Quiet but Mighty SaaS security leads Zscaler just keeps on growing at epic rates at $1.5 Billion in ARR — growing a stunning 46% even at that scale. And profitably (or at least with strong operating margins). And with high NRR. And with … well just about everything. It’s the full package.

Zscaler:

▶️ $1.5B ARR

▶️ 46% Growth

▶️ 125% NRR

▶️ 400 $1m+ Customers

▶️ 15% Operating Margins

▶️ $22B Market CapIt doesn't get too much better

— Jason ✨Be Kind✨ Lemkin (@jasonlk) July 25, 2023

Yes, times are a bit tougher out there. But Zscaler has mostly shrugged it off by providing a mission-critical solution with strong demand — cyber attacks are only growing and growing, and stopping them is seen as a “must have”. And it’s been rewarded for it.

5 Interesting Learnings:

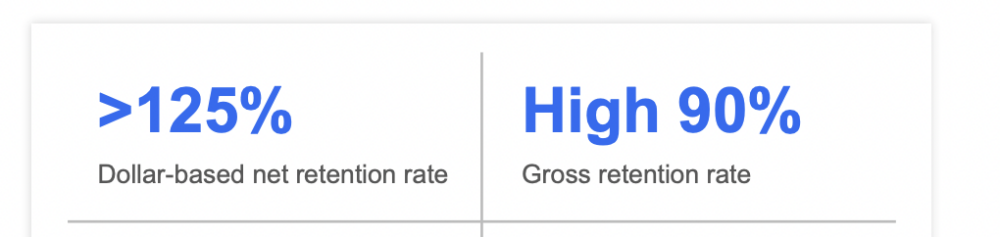

#1. “High 90%” GRR, and 125% NRR.

With closing to 100% of its customers renewing, Zscaler is an engine at scale. ServiceNow sees a similar almost 100% GRR. We can’t all do this, but the closer we get, the more magic there is as you scale.

