Generative AI is a platform shift where models can take inputs such as text, image, audio, video, and code and generate new content into any of the modalities mentioned. TJ Nahigian, co-founder and Managing Partner of Base10 Partners, and Luci Fonseca, Partner, deep dive into the current GenAI landscape, incumbents vs. startups, and the six questions founders should ask themselves to drive value from GenAI.

For some context, Base10 is a research-driven investment firm focusing on companies automating the largest sectors of the real economy. They’re trying to figure out what will happen with GenAI and share what they’re observing today so startups and incumbents can take advantage of it to build significant value.

Base10 is interested in mega-trends that change how people live and work in the next ten years. We’re at the beginning of a platform shift, and for the first time, GenAI has become accessible to more than just the mega businesses of the world.

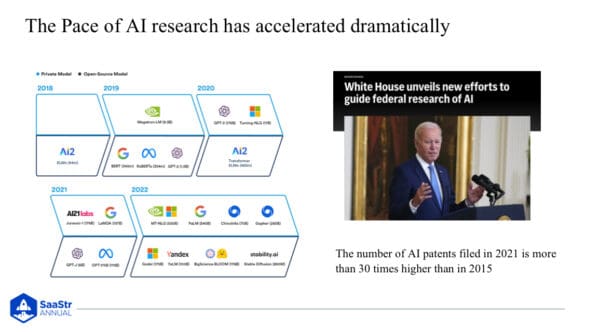

The Pace of AI is Increasing Dramatically

Something ground-shifting has been happening over the last five years — the pace of innovation. The number of patents filed in 2021 in Artificial Intelligence was 30x the number published six years earlier. If we project out and keep the pace of innovation, think about what will happen in the next five years.

We’re on the cusp of a golden age in AI, and the lesson learned from Cloud was that Cloud sped up the pace of development by a lot. At Base10, they expect to see the speed of development and deployment accelerate so dramatically that it will make our heads spin.

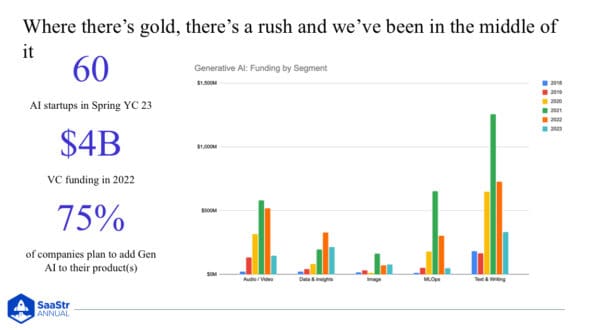

Another way to look at this is by how much venture funding goes into the sector. As founders, you know the last 18-24 months haven’t been the most fun time to fundraise, but with one exception — AI businesses.

Last year, over $4B was raised in the first half. This year, it’s already 5x more than last year, which was 5x more than the year before that.

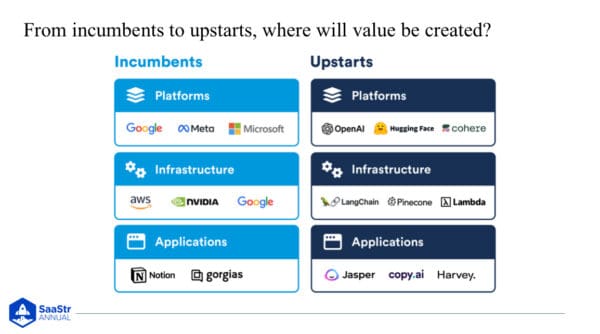

Incumbents vs. Startups — A Framework to Understand Where You’re Building

It’s helpful to have a framework to understand the universe and who’s building where from incumbents to startups. By observing these segments, you can glean lessons if you’re building in the same category.

Within these categories, you have platforms, infrastructure, and applications.

- Platforms are the model layer, the Googles, Metas, and incumbents. Startup platforms are OpenAI, Hugging Face, and Cohere.

- Infrastructure is the layer where anyone allows you to use these largely generalizable models to create something with a more specific use case.

- The last bucket is applications, both horizontal and vertical. For the incumbents, you have Notion and Gorgias, and the startups are Jasper, Copy, and Harvey.

