Veeva Systems is a quieter SaaS enterprise giant that if you sell bigger deals, and/or do vertical SaaS, it’s worth learning more about.

CEO Peter Gassner is truly of the most impressive founders I’ve personally met and you can take a look at our deep dive from SaaStr Annual 2017 here not long after they’d IPO’d:

One of many remarkable things about Veeva: it burned about $3m on the way to IPO. Yes, $3m. In basically one venture round and a bit of angel investing. And that’s with a sales-driven, enterprise model.

Fast forward to today, they are growing 29% at $2 Billion in ARR!

5 Interesting Learnings:

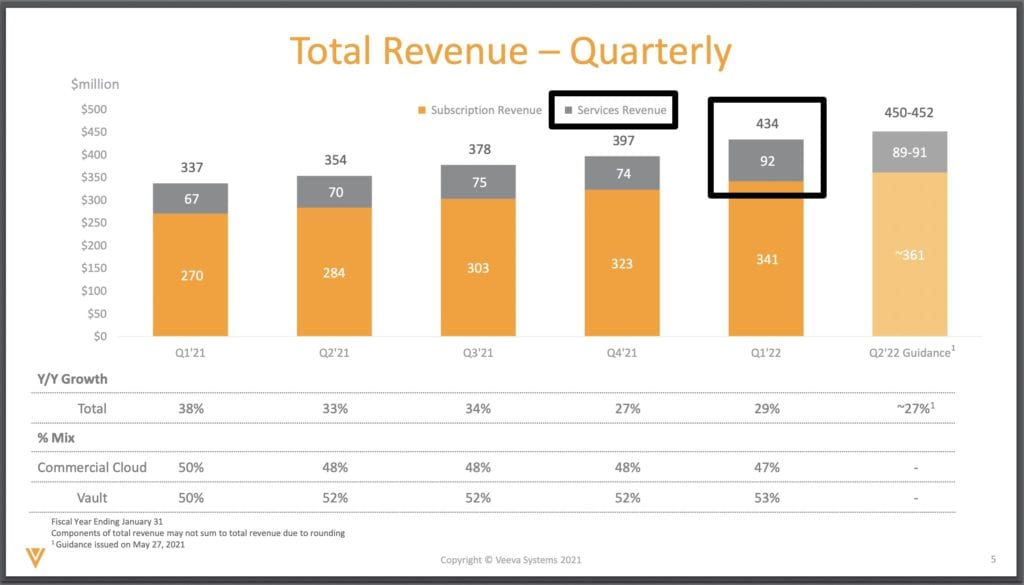

#1. Professional Services remains 20% of revenues, even at $2B in ARR.

We’ve talked a lot about professional services over this series, and seen folks like Qualtrics, and now Veeva, sell them profitably, for up to 20% of revenues, and others in the enterprise try to minimize the services revenue and have partners do most of the heavy lifting. Salesforce and ServiceNow do the latter. Salesforce, for example, only gets 6% of its revenue from services. More on that here. Different approaches clearly work for different vendors. But it’s interesting to see that even at $2B in ARR, Veeva continues to “in-source” professional services:

More on services revenue here.

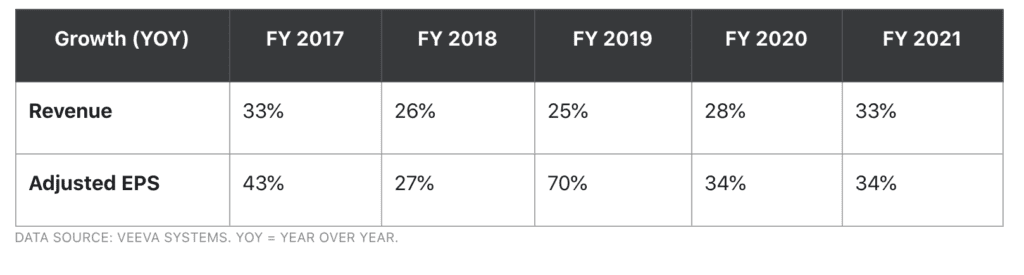

#2. Revenue has accelerated in 2021 — even at $2B in ARR — to 34%.