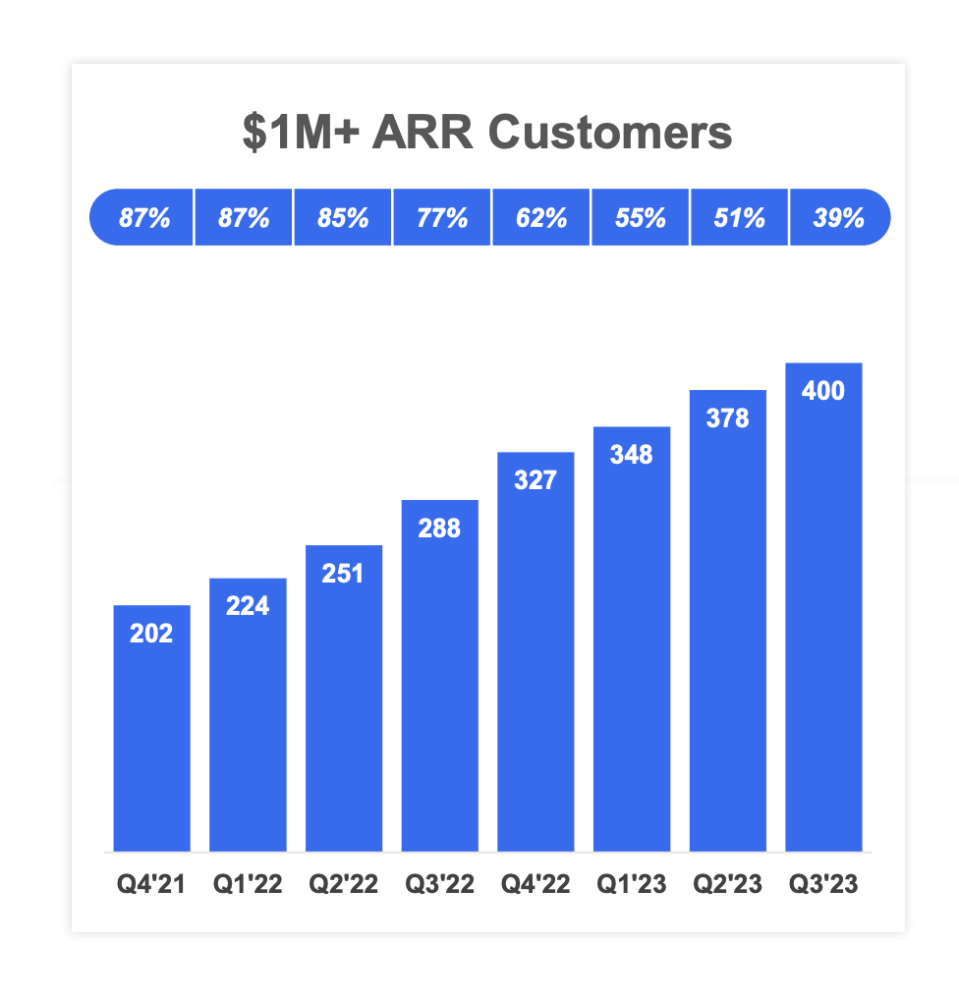

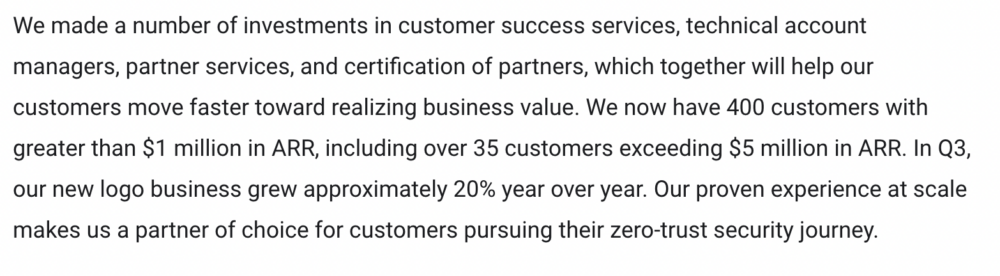

#2. $1m+ Customers Are the Biggest Engine of Growth.

$1m+ customers are still growing 39%, and 35 of their 400+ $1m customers now pay $5m+ as year.

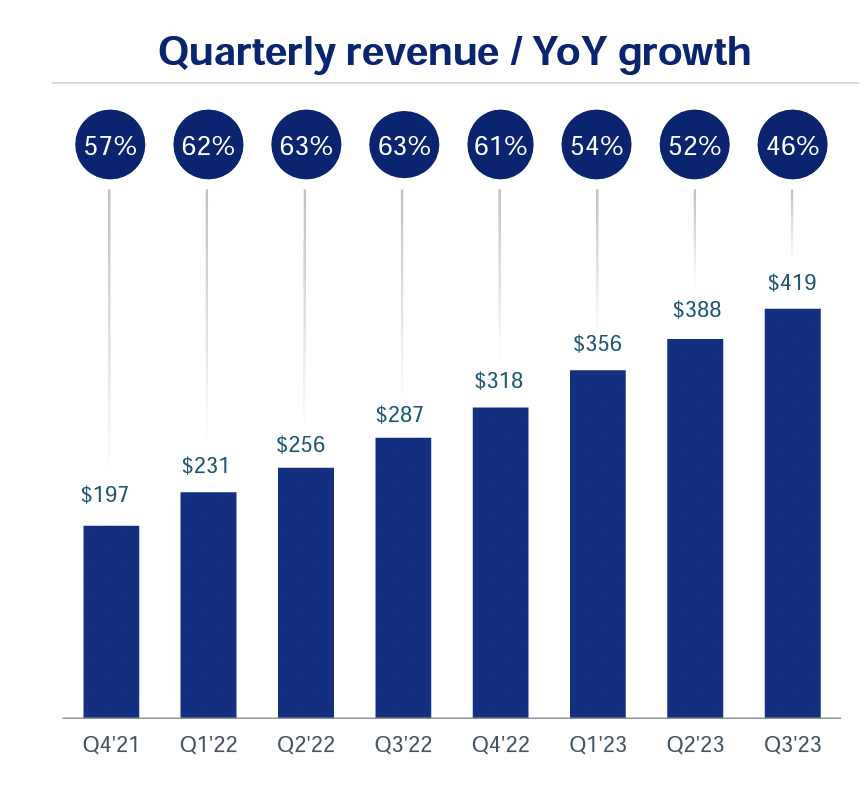

#3. Strong, Strong Growth — But Still Macro Impacts. Only Mission Critical Projects are Getting Approved.

Still, Zscaler is fortunate in that it is mission-critical in many cases. Still, growth while still torried, has slowed from the crazy pace of 12 and 24 months ago. At $1B ARR, it was growing 63% — vs 46% today at $1.5B ARR. So it’s gotten harder for Zscaler the past 12 months, no doubt.