Now, let’s walk through startups at the platform layer.

New Startups: Platform Layer

The platform layer, or model layer, sees OpenAI as the clear giant in the room. Many others are also creating new LLMs and other models that folks use to get value out of GenAI. How are they doing this? By building their own tooling but leveraging third-party tooling as well.

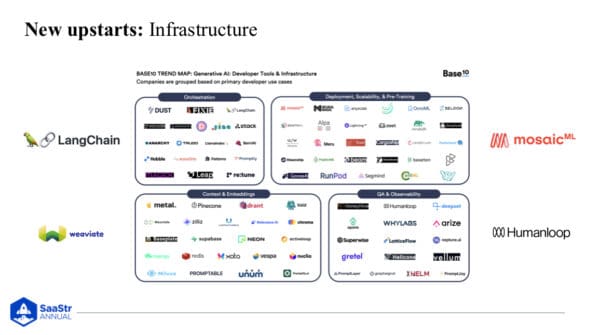

New Startups: Infrastructure Layer

The infrastructure layer is exciting and is tooling that enables you to tweak different models, integrate them, and scale them in cost-effective ways. LangChain is a popular framework to integrate and get value out of GenAI, for example.

There is a whole host of companies innovating at the infrastructure layer to get more value, more control, and cut down costs as they scale GenAI for specific applications.

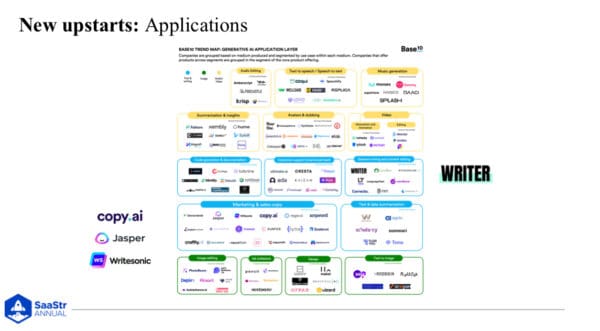

New Startups: Applications Layer

There’s a lot of fascinating innovation happening at the applications layer — changing mediums with text, writing, images, and audio. Businesses are changing the way you create music, recreating how films are made or dubbed, and disrupting the way programmers code.

On the startup side, these businesses have scaled incredibly fast by taking large foundational models and wrapping them in a magical experience for the end user. In the application layer for startups, many face challenges that boil down to retention. It’s been tough for a few reasons.

- For those of you selling to Enterprise, they have experimental budgets that run out.

- For those selling to the prosumer base, they can be very churny.

- There are a lot of copycats, making it difficult to tell a differentiated story.

If you’re a startup building in this space, retention is a challenge, and you’ll need to be more strategic.

Incumbents: Platform Layer

At the platform layer, you can study these three large incumbents.

- Microsoft

- Meta

Each is playing a different strategy. Google came out with the transformer model and then open-sourced it. That enabled LLMs built to leverage GenAI. Google was caught on its heels when it saw how fast OpenAI commercialized its offering. Since then, Google has rethought itself as an AI company, coming out with Bard.

Meta has leveraged incredible tech, primarily for their ad model and monetizing in a material way over the last 7-8 years, and also their feed and content model.

Microsoft is a master class in strategy for us. They’ve opted to partner and outsource innovation, partnering with OpenAI early on with a billion dollars and, more recently, $10B. They have a lot of preferred access, rights, and control over OpenAI.

If you look at the market caps of these businesses, they’ve all done incredibly well this year. If you read earnings reports, two years ago, AI came up maybe once or twice in a call. Now, it’s 100+ times.

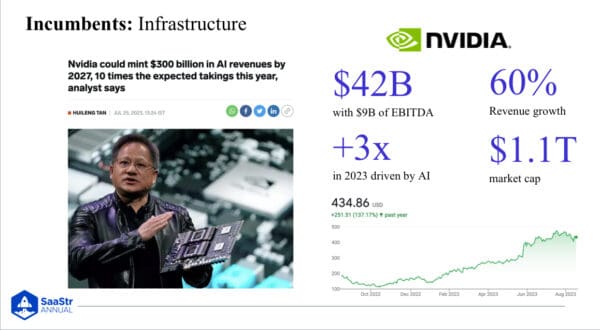

Incumbent: Infrastructure Layer

How do you enable folks to do this? A perfect example is NVIDIA. They are the popularizer of GPUs necessary to run LLMs, and they’ve seen insane demand for GPUs. This last quarter announced revenue was up over 100% in the quarter, and now they’re a top five company in the world by market cap.

