With the turbulence in the market in 2023, sales cycles have only been getting longer and a lot more complicated. At this year’s SaaStr Annual, CEO and co-founder of Capchase Miguel Fernandez and Director of Marketing Rose Johnson share five tips for getting sales right in any market.

They wanted to quantify this trend of a longer sales cycle, so they commissioned a study of 500 revenue leaders in the U.S. to find out what was going on.

What were some of the reasons for longer sales cycles?

- Churn increase due to greater scrutiny of costs

- Contract values declining

- More stakeholders involved in decision-making

Capchase combined the study with their data set of thousands of SaaS companies and looked at what the best companies do to overcome these hurdles.

Here are the top five tips to get sales right, no matter the market.

#1: Cut the Sales Cycle

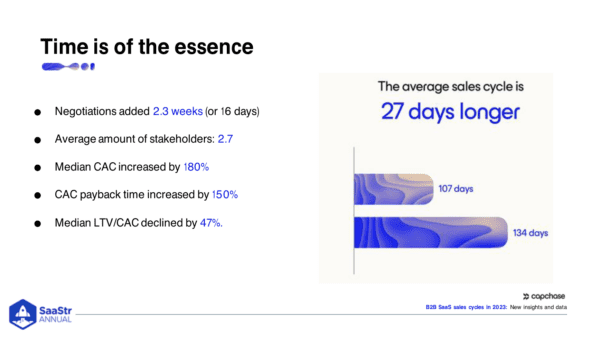

This is easier said than done. Sales has gotten harder, and those cycles take almost one more month to close than before. The sales cycle is important because it cascades into a bunch of critical metrics for you and investors, including revenue. So if deals take longer to close, you’re spending more money and paying people longer, so your customer acquisition costs are increasing, payback takes longer to materialize, and your LTV to CAC goes down.

The sales cycle is even more critical now more than ever since every buyer is much more cautious about budget. People are looking at competitors more and making sure that what they’re buying is generating a positive ROI of about 10x.

What are the best companies doing?

- Discovery. Discovery is super involved now, and you need to understand what pains customers have and then isolate the most pressing pain your product can solve. Use this knowledge across the whole process to refer to constantly and drive urgency.

- Lay out the sales process early on. You need to be transparent with the sales process with champions within companies. Lay it all out at the beginning and make sure the prospect is interested. And then run all of those processes at the same time. Running parallel streams instead of one after the other will speed up the sales cycle.

- Know what your buyer really cares about. What is that one blocker that could delay sales? It could be price, product composition, or payment terms. Whatever it is, you need to understand if you’re able and willing to compromise on it. Then, get something exchanged. If you want to cut the sales cycle, always do an exchange of urgency, i.e., “I’ll accept flexible payment terms, but we need to close this week.”

#2: Offer Flexible Payment Terms

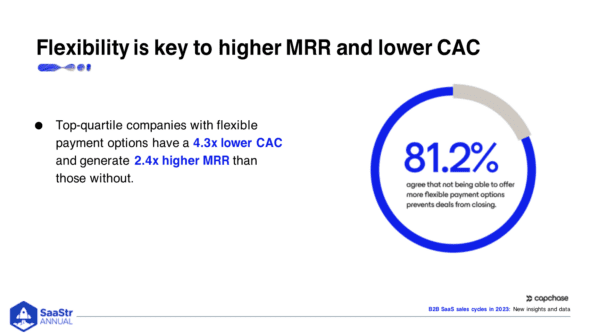

This is another debate going on in SaaS. Do you charge upfront or should you be flexible? Either option has pros and cons, but today every vendor wants to get paid upfront, while every buyer wants flexible payment terms as late as possible. If you want to accelerate your sales cycles, you need to meet customers where they are. Offering flexible payment terms increases the likelihood of closing the deal. If you don’t have flexible terms, you may have to wait while the business builds a feasible use case, or you may ultimately lose the deal.

How can you justify flexible payment terms to your internal stakeholders? The reality is you need to meet customers where they are. Make it easier for them to buy your product. If they want to pay monthly or quarterly, offer it to them. This has cons. Cash-flow could suffer, and you get paid month-to-month instead of upfront. Collections are also tricky, as the hardest part is staying on top of different payment plans for different customers. But as founders, we value everything as ARR growth.

How many customers do you close and retain, and how much are they paying? That’s your North Star. You can solve for cash upfront with a third party, but you can’t solve for more customers at a higher price, so make that your top priority. One of Capchase’s customers, which is at $7.8M ARR, changed from forcing payments upfront to flexible terms, and growth skyrocketed almost 200% while a competitor in the space grew 54%.