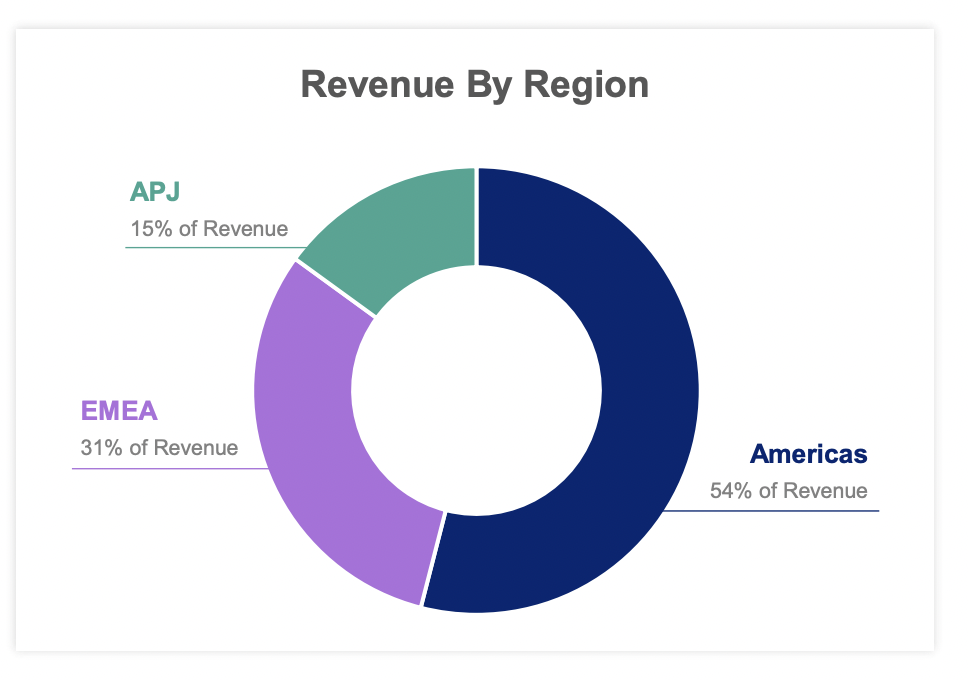

#4. 46% of Revenue From Outside the U.S.

Consistent with other Cloud and SaaS leaders. Go Global folks, if you can!

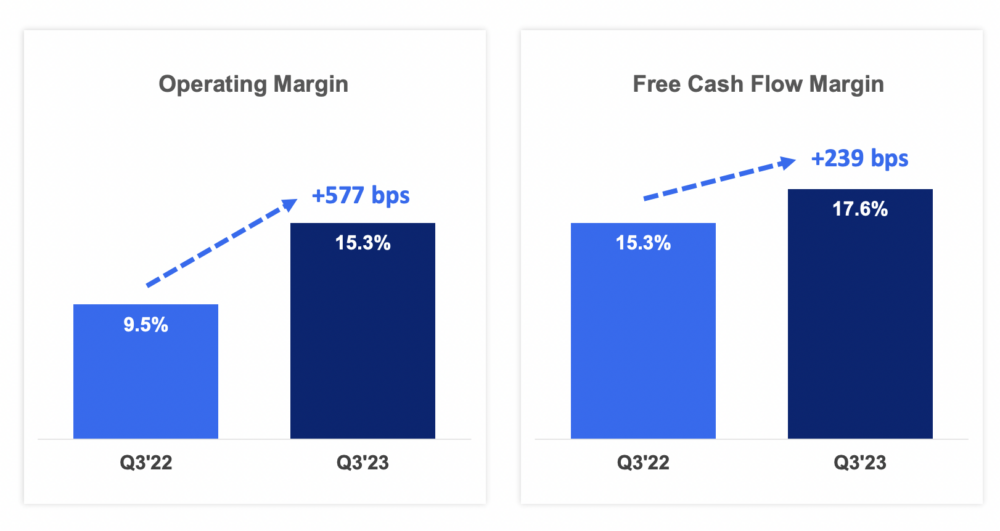

#5. Like Almost Everyone, They’ve Gotten More Efficient The Past 12 Months.

Zscaler didn’t go through the radical efficiency changes of some like Monday or MongoDB, since it was already operating margin positive. But it still got leaner and fitter, driving operating margins from 9.5% to 15% in just one year. That’s pretty fast.

And a few other interesting bonus learnings:

