In some ways, the “local maximum” for SaaS companies was 2015. Valuations as a multiple of revenues, both for public companies and startups, peaked back then.

But revenues didn’t peak. SaaS recurring revenues have just grown from there. Even if multiples have retreated a bit, it almost doesn’t matter. Because many of the best SaaS companies have doubled or tripled their revenues since then.

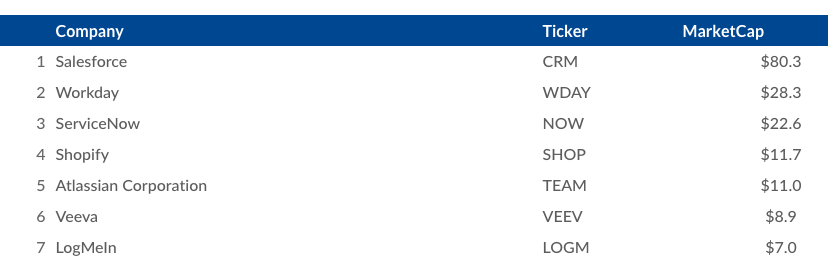

Fast forward to 2018, and we’ve now got 5 SaaS Decacorns and another 7 worth $5b or more.

This is a big change in the evolution of SaaS. I remember when Accel invested $60m into Atlassian at a $360m valuation. I loved the Atlassian products and was a long time customer, but it seemed an insanely large round at the time. Fast forward to today, and Atlassian is worth almost 30x that. $11 billion.

And as long as the good times last, we should add more decacorns to the list. Veeva and others should grow into Decacorns, and Dropbox and Slack and others are potential candidates in the not-too-distant future. And companies like Adobe with huge valuations have become SaaS companies.

This should keep the VC taps running, and Private Equity engines running, and the general SaaS ecosystem thriving, and M&A potential at least interesting — at least as long as the market stays strong.

Hope and confidence are important but fragile things. But for every decacorn, at least when times are good — there can be 10-20 unicorns that can hope to become them. That makes room for 100+ SaaS unicorns today (wow). And for every unicorn, there can be 10-20 $100m+ valuation SaaS startups working and hoping to get there. That makes room in the market for 1000-2000 SaaS startups worth $100m+ or more (!)

Good times, indeed.