In theory, many things can kill a SaaS startup after $4m-$5m ARR

In practice, quitting is the only thing

In theory, many things can stop a SaaS startup after $4m-$5m ARR from getting to $100m

In practice, high churn is the only thing

— Jason ✨BeKind✨ Lemkin ⚫️ (@jasonlk) January 17, 2021

Part of my job when I invest in a start-up is to get folks excited about the company. It’s not that hard. Because I am genuinely excited. Or I wouldn’t make the investment. And part of the picture I try to paint for the The Next Investor is where they’ll be in 12-18 months.

E.g., “Well, MaestroQA is at $5m ARR and has grown 14.20309% a month for the past 5 months and is completely changing the way a $50 billion market does …” [numbers not actual, just for the sample anecdote].

If the growth is there, the company is solid, the market good, and the CEO credible and strong, then usually, there’s just one point of pushback I get.

“It will never last. There’s no chance they can keep it up.”

OK, I say. Agreed. But what’s going to stop company X from continuing to grow at outlier rates?

“You’ll see,” they say. “I have so many companies in my portfolio that totally stalled out at $20m ARR”.

After hearing it about 15-20 times from many of the most successful SaaS VCs, I decided to do a bit of an analysis here. I don’t have all the data. But I’ve now looked into almost 20 SaaS companies that stalled out somewhere in the $20m-$40m ARR range. And I’ve found an obvious pattern.

After hearing it about 15-20 times from many of the most successful SaaS VCs, I decided to do a bit of an analysis here. I don’t have all the data. But I’ve now looked into almost 20 SaaS companies that stalled out somewhere in the $20m-$40m ARR range. And I’ve found an obvious pattern.

It’s not market size. The best founders always find a way to grow their deal size, their market, their segment. Almost always. They solve a bigger problem. They expand the platform. They go upmarket.

It’s not competition. Yes, they can slow you down. But if you are the #1 or #2 by market share, competition can slow you, but it doesn’t stall you out. More on that here. Unless your competition is much more agile than you, they can’t really kill you once you hit even $3m-$4m in ARR.

It’s not leads and sales and marketing. Sometimes it is, yes. But once you have a brand, one way or another, the leads come. Often not enough of them. But they do come. And the sales team, even if they are imperfect, gets pretty good at selling a product after they’ve been doing it for a while.

Turns out it’s always the same root cause.

The ones that stall out at $20m ARR, or thereafter? They all aren’t beloved products. They all have low NPS, or at least, relatively high churn and low NRR. They all have brands, yes. But the customers are really only behaviorally loyal — see more on this critical point here. The customers use the product because they have to. Not because they love to. It’s what we use for sales automation of a certain process. Or marketing automation of a certain process, they say. We use it. But. It goes down all the time. But. It’s really dated. But. No one ever gets back to our calls. But. It doesn’t have core competitive features. But. No one ever comes and visits us and truly solves our problems.

Because what happens is, just as you finally go from Mini-Brand to Real Brand, you start to get into every deal. That’s when it actually gets easier on many levels, usually around $10m ARR or so, whenever you have a true brand (more that here). Then every prospect has heard of you. They all at least want to kick the tires.

