The role of finance in SaaS is changing. No longer are finance teams the traditional “bean counters” of ages past. Instead, due to a decade-long exodus from Wall Street, the strategic CFO has burst onto the tech scene.

IVP Partner Michael Miao explains, “The role and the scope of the modern finance team has changed dramatically in the last decade. I think what we’re seeing in all of our portfolio companies and tech at large is that finance is increasingly seen as strategic, and they now have a seat at the table when it comes to making major decisions at the company.”

In a fascinating workshop session, Miao shares his thoughts on how finance teams can contribute to company strategy and grow revenue.

SaaStr Workshop Wednesdays are LIVE every Wednesday. Sign up for free.

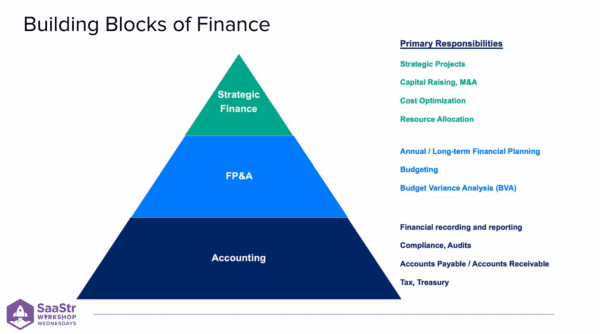

Basics: The Building Blocks of the Finance Team

To understand how finance teams impact an organization, it’s helpful to break down various functions and how they support the business.

The Accounting Team

Responsibilities:

- Financial recording and reporting

- Compliance, Audits

- Accounts Payable/Accounts Receivable

- Tax, Treasury

Your accounting team makes sure every financial transaction is recorded correctly and categorized. Accountants are responsible for ensuring the company has clean financial statements and data. They will also take charge during an audit if the situation arises. This function can be outsourced in the early days of a startup, but it is usually brought in-house after Series B.

FP&A Team

Responsibilities:

- Annual/Long-Term Financial Planning

- Budgeting

- Budget Variance Analysis (BVA)

The FP&A (Financial Planning & Analysis) team owns the company model. Team members are responsible for putting together a company’s financial plan, budgeting, and building a financial roadmap for their business.

The Strategic Finance Team

Responsibilities

- Strategic Projects

- Capital Raising, M&A

- Cost Optimization

- Resource Allocation

The strategic finance team works on special projects that either increase revenue or decrease costs. Strategic finance can be thought of as a project management function for your company’s underlying business model or a BizOps team that operates within a more financial lens.

Strategic Finance Core Responsibilities

“The core of the strategic finance team aims to optimize a company’s business model, and they do this by either increasing revenue growth or decreasing costs.” – Miao.

Strategic Finance optimizes a company’s underlying business model to create long-term value by increasing revenue and decreasing costs. The team is typically highly cross-functional, working together with sales, product, engineering, and marketing, and the goal is to help the other teams make better decisions through data and financial modeling.

To get a clear picture of how strategic finance functions, it’s helpful to gain insight into their core goals and responsibilities.

| Growth Strategy | Identify and implement new growth opportunities and revenue streams. |

| Cost Optimization | Identify and implement strategies to improve margins. |

| Business Development | Identify and assess partnership opportunities to drive growth |

| Business Intelligence | Turn data into insights to inform decision-making. |

| Cross-Functional Alignment | Get buy-in from all stakeholders on key initiatives. |

| Capital Raising | Manage and execute equity and debt transaction to raise capital. |

In Action: Strategic Finance at Dropbox

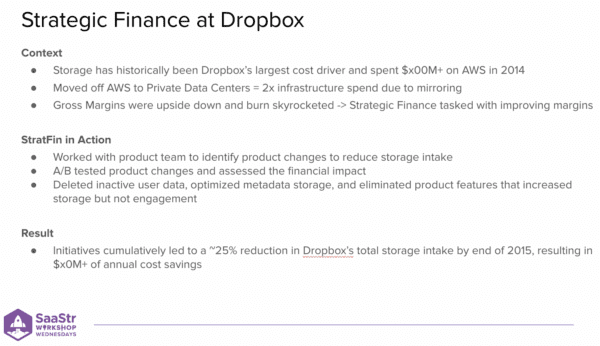

Before becoming a Partner at IVP, Michael Miao had experience in strategic finance at Dropbox. Miao’s experience at Dropbox helps illustrate how the financial team’s input can help a company reach a more successful growth path.

