There may or may not be an extended funding winter in the coming months, but it’s clear that something is going on right now. One only has to read Twitter or any VC blog post to know that things have changed in the funding environment. Growth at any cost is no longer rewarded and startups need to pay close attention to their burn rate and runway. At SaaStr Europa, Point Nine Managing Partner Christoph Janz shared tactical advice on how to weatherproof your financial plan for the funding downturn.

You can see Christoph’s slides here.

Hyper-growth is great, but don’t die trying

Have you ever been just crushing it, maybe to the point that your VCs are telling you your burn rate is too low, only to wake up one day and realize everything has turned around? Now your burn is rate is way too high and your runway is dangerously short. It happens to almost everyone at some point. What happens when you go from boom to bust and how do you deal with it or even prevent it?

How companies can go from boom to bust in a matter of months

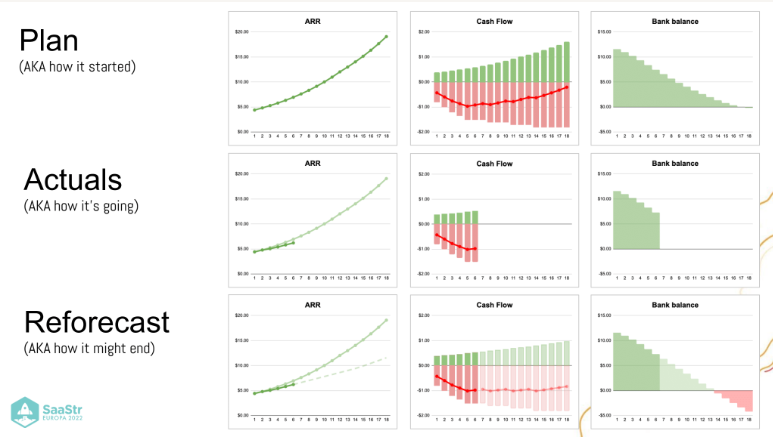

Growth slows down, but you keep spending at the same rate. In the best-case scenario, you might have to raise at a much lower valuation that you’d like. In the worst case, you can literally run out of money. Because SaaS compounds, what seems to be a small variation in actual ARR from planned ARR can create huge cash flow problems quickly if you don’t adjust your spend.

The ability to adapt quickly is absolutely critical. Fortunately, one benefit of being a startup is being agile. You have to be focused on the right KPIs, though, or you won’t be able to react quickly enough.

What to do if you’re already dangerously close to sinking

David Sacks uses the phrase “default investible”. There is no “one size fits all” answer, and this will look different for every company, but it does mean that your metrics are such that you are fundable in whatever the current climate is.

As you scale to later stages, measurable metrics become much more important than qualitative things like your team, product, market, and competition. For later rounds, VCs will be looking at growth, churn, net expansion, efficiency, etc.