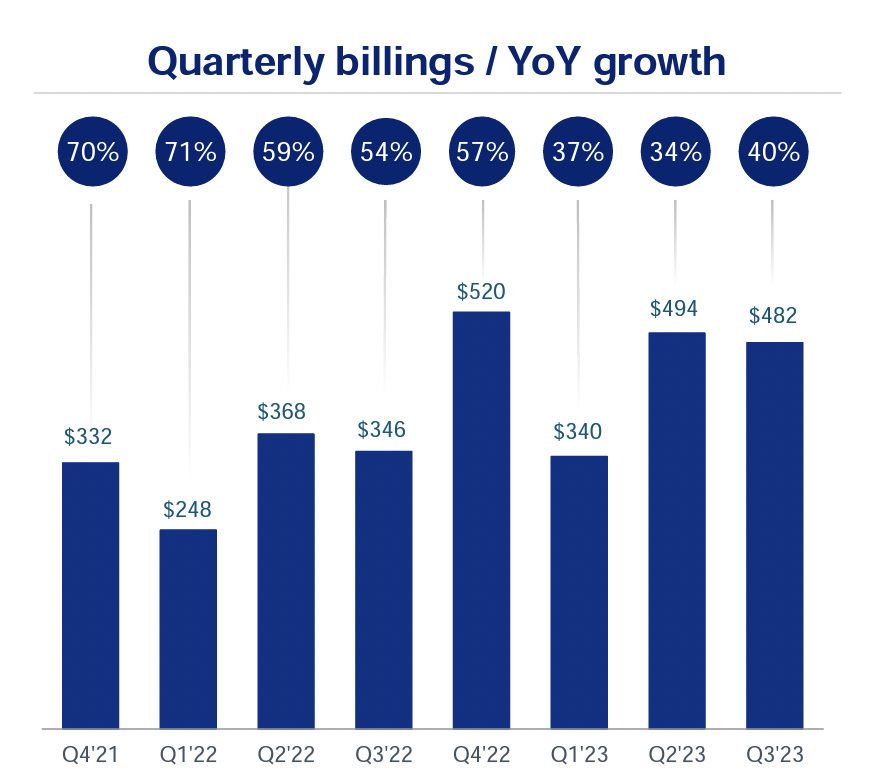

#6. Last Quarter Saw Some Reacceleration in Bookings.

Is this a trend? Have we bounced off the lows in terms of the “marco impacts” of the 2022-2023 era? Possibly. No one’s saying that for sure, but Zscaler did see its first acceleration in new bookings in some time, to 40%, up from 34% the prior quarter. And current billings are up 44%. But Zscaler still said sales cycles are longer, and in fact is modeling them to go even longer for now.

#7. NPS of 70%+.

While NPS isn’t an absolute metric, I still find it directionally correct. 70%+ is impressive.

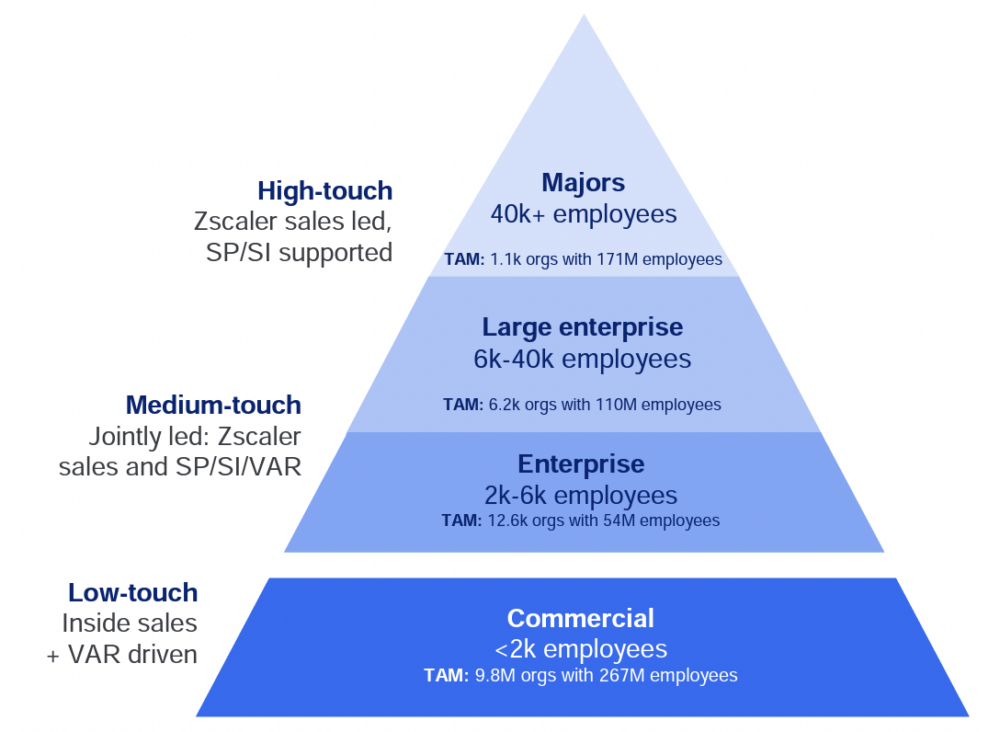

#8. Vast Majority of Revenue Comes in Part or in Whole from the Channel.

In 2021, 94% of Zscaler’s revenue came in part or in whole from channel partners, from SIs at the high end to VARs at the low end. So many enterprise sales are really through the channel — and not direct sales.

#9. New Logos Grew 20% in Last Quarter

This is a strong sign for the future. Zscaler hasn’t exhausted its customer base. Even at $1.5 Billion in ARR, it’s still growing its new logo and customer count 20%.

Wow, Zscaler. Despite deals getting tougher, it’s just powered through the last 12 months. Growth is down a smidge, but efficiency is way up, and growth is still a stunning 46% at $1.5 Billion in ARR.

It doesn’t get too much better than that.