In 2014, storage had historically been Dropbox’s most significant cost driver, with hundreds of millions of dollars spent on AWS. In its early days, the company made many decisions that boosted user growth, but there wasn’t deep thought about the cost implications.

When Dropbox decided to move off AWS to their own private data centers, they realized that it was a very capital-intensive feat –– there was twice the infrastructure spend due to mirroring from AWS to their own data center. Gross Margins skyrocketed, and the Strategic Finance team was tasked with improving margins.

So, Miao and the team got to work. They consulted with the Product team to identify product changes that could reduce storage intake. A/B tests were conducted to try product changes and assess the financial impact. They decided it would be in the company’s best interest to delete inactive user data, optimize metadata storage, and eliminate product features that increased storage but not user engagement.

As a result of these initiatives, Dropbox saw a 25% reduction in total storage intake by the end of 2015, which meant that the company saved tens of millions of dollars per year.

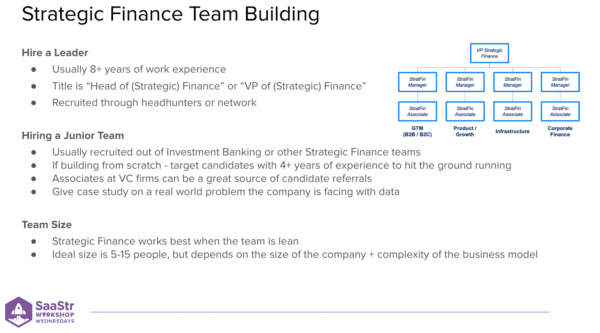

Hiring the Right Leader and Building a Team

“In terms of skillsets, I think you need people who are really analytical and who also enjoy ambiguous problem-solving.” – Miao.

As you search for your next Strategic Finance leader, there are some essential qualities that a successful candidate should possess. Some critical skills will include analytical and problem-solving skills, data literacy, excellent communication skills, and a deep understanding of business models.

A Strategic Finance leader should also have a particular mindset to optimize impact. Intellectual curiosity, agile decision-making, calculated risk-taking, and confidence to respectfully challenge peers and the status quo are all important elements of a Strategic Finance leader’s approach. But most important of all, your chosen Head of Finance should be comfortable with ambiguity and always be proactive, not reactive.

A single person can’t carry the weight of the financial strategy forever. You must build a lean, impactful team to help your business scale.

Strategic Finance Team Building Game Plan

- Hire a Leader

- Find a seasoned candidate –– preferably someone with 8+ years of work experience.

- Prioritize the appropriate skillset and action-oriented mindset in your search.

- The title could be “Head of (Strategic) Finance” or “VP of (Strategic) Finance.”

- This role can be recruited through headhunters or your network.

- Hire a Junior Team

- You can recruit your junior team from investment banking or other Strategic Finance teams. Hint: Associates at VC firms can be a great source of candidate referrals.

- If you are building the team from scratch, target candidates with 4+ years of experience to hit the ground running.

- Team Size

- Strategic finance works best when the team is lean.

- The ideal size is 5 – 15 people, but it depends on the company’s size and the business model’s complexity.

Key Takeaways: Best Practices to Set the Team Up For Success

- Ensure the CEO and CFO instill a culture of accountability and team alignment.

- Encourage bias towards action. Remember, be proactive, not reactive.

- Leverage Strategic Finance to provide broad context to other teams.

- Build a culture of data-forward thinking from day one.

- Invest in next-gen finance tooling. Investigate new software designed to automate more tasks and support more strategic initiatives.