Back in 2012, when the SaaStr audience was about 1/30th of what it is today, I wrote a post that a lot of folks didn’t like: “Workday is Growing 90% this Year. At $250m in ARR. So Wake Up: You Probably Need to Do A Lot, Lot Better.“

Back in 2012, when the SaaStr audience was about 1/30th of what it is today, I wrote a post that a lot of folks didn’t like: “Workday is Growing 90% this Year. At $250m in ARR. So Wake Up: You Probably Need to Do A Lot, Lot Better.“

In fact, it was the first post I wrote that people really hated. They didn’t like it because they didn’t see Workday as a fair comp to almost any other SaaS company. I see their point. Workday is an outlier — the second highest valued, and fastest growing public SaaS company, started by grizzled veterans who sold their last company for $10 billion and had infinite resources to spend. And of course, there are many paths to success. See our classic case study on Pardot vs. Eloqua vs. Marketo on three paths here.

So fair enough. Workday isn’t a fair comp for your SaaS company. We can’t all be WhatsApp, either.

And yet, now we are here in 2014. And I think the message That You Have to Grow Faster has turned out to have been right — at least if you Want To Be Hot. To grab all that venture capital. And probably, to attract and retain the very best talent. To get that M&A offer. Etc.

Recently I met with an outstanding SaaS entrepreneur doing over $8m in ARR, with terrific in-bound lead velocity, and growing revenue almost 100% YoY, in a reasonably hot albeit crowded space with a strong group of existing investors. And yet he couldn’t get funded. Why? It wasn’t good enough. Growing ~100%, Year-over-Year, at $8m in ARR.

Let’s flip it around. The other day, ZenPayroll (which has an outstanding team of founders) announced it had closed a $20m round at a $100m+ valuation. At materially less ARR (I assume) that the company we just discussed. Why? Why was funding (and probably hiring, etc.) so much easier here? Well, according to TechCrunch, “As of last Summer ZenPayroll was processing $100 million in annual payroll, a number that has increased to $400 million [in 9 months].”

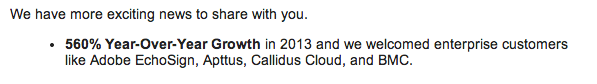

Very well-funded Gainsight recently sent out a similar newsletter, touting 500% growth after their mega round:

In both cases: ~5x growth on the way from $1m to $10m in ARR. (I admit, on top of vanity metrics from an external perspective. Neither company disclosed absolute revenues, which is totally cool by me).

Not just a smidge faster than the first company though. But far, far faster growth. Albeit from a smaller base.

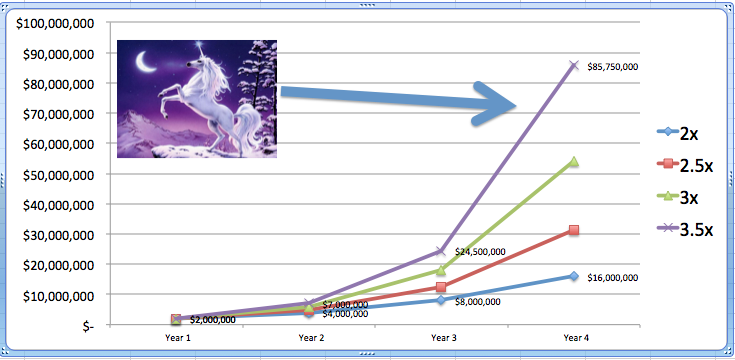

And here’s the thing, from where I sit. It makes sense. Because it’s all about the velocity you build up going from Initial Traction ($1-$2m in ARR) to Initial Scale (~$10m) in ARR. No one really cares how long it takes you to get to $1m-$2m ARR, not really … but it’s critical how fast you get from $2m ARR to $10m ARR. The faster you get there, the more exit velocity you get to, the faster you get to that IPO or Mega Acquisition.

>> In fact, I believe the single most important thing you can do once you hit Initial Scale ($1m-$2m in ARR) in SaaS is run as fast as humanly possible to $10m in ARR.

It used to be >100% YoY growth post Initial Traction was “good enough” to be hot, in the ’05’-06 generation of SaaS 2.0. Then the next wave came of Marketo, Yammer, etc. They grew much faster. 150%-200% YoY or faster post Initial Traction.

Today the bar is even higher in this third wave of SaaS start-ups. The mega rounds, the mega deals we’re seeing. They do make sense. Because while the absolute ARR may still be relatively low in some cases, if it’s early — the growth pace in the best next generation SaaS companies is breathtaking. Because the markets are so much larger today, that the best products should scale must faster. Even my own EchoSign, a relatively old SaaS property, has quadrupled since our acquisition by Adobe, mainly due to market pull. SaaS markets are scaling faster and faster.

So you need to grow faster and faster to keep up. If you do, the rewards are there. The nine-figure valuations. The endless venture capital.

But if you’re at Initial Traction ($1-$2m in ARR) and aren’t growing faster than 125% Year-over-Year … I’d take a quick strategic pause. Because you have to decide what track you are on. Because no matter what you think, at this stage — your market is barely penetrated. I’m sorry, there are no $2.3m or $3.67m TAM SaaS products that any of us would work on. So if it’s feeling hard at $1.5m or so, it’s not a TAM issue. It’s something else.

And figure it out. What can you do to grow faster? Or should you put your head down and grind it out? Both can work. But only the former is going to get the venture capital, the massive sales and success teams, and all that.

It’s not fair our colleague above at $8m in ARR, growing almost 100%, can’t get funded. It’s not fair. And I don’t like it. $8m is only an order of magnitude away from $80m, an IPO, and a big liquidity event.

But 5x is The New 2x in SaaS. It explains the crazy, mega rounds. At least, I think you need to strive for 150%+ YoY growth from $1m to $10m ARR. At least try. It’s just the world we live in.

Unicorn hunters, us all.

Unicorn Hunter image from here.