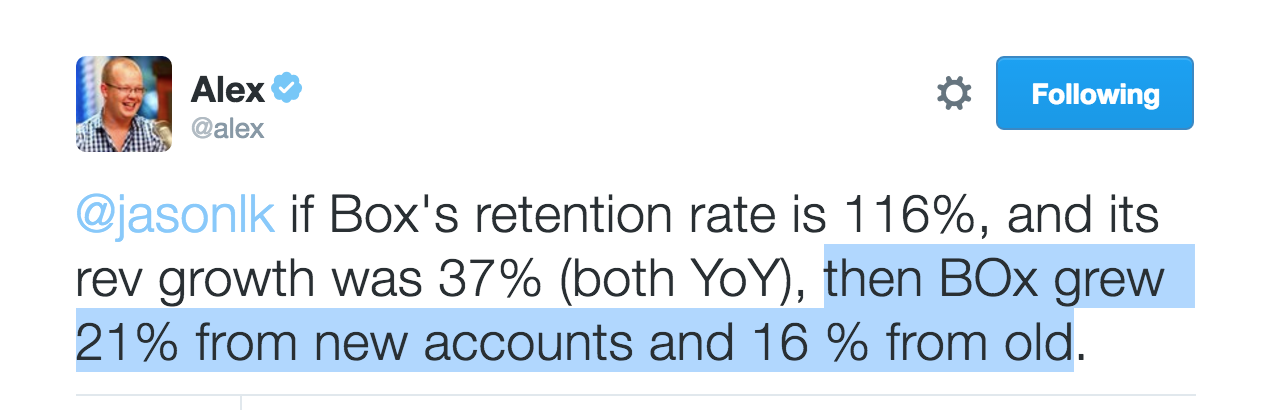

And if your customers love you — magic happens. This is when Second Order Revenue really kicks in. They actively recommend you to their colleagues, and their peers at other companies. Importantly, they buy more stuff from you, too. More seats. More editions. More of everything. Look at Alex Wilhelm’s tweet on Box’s financials above. I don’t know what Box’s NPS and CSAT scores are. But I do know they are high. Otherwise, there’s no way they could generate 40% of their growth from their existing base. And if Box (and its CEO) weren’t loved, they’d be growing 15-21% a year. Not 37%. That’s a huge, huge difference, my friends. More on second order revenue here.

OK, so what’s actionable here?

A few things:

- First, if you aren’t measuring NPS and CSAT yet — start NOW. This month. THIS WEEK. DO IT. I didn’t. It was a big mistake. More on that here.

- Then, segment your NPS and CSAT, so you can see the trends. Are bigger customers happier than smaller ones? Are your buyers happier than your end users? All of this happens. Segment it into 3 groups, ideally, no more than 5 or so. Too few and you can’t see the variances. Too many and it’s too much for everyone in the company to grock.

- Then. make measured customer happiness one of your very core metrics at the company. And review it, and grade progress, at every company meeting. Put NPS and CSAT and churn in every weekly and monthly email. This will rally the troops to the significance of customer happiness as one of your core value.

- Then, set a core company goal here to improve. To drive NPS (and NRR) up. Every quarter, and every year. Period. If your NPS is low, don’t judge. Just acknowledge it and set reasonable goals to improve it each quarter, and maybe even, each month. You can make monthly improvements on the human interaction side at a minimum.

The reality is, there is too much to do in every start-up. One of the corners some of us cut is customer satisfaction. It’s not that we don’t care. But, we de-prioritize customer success. We don’t measure NPS. And often, we sort of live with the complaints, as part of reality. There’s only so much we can do, and we have to pick our battles.

Well, if your NPS is 0 or 10 or 20. Then you’ll stall out. And you’ll stall out once you have a real brand, and it’s just getting good. Because churn will be higher than average. And upsell will be lower. Best case, you’ll grow 30-40% slower than you otherwise would. And that’s with a great sales & marketing team. Worst case, you’ll never really truly benefit from net negative churn.

You’re gonna tell me no one in your industry has high NPS and CSAT.

Well — Poppycock. I have investments in both legal and HR spaces (notorious for low NPS) both with NPS scores across all customers in excess of 60.

More importantly, whatever your NPS and Customer Satisfaction is — you can drive it up. You can. I guarantee it. Make it Job 1 and amazing things will happen. And importantly, this is the one thing everyone in the company can help with. Support, engineering, product, sales, success, marketing, everyone. Everyone knows how to make customers happier. Everyone.

Yes, you can shove stuff through the channel. Yes, great sales teams can close crazy well, and mask issues for a while. Yes, venture capital can help smooth out the bumps here.

But, once you have something, don’t let your customers say they are only using you because it’s the best solution they could find. Or the one they are used to.

You have to be the one they love.

(note: an updated SaaStr Classic post)

Agreed, the entire content marketing platform category got to 10-30M in ARR before churn eventually made the category fizzle out. Most did not make it.

— Shafqat Islam (@shafqatislam) January 17, 2021