It’s incredible how many Cloud leaders today at $1B+ ARR are not just growing quickly, but accelerating. Veeva is another. Veeva is growing far faster than the 25%-28% rate in 2018-2020:

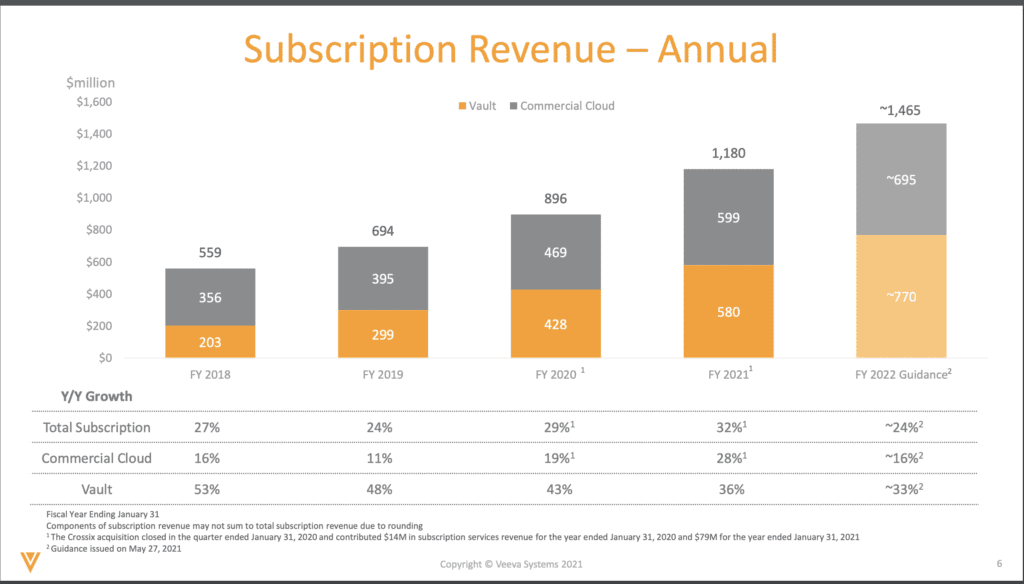

#3. A 2 Product line is key to growth at scale.

Veeva has 2 core products — it’s CRM-like Commercial Cloud for pharma, biotech, and more, and its Vault product for similar industries. For a while, it seemed like the Commercial Cloud product had matured and Vault would be the future growth engine. Interestingly, at $2B in ARR, both are now making equal contributions. Commercial Cloud growth reaccelerated, and Vault growth normalized:

#4. NRR still going up, at 124% today.

We’ve talked a bit on SaaStr about how your NRR often can stay high forever, and Veeva is another great case study. NRR is at 124% today, and that’s up from 121% in 2021 and 122% in 2019.

#5. 1,000 Customers at $2B in ARR. So about $2m ACV on average. And added 59 new customers last quarter.

Another reminder that the enterprise is far bigger than the Fortune 500 and Global 2000. Veeva already has 1,000 enterprise customers alone — that pay $2m each a year on average! And it’s adding 59 a quarter, so that’s another 250 new enterprise customers a year or so. A reminder there are 1000s of enterprise buyers for every leading product. ServiceNow also has well over 1,000 customers paying $1m+ a year (that story here).

And a few other great ones in this series:

- 5 Interesting Learnings from Zendesk. As It Crosses $1B in ARR

- 5 Interesting Learnings from HubSpot as It Approaches $1 Billion in ARR

- 5 Interesting Learnings from RingCentral. As it Approaches $1B in ARR.

- 5 Interesting Learnings from Palantir at $1 Billion in ARR.

- 5 Interesting Learnings from Slack at $1B in ARR

- 5 Interesting Learnings from PagerDuty, as It IPOs

- 5 Interesting Learnings from Zoom at IPO

- 5 Interesting Learnings from Bill.com at IPO

- 5 Interesting Learnings from Asana at $250,000,000 in ARR

- 5 Interesting Learnings from Qualtrics at $800m+ in ARR

- 5 Interesting Learnings from Xero. As It Approaches $1B in ARR

- 5 Interesting Learnings From Snowflake at $600,000,000 in ARR

- 5 Interesting Learnings from New Relic at $650,000,000 in ARR

- 5 Interesting Learnings from Box At $800,000,000 in ARR