We’re seeing this layer created and captured by incumbents.

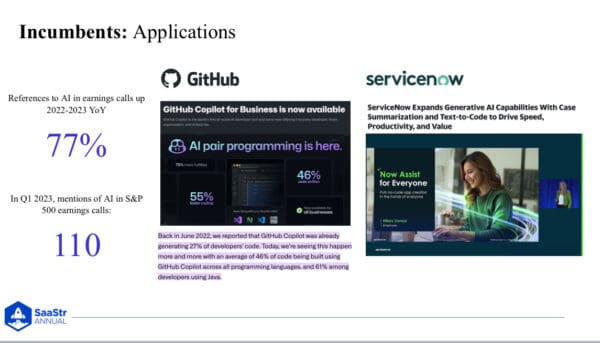

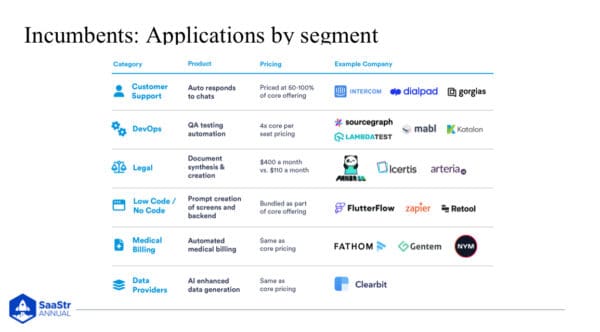

Incumbents: Applications Layer

Incumbents at the applications layer have, by no means, been sleeping at the wheel. NVIDIA is benefiting, not just because of applications at the startup level, but because every single company is developing an AI strategy, and no one wants to be caught without an answer as to what they’re doing with GenAI.

An even more dramatic shift we’re seeing is that many of you are finding yourselves more productive these days. Engineers are more productive because Github’s Copilot writes 50% of code. That’s every other line of code.

If you think about access and democratization of who can create, it’s a really exciting time. ServiceNow has added GenAI into the product so you can do summarization and text-to-code.

What you can see with these incumbent businesses is the ability to experiment quickly with GenAI. Many are doing this in-house, experimenting with open-source tools and building as they go, something worth noting if you’re trying to sell to them.

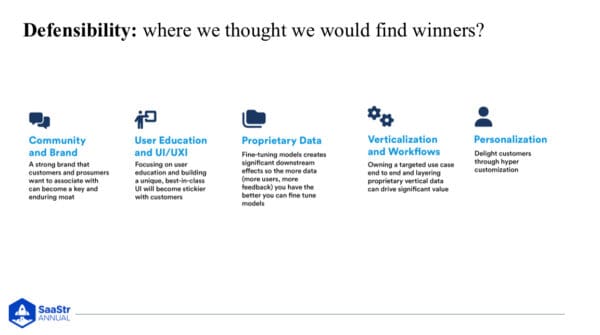

Driving Defensibility and Finding Real Moats

When Base10 Partners started, they were throwing darts at the wall to figure out what would drive defensibility and where the real moats would be found. Everyone said they’d have access to proprietary data, get the best workflows, or hyper-customize in a way that would win.

Today, there are only three things that matter.

- Distribution

- Data

- Workflows

Because only these things matter, Base10 believes that incumbents will capture a lot of the value in this early platform shift because they have huge advantages in distribution, data, and workflow over startup competitors.

Let’s walk through some case studies.