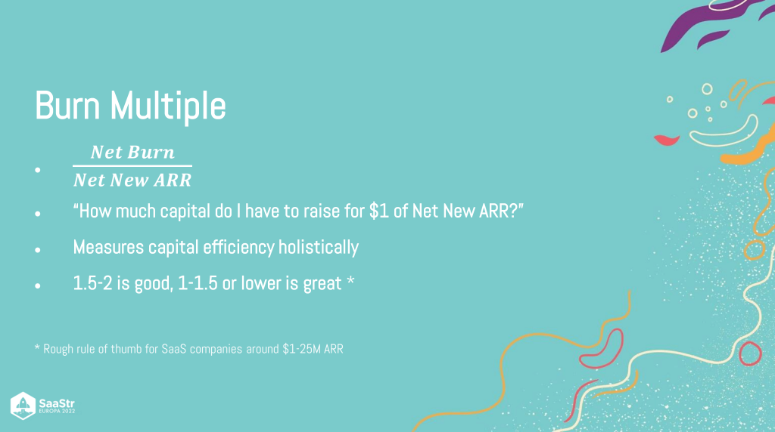

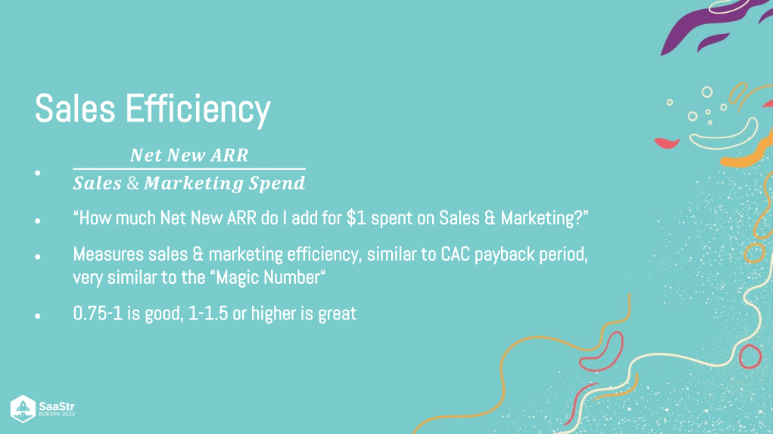

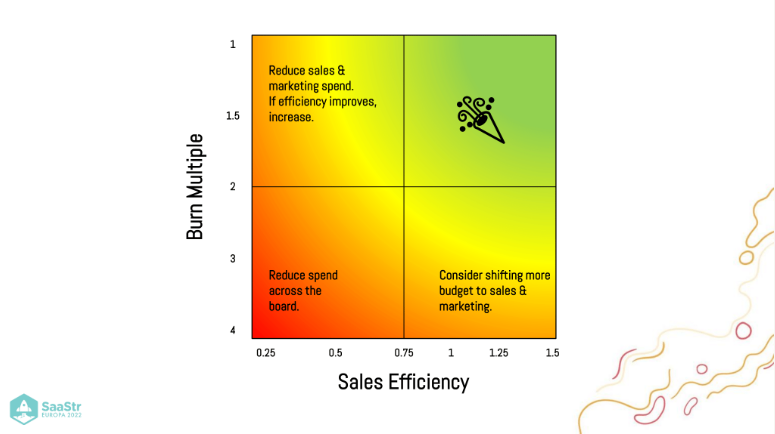

Growth continues to be crucial, but in the new funding environment, growth at any cost is no longer rewarded. You have to find the balance between growth and efficiency. To measure efficiency, Janz likes to use the Burn Multiple and the Sales Efficiency metrics.

You may think that anytime you’re spending too much, you should cut back on sales and marketing, but efficiency is really important here. Cutting sales and marketing may actually be the worst thing you can do right now. It’s going to depend on which quadrant you fall into.

Takeaways:

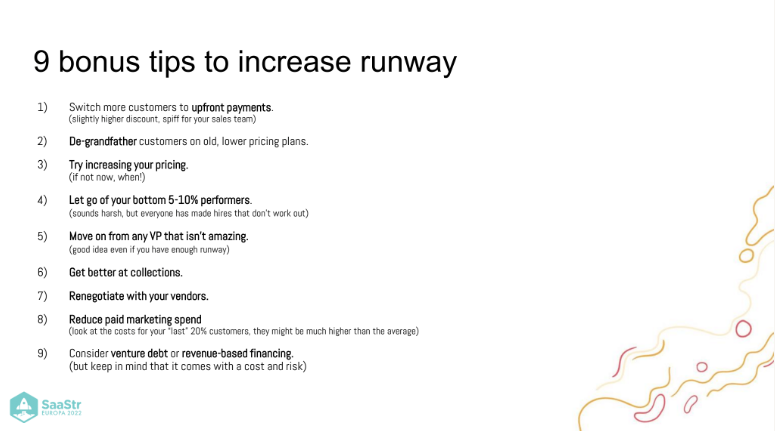

- You can, and should, have an ambitious plan, but your runway must be based on a more modest plan. Even the smallest decrease in net new ARR will compound quickly and erode your runway month by month.

- Have guardrails in place, such as a “burn budget” and adapt quickly when net new ARR slows down.

- If you can’t become “default alive”, become “default investible”.

- Depending on your Burn Mulitple and Sales Efficiency, you may need to move budget around, or reduce costs across the board.