#3: Make Renewals Painless

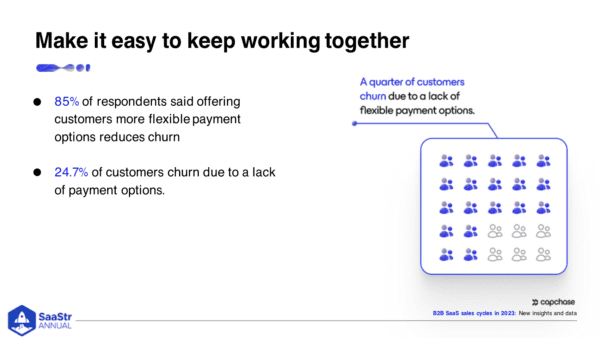

The overwhelming majority of respondents in the survey said being able to offer flexible payment terms could make a real difference to existing customers and reduce churn. About a quarter of customers do churn because of a lack of these options. For example, one of Capchase’s customers at $7.5M ARR selling freelance management software offered multiple-tiered pricing to offset some impact of increasing prices by 56%.

During that same price increase time period, they reduced churn by 60% because of this flexible pricing structure. The answer? Make customers feel heard during negotiations, make more concessions to existing customers, and let customers pay on their own terms.

#4: Be Careful with Heavy Discounts

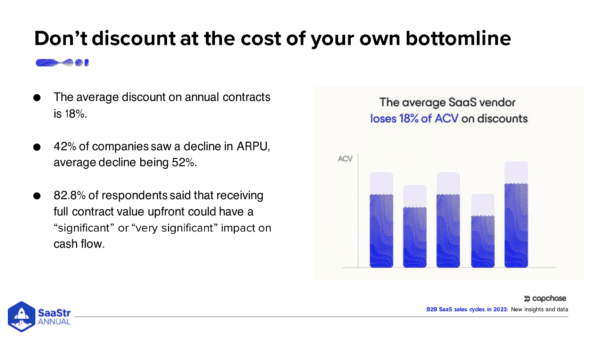

There’s a saying that shortcuts take longer, and this is the same with revenue. When it comes to pricing, companies and customers want entirely different things, and this is where discounts come in.

The average SaaS discount is roughly 18-20%, yet we’re moving into an era of efficient growth. So, while discounts are a short-term win, they are painful in the long term. We need to stop overtly discounting. There are other ways to realize the full contract value without relying on heavy discounts that ultimately hurt your operating margins.

What are the top companies doing to combat the discount?

Reorienting the conversation. Customers you acquire through heavy discounting are more likely to churn in the long run. So, moving the conversation into flexibility sets you up for success and protects your ACV and overall margins. Another example from Capchase’s customers is a $13M ARR healthcare SaaS company. They offered monthly billing and increased their revenue by over 200%.

#5: Optimizing the Sales and Billing Process

You want to optimize and automate as many things as you can in your sales, billing, and collections processes. The one thing no one talks about in SaaS is getting good at collections.

This is important now when most invoices are paid late, and the probability of getting paid decreases with every day that it’s left unpaid. Getting paid on time and automating collections matters from a cash flow perspective, and it also takes a ton of time and energy to chase a payment due. The reality is that most collections processes only involve following up and asking for the status of a payment, which isn’t helpful, with 49% of invoices not being paid on time.

Capchase found that more than three people per company work full-time on invoices, billing, and collections. That’s not a value-add because you’re chasing revenue you already closed and trying to get paid what’s due.

How do you get paid on time in an efficient way?

Define a good collection policy. This has two components. One is automation, and the other is escalation. Automate reminders that an invoice is coming and automate frequent reminders that it was due and not yet paid. Escalation adds more people to those reminders on the buyer side. Make more people aware and increase the tone of voice, talking about penalties, breach of contract, etc.

Make it easier for customers to pay you. Embed different payment types both in invoices and reminders. Make it easy to pay by credit card, ACH, transfers, etc. Maybe you include extended payment terms in exchange for a promise to pay by a specific date.

3 Key Takeaways

- You need to audit your whole sales process and remove the friction. Get models ready to show the ROI of your product and then streamline your sales process, running as many things in parallel as possible.

- Every buyer finds it much harder to justify a purchase. They’re looking at many more things, so you need to differentiate and meet customers where they are. Offer flexible payment terms if they need them.

- Everyone is doing more with less. Have your teams focus on doing the things that add value, like adding revenue, sales, and retaining customers — not doing busy work. Automate what you can, especially those things that are important for the business, like collections, but aren’t a value-add.