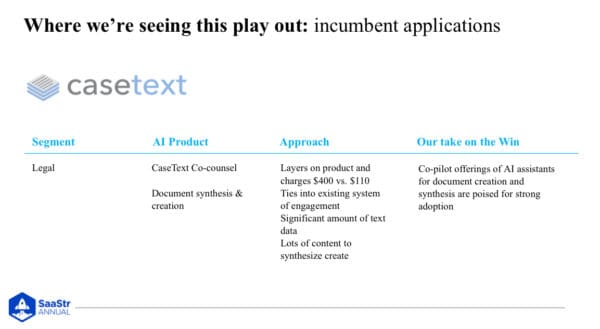

A Case Study: casetext

Casetext is a legal software platform selling to Mid-Market and Enterprise law firms. If you’ve tried to sell to a law firm, you know it can be challenging to get through legal review. Casetext has been doing that for 11 years and built a strong platform.

But business stalled out at around $10M ARR. As a founder of that business, what do you do? Then GenAI comes out, and they’re able to easily plug into GPT and launch their version of Copilot called Co-counsel, which does a lot of tasks lawyers need to do routinely.

It launched last year as an add-on and took off, going from 0 to $9M ARR in nine months. It’s been acquired for about $650M in cash. They achieved this because they had distribution into these law firms, and the law firms wanted to use AI.

If you’re a startup, you’d have a hard time getting through legal review.

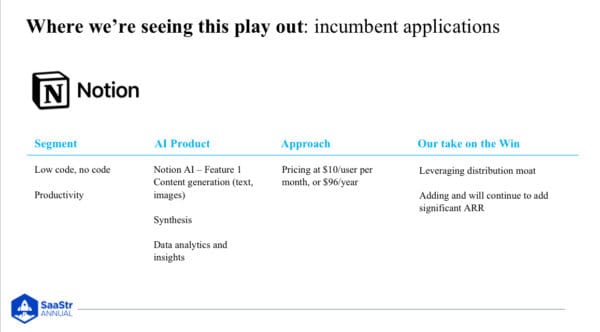

A Case Study: Notion

Base10 spends a lot of time with this team, and they use it every day, leveraging the benefits of NotionAI in their own workflows. Notion launched the first of many upcoming AI features, and they’ve priced it so that it may be at $100M ARR in the near term.

Some important lessons in how Notion executed this include:

- They turned this feature on to a user base of 30M people, including a growing Enterprise practice. Think about the expansion opportunity there. The embedded distribution is a fundamentally huge advantage.

- When using NotionAI, you can utilize it in a workflow in tools that you use every day. It has access to your data and workflows. And while these models are incredibly generalizable, they are useful when you provide them with unique and private data. That’s a huge advantage.

- Understanding Notion’s philosophy around GenAI, it’s clear that this version of NotionAI is a single feature. But they think about GenAI as a core technology, like electricity. So, they’ve gone back to the OG strategy they had 8-9 years ago, making tool-making ubiquitous. That’s the core mission.

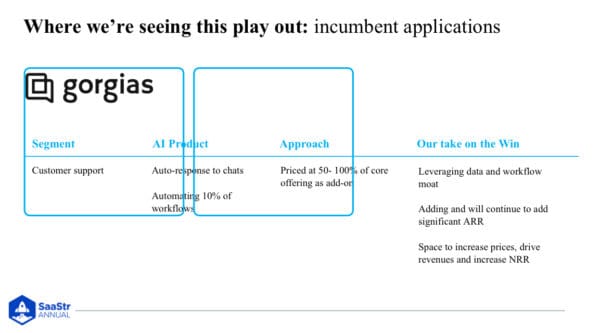

A Case Study: Gorgias

Gorgias is a ticketing platform for customer support focused on e-commerce, primarily Shopify. This is a really constrained use case. The original thesis was to automate everything. It turned out that it was pretty hard to build out workflows and software support systems for individuals to be able to do that at the time.

At the end of last year, they launched automations thanks to GenAI. Their customers don’t know what AI is, but what they do care about is not having to respond to customers to give a better customer experience.

The automations are an add-on, priced at 50% of core offerings. They automated 7% of tickets, and today, are up to 18%. They hope to reach 50%. They have a significant amount of data they can train on this, and they already have distribution across 10k+ merchants.

