Dear SaaStr: Does Raising Funding From VCs Limit Your Exit Options?

While technically true, especially if you’ve raised a lot (as many did in the Boom Times of late 2020 to early 2022), I believe embedded in this thinking is some bad advice.

VCs are expecting a positive return on their investment. They are hoping for 100x their money (that’s what “makes” a fund), and aiming for at least 10x their money, OK with 5x, and will settle for 2x-3x. And even 1x, if the company fails or deeply struggles.

So if you raise money at say, a $50m valuation, and want to sell for $40m … yes, that’s a problem. The VCs will not be happy. They may even block the sale.

But …

Three things:

First, if the exit price is at least 2x-3x the total amount raised, it can be worked out. It may be messy and painful. No one may make a ton of money, especially employees (unfortunately). But there is usually enough to find a way to work it out if you want to sell for at least 2x-3x the amount you’ve raised. If you raise $100m at a $500m valuation, and sell for that same $500m, the terms can be restructured, they may even have to be. You can still pay the last round guys 2x. It may be a painful set of discussions. Many fists may be banged on the table. But it can be done, and is all the time. There’s still enough cash to go around, one way or another. Same if you sell for $50m after raising $10m. Not a great exit. But it can be worked out. But selling for $50m after raising $50m? Beyond painful.

So yes, you are giving up some optionality when you raise VC money — for sure. But it’s not always as black-and-white as it looks.

Second, make sure you are committed to an exit of at least 2x-3x the valuation of the last round. Be serious and intentional here. Way too many founders treated this all as a game in the Boom Times. Raise at $100m! Be a unicorn! Hooray! But if you’re a unicorn, you’re making an insane commitment. That’s to being worth at least $2B-$3B, and ideally, $10B. Very, very few are. In fact, only 150 private SaaS companies have hit $100m in ARR. More on that here.

Third, and more importantly, be careful about raising VC money if you don’t need it or can’t deploy it very effectively. Venture fundraising should not be done because it can be done. This is the mistake so many founders made in the Boom Times of late ’20-early ’22. You should only raise Venture Capital if you (x) have to, or (y) it’s “cheap”.

If you need VC $$$ to survive, don’t worry about it. It is what it is. I needed VC $$$ to get both my start-ups off the ground. So — why worry?

And if VC $$$ is cheap and you can deploy it effectively — take the money. By cheap, I don’t just mean price. I mean you can easily generate 5–10x the revenues of each dollar you take in. That the money will be super accretive.

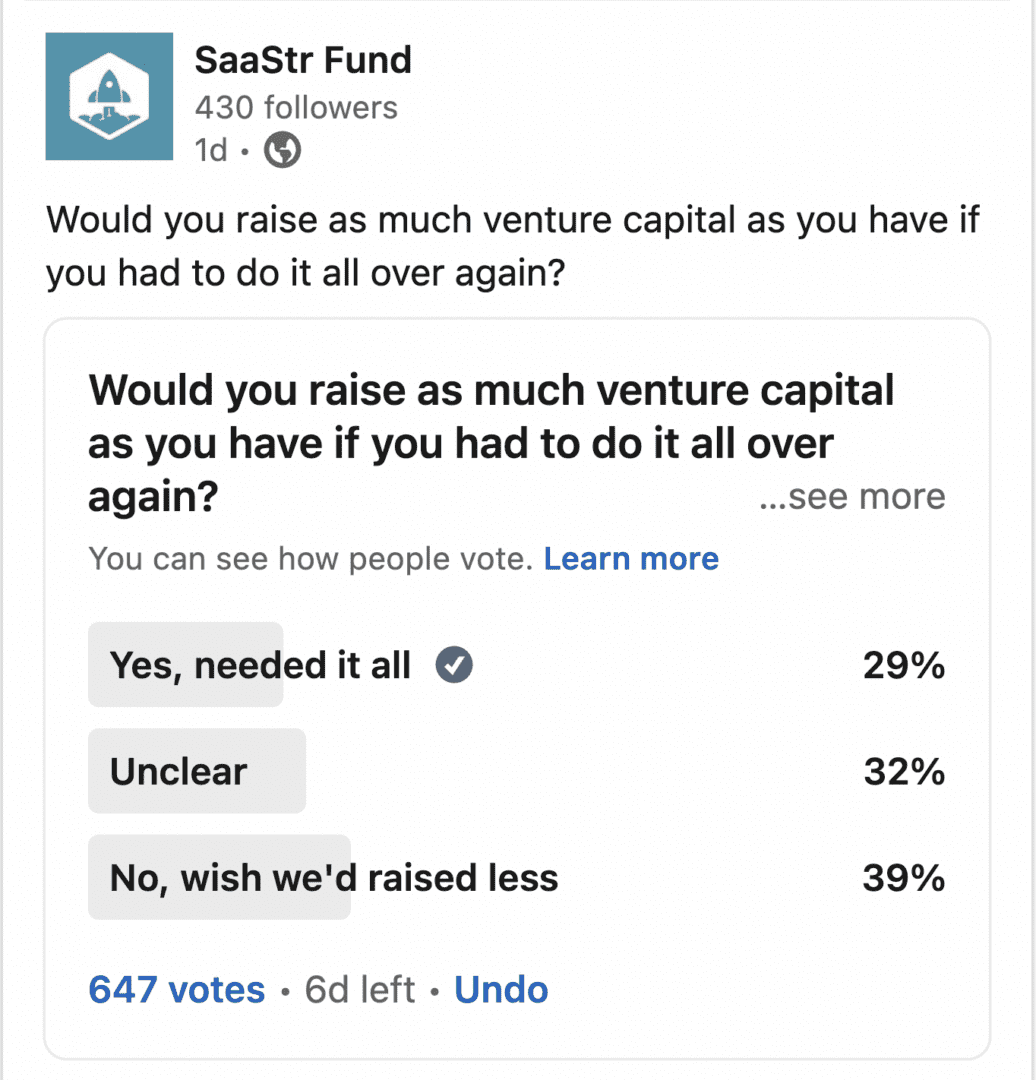

But don’t take VC money just because you can. >> That’s the real trap <<

And especially, don’t take too much if you don’t know what to do with it. It’s very, very expensive capital.