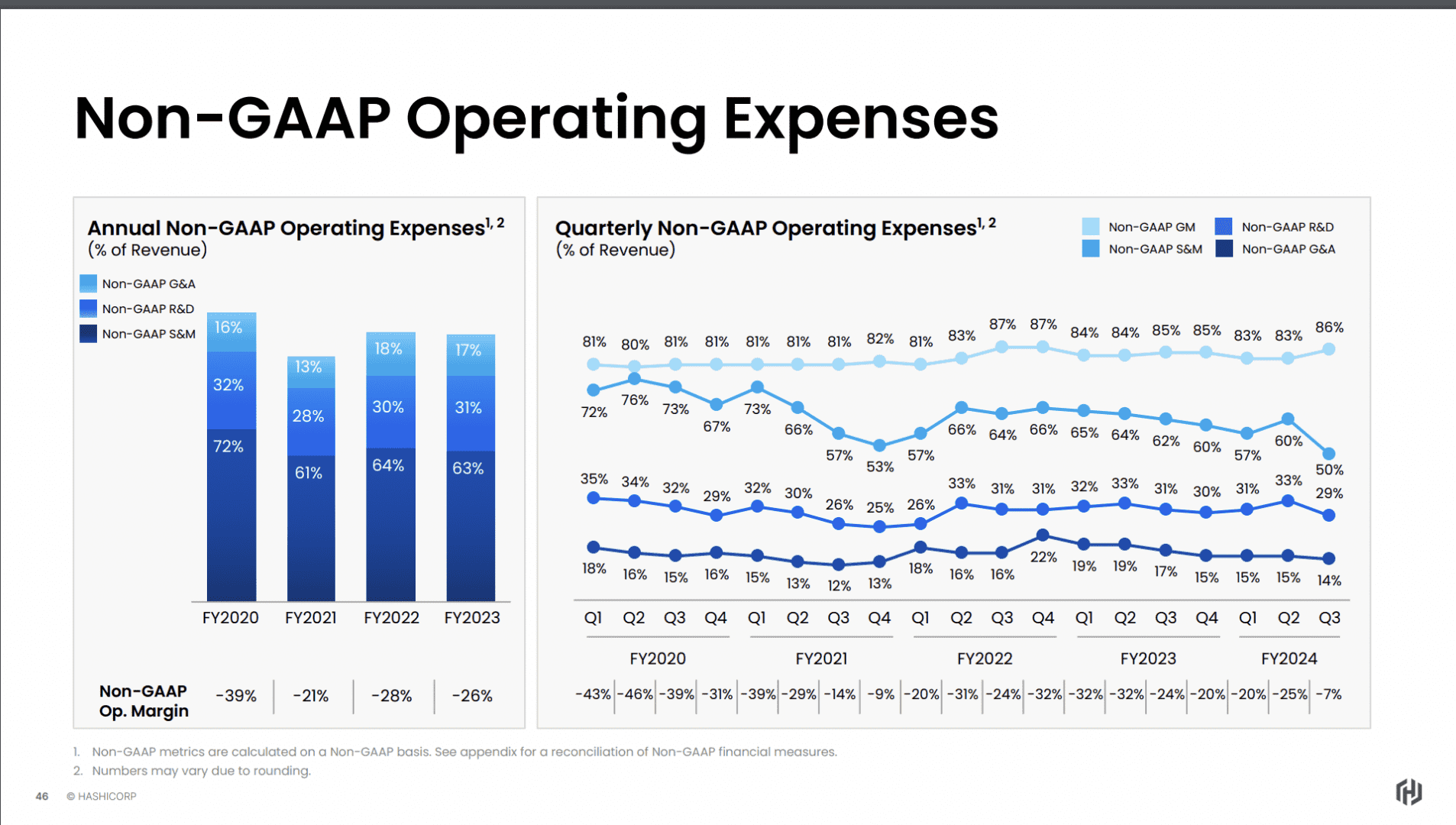

#5. Big Cuts to Sales & Marketing Expenses to Get to Positive Operating Margins

So there’s a lot going on in the chart below, but you can see first, HashiCorp has struggled more than other leaders to get to positive operating margins. Last quarter they finally got them to -7%, but before that operating margins were -20% or worse. They are behind the back here, by far. Most of the public leaders have gotten far more efficient, with positive operating margins in some cases at or approaching +20%. And it’s also a reminder that being based on open source doesn’t necessarily mean you are any more efficient.

What they have done as you can see is cut spend across the board, but especially in sales & marketing. That’s fallen from 60% of revenue to 50%. Still a lot, but that’s a big drop.

So HashiCorp has a lot going for it, with strong new customer growth (+19%) and an impressive book of customer commits (+40%). That’s pretty darn impressive at $600m ARR.

But the business has also been very inefficient until recently, and its growth has been caught up in budget and cost management and a drop in NRR.

Next year looks better than this one. Good stuff is happening. But it can be hard to predict these days. And for me at least, it’s all a reminder of just how hard all this stuff is. Even once you are a leader.