GenAI and the Business Model Perspective

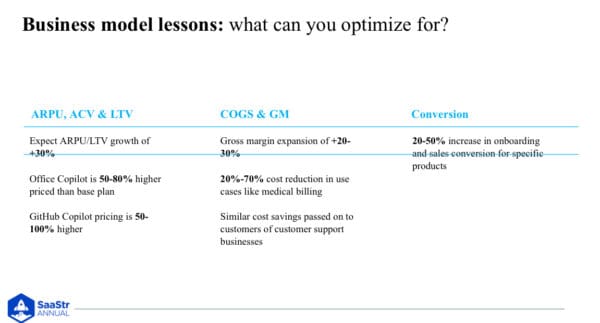

From a business model perspective, a few things are happening.

- ARPU, ACV, and LTV are increasing. Some of that is by launching add-on products that can be priced as subscription fees or transactional per conversation.

- Drop in costs. In the case of medical billing and QA testing for software, a human used to do this. Humans still do, but a lot less of them when you leverage GenAI. Those businesses aren’t dropping prices, so you get a significant margin increase, increasing LTV.

- Retention is increasing pretty dramatically across businesses with data, distribution, and the right use case.

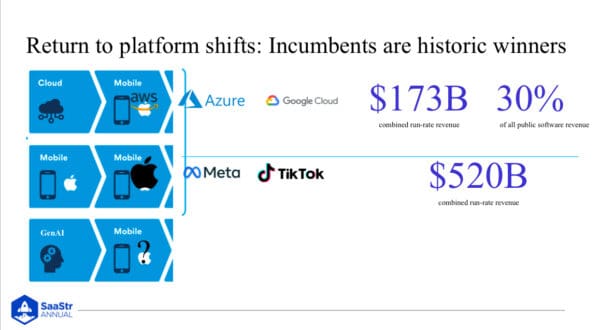

Returning to the hypothesis. Thinking back through Cloud and mobile, what can you learn from them? Amazon wasn’t built as a Cloud business or storage company. It was built as an incumbent e-commerce business. They just happened to launch AWS and ended up capturing way more value just in themselves than the entire on-prem storage market before them.

Meta wasn’t a mobile company, but they captured more value from mobile than AT&T and Verizon combined. The same could happen in GenAI. It doesn’t mean there won’t be startups that win. Incumbents will capture a lot, and we’re starting to see that with Meta and Google, who have traded up dramatically.

This doesn’t mean startups should stand down. It just means that to beat incumbents, you have to be more strategic.

6 Questions Founders Should Ask Themselves

For founders who want to build a new GenAI company, ask yourself these three questions.

- What niche, market, or vertical can you absolutely dominate? Not a slight solution, but it truly dominates in a way that’s not adjacent to particular incumbents.

- Retention is absolutely key. GenAI has fundamentally shifted the way consumers and users actually expect to interact with your product. What can you really change in your product to drive product market fit in a way that tackles all the retention issues these startups are facing?

How do you make GenAI core and foundational to your product and not just a feature? Some of the most interesting GenAI companies don’t even talk about GenAI, but it’s powering everything in the background. You’re building a business for the long term.

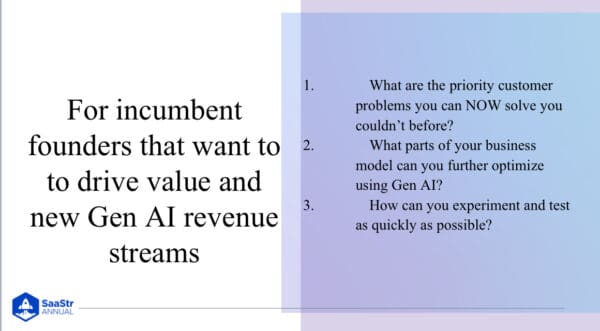

For incumbent founders wanting to drive value and new GenAI revenue streams. Ask yourself these three questions.

- Let’s go back to the original mission and core problem you’re solving for the customer. What are the 1, 2, or 3 problems you can now solve that you couldn’t before because the tech didn’t exist? How do you tackle those and throw resources at them?

- Take out your P&L or metrics dashboard and go through every metric. Ask how Generative AI can actually help you optimize your cogs, LTV, conversions, or whatever.

- The pace of innovation is dramatically fast. How do you actually experiment and test in a way that meets the pace required for this platform shift? There may be cultural and organizational changes you might need to make to do that.